Get the free Cyber Insurance

Get, Create, Make and Sign cyber insurance

How to edit cyber insurance online

Uncompromising security for your PDF editing and eSignature needs

How to fill out cyber insurance

How to fill out cyber insurance

Who needs cyber insurance?

Cyber Insurance Form - How-to Guide Long-read

Understanding cyber insurance

Cyber insurance provides coverage to organizations in the event of a data breach or cyber attack. This insurance aims to mitigate financial losses stemming from these incidents, which can include recovery costs, legal fees, and fines from regulatory bodies. As businesses increasingly rely on digital platforms for operational efficiency, the relevance and need for adequate cyber insurance continue to rise.

Given the significant rise in cyber threats—from phishing attempts to ransomware attacks—organizations can no longer afford to overlook the potential repercussions. Cyber insurance serves not merely as a safety net but as a crucial component of robust risk management strategies.

What is cyber insurance?

In essence, cyber insurance helps protect businesses from various cyber risks, offering support in financial recovery and identity protection services after a breach. Additionally, it provides risk assessments and incident response assistance, enabling businesses to handle breaches more effectively.

Types of cyber insurance policies

Cyber insurance generally falls into two primary categories: first-party and third-party coverage. First-party coverage compensates businesses for their own losses, including data recovery and business interruption. Conversely, third-party coverage addresses liability claims arising from data breaches affecting customers or suppliers.

However, organizations should be aware of common exclusions, such as losses associated with social engineering fraud or acts of war. Understanding these nuances is essential for effective policy selection.

