Get the free Ej-130 K - courts ca

Get, Create, Make and Sign ej-130 k - courts

Editing ej-130 k - courts online

Uncompromising security for your PDF editing and eSignature needs

How to fill out ej-130 k - courts

How to fill out ej-130 k

Who needs ej-130 k?

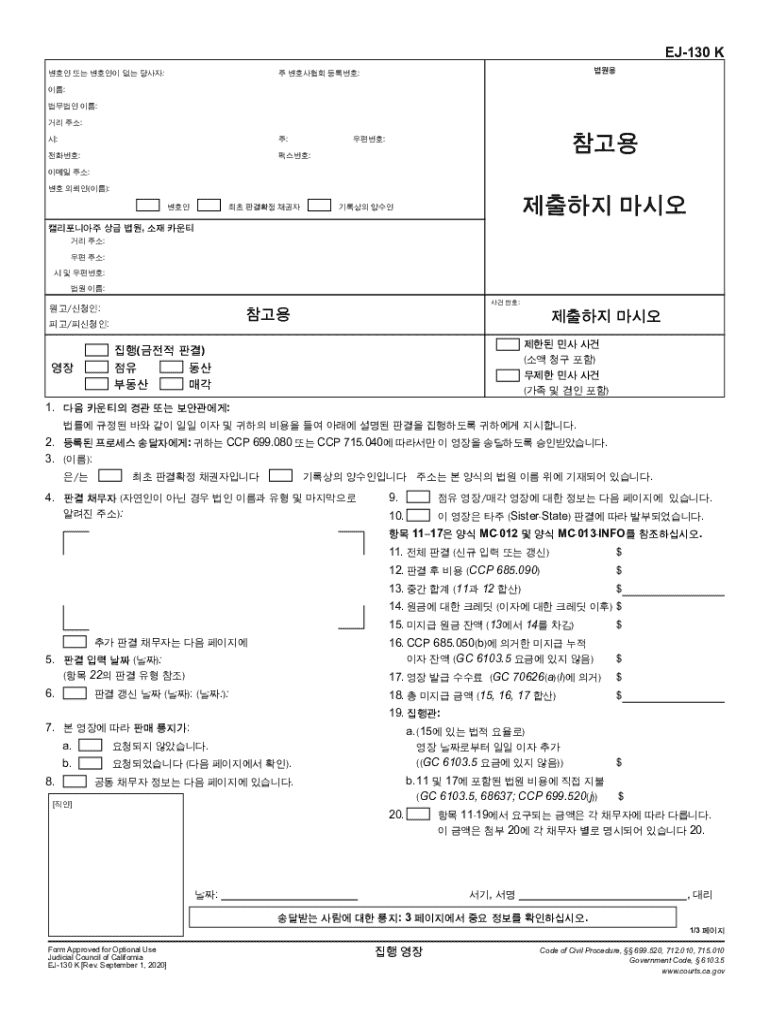

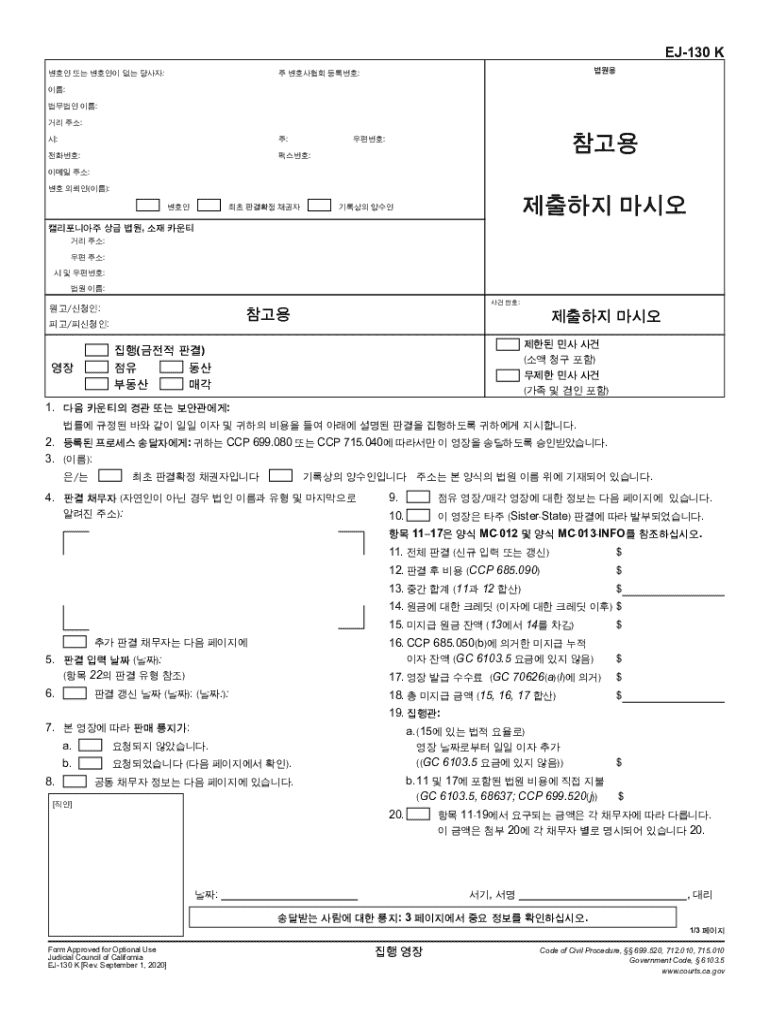

Comprehensive Guide to the EJ-130 K Courts Form

Overview of the EJ-130 K Courts Form

The EJ-130 K form is an essential document used within the California court system. Specifically designed to help individuals and attorneys declare their income, expenses, and overall financial situation, the EJ-130 K serves as a critical tool in various court proceedings, especially in the context of fee waivers and applications for financial assistance. Proper filing of this form ensures transparency and provides the court with necessary information to determine eligibility for certain legal services or assistance.

Ensuring the proper submission of the EJ-130 K form is paramount in navigating court processes. Accurate information helps not only to avoid delays but also to prevent potential legal complications. The stakes can be high, as misrepresentations or incomplete submissions could lead to dismissal of applications or unfavorable legal outcomes.

Individuals needing to fill out the EJ-130 K form include those seeking a fee waiver for court costs, legal aid applicants, and anyone involved in civil cases who needs to declare their financial status. Understanding the requirements and nuances of the form can significantly influence the efficiency of court proceedings.

Key features of the EJ-130 K form

The EJ-130 K form encompasses several critical sections. Here’s a detailed breakdown of what to expect when navigating this form:

Special attention should be given to fields such as declared income and specific expense categories, as inaccuracies may raise questions or result in delays. Compared to similar forms, the EJ-130 K focuses primarily on financial disclosure, whereas others may require legal argumentation or additional documentation.

Step-by-step guide to completing the EJ-130 K form

Completing the EJ-130 K form efficiently requires a well-structured approach. Below is a step-by-step guide to streamline the process.

Step 1: Collect necessary information

Before filling out the EJ-130 K form, gather the following documents to ensure accuracy:

Tip: Organizing your financial documents beforehand allows for a smoother completion of the form. Thoroughly check each source for accuracy.

Step 2: Filling out the form

When filling out the EJ-130 K form, clarity is key. Ensure every entry is understandable and reflective of your true financial status. Specific instructions for each section include the following:

Avoiding common mistakes like incorrect case numbers or unexplained negative figures can significantly enhance your application’s clarity.

Step 3: Editing the form

Once the form is filled out, reviewing and refining your entries is crucial. Utilize tools like pdfFiller for efficient editing.

