Get the free Form 990

Get, Create, Make and Sign form 990

How to edit form 990 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 990

How to fill out form 990

Who needs form 990?

A Comprehensive Guide to Form 990: Understanding and Filing for Tax-Exempt Organizations

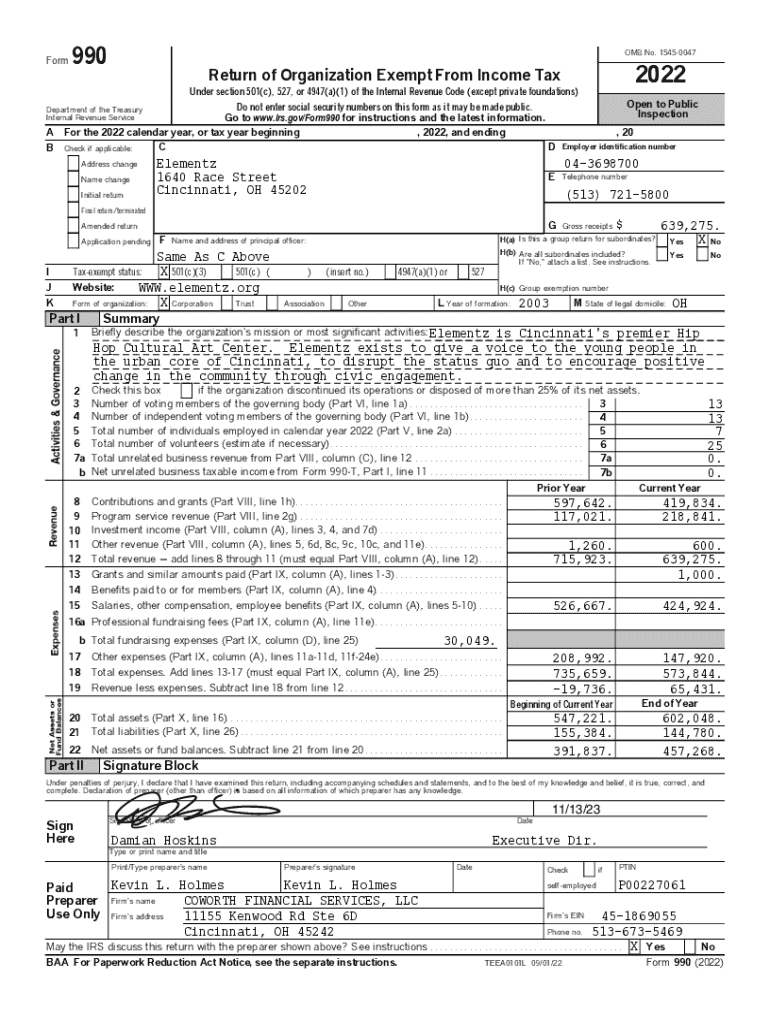

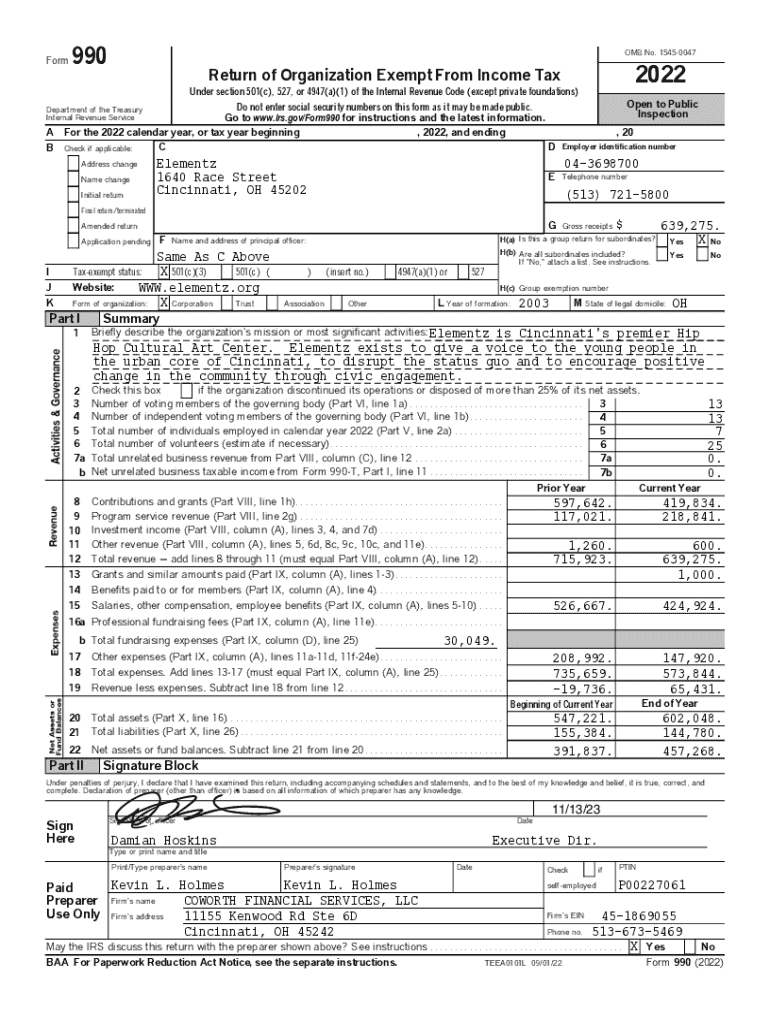

Overview of Form 990

Form 990 serves as a pivotal document for tax-exempt organizations in the United States. It is required by the IRS to ensure that these organizations comply with federal tax regulations, helping to promote transparency and accountability in the nonprofit sector. By providing details about a nonprofit's finances, governance, and activities, Form 990 enables the public, donors, and government agencies to assess the organization’s fiscal health and operational integrity.

