Get the free Maharashtra Revenue Department: Home

Get, Create, Make and Sign maharashtra revenue department home

Editing maharashtra revenue department home online

Uncompromising security for your PDF editing and eSignature needs

How to fill out maharashtra revenue department home

How to fill out maharashtra revenue department home

Who needs maharashtra revenue department home?

Maharashtra Revenue Department Home Form: A Comprehensive Guide

Understanding the Maharashtra Revenue Department Home Form

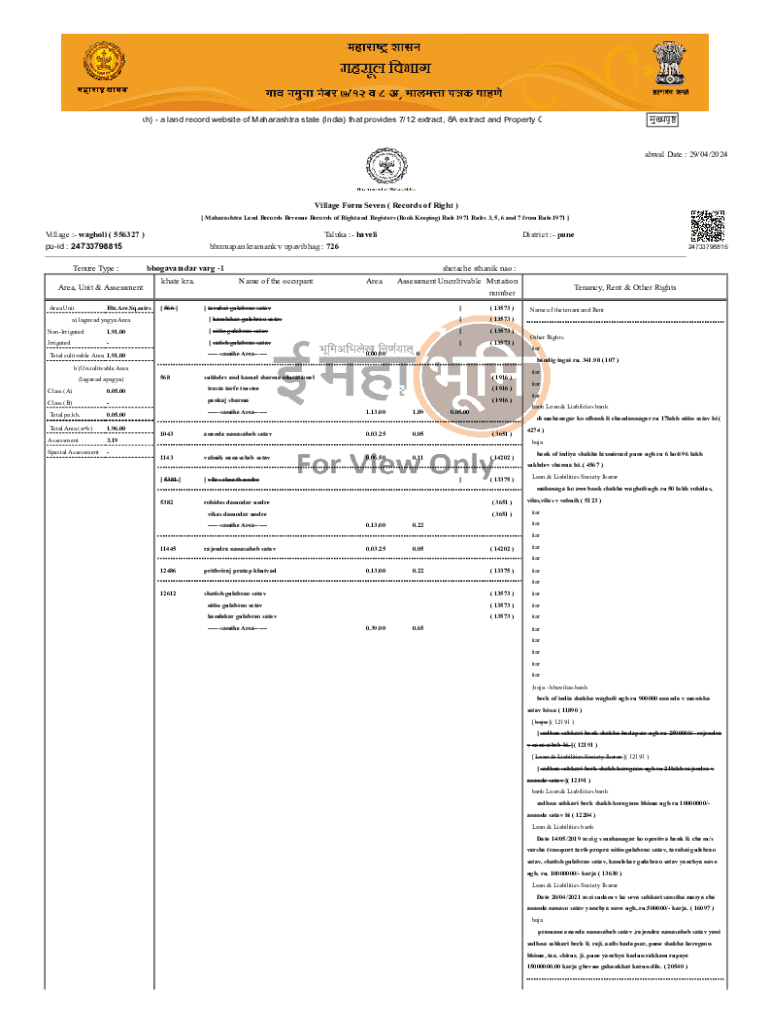

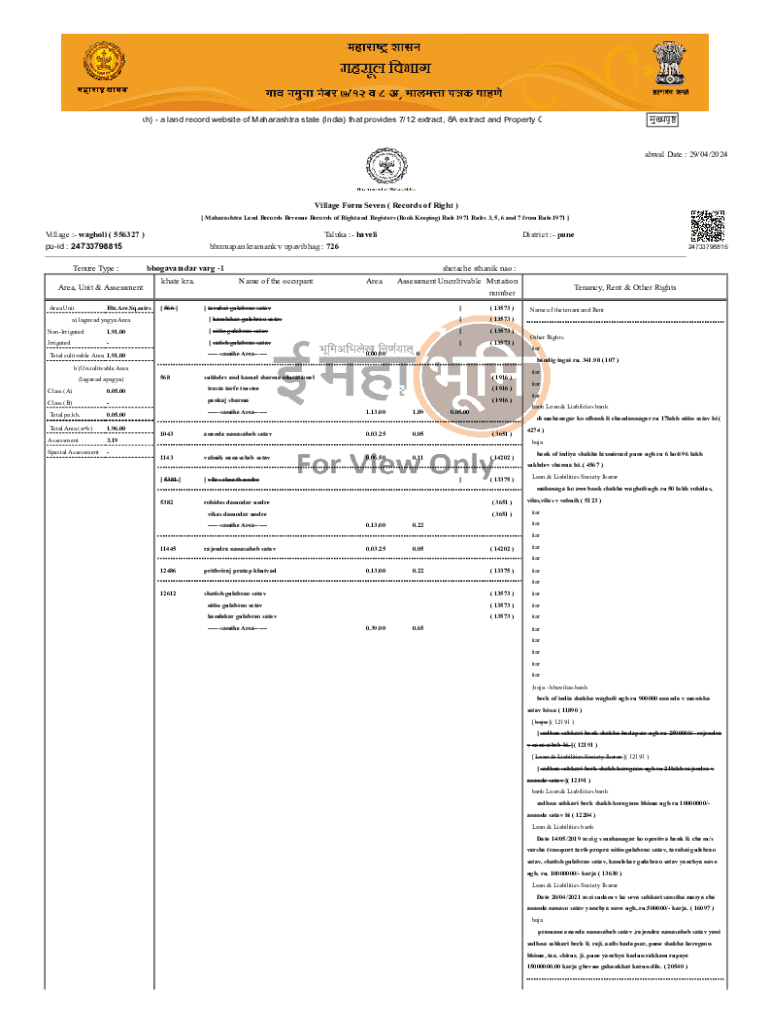

The Maharashtra Revenue Department plays a crucial role in managing land records, fiscal policy, and various civic documentation in the state. Among its many forms, the Home Form is pivotal for residents seeking to consolidate their land ownership or residential status. Understanding this form's purpose and importance is essential for effective utilization of the state's services.

The Home Form primarily facilitates the recording of an individual’s residence at a specified address, which can be fundamental in various legal and financial transactions. Not only does it serve as a proof of residence, but it also impacts eligibility for numerous government schemes and benefits. Thus, accurate completion of the Home Form is vital for maintaining accurate public records and ensuring that citizens can access their rights and entitlements.

How to Access the Home Form

Accessing the Maharashtra Revenue Department Home Form online is straightforward. Begin by visiting the official Revenue Department website, which is designed to help users find relevant forms with ease. To locate the Home Form specifically, navigate to the 'Forms' section and filter through options or search directly using the website’s search feature.

For more direct access, here’s a step-by-step guide:

If you encounter difficulties, user-friendly navigation tips include using the site’s help section or FAQs, which can guide you to the resources you need effectively.

Eligibility criteria for filling the Home Form

Understanding eligibility is a crucial first step in applying for the Home Form. Generally, any resident looking to establish their residence in Maharashtra can apply. However, certain criteria must be met, particularly those pertaining to proof of residency and identity.

In addition to residency, individuals must provide valid identification and, where applicable, an income certificate. Special provisions are often made to assist vulnerable populations, including the elderly, disabled individuals, and those residing in rural areas without easy access to government services.

Required documents and information

To successfully fill out the Home Form, specific documents are required for verification and processing. These documents not only prove your identity but also confirm your residency status, which is paramount for the application to be accepted. A comprehensive list includes:

Gathering these documents efficiently can save time during the application process. Start by ensuring that your proof of residency, which could be a utility bill or rental agreement, is up to date. Additionally, prepare your identity documents such as Aadhaar card or voter ID, and if you are applying based on economic status, ensure you have your income certificate handy.

When preparing your documents, make sure they are scanned clearly and stored in a suitable format for easy upload during the application process.

