Get the free 706-na

Get, Create, Make and Sign 706-na

How to edit 706-na online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 706-na

How to fill out 706-na

Who needs 706-na?

A Comprehensive Guide to the 706-NA Form

Understanding the 706-NA form

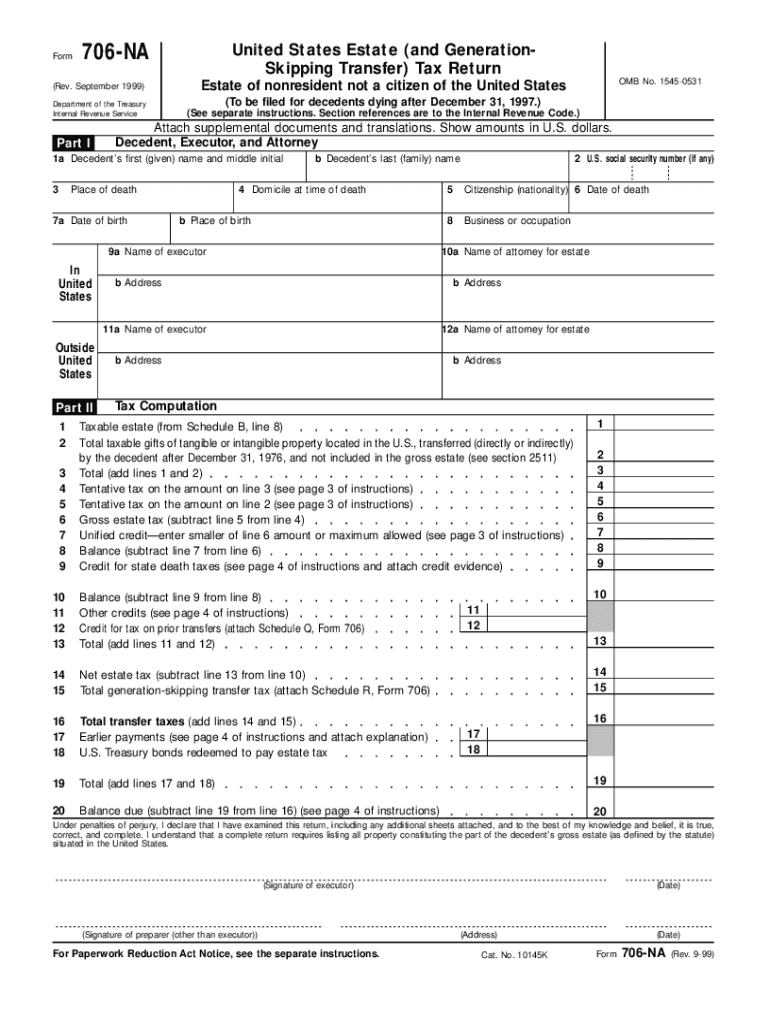

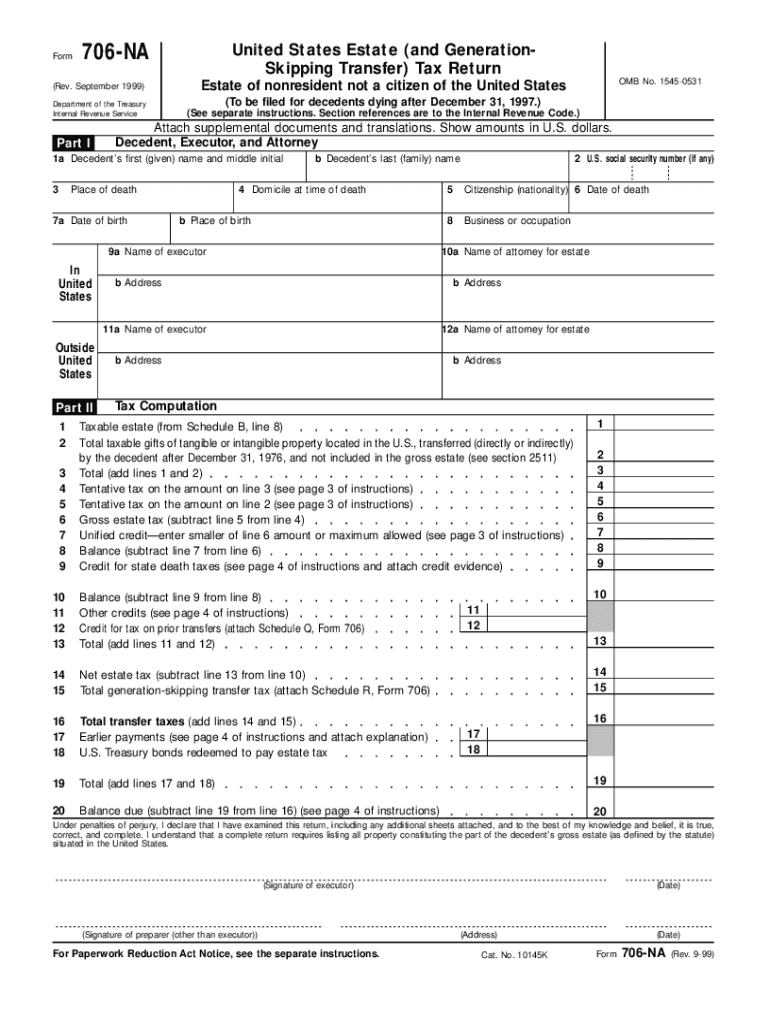

The 706-NA Form, officially known as the United States Estate (and Generation-Skipping Transfer) Tax Return, is a critical document for those dealing with the estate of a U.S. citizen or resident who has passed away. This form is utilized specifically for estates that are not subject to U.S. estate tax because the decedent was not domiciled in the United States at the time of death but whose assets are located within the U.S. The primary purpose of the 706-NA form is to report the gross estate of the decedent and compute any potential estate tax liabilities.

Filing the 706-NA form is paramount in ensuring compliance with federal tax obligations. An understanding of its requirements is essential for executors and administrators managing the estate. If the gross estate exceeds a specific exemption limit, filing may be mandatory. Notably, foreign individuals who possess U.S. assets like real estate or bank accounts will likely need to complete this form to accurately report the value of these holdings.

Key components of the 706-NA form

The 706-NA form consists of several crucial sections designed to capture specific financial and personal details related to the deceased's estate. Understanding these components fully allows for a more effective and accurate filing process. The form is divided into three principal parts: General Information, Assets Valuation, and Deductions and Exemptions.

