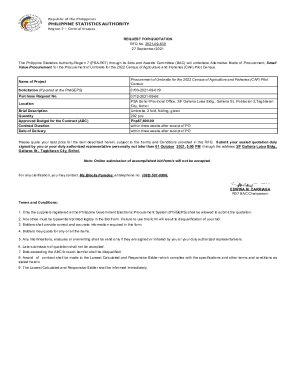

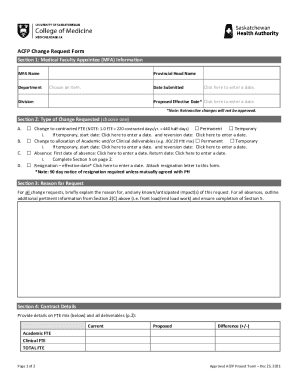

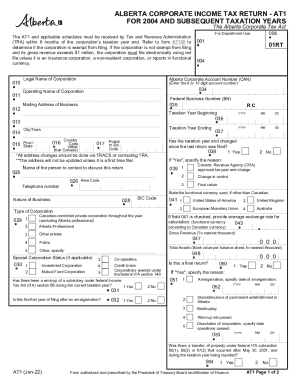

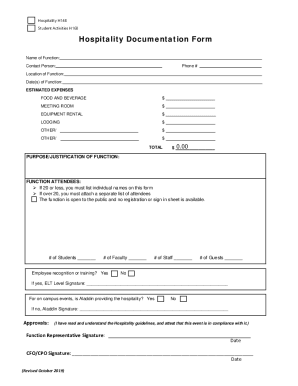

Get the free pdffiller

Get, Create, Make and Sign pdffiller form

Editing pdffiller form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out pdffiller form

How to fill out export customs guide brazil

Who needs export customs guide brazil?

Export customs guide Brazil form: A comprehensive approach to successful exporting

Understanding the export customs process in Brazil

Export customs in Brazil refers to the set of legal and logistical requirements that allow goods to be shipped outside the country. Compliance with these customs regulations is crucial for exporters, as it not only ensures the smooth transit of goods but also avoids penalties and additional costs. A thorough understanding of the key customs documents is essential for navigating this complex landscape effectively.

The Single Export Declaration (DU-E)

The Single Export Declaration (DU-E) is the principal form used in Brazil for all export transactions. It serves multiple purposes, including providing customs authorities with essential shipment details and ensuring compliance with both domestic and international regulations. Within the Brazilian customs framework, the DU-E acts as a gatekeeper, determining whether the exported goods meet legal requirements and are allowed to leave the country.

Completing the DU-E accurately is paramount; inaccuracies can lead to shipment delays or even fines. Exporters must fill it out carefully, as it is pivotal for obtaining clearance from customs and facilitating a smooth shipping process.

Detailed steps for completing the DU-E

Filling out the DU-E accurately involves several key steps, beginning with the gathering of necessary information and documents.

Customs clearance: Requirements and processes

In Brazil, only companies holding a RADAR license can handle customs clearance. This requirement ensures that exporters are pre-authorized to export goods legally. There are primarily two customs clearance processes: traditional and simplified. Traditional processing is more time-consuming and involves comprehensive documentation, while simplified clearance can expedite the process for specific goods and situations.

Additionally, understanding customs channels such as Green (fast clearance), Yellow (additional checks), Red (stricter controls), and Grey (verification of documents) can help exporters prepare adequately.

Financial considerations for exporting to Brazil

Exporters must carefully navigate the financial landscape while factoring in payment processes. Common methods include prepayment, payment at sight, and post-shipment collection. Each method carries different risks and benefits based on the nature of the transaction and relationship with the buyer.

Furthermore, understanding applicable taxes and charges—like IPI, ICMS, and PIS—along with exchange rates is crucial for determining total export costs. Thus, calculating these financial implications will aid in setting appropriate pricing strategies for the Brazilian market.

Navigating regulatory standards and product compliance

Exporters must identify the regulatory standards relevant to their products before shipping to Brazil. Compliance with health, safety, and environmental standards is mandatory and can significantly impact the export process. Depending on the product type, certifications such as Anvisa for health products or INMETRO for electronic goods may be required.

Ensuring that products meet these standards not only facilitates smoother customs clearance but also helps build trust with Brazilian consumers, enhancing market acceptance.

Strategic insights for expanding your business in Brazil

To successfully enter the Brazilian market, businesses should prioritize building relationships with local customers. Utilizing RADAR can help identify potential importers or distributors, facilitating partnerships that enhance market presence. Moreover, understanding local business structures is essential: options may include setting up a subsidiary or finding an importer of record.

Adapting to local market requirements such as cultural preferences or market demand can bolster your export strategy, ensuring a successful long-term presence in Brazil.

Closing the loop: Post-export considerations

Once goods have been exported, monitoring customs status and tracking shipments becomes critical. This enables exporters to handle any disputes or inspections that arise swiftly. Utilizing tools such as pdfFiller can significantly streamline form management when it comes to editing, signing, and collaborating on customs documents.

Post-export analysis is essential for refining future strategies. Learning from feedback and establishing efficient processes will ultimately improve your export ventures.

Expert assistance with customs and exporting

For those new to exporting or those who encounter complexities in customs, consulting with customs specialists can provide invaluable support. They help navigate regulations, ensuring compliance and minimizing risks. Furthermore, resources like pdfFiller offer additional guidance, making it easier to manage customs documentation efficiently.

Exporters often face common challenges, and being equipped with answers to frequently asked questions can greatly reduce uncertainty in the export process.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send pdffiller form for eSignature?

Can I create an eSignature for the pdffiller form in Gmail?

Can I edit pdffiller form on an iOS device?

What is export customs guide Brazil?

Who is required to file export customs guide Brazil?

How to fill out export customs guide Brazil?

What is the purpose of export customs guide Brazil?

What information must be reported on export customs guide Brazil?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.