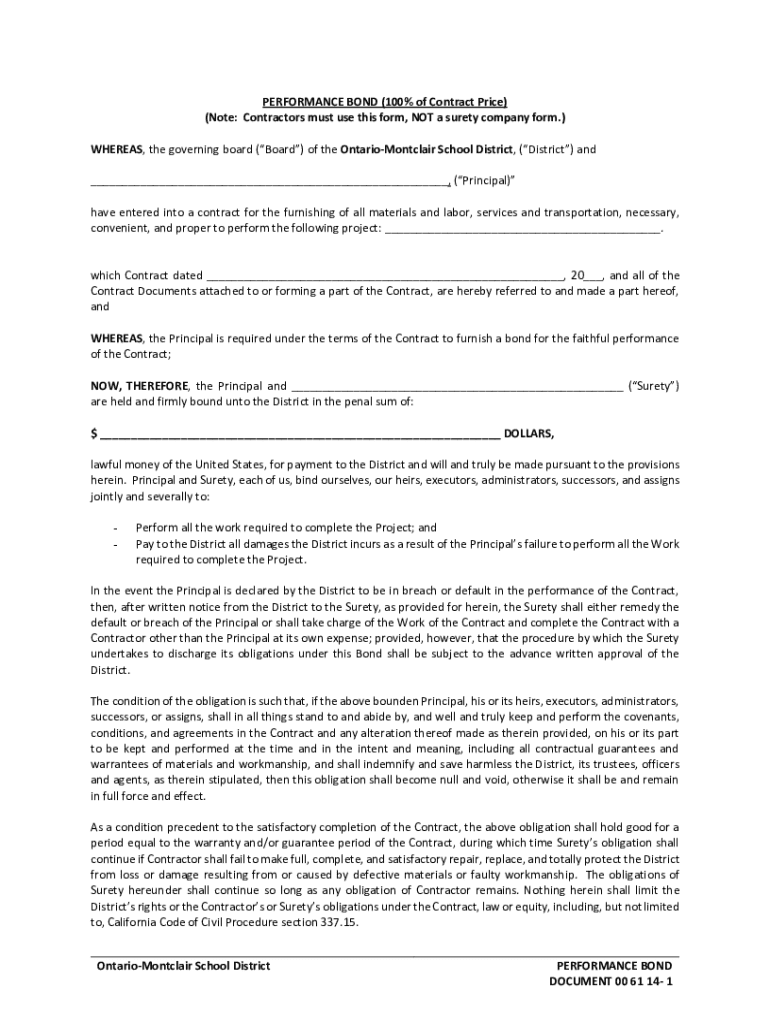

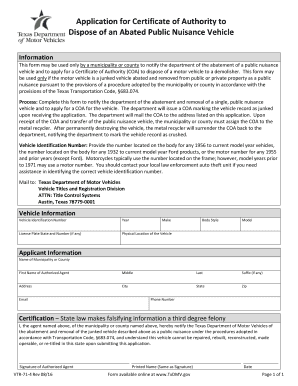

Get the free Performance Bond

Get, Create, Make and Sign performance bond

Editing performance bond online

Uncompromising security for your PDF editing and eSignature needs

How to fill out performance bond

How to fill out performance bond

Who needs performance bond?

