Get the free Ptax-342-r

Get, Create, Make and Sign ptax-342-r

Editing ptax-342-r online

Uncompromising security for your PDF editing and eSignature needs

How to fill out ptax-342-r

How to fill out ptax-342-r

Who needs ptax-342-r?

PTAX-342-R Form: A Comprehensive Guide

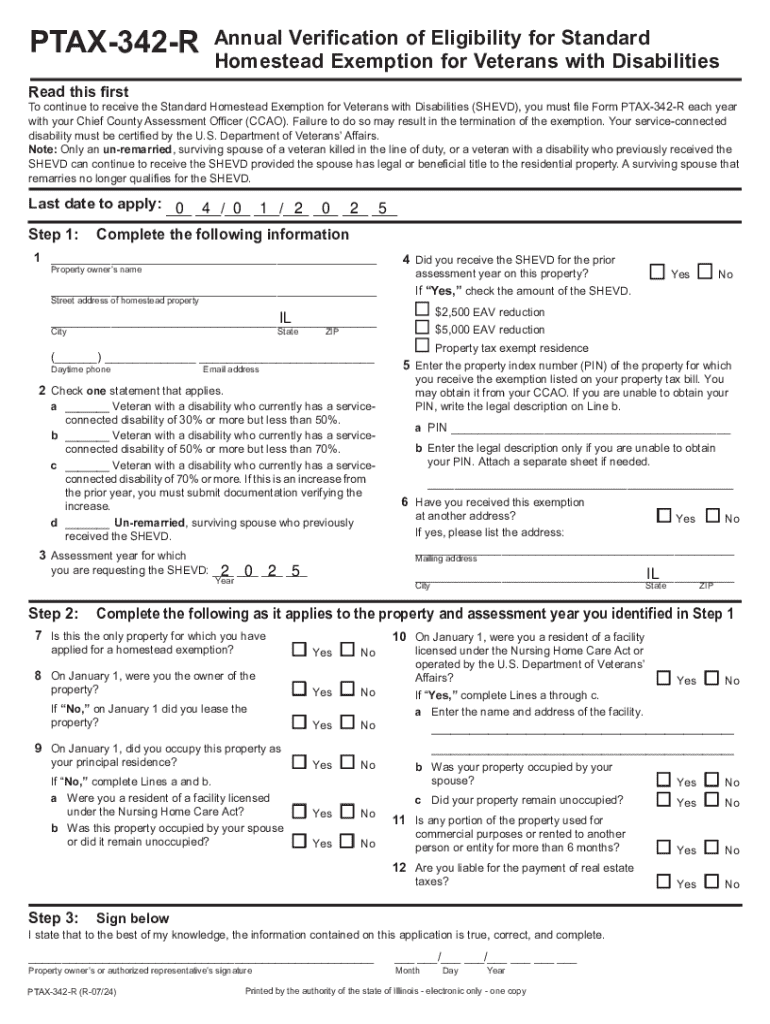

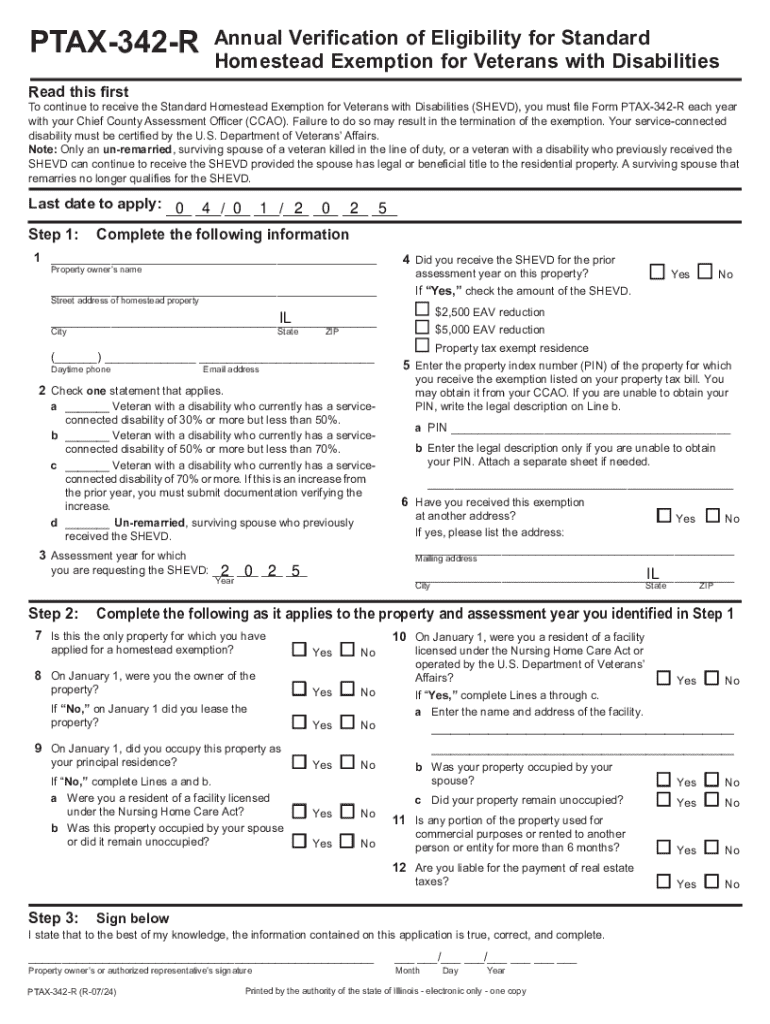

Overview of the PTAX-342-R Form

The PTAX-342-R form serves a critical role in property tax assessments, specifically designed for property owners who wish to appeal their property tax assessments in Illinois. This form allows property owners to formally make a request to their local board of review to lower their property assessments based on evidence they provide.

