Get the free Form 712

Get, Create, Make and Sign form 712

How to edit form 712 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 712

How to fill out form 712

Who needs form 712?

Understanding IRS Form 712: A Comprehensive Guide

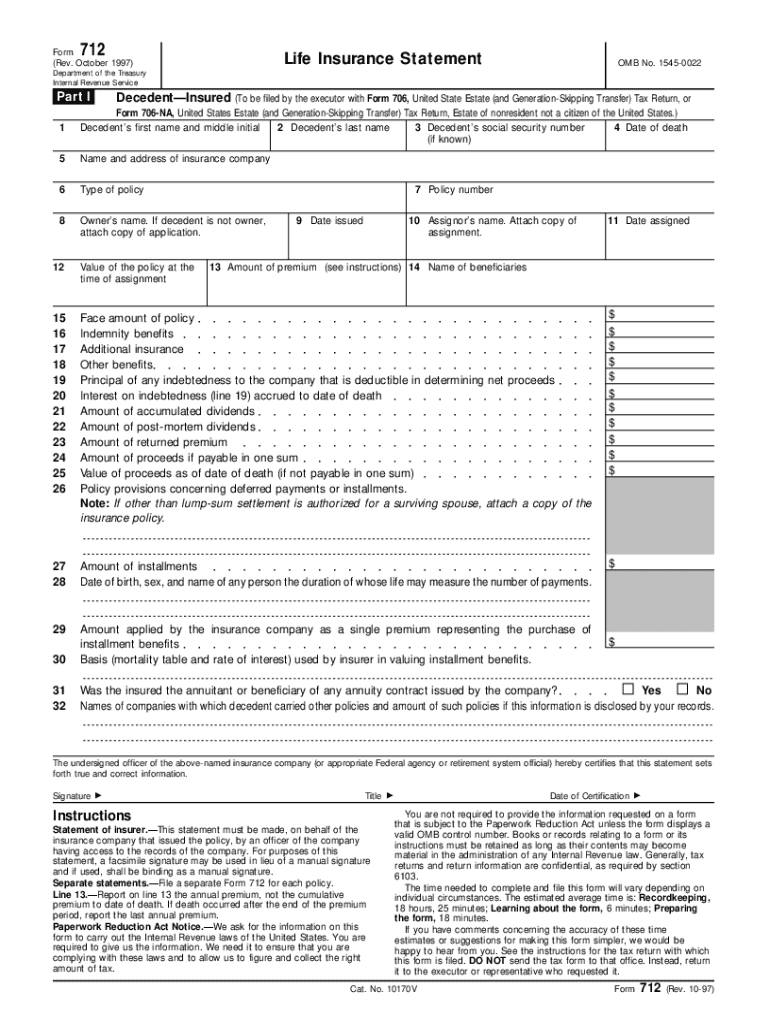

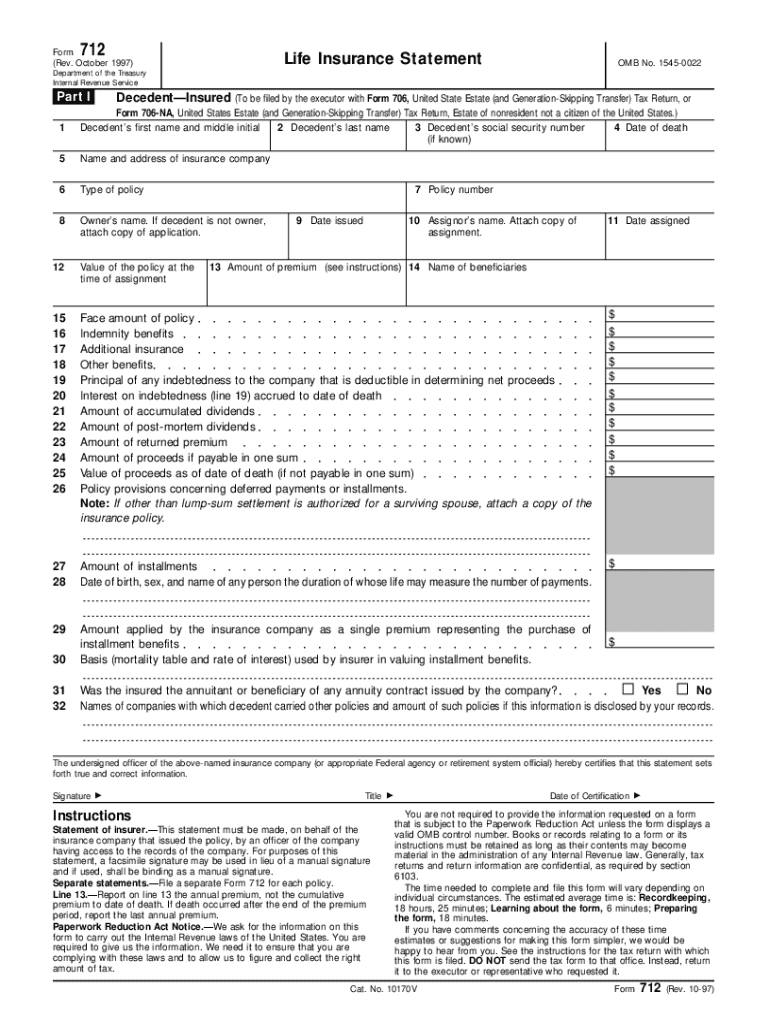

What is IRS Form 712?

IRS Form 712 is a crucial tax document known as the Life Insurance Statement. It is vital for establishing the value of a decedent’s life insurance policies when formulating estate or gift tax returns. This form encapsulates information pertaining to life insurance policies held by an individual who has passed away (the decedent), making it essential for various beneficiaries and fiduciaries.

