Get the free Tax Information / Certificate Request

Get, Create, Make and Sign tax information certificate request

How to edit tax information certificate request online

Uncompromising security for your PDF editing and eSignature needs

How to fill out tax information certificate request

How to fill out tax information certificate request

Who needs tax information certificate request?

Tax Information Certificate Request Form How-to Guide

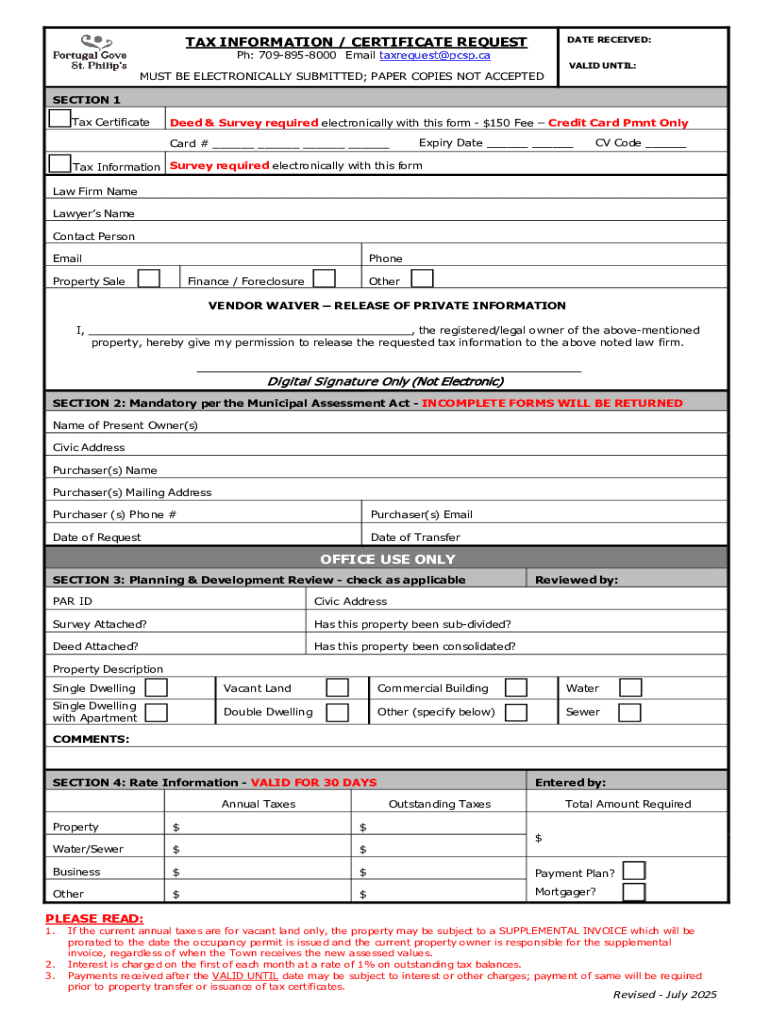

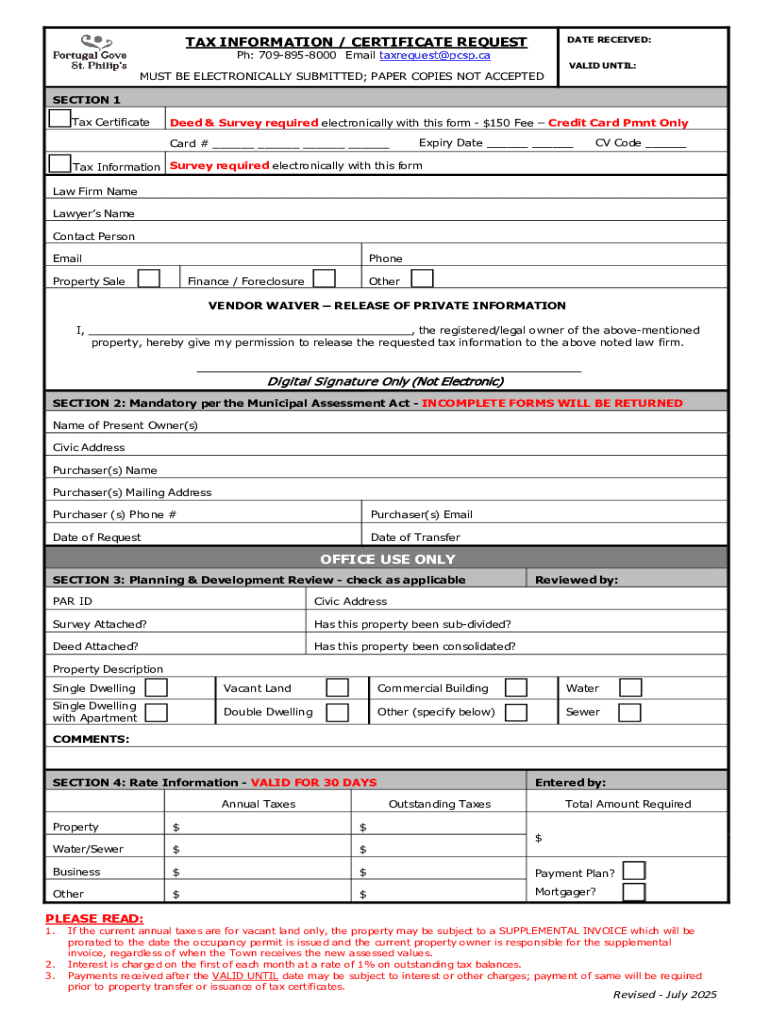

Overview of tax information certificate

A Tax Information Certificate serves as a formal document that outlines an individual’s or business’s tax history and status within a given jurisdiction. This certificate is essential for various processes, including loan applications, grant applications, and verifying tax payments to regulatory authorities. By obtaining this certificate, taxpayers demonstrate their compliance with local tax laws, which can significantly streamline numerous bureaucratic processes.

