Get the free Application for Homestead and Farmstead Exclusions

Get, Create, Make and Sign application for homestead and

How to edit application for homestead and online

Uncompromising security for your PDF editing and eSignature needs

How to fill out application for homestead and

How to fill out application for homestead and

Who needs application for homestead and?

Application for Homestead and Form: A Comprehensive Guide

Understanding homestead exemptions

A homestead exemption allows homeowners to shield a portion of their property's value from taxation, which ultimately reduces their tax burden. Understanding homestead exemptions is essential for any property owner seeking relief. A homestead is typically defined as a primary residence occupied by its owner. This is flatly important as it provides various benefits, including financial security in times of hardship, legal protections against creditors, and potential property tax savings.

Homestead exemptions can significantly impact eligibility for various programs and benefits. Generally, to qualify, homeowners must meet specific criteria, which can include residency requirements, owner occupancy, and compliance with local laws. Each jurisdiction may have different rules, emphasizing the importance of thorough research.

The homestead application process

Starting your homestead application can seem daunting, but breaking it down into steps simplifies the process. First, check your state's specific application requirements, which can typically be found at either state or local government websites. Understanding the essential documentation needed for submission is crucial, as missing paperwork can delay the process.

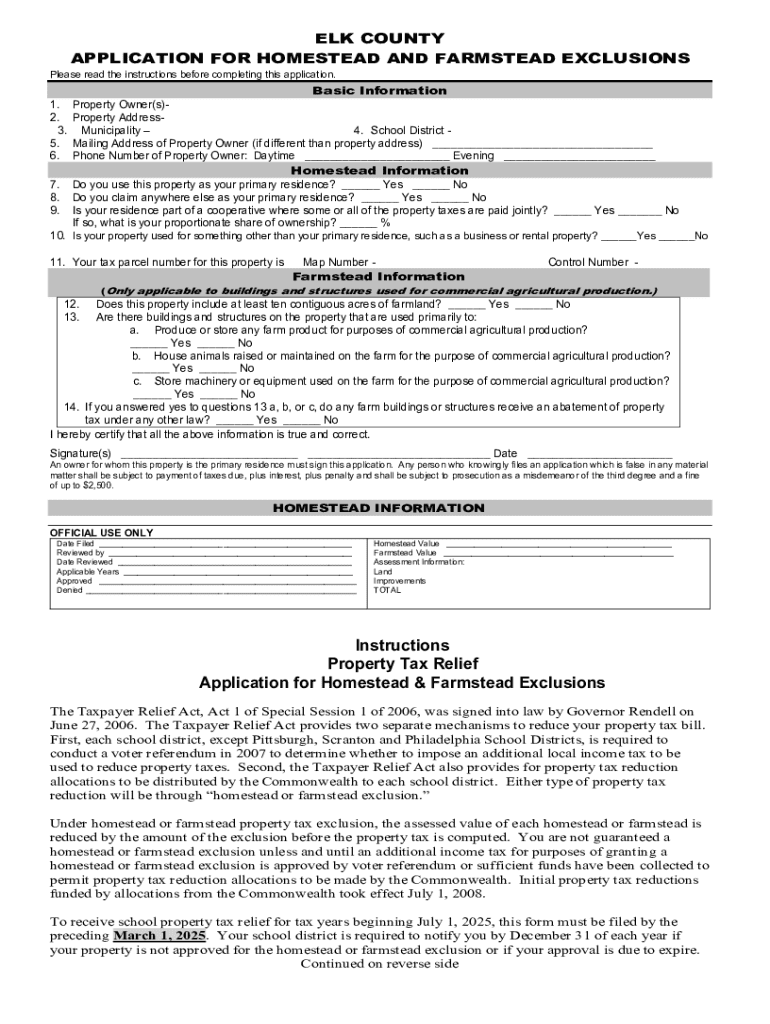

Completing the homestead application form

Completing the homestead application form is a critical part of the process. The form typically consists of several sections, each requiring specific information. The first section usually pertains to the applicant’s personal details, such as name, address, and contact information, which must match the records held by property authorities.

It's common to encounter mistakes during form submission. Common pitfalls include incorrect personal details or failure to provide required documentation. To ensure a smooth application, take time to double-check all information for accuracy.