For collaboration, share your completed form with trusted associates or attorneys for feedback before final submission. This step can highlight issues overlooked during initial completion.

Step 4: Signing the form

Proper execution of your EJ-130 K form includes signing it correctly. eSigning with pdfFiller allows for a secure, verifiable signature that meets legal requirements.

Ensure that your signature is provided in the designated area to uphold submit validity. Familiarize yourself with the specific rules governing signature requirements in your jurisdiction.

Step 5: Submitting the form

The final step is submission, which can typically be done in two ways: online or in-person. Choose the method that suits your timeframe and resources best.

Additionally, be mindful of any deadlines surrounding your submission. Failing to submit the form in time could adversely affect your case.

Interactive tools to enhance form management

pdfFiller offers a suite of online tools designed to simplify the management and submission of the EJ-130 K form. These tools not only streamline the process but also enhance the overall user experience.

These interactive tools ensure that users are not left in the dark regarding their document status and allow for efficient management of revisions.

Additional considerations and tips

While filling out the EJ-130 K form, it's crucial to be aware of potential court fees and associated costs. These can vary significantly based on the specific court and the nature of your case.

These considerations not only improve your experience but also protect your legal standing throughout the duration of your case.

Common FAQs about the EJ-130 K courts form

Frequently asked questions about the EJ-130 K form focus often on the nuances of its completion and submission.

Addressing these questions can mitigate anxiety surrounding the form's complexities and aid in effective preparation.

Conclusion on the significance of using the EJ-130 K courts form effectively

Your understanding and mastery of the EJ-130 K form can significantly impact the outcome of your legal matters. Focusing on each section's details brings clarity and legality to your financial declarations before the court.

Leveraging tools like pdfFiller not only simplifies the process of document management but also provides access to essential support for eSigning, editing, and collaboration. By being thorough in your preparation and submission, you position yourself for success in navigating the intricate legal landscape.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my ej-130 k - courts directly from Gmail?

How do I fill out the ej-130 k - courts form on my smartphone?

Can I edit ej-130 k - courts on an iOS device?

What is ej-130 k?

Who is required to file ej-130 k?

How to fill out ej-130 k?

What is the purpose of ej-130 k?

What information must be reported on ej-130 k?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.