Get the free 941-ss

Get, Create, Make and Sign 941-ss

How to edit 941-ss online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 941-ss

How to fill out 941-ss

Who needs 941-ss?

Understanding Form 941-SS: Your Comprehensive Guide

Overview of Form 941-SS

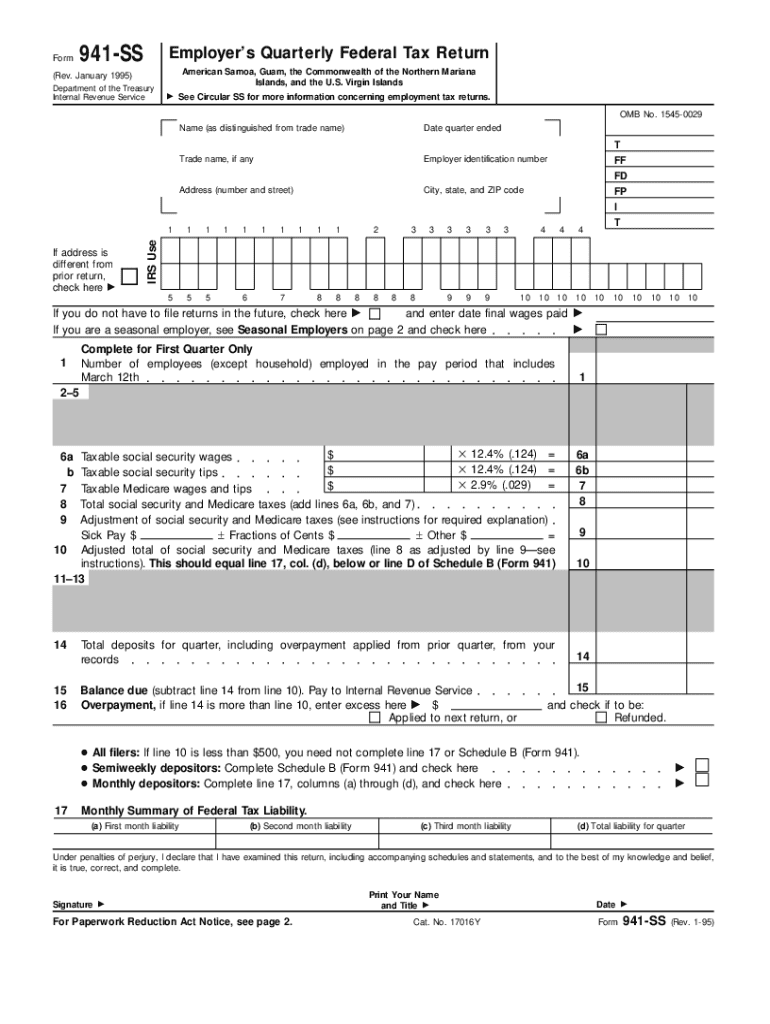

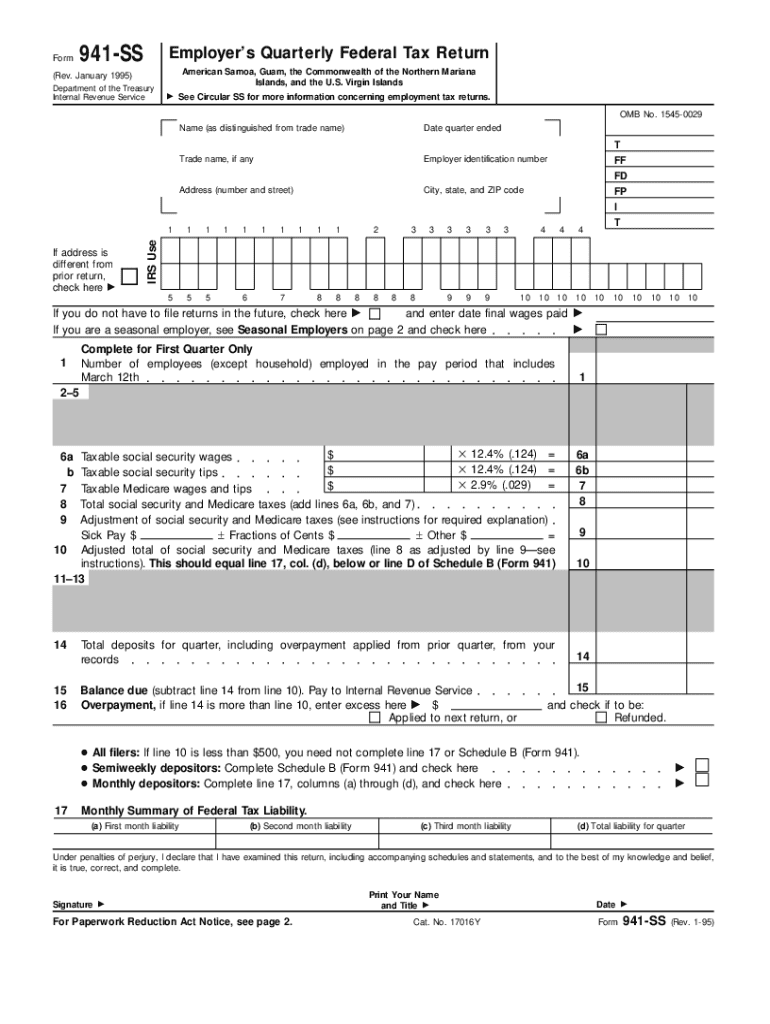

The 941-SS form is a critical document for employers operating in specific U.S. territories, including American Samoa, Guam, the Commonwealth of the Northern Mariana Islands, and the U.S. Virgin Islands. Designed by the IRS, this form facilitates the reporting of payroll taxes withheld by employers from employee wages and various employer contributions related to social security and Medicare taxes. Its primary purpose is to ensure compliance with federal tax obligations, while also providing essential data that impacts the social safety net programs on which many Americans rely.

