Get the free Form 4797

Get, Create, Make and Sign form 4797

How to edit form 4797 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 4797

How to fill out form 4797

Who needs form 4797?

A comprehensive guide to Form 4797: Sale of Business Property

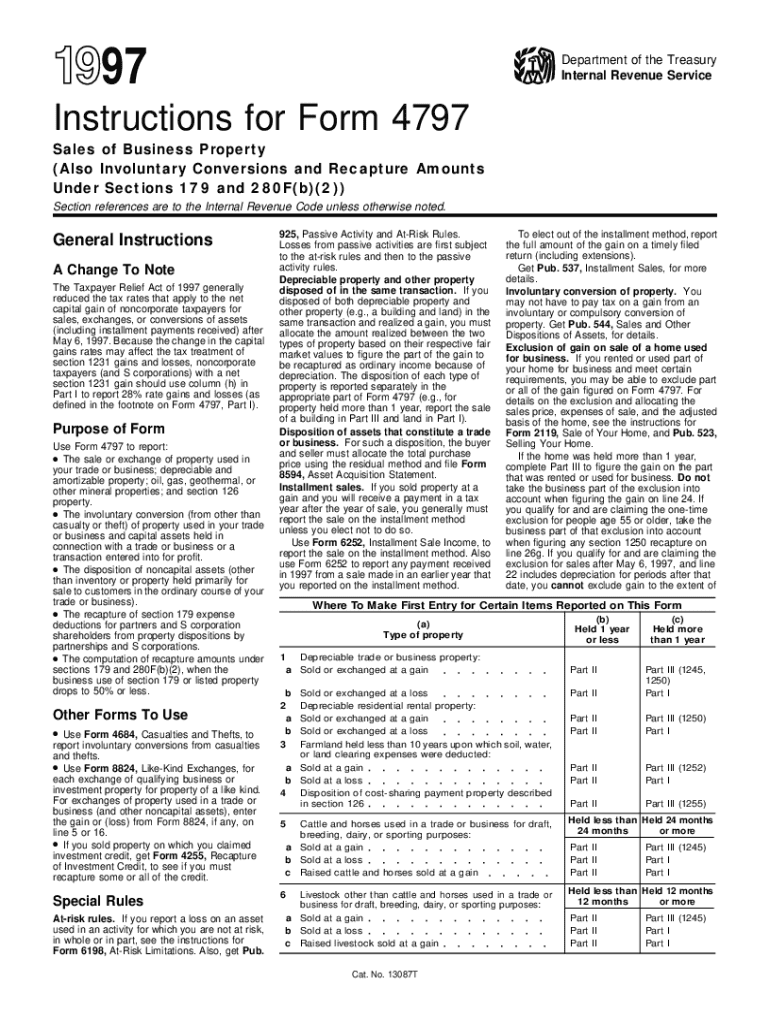

Understanding IRS Form 4797

Form 4797, titled Sale of Business Property, is a crucial document for taxpayers involved in selling or disposing of business assets. Its primary purpose is to report the sale of business property, including real and personal property. Understanding how and when to use this form is vital to ensure compliance with tax regulations and optimize tax outcomes.

Individuals or businesses that have sold Section 1245, Section 1250, or other types of business properties are required to file this form. This includes entities engaged in real estate transactions, business owners selling equipment, or any taxpayer who has exchanged property as part of their business operations. Ignoring Form 4797 can lead to penalties and inaccuracies in your tax filings.

Key components of Form 4797

Form 4797 is structured into three main parts, each focusing on different types of property sales. Understanding these components is essential for accurate reporting and tax calculation.

Each part has specific tax implications, especially regarding depreciation recapture, which needs to be approached with care to avoid costly mistakes in tax obligations.

When and how to use Form 4797

Situations that necessitate the filing of Form 4797 often revolve around business asset sales. Common scenarios include selling machinery, vehicles, or real estate owned for business use, as well as like-kind exchanges where one property is traded for another.

To fill out Form 4797 accurately, begin by gathering all necessary information regarding the assets sold or exchanged. This includes original purchase prices, expenses related to selling the assets, and any depreciation claimed in the past. Each section must be filled with precision to ensure compliance and correct tax calculations.

Calculating amount realized and tax basis

Calculating the amount realized from asset sales is a fundamental part of completing Form 4797. This amount essentially represents the total money received from the sale, which includes cash and the fair market value of any property received.

The tax basis of property sold is crucial for determining gain or loss. This basis can include costs related to improvements but must account for any depreciation claimed over the asset's life. Accurately adjusting this basis is necessary to reflect true economic gain or loss, avoiding underreporting or overreporting.

Understanding different property types

Form 4797 categorizes properties into different sections, each with unique implications. This distinction is vital, as it affects the manner in which gains or losses are calculated and reported.

Knowing the type of property involved in the sale is essential, as this determines your obligations under tax law when completing Form 4797.

Common mistakes to avoid with Form 4797

Filing inaccuracies can lead to significant tax penalties or audits from the IRS. Some common mistakes include incorrect calculations of gains and losses, failing to report all income received, and not considering depreciation adjustments.

Double-checking each section of the form is crucial. Ensuring all information corresponds with supporting documents will help mitigate the risks of errors.

Resources available for assistance

Navigating the complexities of Form 4797 requires access to reliable resources and tools. Using pdfFiller's platform can simplify both the editing and signing processes of your forms. An interactive platform allows you to access forms easily and make needed corrections seamlessly.

Consulting the right resources can streamline your filing process, allowing for accurate and timely submissions.

Tips for efficient document management

Efficient document management is essential for Tax Form 4797 preparation and compliance. Keeping organized records will not only make it easier to complete your filings but also prepare you for future audits.

By employing best practices for document management, you can ensure a smooth filing experience, which reduces stress and saves time.

Conclusion

Accurately filing Form 4797 is critical for business owners and individuals engaged in asset sales. The potential tax implications necessitate understanding the form’s intricacies and adhering to deadlines. Utilizing the available tools and resources can lead to a seamless experience that not only complies with IRS requirements but also maximizes your financial outcomes.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my form 4797 directly from Gmail?

How do I execute form 4797 online?

Can I edit form 4797 on an Android device?

What is form 4797?

Who is required to file form 4797?

How to fill out form 4797?

What is the purpose of form 4797?

What information must be reported on form 4797?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.