Step-by-step instructions for completing the Home Form

Completing the Home Form accurately is essential for avoiding delays in processing. The form is typically divided into several sections, each requiring specific information. Here’s a breakdown of the key sections:

While filling out the form, avoid common pitfalls such as typographical errors or leaving mandatory fields blank. Provide accurate and up-to-date information to streamline the review process and enhance the chances of successful approval.

Editing and signing the Home Form

After completing the Home Form, ensuring that it is edited and signed properly is essential before submission. Using tools like pdfFiller can greatly simplify the process, allowing users to edit their documents seamlessly. It provides an intuitive interface to correct any errors easily.

In addition to editing, pdfFiller offers e-signature options that allow you to sign documents digitally without the need for printing. This enhances convenience, especially for those who may lack access to printing facilities. Moreover, security features within pdfFiller help protect your documents from unauthorized access.

Submitting the Home Form

Once your Home Form is complete, the next step is submission. Submitting the form online can be done directly through the Maharashtra Revenue Department website. Ensure you follow these steps carefully:

If you prefer alternative submission methods, you can send the completed form by mail to your local Revenue Department office. After submission, keep an eye out for a confirmation email or message that acknowledges receipt of your application.

Tracking your application status

After submitting the Home Form, tracking its status becomes essential to ensure it is being processed. To check the application status, revisit the Revenue Department website and navigate to the application tracking section. Often, you will need to enter details such as your application number and the date of submission.

Processing timelines can vary, but updates are typically provided through the website. It is crucial to stay updated, and if there are any questions regarding your application, reach out to the designated contact points provided on the site for support.

Common queries and troubleshooting

Frequently asked questions often arise regarding the Home Form. Some common queries include issues with document submissions, acceptance criteria, and how to amend errors after hitting the submit button. To troubleshoot these issues, ensure you always read the guidelines on the Revenue Department's website thoroughly.

In cases of rejected forms or lost documents, it is advisable to contact the Revenue Department directly for assistance. Having the right information ready, such as your application number, can help expedite the support process.

Benefits of using pdfFiller for the Home Form

Opting for pdfFiller to manage your Home Form offers numerous benefits over traditional methods. By utilizing a modern cloud-based platform, users can easily edit PDFs, eSign, and collaborate in real-time, all from the same application.

Compared to older methods, pdfFiller reduces the need for physical documents, enhances document security, and streamlines the application process. User testimonials highlight the convenience and efficiency of managing documents electronically, leading to a quicker turnaround time.

Contact the Maharashtra Revenue Department

For further assistance, reaching out to the Maharashtra Revenue Department is encouraged. Key contact information, including phone numbers and email addresses, are typically listed on their official website. Additionally, online support channels such as live chat can offer immediate assistance for urgent inquiries.

If you need to visit in person, refer to the website for a list of locations and their operational hours to ensure a smooth visit.

About the Maharashtra Revenue Department

The Maharashtra Revenue Department is committed to efficient governance and service delivery, aiming to provide residents with timely access to crucial documents and support. Beyond managing forms like the Home Form, the Department oversees various functions including land records and revenue collection.

Citizens' engagement is a core principle, with feedback mechanisms in place to ensure that services are continuously improved based on public input. This dedication fosters transparency and nurtures a stronger relationship between the government and its constituents.

User resources

To better assist users, the Maharashtra Revenue Department offers a range of resources, including guides and tutorials specifically for beginners tackling forms like the Home Form. Community forums provide platforms for discussion and sharing of tips among user groups.

For additional services, links to other necessary forms and applications are accessible within the Revenue Department's online portal, ensuring that residents have a one-stop destination for their document needs.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in maharashtra revenue department home?

Can I create an electronic signature for the maharashtra revenue department home in Chrome?

How do I fill out maharashtra revenue department home using my mobile device?

What is maharashtra revenue department home?

Who is required to file maharashtra revenue department home?

How to fill out maharashtra revenue department home?

What is the purpose of maharashtra revenue department home?

What information must be reported on maharashtra revenue department home?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.