The importance of IRS Form 712 extends beyond mere recordkeeping; it plays a significant role in determining the taxable value of an estate. By accurately capturing the details of life insurance policies, this form helps ensure compliance with federal tax regulations.

Who uses IRS Form 712 in a tax return?

IRS Form 712 is predominantly used by individuals involved in estate management. The key players in this scenario include beneficiaries, executors, and trustees. Beneficiaries, those who inherit the assets, need to understand the insurance valuations to assess the total value of their inheritance.

Executors, tasked with managing a deceased person’s estate, must submit Form 712 to report the life insurance policy values accurately. Trustees may also use this form for trust-related tax filings that involve life insurance policies, ensuring that all financial aspects are adequately covered.

Understanding Form 712: A step-by-step guide

Form 712 is divided into two main parts: Part I pertains to the decedent-insured, while Part II references the living insured. Each part requires specific information and different handling.

Part : Decedent-Insured

In Section A, basic information such as the decedent’s name, Social Security Number, and policy number must be entered. Section B focuses on policy details, like issuer name and type of coverage.

Part : Living Insured

This part captures different details relevant to the living insured person if the insured party and the owner are not the same. Differences in policy ownership may influence tax implications.

Filling out IRS Form 712: Detailed instructions

Completing IRS Form 712 requires detailed accuracy. Knowing the required personal and policy information is critical for avoiding mistakes. First, personal information must include the name, address, and details of the insured, including their date of birth.

Policy information typically includes the insurance company’s name, policy number, and face value. Each section should be meticulously filled to reflect true and fair values, with common pitfalls including missing information or incorrect policy valuations to avoid tax complications.

Valuing life insurance for tax purposes

IRS Form 712 serves a vital role in valuing life insurance for tax purposes. Establishing the correct value ensures accuracy when determining estate or gift taxes. The key valuation factors consist of the death benefit comprised of the payable benefits upon death and the cash value representing the sum accumulated through the policy over time.

Determining the cash value versus the death benefit is essential when preparing estate tax returns, as discrepancies can lead to penalties or additional taxes from the IRS.

Tax implications of Form 712

One of the central implications of IRS Form 712 revolves around its relationship to gift and estate tax returns. The form provides vital information to assess tax obligations during estate administration. Gift taxes can be influenced by the valuation reported on this form, depending on the total life insurance payable to beneficiaries.

Another significant aspect to note is that life insurance proceeds paid to beneficiaries upon the insured's death are generally tax-free. However, their contributions may impact the overall taxable estate value, thus intertwining with broader estate tax strategies.

Comparing inheritance tax vs. estate tax

Understanding the distinctions between inheritance tax and estate tax is vital for individuals dealing with Form 712. Inheritance taxes are levied on the amount inherited by beneficiaries, usually at the state level. Conversely, estate taxes are based on the value of the deceased's entire estate, calculated before distribution to any heirs.

IRS Form 712 directly relates to estate tax filings, as it provides critical valuations needed to compute the tax owed. Knowing how each tax type operates can aid beneficiaries in their financial and estate planning processes.

Common scenarios involving Form 712

Life insurance presented in various contexts can affect tax situations differently. For instance, donors considering donating a life insurance policy to a charity can leverage IRS Form 712 to determine potential tax benefits. The valuations recorded can influence charitable deductions.

Claims made under life insurance policies can also benefit from Form 712, especially when determining the payout amounts to beneficiaries and clarifying tax obligations. Furthermore, proactive estate tax planning should consider the implications of life insurance to address potential taxable estate liabilities effectively.

Frequently asked questions about IRS Form 712

A common question revolves around the acquisition of IRS Form 712. Users can access it directly through the IRS website or through platforms like pdfFiller, which simplifies document management and editing.

Filing Form 712 requires submission with the decedent’s estate tax return. If mistakes are made, beneficiaries or executors must amend the form promptly to avoid complications with the IRS or misrepresenting estate values.

Video walkthrough: Filling out IRS Form 712

Utilizing multimedia resources can enhance understanding when filling out IRS Form 712. A step-by-step video guide demonstrates how to complete each section accurately, providing valuable visual aids that illustrate key details.

Engaging with interactive visuals helps clarify complex terms and processes, making it easier for beneficiaries, executors, and trustees to navigate their obligations effectively.

Related topics and articles

Exploring connected subjects provides additional context and understanding surrounding IRS Form 712. Related articles discuss topics such as Social Security widow's benefits, life insurance valuation principles, and utilizing life insurance within irrevocable trusts.

Keeping up with latest trends in estate planning also aids individuals in making informed decisions, substantially impacting the management of their estate and tax returns.

Additional insights on Form 712

Fiduciaries must understand their responsibilities in handling Form 712. Executors administer the estate's assets, ensuring that all tax obligations are met. Similarly, trustees manage trust assets, necessitating awareness of how life insurance policies fit into broader estate planning.

Strategic planning well in advance involves understanding the implications of life insurance within estate documents. Preparing comprehensive estate documents facilitates streamlined management and proper tax compliance.

Conclusion

Navigating the complexities of IRS Form 712 is vital for proper tax reporting and estate management. Familiarizing oneself with the form's requirements and implications can ease the burden during difficult times. Users are encouraged to utilize tools on pdfFiller for straightforward document management and an organized approach to filling out, editing, signing, and maintaining IRS Form 712.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the form 712 in Chrome?

How can I edit form 712 on a smartphone?

Can I edit form 712 on an Android device?

What is form 712?

Who is required to file form 712?

How to fill out form 712?

What is the purpose of form 712?

What information must be reported on form 712?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.