Get the free Ct-1

Get, Create, Make and Sign ct-1

How to edit ct-1 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out ct-1

How to fill out ct-1

Who needs ct-1?

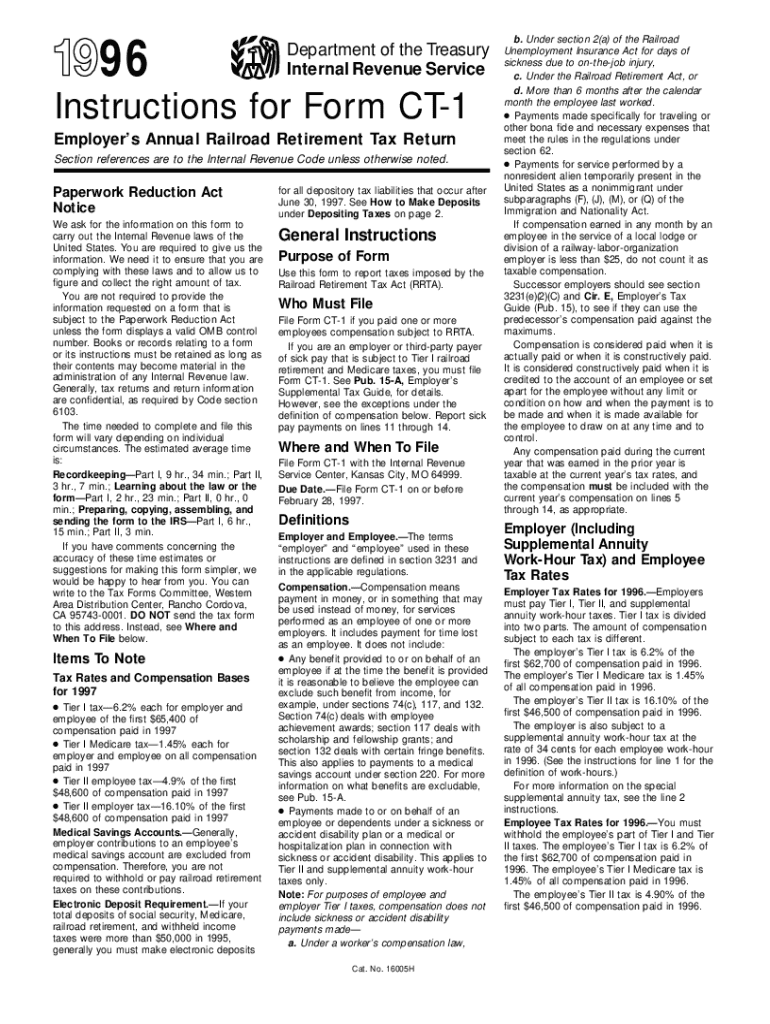

Comprehensive Guide to the CT-1 Form

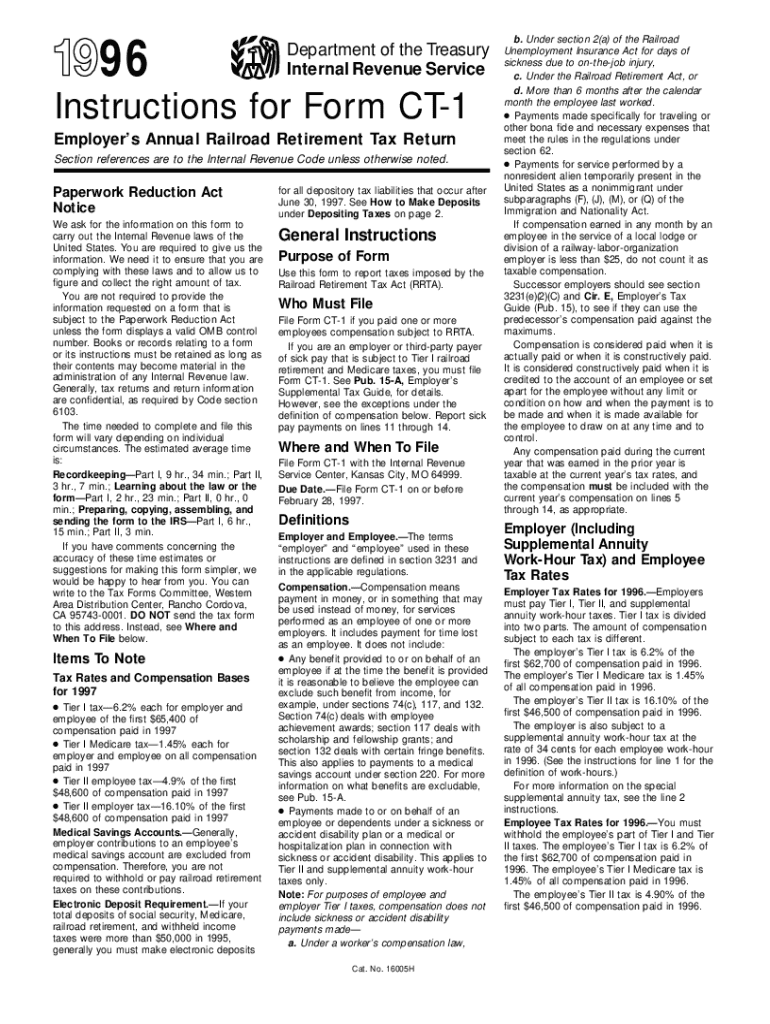

Understanding the CT-1 Form

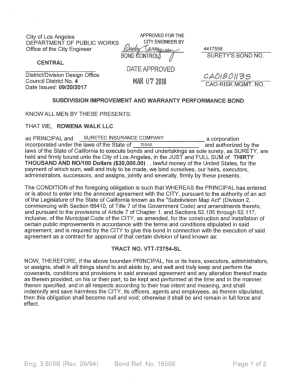

The CT-1 Form, often referred to as the 'Qualified Transportation Fringe Benefit Form,' is a significant document utilized primarily for reporting and assessing employer-provided transportation benefits. This form is essential for ensuring compliance with tax regulations as it allows employers to declare the amount of fringe benefits offered to employees for commuting purposes.