Part 1: General Information is where the filer provides basic details about the decedent, including name, date of death, and taxpayer identification number. Part 2: Assets Valuation focuses on the appraisal of all U.S. situated properties and assets, ensuring that they are valued appropriately for tax calculations. In Part 3: Deductions and Exemptions, allowable deductions such as funeral expenses, debts of the decedent, and any bequests to charities are reported, offering potential tax relief.

Step-by-step guide to completing the 706-NA form

Completing the 706-NA form requires meticulous preparation and organization. Start by gathering all necessary information and documentation which includes the decedent's will, financial statements, bank records, property deeds, and valuations of stocks and bonds. Having all this information at hand simplifies the process considerably.

Next, fill out personal information such as the decedent's full name, address, and date of birth. It is vital to ensure this information is accurate to avoid complications later. When valuing different types of assets, provide accurate market valuations—this applies to real estate, bank accounts, and investments. Each asset should be supported by documentation evidencing its value. Lastly, report any eligible deductions; common examples include debts owed by the decedent and qualified funeral expenses. Don’t forget to include your signature and those of any witnesses as required.

Editing and modifying the 706-NA form

Once the 706-NA form is filled out, you may find necessary corrections that need to be made. For example, errors in amounts or misreported asset information can happen. Fortunately, modifying this form is straightforward, especially with tools like pdfFiller, which offers a user-friendly interface for editing PDF documents.

