Get the free Cigarette Floor Tax Return

Get, Create, Make and Sign cigarette floor tax return

Editing cigarette floor tax return online

Uncompromising security for your PDF editing and eSignature needs

How to fill out cigarette floor tax return

How to fill out cigarette floor tax return

Who needs cigarette floor tax return?

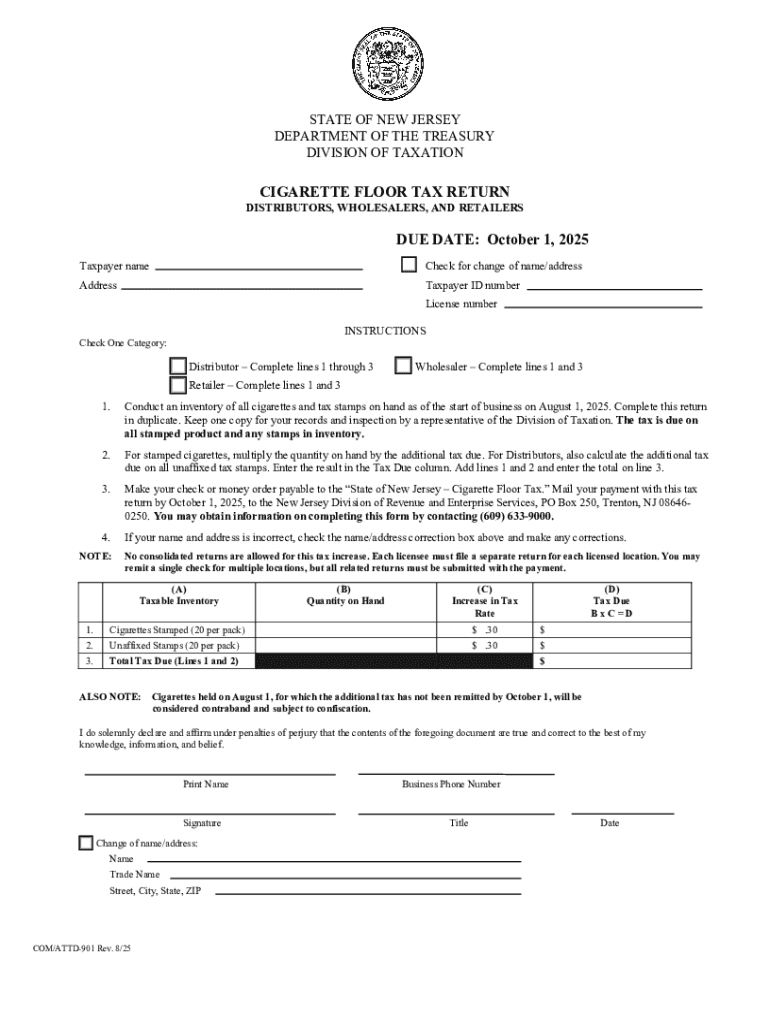

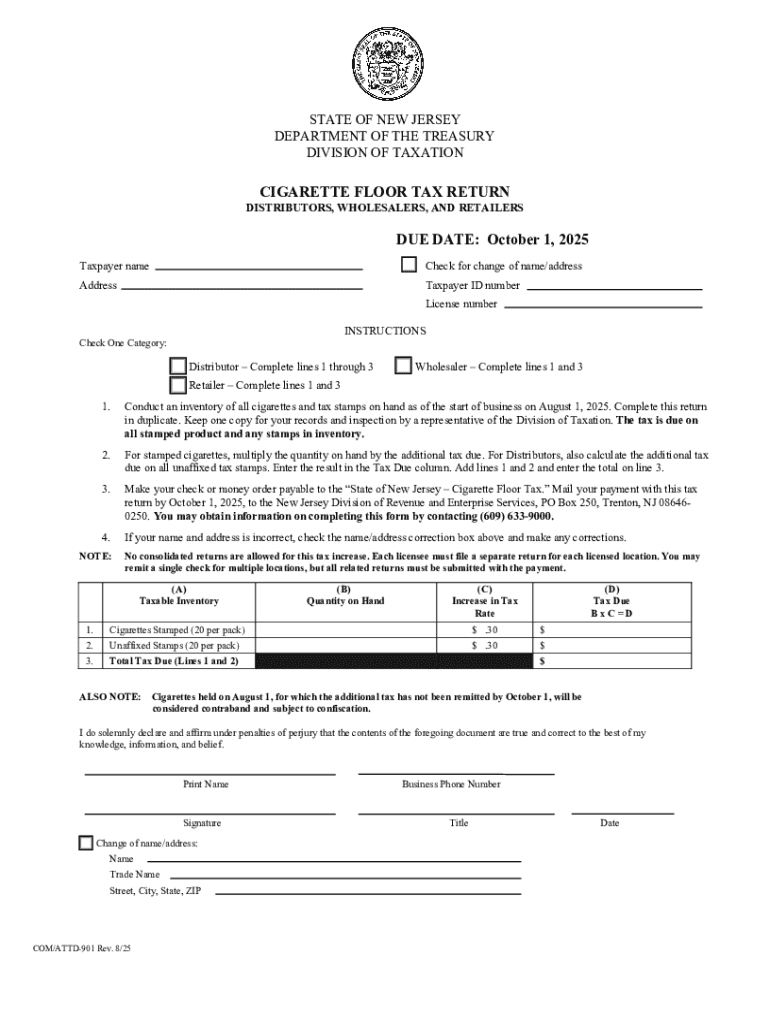

Understanding the Cigarette Floor Tax Return Form

Understanding the cigarette floor tax

The cigarette floor tax is a specific excise tax that applies to the wholesale distribution of cigarettes, aimed at ensuring states collect revenue on tobacco sales. This tax, varying by jurisdiction, serves as both a revenue-generating mechanism for state budgets and a public health effort to disincentivize tobacco use. Compliance with this tax is crucial for businesses involved in the sale of cigarettes, as failure to adhere to regulations can result in severe penalties, including fines and revocation of business licenses.

Both state and federal laws regulate this tax. Many states have implemented their own guidelines, which often differ significantly from one another. Businesses must navigate the intricacies of both federal requirements and state-specific rules to ensure full compliance, emphasizing the importance of understanding the cigarette floor tax.

Key components of the cigarette floor tax return

A cigarette floor tax return form comprises several critical components that need to be meticulously filled out. Key aspects include an overview of the applicable tax rates, which may differ based on local regulations. Additionally, businesses must categorize sales accurately to determine the exact tax owed. Understanding how to break this down can significantly impact tax calculation and compliance.

Required information typically includes:

Step-by-step guide to filling out the cigarette floor tax return form

Filling out the cigarette floor tax return form can seem daunting, but it’s a straightforward process if approached methodically. To begin, you can access the form through pdfFiller’s intuitive platform, which offers an easy-to-use interface.

Here’s a detailed guide on how to fill out each section of the form:

Interactive tools and features on pdfFiller

pdfFiller streamlines the tax return process by offering various interactive tools to assist you. For instance, utilizing pdfFiller’s editing features allows you to modify the form to suit your specific needs seamlessly. You can add annotations, highlight important areas, or adjust text sizes as necessary.

The eSign functionality enables you to sign documents electronically, which is especially useful for remote teams. Furthermore, pdfFiller offers collaboration tools that make it easy for team members to work on multiple entries or return filings simultaneously. This feature is invaluable when multiple team members are involved in managing returns for various jurisdictions.

Managing your cigarette floor tax filing process

Maintaining organized records is pivotal for any business managing cigarette floor tax obligations. Best practices for tracking your filing process include establishing a dedicated system for documentation. Utilize both digital tools and traditional filing systems to ensure easy access to records in case of audits or inquiries.