Understanding key terms related to tax certificates is crucial. For example, terms like 'tax liability', 'account status', and 'clearance' come into play when discussing tax compliance. Familiarizing yourself with these terms before requesting a Tax Information Certificate can greatly enhance your understanding of the application's relevance and importance.

Understanding different types of tax certificates

There are different types of tax certificates, each serving unique purposes. The most common types include Tax Clearance Certificates and Certificate of Account Status. A Tax Clearance Certificate confirms that an individual or business has paid all taxes owed and is thus in good standing with tax authorities. On the other hand, a Certificate of Account Status simply summarizes an account's overall standing, indicating if there are any outstanding liabilities.

These certificates have varied applications. Tax Clearance Certificates are often required for bid submissions and tender offers, while Certificate of Account Status might be needed for business licensing or renewal applications. To request these certificates, individuals or businesses must meet specific eligibility and qualification criteria, such as having no unresolved tax liabilities and maintaining an active status with the taxing authority.

Preparing to request a tax information certificate

Before initiating the request for a Tax Information Certificate, certain key documents must be gathered. These typically include your tax identification number, proof of identity (such as a driver’s license or passport), and any documentation that supports your reasons for needing the certificate. Depending on the specific certificate being requested, additional documents may be required.

Eligibility criteria may differ based on whether you're an individual or a business. Individuals typically need to show compliance with personal tax filings, while businesses may require proof of corporate tax payments. Keeping in mind the submission timelines is also crucial; some requests can take longer than others, especially during peak tax seasons.

Step-by-step guide to requesting your tax information certificate

Requesting your Tax Information Certificate involves a structured approach to ensure accuracy and compliance with tax authority requirements.

Step 1: Accessing the request form

To begin, locate the online request form, which is hosted on the relevant tax authority's website. Alternatively, pdfFiller offers a streamlined way to access these forms, allowing you to fill them out electronically for easy submission.

Step 2: Filling out the request form

Filling out the form correctly is vital. Be sure to enter all required fields accurately and double-check your entries for common pitfalls such as typographical errors and incorrect identification numbers. Every detail counts toward the swift processing of your request.

Step 3: Submitting the request form

Once your form is completed, you can opt for electronic submission or print it out for mailing. Electronic submissions via platforms such as pdfFiller often provide tracking features, allowing you to monitor the status of your request efficiently.

Editing and managing your request form

Utilizing tools like pdfFiller for real-time document editing enhances the management of your Tax Information Certificate request form. With cloud storage capabilities, you can save your progress and make necessary changes at your convenience. E-signatures are also essential, allowing you to authenticate your request seamlessly and thereby accelerating processing times.

Collaboration features on pdfFiller make it easier for teams managing tax documents to work together efficiently. These features help ensure that everyone involved remains updated on the document's status, reducing the risk of discrepancies.

Troubleshooting common issues

If your request is rejected, it's critical to understand the reasons behind the decision. Common issues may arise from incomplete forms or discrepancies in your declared income and tax amounts. Addressing these issues promptly can save you time and prevent unnecessary delays in obtaining your certificate.

In case discrepancies appear in your Tax Information Certificate, gathering the relevant documents and reaching out to customer support through pdfFiller or the appropriate tax authority can help resolve these concerns efficiently. Make sure to keep comprehensive records as proof to support your claims.

Additional insights and tips

Maintaining accurate tax records is vital for both individuals and businesses. Regularly reviewing your financial statements and ensuring that your tax documents are up-to-date can alleviate many complications when it comes to requests for Tax Information Certificates.

Understanding the implications of your tax certificates is equally important. An up-to-date certificate ensures that you are compliant with tax regulations, while outdated information could lead to penalties and complications during financial assessments. Using pdfFiller's features can greatly enhance your ability to manage these documents effectively.

Interactive tools and resources

pdfFiller offers a range of interactive forms and resources related to tax documentation. Access these tools to not only request tax certificates but also stay informed about fiscal notes and educational opportunities. Links to economic development programs may also be available, providing additional support for business owners.

Stay compliant and informed

Continuously monitoring tax rules and regulations is paramount for maintaining compliance. Tax laws frequently change, so remaining informed about these developments can aid in avoiding potential penalties. Websites and support communities are excellent resources for real-time updates and assistance.

Engaging with taxpayer resources also helps broaden your understanding of obligations. Workshops, webinars, and community forums hosted by tax professionals can provide valuable insights and clarifications on various tax-related topics.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit tax information certificate request in Chrome?

How can I edit tax information certificate request on a smartphone?

How do I edit tax information certificate request on an iOS device?

What is tax information certificate request?

Who is required to file tax information certificate request?

How to fill out tax information certificate request?

What is the purpose of tax information certificate request?

What information must be reported on tax information certificate request?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.