The purpose of the CT-1 Form extends beyond simply declaring transportation benefits; it serves to facilitate the calculation of employment taxes related to these benefits. This document is particularly relevant for companies looking to maximize tax deductions related to employee transport.

Key features of the CT-1 Form

The CT-1 Form includes several essential components that ensure complete and accurate reporting. Key features include fields for identification, dates of reporting, and detailed financial information regarding transportation benefits provided to employees.

Employers must pay close attention to these components to avoid common mistakes during submission, which can lead to delays or penalties. The formatting and layout of the CT-1 Form play a vital role in its usability, as clear and organized sections facilitate data entry and enhance the overall experience for users.

Step-by-step guide to filling out the CT-1 Form

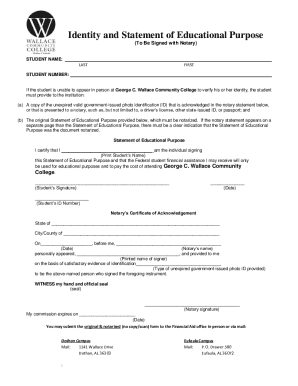

Filling out the CT-1 Form accurately is crucial for smooth compliance with tax requirements. Before starting, it's advisable to prepare by gathering all necessary documents, including employee records and related tax documentation.

Each section of the CT-1 Form serves a specific purpose. The personal information section includes fields for the employer’s name and EIN, while the employment details require information about the employees receiving the benefits. Lastly, the financial data must reflect the total benefits distributed.

Using pdfFiller to edit and manage your CT-1 Form

pdfFiller offers a convenient platform for managing the CT-1 Form. Users can easily upload the form in a PDF format, allowing for streamlined editing and completion. The user-friendly interface reduces the complexity associated with document modifications.

Once uploaded, pdfFiller provides a suite of tools for editing the CT-1 Form. Users can add text, include signatures, and make annotations directly on the form, ensuring that every detail is addressed effectively.

eSigning the CT-1 Form with pdfFiller

The importance of eSigning the CT-1 Form cannot be understated, as electronic signatures enhance the verification process and ensure compliance with legal standards. With pdfFiller, users can easily apply eSignatures, streamlining the approval process.

To eSign, the process is simple: upload your completed CT-1 Form, then use pdfFiller’s eSignature tool. Additionally, users can invite others to sign the document, allowing for collaboration in a secure manner.

Collaborating on the CT-1 Form

Collaboration is essential when completing the CT-1 Form, especially for larger organizations. pdfFiller provides tailored sharing options that facilitate ease of access for team members. This ensures that everyone involved can contribute effectively to the document.

In addition to simple sharing, pdfFiller features real-time collaboration tools, which allow multiple users to work on the document simultaneously. Feedback management is streamlined, making it simple to address revisions and suggestions.

Troubleshooting common issues with the CT-1 Form

Even with a robust platform like pdfFiller, users may encounter issues while completing or submitting the CT-1 Form. Knowing how to address these challenges can save time and minimize stress. If incorrect information is noticed post-filing, ensure to review submission guidelines and contact the respective tax authorities promptly.

Submission errors are often a result of missing or incorrect data. It's crucial to double-check all entries before submission. Should issues arise that cannot be resolved, pdfFiller’s support team can assist users through the troubleshooting process.

Best practices for keeping your CT-1 Form secure

The security of the CT-1 Form is paramount, especially given the sensitive nature of the financial information in it. When using pdfFiller, implement best practices for document security to protect yourself and your organization. This includes using strong passwords for shared documents and enabling encryption where possible.

Additionally, staying compliant with data protection standards will help safeguard all information contained within the CT-1 Form. Regular audits and updates regarding security measures will enhance the protection of your documents.

Managing and storing your CT-1 Form digitally

The digital management of the CT-1 Form through pdfFiller allows users to store their forms securely and retrieve them when necessary. Organizing forms in a systematic manner improves accessibility and ensures efficient document handling.

Establishing archiving practices is also crucial. Users should clearly label stored forms and maintain a version history, which helps track changes and ensures that documentation remains current.

Exploring advanced features for CT-1 form users

For users who frequently work with the CT-1 Form, pdfFiller offers advanced features that integrate form usage with broader business processes. Automating certain tasks minimizes manual intervention, which can save time and reduce errors.

Automation tools in pdfFiller can be particularly beneficial for large enterprises, allowing them to streamline workflows associated with transportation benefits. This fosters efficiency and enhances overall productivity.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute ct-1 online?

Can I create an electronic signature for the ct-1 in Chrome?

How do I fill out ct-1 on an Android device?

What is ct-1?

Who is required to file ct-1?

How to fill out ct-1?

What is the purpose of ct-1?

What information must be reported on ct-1?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.