Here are some essential tips:

Troubleshooting common issues

Completing the cigarette floor tax return form can come with its own set of challenges. Common pitfalls include incorrect calculations, missing signatures, and inaccurate inventory counts. Addressing these issues proactively can save you from inconvenience during audits or inspections.

Solutions for frequent problems include consulting with accounting professionals to verify your calculations and ensuring all required fields are filled. If you encounter specific issues, having contact information for your state tax department can provide guidance on resolving any questions you might have regarding your return.

Additional information and resources

To enhance your understanding of the cigarette floor tax and related filings, accessing official resources from your state tax department is crucial. Many states publish comprehensive guides and FAQs to assist filers in understanding their tax obligations.

Additionally, seeking insights from tax experts can provide valuable perspectives on ensuring compliance and optimizing your submissions. These resources are instrumental for individuals and teams to stay informed about updates in tobacco tax legislation and filing requirements.

Staying informed on changes and updates

Tax regulations, particularly around tobacco, can frequently change. Therefore, remaining informed about the latest updates is vital. Subscribing to newsletters from your state tax department or using resources like pdfFiller can help ensure you never miss important changes.

Ongoing education about tobacco taxation also contributes to smooth operations. Regularly attending workshops or seeking online courses can empower teams and individuals to navigate this complex landscape confidently.

Language assistance and accessibility options

For non-English speakers, pdfFiller provides language support, ensuring that all users can access and understand the cigarette floor tax return form fully. Features are designed to cater to various languages and offer translations of essential terms.

Moreover, pdfFiller is committed to accessibility. Ensuring that all users, including those with disabilities, can skillfully navigate the platform is a priority. Providing feedback on your experience can help pdfFiller continuously enhance its offerings.

Bookmarking key pages and tools on pdfFiller

Efficiency is vital when filing tax returns. pdfFiller encourages users to bookmark key pages, including frequently accessed forms and templates. This can significantly reduce time spent searching for resources and streamline the overall filing process.

Navigating the pdfFiller interface efficiently can enhance your experience further. By customizing your dashboard to include essential forms and links to resources, you can quickly access information when it matters most.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find cigarette floor tax return?

How do I make changes in cigarette floor tax return?

How do I complete cigarette floor tax return on an Android device?

What is cigarette floor tax return?

Who is required to file cigarette floor tax return?

How to fill out cigarette floor tax return?

What is the purpose of cigarette floor tax return?

What information must be reported on cigarette floor tax return?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.