Using pdfFiller, you can easily add notes or comments, revise information electronically, and ensure the document reflects the accurate information before filing. Always save a backup copy after making changes to ensure that all modifications are captured and documented, keeping your records organized.

eSigning the 706-NA form

In today’s digital age, signing documents electronically is not only efficient but increasingly necessary for timely filing. The 706-NA form requires that signatures of the involved parties, including designated executors, be included before submission. eSigning ensures the document is not only valid but also legally binding.

Setting up your eSignature through platforms like pdfFiller is user-friendly. Once your eSignature is established, you’ll feel confident in ensuring the document complies with requirements regarding identity verification and security. Always double-check that all signing parties have viewed and signed the document before finalizing it.

Filing the 706-NA form

Once your 706-NA form is completed and signed, it’s time to file it with the IRS. You have multiple pathways for submission which include electronic filing through the IRS's e-file system or mailing a hard copy of the completed form to the appropriate address for submission. If going the traditional mailing route, ensure that the envelope is postmarked by the designated deadline to prevent late filing penalties.

Understanding filing deadlines is crucial in avoiding unnecessary complications. Typically, the 706-NA form must be filed within nine months of the decedent's date of death, although extensions may be available under specific scenarios. By adhering to these timelines, you can respectively manage the estate tax obligations without unnecessary stress.

Frequently asked questions about the 706-NA form

Many individuals have queries surrounding the 706-NA form, particularly regarding late filings and amendments. If the form is submitted after the due date, penalties can incur, potentially compromising the estate's financial standing. However, there is the option to amend the 706-NA form if changes are required post-filing.

Moreover, if the value of your estate exceeds the exemption limit, it can create additional complications pertaining to tax obligations but understanding where these thresholds are set can aid in proper planning. Lastly, it’s essential to realize how the 706-NA form affects heirs and beneficiaries, as the estate's obligations can subsequently influence the inheritance left for them.

Common mistakes to avoid when filing the 706-NA form

While navigating through the filing of the 706-NA form, it’s easy to make errors that can complicate the process. Common mistakes include misreporting asset valuations, failing to include all eligible deductions, and incorrect personal information in the header. Each of these issues can lead to delays, audits, or even penalties from the IRS. Therefore, having checks in place to verify accuracy is critical.

Ensuring all information is complete and accurately reflects the decedent's estate is paramount. Take the time to review the completed form before submission, and consider having an extra pair of eyes on the documentation to review for mistakes. This step can save time and setbacks in the long run.

Resources for managing estates

Managing an estate can feel overwhelming, but various resources are available to simplify the journey. Utilizing platforms like pdfFiller, estate executors can access related services such as document storage, collaboration tools for sharing documents with professionals, and additional IRS form guidance.

Furthermore, having a grasp on available online calculators for estate valuation can enhance your understanding of the financial landscape you’re managing. These resources empower estate managers and beneficiaries alike, leading to more informed decisions and strategies during the estate management process.

Contacting professionals for assistance

While navigating the complexities of the estate tax process, there may come a time when hiring a tax professional or estate planner becomes beneficial. These experts can provide personalized guidance, ensuring that all filings are completed accurately and efficiently. Whether it’s about understanding the nuances of the 706-NA form or strategizing around tax obligations, a professional's expertise is invaluable.

Furthermore, pdfFiller facilitates easy collaboration with professionals by making document sharing simple and secure. Users can invite tax advisors or estate planning lawyers directly to the platform, streamlining communication and document management, enhancing the overall efficiency of managing estate processes.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my 706-na directly from Gmail?

How do I edit 706-na online?

Can I create an electronic signature for signing my 706-na in Gmail?

What is 706-na?

Who is required to file 706-na?

How to fill out 706-na?

What is the purpose of 706-na?

What information must be reported on 706-na?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.