Performance Bond Form: A Comprehensive How-to Guide

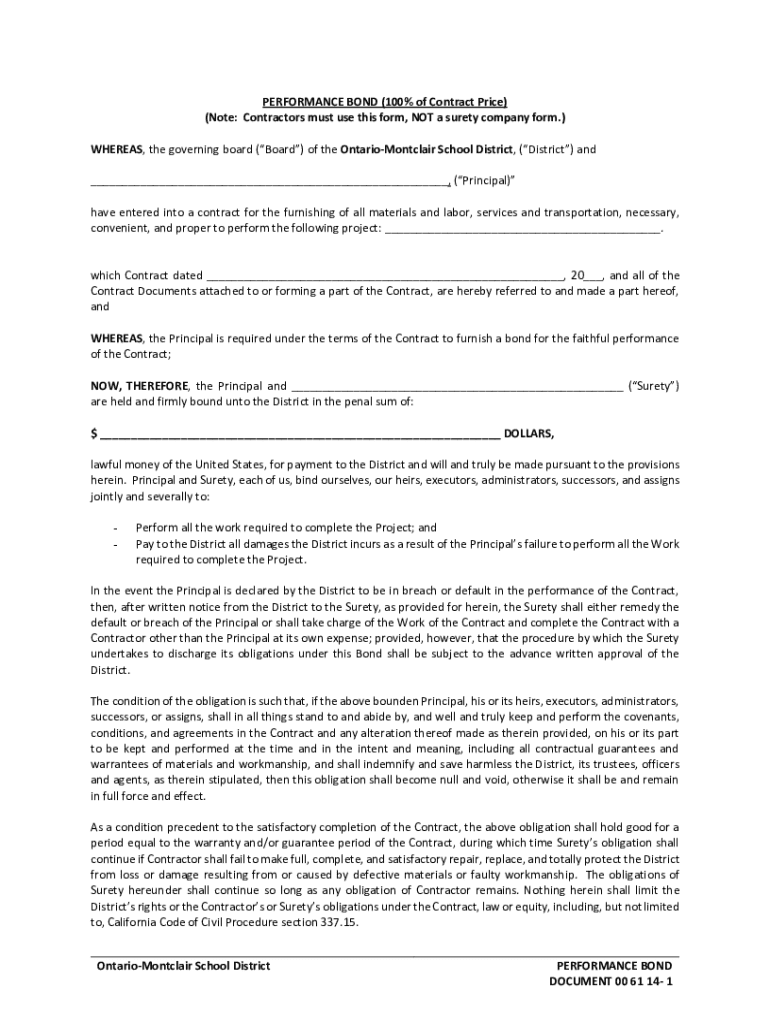

Understanding performance bonds

A performance bond is a crucial element in contractual agreements, particularly in the construction sector. It serves as a guarantee that the principal, typically the contractor, will fulfill their obligations under the contract. If the principal fails to do so, the surety, usually a bonding company, is obligated to cover the financial losses incurred by the obligee, the entity that requires the bond.

Key parties involved in a performance bond include the obligee, who benefits from the bond, the principal who obtains it, and the surety that issues the bond. This structure ensures risk management for project owners while providing financial assurance for contractors, making performance bonds essential for both parties.

Types of performance bonds

Performance bonds come in various forms to suit different types of contracts. Understanding these types is critical for choosing the right bond for your project. Contractor performance bonds ensure that a contractor will complete a job according to the contract's terms. Supply performance bonds assure the timely delivery of goods and services, while maintenance bonds protect against defects for a specified period after project completion.

In some cases, you may need to customize your performance bond. Additional bond types might be necessary to address specific project risks or requirements. For instance, if a project has unique completion risks, a specialized bond may offer additional protection.

How to choose the right performance bond form

Selecting the correct performance bond form begins with identifying your needs based on project specifics. Consider the type of project, the dollar amount involved, and the nature of risks anticipated. The bond amount is typically a percentage of the total project cost, and this figure can affect your overall budget.

Comparing bond providers is equally important. Evaluate their credibility and reputation in the market, as well as the specific terms they offer. Ask potential bond companies detailed questions about their processes, service fees, and whether they have experience with your type of project.

The performance bond application process

The application process for a performance bond entails gathering necessary documentation. Typically, you will need financial statements, project details, and other paperwork that demonstrates your capability to complete the project. Understanding the credit requirements set by the surety is also essential; a strong credit profile can facilitate a smoother approval process.

