Get the free Verification Worksheet — 2025-2026

Get, Create, Make and Sign verification worksheet 2025-2026

Editing verification worksheet 2025-2026 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out verification worksheet 2025-2026

How to fill out verification worksheet 2025-2026

Who needs verification worksheet 2025-2026?

Complete Guide to the Verification Worksheet 2 Form

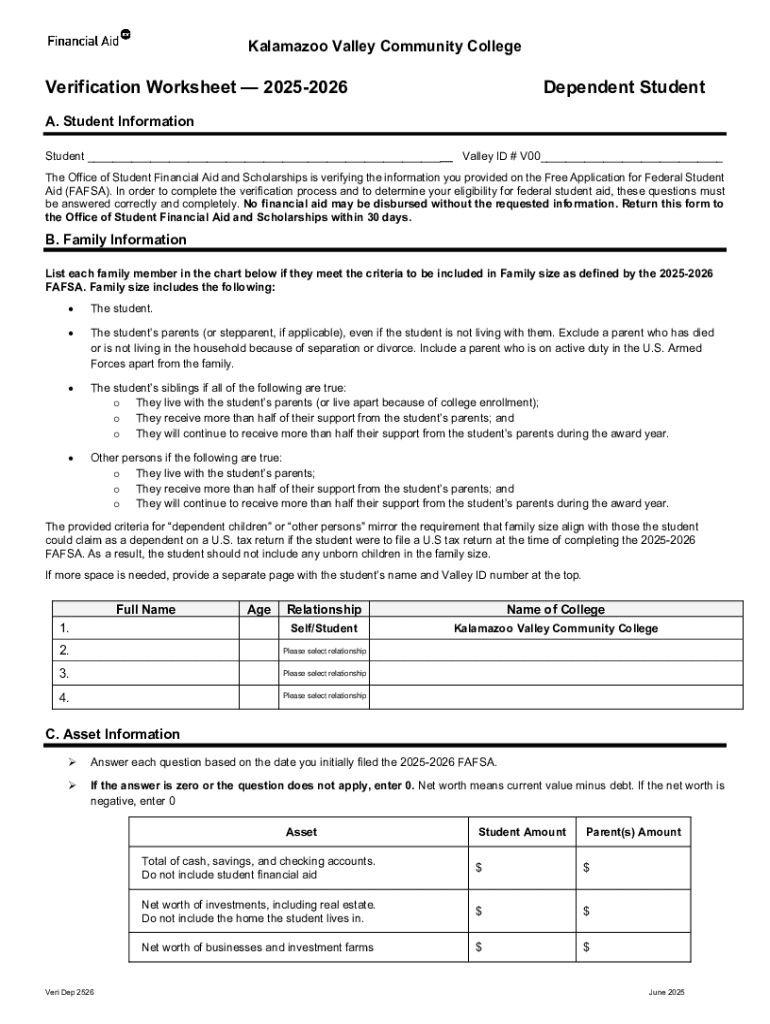

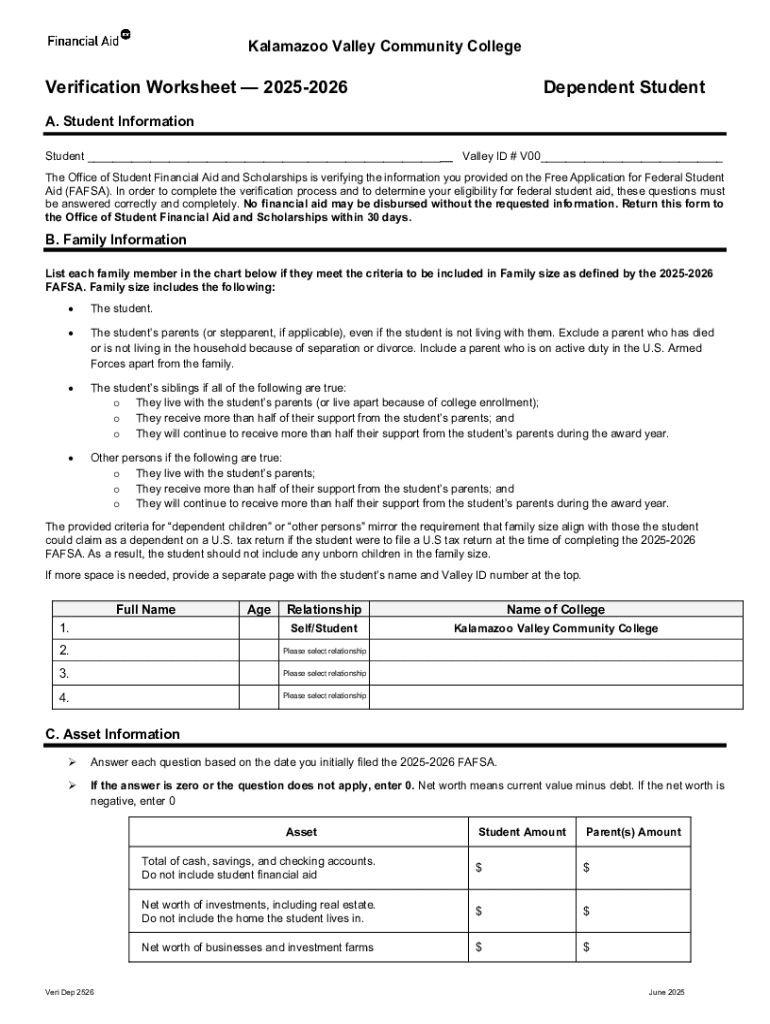

Overview of the verification worksheet

The verification worksheet 2 form serves as a critical component in the financial aid process for students seeking assistance for their education. This form primarily verifies the accuracy of information submitted on the FAFSA (Free Application for Federal Student Aid). The verification process helps ensure that students receive the correct financial aid package based on their true financial circumstances.

