Get the free Sr01

Get, Create, Make and Sign sr01

How to edit sr01 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out sr01

How to fill out sr01

Who needs sr01?

A Comprehensive Guide to the SR01 Form: Protecting Your Privacy

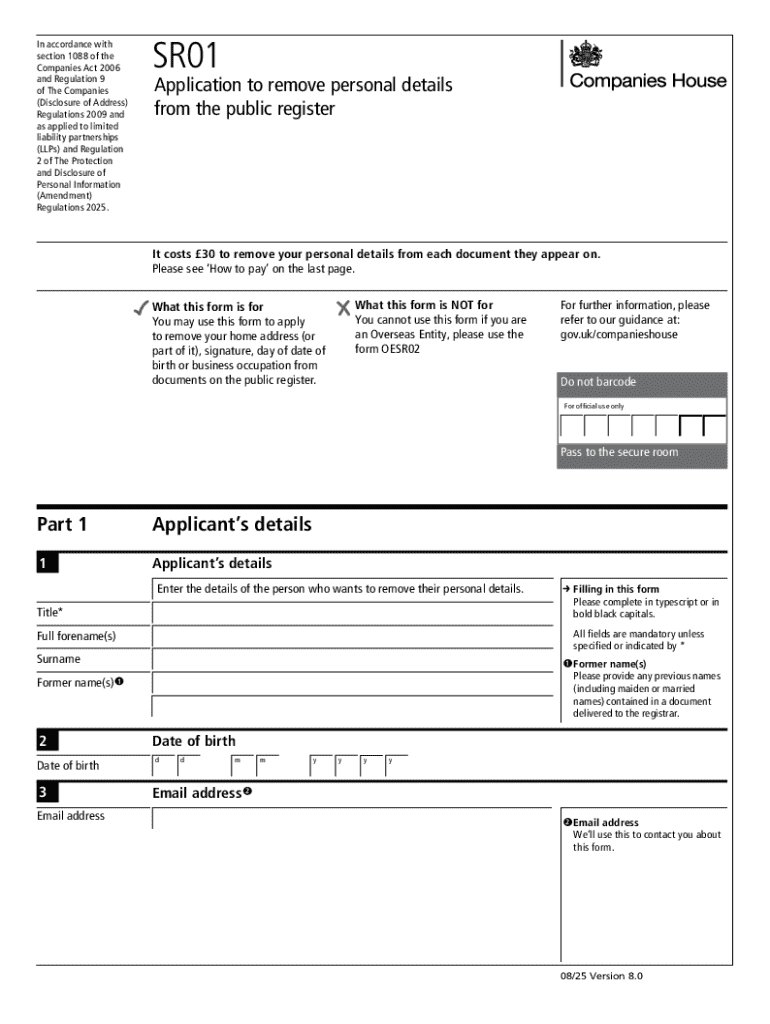

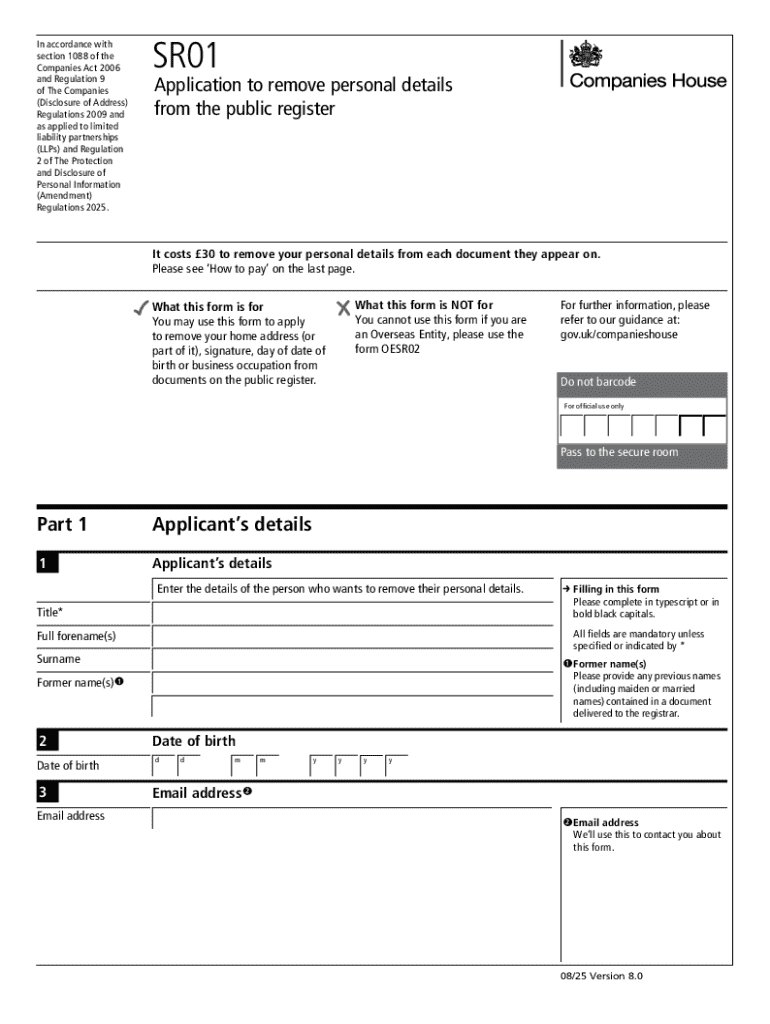

Understanding the SR01 Form

The SR01 Form is a key document designed for individuals and businesses operating in the UK who wish to keep their home addresses confidential. This form is particularly useful for company directors and secretaries who want to avoid disclosing their personal addresses on public records. While transparency in business is crucial, there are valid reasons for seeking privacy. The SR01 Form serves as a formal request to have your residential address removed from Companies House records.

The primary purpose of the SR01 Form is to safeguard personal information. With the growing concerns over identity theft and privacy breaches, many individuals are opting to protect their home addresses from public view. This form enables you to designate an alternative address, ensuring your personal residence does not become a matter of public knowledge.

Eligibility to file the SR01 Form

Not everyone is eligible to apply for the SR01 Form. Typically, this form is available to certain individuals who have a legitimate reason to keep their address hidden due to personal safety concerns or harassment. Eligibility primarily extends to company directors, secretaries, or those involved in specific occupations, such as solicitors, MPs, and others in sensitive positions.

To successfully file an SR01 Form, applicants need to meet certain conditions. These include demonstrating a genuine risk to their safety or confidential status, as well as satisfying the rules set forth by Companies House. It's essential to stay informed about the current regulations surrounding home address disclosures, which can evolve over time.

Step-by-step process to complete the SR01 Form

Completing the SR01 Form requires careful preparation. Before diving into the form itself, gather all necessary information and documents. This includes identification documents, current address information, and any prior communications with Companies House regarding your request. Ensure you have an official reduced address available that will serve as your official communication address once your request is processed.