Filling out the performance bond form can be straightforward if you follow a structured approach. Start by entering your business information, bond amount, and details about the project. Be thorough and precise, as errors can lead to delays. Common pitfalls include failing to provide adequate supporting documents or omitting necessary information.

Tips for editing and signatures

Editing your performance bond form doesn’t have to be a daunting task. Using tools like pdfFiller allows you to customize your document interactively. This platform provides features that simplify document management, enabling you to edit online, add fields, or even collaborate with others in real-time.

When it comes to signatures, electronic signing is gaining traction due to its convenience and security. pdfFiller offers a straightforward eSigning process that ensures your bond is signed promptly while maintaining compliance with legal standards. Simply follow the step-by-step guide provided on the platform to securely sign your performance bond.

Submitting your performance bond

Once your performance bond is completed and signed, understanding where to submit your form is critical. Different stakeholders may have unique submission guidelines, typically outlined in your contract or bonding requirements. Ensure you follow these guidelines closely to prevent any issues.

After submitting, tracking your performance bond is essential. Keeping lines of communication open with the surety and the obligee will help ensure your bond is reviewed in a timely manner. If delays occur, don't hesitate to follow up with relevant parties to keep the process moving.

Managing your performance bond

Effective management of your performance bond is vital to ensure compliance and safeguard your project. Storing and accessing your bond form should be done in a secure manner, preferably within a digital document management system like pdfFiller. This allows for easy retrieval and makes it simple to track expiration and renewal dates.

Leveraging features of pdfFiller can streamline ongoing management. Use the platform to make updates, track changes, and monitor document revisions. With a robust document management system, you'll maintain organization and clarity on your obligations.

Questions and answers

Several common concerns arise regarding performance bonds. For instance, users often ask what happens if a bond is called—this refers to the situation where the obligee makes a claim against the surety due to the principal's non-compliance. Understanding the claims process and how to respond is crucial for managing potential risks.

Additionally, addressing FAQs can provide clarity on topics such as the types of claims, timelines, and specific compliance requirements for bonding companies. Expert insights can further aid in troubleshooting any issues that may arise during the bonding process.

Related considerations

Understanding bond obligations and claims is fundamental in managing a performance bond. It is vital to know what steps to take if a bond is called, including immediate communication with your surety and gathering necessary documentation for the claims process.

On the legal side, performance bonds are subject to various regulations, and compliance is crucial. Familiarize yourself with relevant laws and best practices to avoid compliance issues during your project.

Future of performance bonding

The landscape of performance bonding is shifting, particularly with the emergence of new technologies and evolving market demands. Technology is streamlining the bonding process, enabling quicker approvals and more efficient contract management. This evolution may change how performance bonds are viewed and utilized in the coming years.

Additionally, potential future regulations and market changes may impact bonding practices. It's essential to stay informed about these trends to remain competitive and compliant within the industry.

Interactive tools and features

To enhance your experience with performance bond forms, tools like a dynamic performance bond calculator can assist in estimating required bond amounts based on project scope. This interactive feature can streamline the bonding process, ensuring that you choose the right amount based on your project's specific needs.

Additionally, having access to customizable performance bond templates through pdfFiller can save you time and effort. You can modify these templates to suit your project needs and preferences, making the creation of a performance bond form a straightforward task.

User testimonials and success stories

Real experiences from users illustrate how pdfFiller has streamlined their performance bonding processes. Testimonials highlight the simplicity and efficiency of using the platform for document creation and management, showcasing satisfaction among individuals and teams.

Case studies on effective bond management reveal successful projects that have leveraged performance bonds efficiently. These success stories underscore the importance of choosing the right tools and processes in navigating the often-complex world of bonding.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send performance bond to be eSigned by others?

How do I edit performance bond in Chrome?

Can I create an electronic signature for the performance bond in Chrome?

What is performance bond?

Who is required to file performance bond?

How to fill out performance bond?

What is the purpose of performance bond?

What information must be reported on performance bond?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.