Get the free Business License & Tax Certificate Application

Get, Create, Make and Sign business license tax certificate

How to edit business license tax certificate online

Uncompromising security for your PDF editing and eSignature needs

How to fill out business license tax certificate

How to fill out business license tax certificate

Who needs business license tax certificate?

Business License Tax Certificate Form: A Comprehensive How-to Guide

Understanding the business license tax certificate

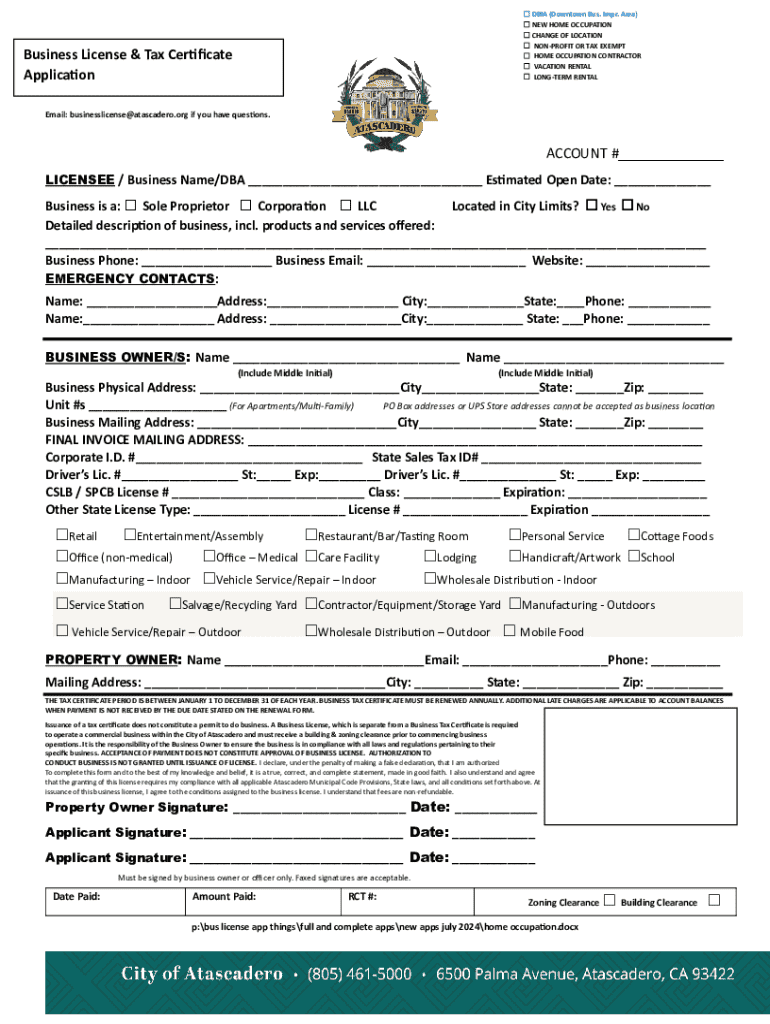

A business license tax certificate is a legal document that permits you to operate a business within your jurisdiction. Its purpose is multifold, primarily ensuring that the business complies with local laws and regulations, including tax obligations. Without this certificate, you may face penalties or even be forced to cease operations.

It is essential for legitimizing your business operations, demonstrating your commitment to following regulations and contributing to local economies. Moreover, it can serve as proof of your business's legitimacy to customers and other entities.

Who needs a business license tax certificate?

Generally, any business entity operating within a specific geographical area is required to obtain a business license tax certificate. The necessity of this certificate applies to various business types, including sole proprietorships, partnerships, and corporations.

Sole proprietors and partnerships might not have as many regulatory complications as corporations, but they are no less obligated to secure the appropriate licenses. Additionally, specific professions such as healthcare providers, real estate agents, or tradespeople—who typically require more specialized licenses—are also mandated to obtain this certificate.

Certain businesses may be exempt based on local regulations. For instance, home-based businesses or non-profit organizations might qualify for exemption, making it crucial to check local laws before assuming a license isn't required.

Steps to apply for a business license tax certificate

To obtain a business license tax certificate, begin by gathering all necessary information and documents. This usually includes your personal identification, business name registration paperwork, and if applicable, a Federal Employer Identification Number (EIN). These documents serve as proof of your identity and indicate that you are the legitimate owner of your business.

After gathering the necessary info, choose an application method that works for you. Many jurisdictions now offer online application processes, simplifying the submission of applications. Alternatively, you can apply in person at your local business licensing office or via mail, although the latter can extend the processing time.

While filling out the application form, pay special attention to key sections that require accuracy, like your business type, address, and ownership details. Common errors include typing mistakes or forgetting to include necessary documents. Being meticulous can save you a lot of time and hassle during the application process.

Application fees and payment options

Most jurisdictions charge fees for processing a business license tax certificate application. This fee can vary widely based on the type of business, location, and even the expected annual revenue. Typically, you'll encounter flat rates, sliding scales, or even lump sums based on your business's gross receipts.

Payment methods are generally accommodating, allowing you to pay via credit or debit card, electronic checks, or even set up payment plans in some cases. It's worth checking your local authority's requirements to see if they offer a financial assistance program for struggling businesses needing licensure.

After your application: What to expect?

Once your application for a business license tax certificate is submitted, processing times can vary widely. Typically, you might expect a response within a few weeks, but it can take longer depending on your jurisdiction and the volume of applications they process. Many localities offer online portals where you can check the status of your application.