Its importance cannot be overstated, as financial aid offices rely on accurate data to award funds fairly and appropriately. The verification worksheet acts as a safety mechanism, preventing discrepancies that could occur from misinformation or misunderstanding of data requirements.

The 2 version has introduced key changes, particularly in the way data is reported and verified. Students can expect clearer guidelines and updated requirements, reflecting the evolving landscape of educational financing and compliance.

Eligibility criteria for verification

Not all students are subject to verification. The process specifically targets certain applicants based on various criteria established by the Department of Education. Generally, students may be selected for verification if there were inconsistencies noted in their FAFSA data, such as information discrepancies between reported income and tax documents.

Furthermore, some students may find themselves selected through a random sampling process. It's also crucial to recognize that being chosen for verification does not indicate any wrongdoing; it's a standard part of the federal financial aid process designed to ensure the integrity of the system.

For students and families, these implications mean that being selected for verification may require extra effort to provide the necessary documentation but is ultimately intended to facilitate an accurate determination of eligibility for aid.

Detailed components of the verification worksheet

The verification worksheet comprises several essential components that students must address. Accuracy in compiling this information is crucial, as it directly affects financial aid eligibility. Key sections of the form include personal identification details, household size, and income reporting.

Acceptable documentation to illustrate this information includes IRS tax transcripts and W-2 forms for income verification, among other records. In cases of unique circumstances, such as a person being confined or experiencing a significant financial change, additional considerations may apply.

Completing the verification worksheet

To complete the verification worksheet effectively, follow a step-by-step approach. Start by gathering all necessary documentation, as having these handy will streamline the process. Include tax returns, income statements, and any official papers that may support your claims.

Once you have all required documents, proceed to fill out the worksheet carefully. Ensure that all sections are completed accurately and reflect your current financial situation. Common mistakes include transposing numbers or failing to report all sources of income.

When it comes to submission, consider whether to send digitally or via physical mail. Utilizing tools like pdfFiller can facilitate smoother processing by allowing users to sign, edit, and submit forms online, ensuring a more organized approach.

Key policies and procedures

Understanding the policies and procedures surrounding the verification process is essential. Each institution sets its own timeline for verification, often requiring all necessary documents to be submitted within a specific timeframe post-FAFSA submission.

Missing these deadlines can significantly delay financial aid disbursements. Students should familiarize themselves with the specific deadlines imposed by their institutions to avoid adverse impacts on their education funding.

Financial assistance programs related to verification

Different types of financial assistance programs exist, categorized primarily into subsidized and unsubsidized options. Subsidized loans are given based on demonstrated financial need, whereas unsubsidized loans are available regardless of financial status.

The verification process significantly affects a student's eligibility for these programs. Students may find their loan amounts adjusted based on accurate reporting and verification, which can influence their overall financial planning for college.

Addressing common challenges in the verification process

Students often encounter challenges when navigating the verification process. One of the most common issues is dealing with missing or incorrect documentation. To troubleshoot these concerns, proactively check all documents before submission and follow up with employers or financial institutions if necessary.

Avoiding delays is crucial; students should remain responsive to requests from their financial aid offices and ensure prompt submission of any additional information. If verification is a new process for you, understanding its function and preparing accordingly can alleviate many stressors.

Follow-up actions after verification completion

Following the successful completion of the verification process, students should take a moment to review their financial aid offers. Understanding what packages are available and how they correspond to your financial needs is vital. Each offer may vary based on aid eligibility after verification.

Moreover, being aware of your rights and responsibilities as a financial aid recipient is crucial. Should students find that their financial situation does not align with awards, an appeal process exists that can help. Each institution has its procedures, and students should consult their financial aid office for guidance.

Leveraging pdfFiller for effective document management

Utilizing a platform like pdfFiller can significantly simplify the process of managing the verification worksheet 2 form. With features designed for document creation, editing, and collaboration, users can easily navigate through required steps without the need for cumbersome paper forms.

Benefits include cloud-based access allowing users to retrieve their documents from any location, as well as eSigning capabilities for quick submissions. By streamlining this process, pdfFiller can help students minimize errors and speed up their verification submission.

Frequently asked questions

Throughout the verification process, students often have lingering questions regarding their documentation and eligibility. One common inquiry is, 'What if I can’t provide required documentation?' Students should consult with their financial aid office to discuss alternatives or potential waivers but should strive to provide as much relevant information as possible.

Additionally, students may ask, 'Can I appeal if my financial aid is affected by verification?' The answer is yes; students can appeal based on their financial situation post-verification as long as they follow their institution's specific procedures. Lastly, many wonder, 'How long does the verification process typically take?' Timeframes can vary, but it’s essential to submit documents as soon as possible to expedite the process.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get verification worksheet 2025-2026?

How do I edit verification worksheet 2025-2026 in Chrome?

How do I edit verification worksheet 2025-2026 straight from my smartphone?

What is verification worksheet 2026?

Who is required to file verification worksheet 2026?

How to fill out verification worksheet 2026?

What is the purpose of verification worksheet 2026?

What information must be reported on verification worksheet 2026?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.