Post-submission steps

After submitting your homestead application, tracking your application status is essential. Most local or state offices will provide you with a tracking number upon submission. Keeping an eye on this will help you know when to expect updates or if there are any issues requiring your attention.

What to expect after submission can vary by area. Generally, you should receive confirmation of receipt and a time frame for processing. Possible outcomes include approval, denial, or the request for further information, which may mean additional time. Understanding the timeline and process helps you remain proactive and prepared for any necessary follow-ups.

Benefits of successful homestead applications

Successfully applying for a homestead exemption can provide substantial financial implications. Homeowners may benefit from significant tax savings, as exemptions can lower the taxable value of their property. For example, a homestead exemption might reduce a property’s assessed value by thousands of dollars, translating directly into reduced property taxes.

Additionally, successful homestead applications can positively impact property value and marketability. Properties with homestead exemptions can be more appealing to buyers, which could lead to greater market interest and potentially higher sale prices when you decide to sell.

Local homestead exemptions and variations

It's essential to recognize that homestead exemptions vary widely by state and municipality. Some areas offer a flat exemption amount, others may provide a percentage of the property value, and still others may have different types of exemptions for seniors, disabled individuals, or veterans. Understanding these local variations can significantly affect your application experience.

For example, in Florida, the homestead exemption can reduce the taxable value of your home by up to $50,000. However, in California, the rules may be completely different, affecting what homeowners can expect depending on their locality. Always consult local guidelines to ensure you meet criteria specific to your area.

Resources for homestead application assistance

Many resources are at your disposal when applying for a homestead exemption. Online tools available through platforms like pdfFiller can offer interactive guides for filling out applications. These resources streamline the process, ensuring you do not miss essential steps or required fields.

Advanced topics in homestead management

Managing your homestead exemption can get complicated especially in transition scenarios like moving. Understanding homestead portability allows homeowners to transfer their exemptions when selling a home and purchasing another. Conditions apply to this process, so research local regulations.

Moreover, changes in property ownership such as moving from singular to joint ownership or into a trust may require updates to your homestead application. It’s vital to keep your application current to maintain your exemption. Understanding homestead fraud is equally essential since misrepresenting property ownership can lead to severe legal consequences.

User testimonials and experiences

Case studies highlight the significance of proper application for homestead exemptions. Many homeowners report substantial financial benefit post-application, enjoying lower taxes allowing them to allocate more funds towards savings or home improvements. User reviews often indicate satisfaction with streamlined application processes, particularly when using online services that help pre-fill forms and provide submissions to the appropriate authorities.

Personal stories add depth to the understanding of the homestead application process, often detailing the emotional relief accompanying successful applications. With many users sharing their positive experiences, it is evident that leveraging online tools can enhance submission efficacy, transforming a potentially overwhelming task into a manageable one.

Staying informed about homestead laws and updates

Staying current on homestead laws is paramount for property owners. Changes in legislation can significantly impact eligibility and benefits, making participation in local workshops and events highly beneficial. These forums can provide insights into upcoming changes and offer networking opportunities with local officials and other homeowners.

Additionally, subscribing to newsletters and local government updates ensures you have the latest information. This will keep you informed about any new homestead exemptions introduced or updates to current laws that may affect your financial planning.

Interactive tools and features from pdfFiller

pdfFiller offers a myriad of interactive tools that simplify the homestead application process. Utilizing these online features, users can easily create, edit, and manage PDF forms without the hassle of printing or scanning. The platform supports seamless e-signature integration, allowing users to sign documents electronically with ease.

Collaboration features let you share documents with family members or financial advisors who might need to review or help complete the forms, promoting a cooperative environment for managing documentation. Storing all homestead-related documents in the cloud ensures easy access anytime, empowering users to track their submission progress and stay organized.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit application for homestead and in Chrome?

Can I create an electronic signature for the application for homestead and in Chrome?

How can I edit application for homestead and on a smartphone?

What is application for homestead and?

Who is required to file application for homestead and?

How to fill out application for homestead and?

What is the purpose of application for homestead and?

What information must be reported on application for homestead and?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.