Historically, Form 941-SS has been vital for businesses operating in these territories—it allows them to maintain their tax compliance while facilitating their contributions to broader economic stability. Given the unique challenges faced by employers in these regions, understanding the nuances of this form is essential.

Understanding the 941-SS form

IRS Form 941-SS is specifically tailored for employers in U.S. territories mentioned earlier. By completing this form, employers report in detail about their employees’ wages, tips, and other compensation, alongside withholding taxes. Filing this form confirms the employment status and payment of taxes, which directly affects the workers' eligibility for benefits like Social Security and Medicare.

Employers are required to file Form 941-SS quarterly, with key deadlines being the last day of the month following the close of the quarter. For instance, returns for the first quarter should be submitted by April 30. Failure to meet these deadlines could result in penalties, which can be severe, including fines and interest on unpaid taxes.

Changes to Form 941-SS

Recent announcements from the IRS indicate that the Form 941-SS will be discontinued after 2023. This transition is essential for streamlining tax reporting processes and offering a more unified framework for all employers across the U.S. As a result, employers will need to familiarize themselves with alternative forms like the standard Form 941 and related variations.

For the tax years 2023 and 2024, notable adjustments will be made to specific fields on the 941-SS form. For instance, revised guidelines will clarify the reporting of credit and allowances, thereby simplifying the filing process for employers. Understanding these changes is crucial for ensuring compliance and avoiding penalties.

E-filing Form 941-SS: A step-by-step guide

E-filing offers a modern approach to submitting Form 941-SS, eliminating paperwork and reducing processing times. The benefits of e-filing over traditional paper filing include faster submissions, automatic calculations, and immediate confirmations upon receipt. Given these advantages, many employers are shifting towards electronic submissions.

To e-file Form 941-SS, follow this step-by-step guide:

When filling out Form 941-SS, employers must provide their taxpayer information along with details regarding employee wages and the taxes withheld. Additionally, any eligible credits should be claimed correctly to maximize possible tax benefits.

Exclusive features of pdfFiller for Form 941-SS

pdfFiller stands out as an efficient solution for managing Form 941-SS filings. Offering seamless editing and management tools, users can interactively adjust PDFs, ensuring that all necessary information is correctly entered. This flexibility makes it easy for users to adapt the form to their specific needs.

The platform also supports collaboration options, enabling teams to share documents for input and review, which is ideal for businesses where multiple stakeholders may need to assess the information prior to final submission.

Tracking and reporting features keep users informed on the filing status, ensuring that submissions are not only completed but also tracked effectively. Additionally, the e-signature feature simplifies the signing process, allowing employers to complete Form 941-SS without the need for printing and scanning.

Common issues and FAQs related to Form 941-SS

When filing Form 941-SS, common mistakes can lead to complications, such as incorrect data entry or missed deadlines. It's crucial for employers to implement thorough checks to minimize errors and meet all filing requirements diligently. A robust tracking system can help ensure timely submissions.

In response to FAQs, an important aspect is understanding the implications of submitting the form late. Employers who miss deadlines may face penalties, but it is important to recognize that they can rectify errors by filing an amended form if necessary. Engaging with support resources provided by platforms like pdfFiller can offer users peace of mind while navigating these challenges.

Understanding related forms

When dealing with payroll taxes, various forms may be applicable based on specific business conditions. Aside from Form 941-SS, businesses should also consider other forms such as Form 941, intended for employers in the continental U.S.; Form 941-PR specifically for Puerto Rico; and Form 941-SP which is geared toward Spanish-speaking filers. Each of these forms comes with its nuances and filing requirements.

It's essential for employers to determine when to use these forms compared to Form 941-SS, ensuring they are compliant with federal and local tax regulations while avoiding unnecessary penalties.

Best practices for maintaining compliance

To uphold compliance, effective record-keeping is crucial. Employers should retain relevant documentation related to payroll, employee tax information, and filed forms for several years. The IRS recommends maintaining records for at least four years from the date of the tax return.

Conducting annual reviews of tax filings and staying updated on tax law changes is vital for all employers. By remaining informed, businesses can proactively adapt their tax strategies and ensure that they continue to meet compliance requirements without interruption.

Expert insights and stories

Numerous businesses have successfully streamlined their Form 941-SS filings using pdfFiller. These success stories illustrate how the platform has simplified the filing process, minimized errors, and saved valuable time for employers, allowing them to focus on their core business operations.

Experts recommend that first-time filers familiarize themselves with the layout of Form 941-SS. Engaging with seasoned tax professionals can provide invaluable insights, ensuring that new filers avoid common pitfalls and maximize their tax compliance efforts.

Connect with the community

If you're looking to enhance your understanding of Form 941-SS and related processes, numerous engagement opportunities are available. Participating in webinars and community events facilitated by experts can provide valuable insights and practical knowledge on effective form management.

For ongoing learning, pdfFiller hosts an extensive knowledge base that includes blogs, videos, and forums where users can discuss challenges and solutions, ensuring that everyone in the community has access to the resources needed for best practices in document management.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit 941-ss from Google Drive?

How can I send 941-ss for eSignature?

How do I edit 941-ss on an iOS device?

What is 941-ss?

Who is required to file 941-ss?

How to fill out 941-ss?

What is the purpose of 941-ss?

What information must be reported on 941-ss?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.