When filling out the SR01 Form, each section has its specific requirements. Ensure that personal details, including your name and alternative address, are accurate. Pay close attention during this step, as common mistakes can delay processing. Double-check for any typos or inaccuracies that may raise questions during review.

Submitting the SR01 Form

Once completed, the next crucial step is to submit your SR01 Form. You have the option to file this form online or send it through post. Online submission is often preferred as it is faster and allows for easier tracking of your application. For postal submissions, ensure that you use the correct address for Companies House, and it might be wise to opt for a signed-for delivery option.

Be aware that there may be fees associated with filing the SR01 Form, depending on the submission method you've chosen. Generally, the online submission process incurs fewer fees than postal submissions. After submission, you will receive confirmation and acknowledgment, giving you peace of mind that your request is underway.

After submission: What to expect

After you’ve submitted your SR01 Form, be aware of the processing times that can generally vary. Companies House typically processes these forms within a few weeks, but longer times may arise during busy periods or complicated requests. It is advisable to keep track of your submission and note any reference numbers provided during the acknowledgment phase.

Once processed, you will receive confirmation regarding the change of your address on the public register. This is an important step in ensuring your privacy, so be vigilant for any further communication or directives from Companies House.

Withholding your address from other entities

It's essential not only to remove your address from Companies House but also to consider other sensitive areas like credit reference agencies. Disclosure of your address to these entities can lead to unintentional exposure of your personal information. Steps can be taken to withhold your address, which may involve contacting the agencies directly.