If your application experiences delays, common reasons may include missing documents, errors in the application, or a high volume of applicants ahead of you. If your application is delayed or denied, it’s essential to reach out to your local authority to understand the next steps you can take.

Renewing your business license tax certificate

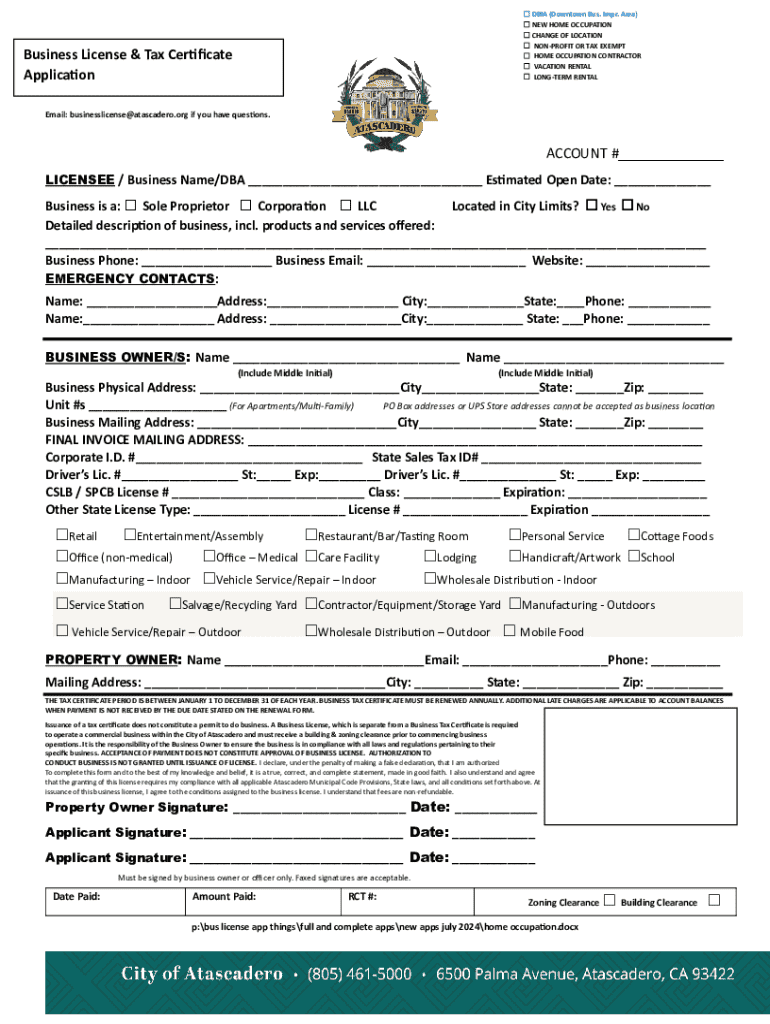

Business license tax certificates typically have expiration dates and require renewal. Depending on your jurisdiction, renewals may be annual or biennial. To renew, ensure that you prepare the same documents you submitted during your initial application and check for any changes in local law that may affect your renewal process.

Keep note of important deadlines related to renewal, as missing these can result in penalties or the need for reapplication. If you need to make changes to your license, such as updating business information or amending for new activities, be sure to follow the specified procedures for these updates.

Managing your business license tax certificate

Once you have obtained your business license tax certificate, it's paramount to manage it effectively. Best practices involve keeping digital and physical copies in secure and organized locations. Regularly track expiration dates to ensure compliance, and consider using calendar alerts or project management tools to maintain oversight.

Additionally, staying updated on regulatory changes relevant to your business can help you maintain compliance and avoid potential penalties. Many government websites and platforms like pdfFiller can provide useful information and support throughout this process.

Frequently asked questions (FAQs)

Prospective applicants often have a slew of questions when navigating the business license tax certificate application process. One common question is what to do if you lose your certificate. In most cases, you will need to contact the issuing authority to report the loss and request a replacement.

Another pressing question is whether it is legal to operate without a license. Generally, the answer is no; operating without a license can lead to severe penalties, including fines or business shutdowns. If your application is denied, there is typically an appeals process to rectify any issues.

Benefits of using pdfFiller for your business license tax certificate needs

Utilizing pdfFiller for your business license tax certificate requirements can enhance the way you manage forms. With enhanced features like seamless document editing and eSigning capabilities, filling out and finalizing important forms becomes a breeze. Moreover, its cloud-based platform allows you to access your documents anytime, anywhere, facilitating easier management of critical certificates.

In any collaborative business environment, pdfFiller provides tools that enable multiple users to work on the same document. This makes it particularly beneficial for teams, as well as offering user support for anyone who needs assistance while filling out forms. The all-in-one solution positions pdfFiller as an invaluable tool for maintaining your business licenses efficiently.

Interactive tools and additional resources

In addition to the guidance provided, pdfFiller offers interactive tools to enhance your application experience. The template library houses numerous business license forms, making it easy to find and fill the required documents. Step-by-step interactive guides can walk you through the process, ensuring you never miss a crucial step.

Furthermore, the live chat support enables users to ask questions and receive instant feedback, enhancing the overall process of managing your business license tax certificate effectively.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in business license tax certificate?

How do I edit business license tax certificate straight from my smartphone?

How do I fill out business license tax certificate on an Android device?

What is business license tax certificate?

Who is required to file business license tax certificate?

How to fill out business license tax certificate?

What is the purpose of business license tax certificate?

What information must be reported on business license tax certificate?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.