Accurate completion of the PTAX-342-R form is essential. Submitting incorrect or incomplete information can lead to delays in the review process or, worse, a dismissal of the appeal. Understanding the implications of errors underscores the importance of diligence and attention to detail when filling out this crucial document.

Key features of the PTAX-342-R Form

The PTAX-342-R form is specifically designed for property owners, ensuring that only individuals with a direct stake in the property can utilize this form for tax assessment appeals. Eligibility requires the submitter to be the legal owner of the property in question, which reinforces the form's credibility.

This form requires various essential information, including property identification numbers, assessment values, and personal details of the property owner. The user must accurately report the assessed value of their property while also providing supporting documentation to bolster their appeal.

Additionally, the PTAX-342-R form is compatible with digital platforms, particularly pdfFiller, which streamlines the editing and submission process. This compatibility ensures that property owners can access and manage their documents more efficiently.

How to access the PTAX-342-R Form

Accessing the PTAX-342-R form online is straightforward. Users can navigate to pdfFiller's website, where the form is readily available. Simply search for 'PTAX-342-R Form' in the search bar to access the document instantly.

For those who prefer a physical copy, pdfFiller also offers printable options. After locating the form online, users can easily download it in PDF format and print it for offline use, ensuring everyone has access regardless of their technological preferences.

Step-by-step instructions for filling out the PTAX-342-R Form

Filling out the PTAX-342-R form involves several key sections, each vital for a complete application. Here’s a breakdown of the process:

It's crucial to review each section carefully to avoid common mistakes, such as entering an incorrect assessment value or omitting required details. Double-check your data before submission to mitigate potential issues.

Editing and customizing the PTAX-342-R Form using pdfFiller

pdfFiller offers robust editing tools that enable users to customize their PTAX-342-R form seamlessly. After accessing the form, users can edit the text fields directly, ensuring that all information is tailored to their specific circumstances.

Adding signatures and initials is also a feature provided by pdfFiller. Users can quickly sign their forms electronically, saving time and effort compared to traditional methods. For teams, collaboration features allow multiple individuals to work on the same document, streamlining the review and approval process.

Submitting the PTAX-342-R Form

Understanding the submission methods for the PTAX-342-R form is crucial for ensuring timely processing. Users can choose between electronic submission via the local board's online portal or traditional physical submission through mail.

It's important to remain aware of deadlines for submission, which can vary by locality. Typically, the deadline for submitting tax assessment appeals falls within a specific range following the issuance of property tax assessments. Following up after submission is vital, whether it's confirming receipt with the local board or checking the status of your appeal.

Frequently asked questions (FAQs) about the PTAX-342-R Form

Property owners often have questions regarding the PTAX-342-R form. Common issues include the eligibility criteria for submission, the types of evidence required to support their appeal, and the process for addressing denied appeals. Below are some quick answers to typical inquiries:

For further assistance, property owners can contact their local board of review or visit the Illinois Department of Revenue’s website for additional resources.

Related forms and documentation

Property assessments often require multiple forms to address various aspects of tax appeals. Other relevant forms include PTAX-340, which is used for exemption claims, and PTAX-341, intended for assessment appeals not covered by PTAX-342-R.

Managing all these documents can be a challenge, but pdfFiller streamlines the process, allowing users to keep all related documents organized in one location. This ensures easy access whenever you need to reference or submit your forms.

Integrating pdfFiller into your document workflow

Utilizing pdfFiller for managing the PTAX-342-R form offers numerous benefits. The platform enhances efficiency through its user-friendly interface, allowing users to edit, sign, and collaborate on documents from any location.

For those new to the platform, pdfFiller provides comprehensive tutorials and guides. These resources enable users to make the most of the platform’s features, ensuring a smooth and efficient document management experience.

User testimonials and success stories

Countless users have shared how pdfFiller has transformed their document handling experiences. Testimonials reflect the platform's impact on simplifying the appeal process for the PTAX-342-R form and beyond.

Here are a few quotes from satisfied users: 'With pdfFiller, I was able to complete my PTAX-342-R form quickly and submit it without hassle,' and 'The collaboration features made it easy for my team to work together on our property assessments.'

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my ptax-342-r in Gmail?

How can I send ptax-342-r to be eSigned by others?

How do I make edits in ptax-342-r without leaving Chrome?

What is ptax-342-r?

Who is required to file ptax-342-r?

How to fill out ptax-342-r?

What is the purpose of ptax-342-r?

What information must be reported on ptax-342-r?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.