Understand the difference between your business address and your registered office address. The latter is the legal address for receiving documents, while your business address may be more publicly accessible. By differentiating both, you can enhance your privacy.

Common questions about the SR01 Form

As with any official process, questions often arise regarding the SR01 Form. One common query is whether anyone can apply to have their address removed. The short answer is no; only eligible individuals meeting specific criteria can make this request. Others often ask what happens if the SR01 Form is not filed. Failing to submit this form can lead to your address remaining publicly available, thus potentially compromising your safety.

Additionally, many individuals wonder if it’s possible to retract an application after submission. Unfortunately, the approval process is quite formal, and once the request is submitted, it cannot be undone easily. Understanding these implications and questions surrounding the SR01 Form is crucial for prospective applicants.

Potential issues and solutions

Navigating the application process for the SR01 Form can present its own set of challenges. One of the most common issues faced is difficulty filling out the form accurately. If you encounter problems, do not hesitate to reach out to Companies House for guidance. They can provide clarification and help you resolve misunderstandings about the submission process.

Additionally, there might be situations where your request is outright denied. In such cases, it's vital to understand the reasons for denial so that you can adjust your application in future submissions. Learning from any issues faced can help streamline your future interactions with Companies House.

Additional considerations

Maintaining the security of your personal information doesn’t end with the submission of the SR01 Form. It’s crucial to consider how this information may impact your overall privacy and the potential legal ramifications of providing false information within the form. Companies House takes inaccuracies seriously, and supplying misleading information can have grave consequences.

Ensuring your information is kept private and secure goes beyond just filing paperwork. It’s important to stay informed about updates to laws and regulations concerning disclosure and address confidentiality, as these can affect your ongoing compliance.

Interactive tools and resources

For those looking to streamline the SR01 Form process, various online resources are available. pdfFiller provides document templates for the SR01 Form, simplifying the completion process. Additionally, online calculators can assist in determining potential fees or costs associated with the form. Engaging with these tools can significantly enhance accuracy and efficiency during your application process.

Utilizing pdfFiller's platform offers a user-friendly approach to filling out, editing, and signing forms securely online. This not only speeds up the process but also allows users to focus on their core business without unnecessary paperwork interruptions.

Real-life examples and case studies

Understanding the practical implications of the SR01 Form is vital, and real-life examples shed light on its effectiveness. Numerous individuals and businesses have successfully utilized this process to safeguard their addresses from public view. Testimonials reveal that directors who had previously faced harassment reported significant relief upon successfully filing the SR01 Form, allowing them to operate without fear of uninvited visitors at their homes.

Conversely, some stories highlight challenges faced before filing. In cases where individuals did not file the SR01 Form, they experienced persistent unsolicited contact, showcasing the necessity of taking proactive steps to protect one’s privacy. These real-life narratives reinforce the importance of the SR01 Form as an essential tool for many.

Leverage pdfFiller for a seamless experience

pdfFiller empowers users to take control of their documentation needs by offering robust features for document management. Its cloud-based platform allows for seamless editing, signing, and sharing of forms, including the SR01 Form. By leveraging these capabilities, users can efficiently manage their submissions while enhancing their privacy.

By utilizing pdfFiller, businesses and individuals are assured compliance with current regulations, all while maintaining the highest standards of security and confidentiality. This comprehensive approach not only aids in filling out the SR01 Form but broadens the overall document management experience.

What’s next?

After submitting the SR01 Form, consider your next steps in optimizing your business operations. Ensure that all your records with Companies House remain updated and accurate, as this will reflect positively on your compliance and transparency. Regularly check for any messages from Companies House and stay alert to any changes in registration requirements.

By staying proactive and organized, you can further maintain your privacy and continue to run your business without disruptions. The SR01 Form is just one part of a larger strategy to professionalize your document management and privacy measures.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send sr01 for eSignature?

How do I edit sr01 in Chrome?

How do I fill out the sr01 form on my smartphone?

What is sr01?

Who is required to file sr01?

How to fill out sr01?

What is the purpose of sr01?

What information must be reported on sr01?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.