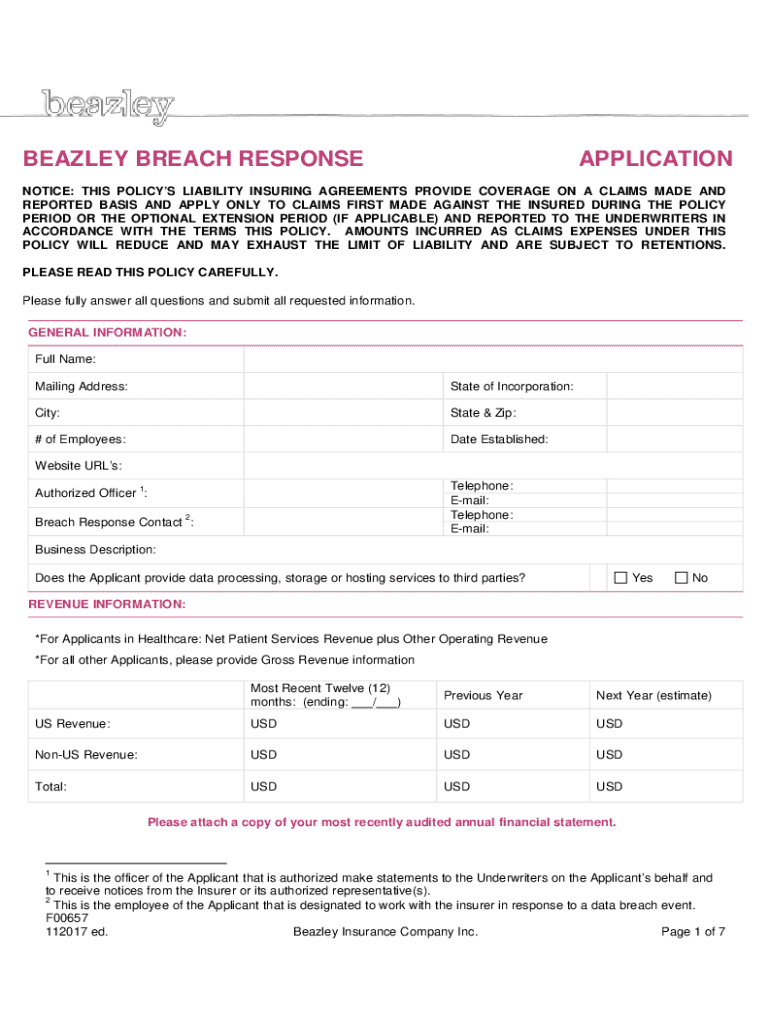

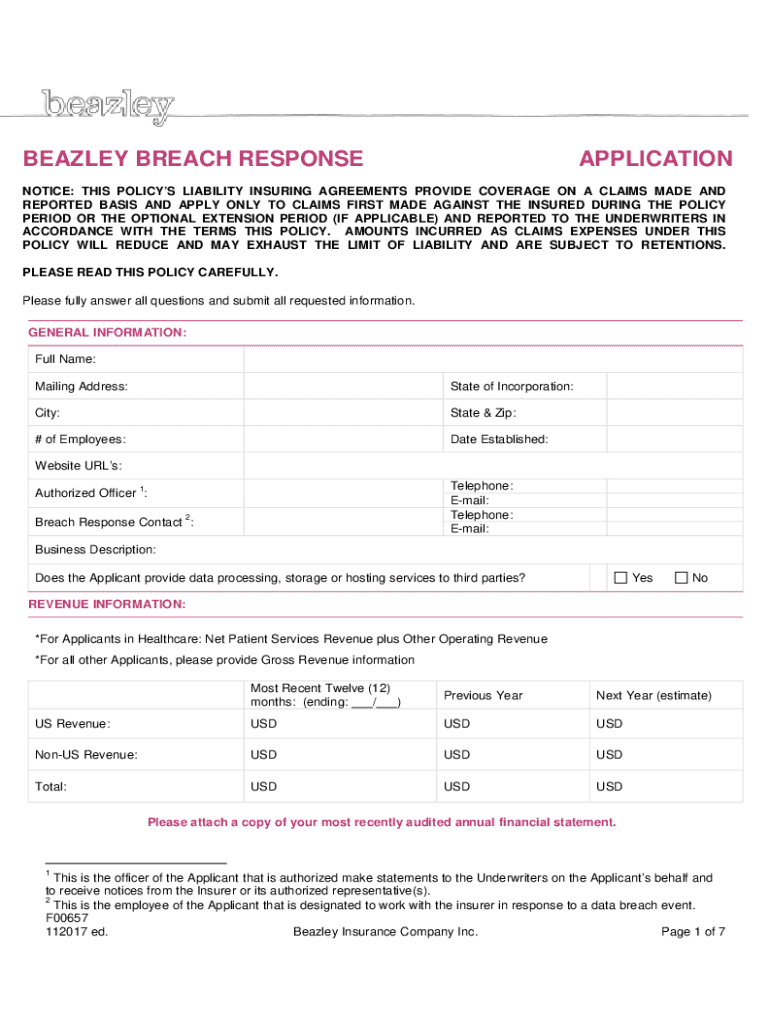

The importance of the cyber insurance form

Completing the cyber insurance form is a crucial step for businesses seeking adequate coverage. This form allows insurers to assess the risk profile of an organization effectively, tailoring coverage options based on the specific data management practices and security protocols a business employs.

Key information that must be disclosed includes details about existing security measures, the nature of the data handled, and any past incidents of data breaches. Transparency is vital as insurers can identify potential risks and provide appropriate coverage options.

Why you need a cyber insurance form

The cyber insurance form serves as a foundational document for risk assessment and coverage customization. In addition to covering potential losses, it highlights your organization’s risk management capabilities, which can lead to better premium rates.

Common use cases for cyber insurance

Various industries can benefit from cyber insurance, including healthcare, finance, and retail. For example, healthcare organizations handle sensitive patient information and require robust protections to avoid substantial financial penalties following a breach.

Moreover, companies within the finance sector often grapple with increasing regulatory scrutiny, making specialized cyber coverage vital for maintaining compliance and safeguarding against breaches that could result in significant financial loss.

How to fill out the cyber insurance form

Filling out the cyber insurance form accurately is critical. To start, gather necessary information that clearly defines your organization's operations, risk management capabilities, and overall data security posture.

Gathering necessary information

Identify crucial data points that should be included in the form, such as: - Business structure and ownership details - Types of data processed or stored - Description of risk management procedures in place - Historical incidents related to data breaches or cyber threats.

Step-by-step instructions for completing the form

Be aware of nuances in data representation to prevent errors that could impact your coverage. Accurate information is essential.

Tips for accurate representation

As you fill out the cyber insurance form, accuracy and honesty are paramount. Providing false information or omitting crucial details can lead to denied claims or even policy cancellations. Insurers rely on your self-reported data to make informed decisions, and any discrepancies can complicate future coverage.

Therefore, keep detailed records of your organization’s cybersecurity practices, incidents, and ongoing projects. Regularly updating this information will aid in completing your form accurately. Lastly, ensure that all stakeholders involved in data security are aware of their roles and responsibilities to facilitate better reporting.

Reviewing your cyber insurance form

After completing the form, conducting a thorough review is essential. This includes checking for completeness and correctness. Additionally, look for common pitfalls—such as incomplete sections or typographical errors—that could impact your application’s success.

Engaging with knowledgeable team members or partners could yield insights. A fresh pair of eyes can often spot discrepancies that you might miss.

Getting assistance

You can involve legal or insurance professionals to review your application to ensure compliance with industry standards and regulations. Various online tools may also assist in validating your form.

Submitting the cyber insurance form

Once the form has been reviewed and finalized, it’s time to submit it. Different submission methods exist depending on the insurer, including online forms and manual submissions. Ensure you have clear confirmation of your submission to avoid future complications and misunderstandings.

Follow-up procedures

After submitting your form, you should have a plan for follow-up. Expect a timeline for responses, which can vary widely among insurers. Engage with their representatives to clarify the next steps, emphasizing that proactive communication is key.

Managing your cyber insurance policy

Active management of your cyber insurance policy is essential for long-term effectiveness. Understanding policy terms is critical. Familiarize yourself with key terms, including deductibles, limits, and covered perils, to ensure you know what to expect during the claims process.

Keeping your policy updated

Reassessing your coverage needs periodically is also crucial. Changes in business operations, data processing, or regulatory requirements might necessitate updates to your policy. Adjustments will ensure compliance and adequate protection against evolving cyber threats.

Engaging with your insurer

Maintaining an open line of communication with your insurer promotes a mutually beneficial relationship. Handling inquiries efficiently and reporting incidents promptly ensures that your organization remains on the front lines of cyber resilience.

Enhancing cyber security and risk management

To complement your cyber insurance policy, your organization must actively enhance its cybersecurity posture. Educating your team is fundamental; implementing training programs ensures everyone understands their responsibilities and secures sensitive data.

Best practices for data protection

Consider adopting best practices for data protection, including: - Regularly updating software and systems - Employing multi-factor authentication for sensitive accounts - Conducting regular security audits to identify vulnerabilities.

Conclusion: creating a culture of security

Fostering a culture of cybersecurity within your organization extends far beyond simply purchasing insurance. By encouraging a proactive approach to data security, organizations can better anticipate and mitigate risks, ultimately leading to enhanced resilience against cyber threats.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit cyber insurance from Google Drive?

Where do I find cyber insurance?

How do I complete cyber insurance on an iOS device?

What is cyber insurance?

Who is required to file cyber insurance?

How to fill out cyber insurance?

What is the purpose of cyber insurance?

What information must be reported on cyber insurance?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.