The importance of Form 990 cannot be understated; it serves as a compass guiding organizations to maintain their tax-exempt status while offering insight to stakeholders about how funds are generated and utilized. The data captured through the Form not only assists nonprofits in self-evaluation but also furthers community engagement by allowing potential donors to make informed decisions.

Types of organizations required to file Form 990

Several types of organizations are mandated to file Form 990, including charitable organizations which operate under section 501(c)(3) of the IRS code. This category encompasses a vast range of entities such as hospitals, educational institutions, and various social service agencies. Additionally, private foundations and certain social and recreational clubs also fall under the purview of Form 990 filing requirements. Understanding which organizations are required to file is crucial, as it affects compliance and operational processes.

Components of Form 990

Form 990 comprises several crucial components, each offering specific insights into the organization's operations. Schedule A is dedicated to detailing the public charity status, where organizations must affirm their classification as public charities versus private foundations. It outlines qualifications and standards that must be met to maintain this status, ensuring donors have confidence in the organization’s operational credibility.

Another vital section is Schedule B, which captures information about contributors. This section must maintain confidentiality while still adhering to IRS requirements, balancing privacy for donors with the need for transparency. Further, Schedule C discusses political campaign and lobbying activities, ensuring organizations disclose any involvement and adhere to legal limitations on lobbying activities to sustain their tax-exempt status. Lastly, Schedule D complements financial disclosures, offering key metrics that facilitate evaluations of operational effectiveness.

Filing requirements for Form 990

Understanding who must file Form 990 is essential for compliance. Organizations must file based on minimum income thresholds set by the IRS. For instance, organizations with gross receipts exceeding $200,000 must submit Form 990, while those with less than this amount may file a shorter version, Form 990-EZ. However, there's an exemption for organizations with minimal income, including those which may not be required to file any form at all, based on their classification.

Deadlines for filing Form 990 are critical. The standard due date is the 15th day of the 5th month after the organization’s fiscal year ends. While extensions can be requested using Form 8868, organizations must be diligent about adhering to these timelines to avoid penalties. Filing modalities have advanced, with electronic submission being the preferred method, offering numerous advantages such as accuracy and efficiency.

Detailed steps for completing Form 990

Completing Form 990 involves meticulous preparation. Start by gathering necessary information, including financial records, detailed income statements, and legal documents such as bylaws and articles of incorporation. This foundation is critical, as it informs the data needed throughout the form. Next, move on to the filling out each section of the Form. Focus on accuracy, especially in financial sections, as errors can lead to scrutiny from the IRS or the public.

As you complete the forms, utilize tools such as pdfFiller, which provides editing capabilities that facilitate the input of data and ensure everything is organized. Once completed, review your submission thoroughly, looking for common mistakes like transcription errors or miscalculations. After verification, submit the form either online or in paper form, ensuring you keep a record of submission confirmation in case of inquiries down the line.

Understanding the implications of filing Form 990

The consequences of failing to comply with Form 990 filing requirements can be significant. Late or incorrect filings may incur penalties ranging from monetary fines to legal ramifications, including loss of tax-exempt status. Organizations must be acutely aware of deadlines and the importance of maintaining compliance to safeguard their integrity as tax-exempt entities.

Moreover, Form 990 becomes a public document once filed, allowing for public inspection. This transparency is vital for fostering trust between nonprofit organizations and their supporters. By conducting regular public reviews of Form 990, donors and the public can maintain accountability, further encouraging the nonprofit to uphold ethical operational standards.

Utilizing Form 990 for charity evaluation research

Form 990 is not just a compliance document; it is an invaluable tool for charity evaluation and research. Stakeholders can analyze the data to gauge an organization's financial health using key indicators such as revenue, expenses, and net assets. This information is paramount for nonprofits seeking to demonstrate their efficacy and for donors gauging the effectiveness of potential contributions.

In exploring how to read and analyze Form 990 data, users can focus on metrics such as the ratio of program expenditures to total expenditures, which signifies how effectively the organization allocates its resources toward its mission. Third-party databases and online resources can further facilitate in-depth research, providing insights that empower donors to make well-informed decisions.

Additional tools and resources

pdfFiller offers interactive tools that streamline the preparation and submission of Form 990. With document creation tools and online collaboration features, organizations can work together in real time, making the process of completing forms smoother and more efficient. The ability to eSign documents online enhances security and provides a clear audit trail, which is especially beneficial for nonprofits managing multiple stakeholders.

Furthermore, pdfFiller’s customer support can assist users in navigating the complexities of the Form 990 filing process. Access to FAQs and tips can equip organizations with the necessary information to address common concerns and challenges encountered when filing, ensuring they stay compliant with evolving regulations.

Common questions about Form 990

As organizations prepare to file Form 990, several frequently asked questions arise. For instance, one common concern relates to confidentiality for donor information, particularly regarding Schedule B. Organizations can reassure donors that sensitive information will be reported without compromising individual identities, maintaining the balance between transparency and privacy.

Expert insights suggest that keeping abreast of evolving regulations is critical. Organizations should regularly review best practices not just for compliance but to enhance operational efficiency. Changes in tax laws, reporting requirements, and industry standards can shift frequently, making ongoing education and adaptability vital for any tax-exempt organization.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in form 990 without leaving Chrome?

Can I create an electronic signature for the form 990 in Chrome?

How do I edit form 990 on an Android device?

What is form 990?

Who is required to file form 990?

How to fill out form 990?

What is the purpose of form 990?

What information must be reported on form 990?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.