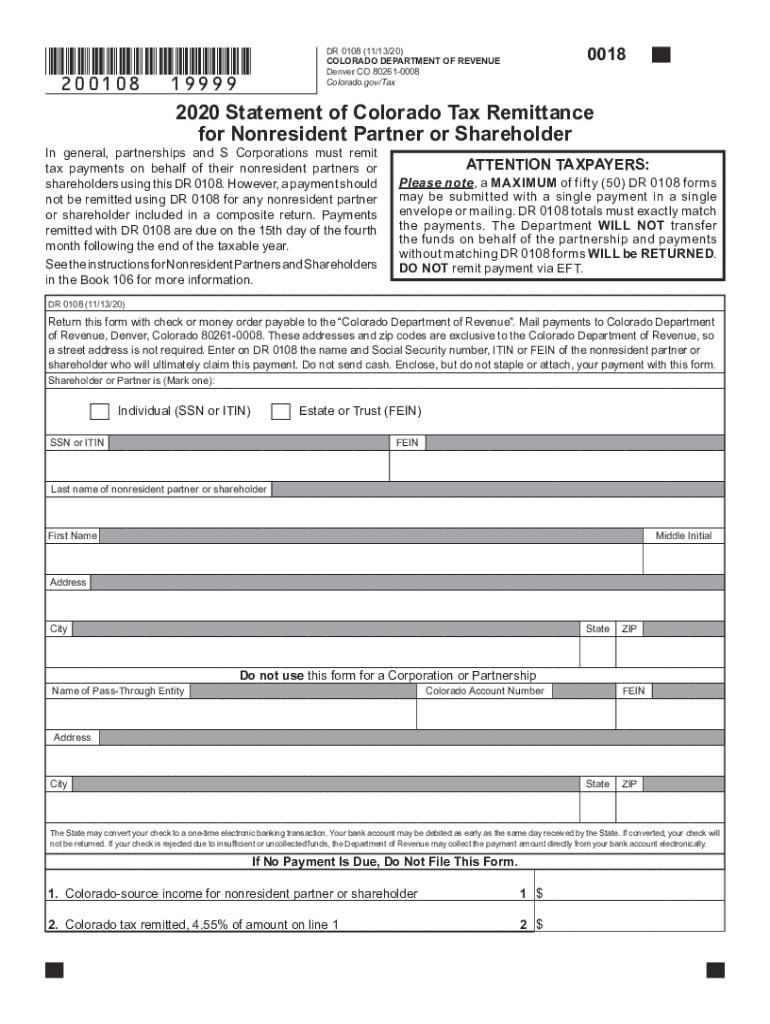

Get the free colorado dr 0108

Get, Create, Make and Sign colorado dr 0108 form

Editing colorado dr 0108 form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out colorado dr 0108 form

How to fill out dr 0108

Who needs dr 0108?

Comprehensive Guide to the DR 0108 Form

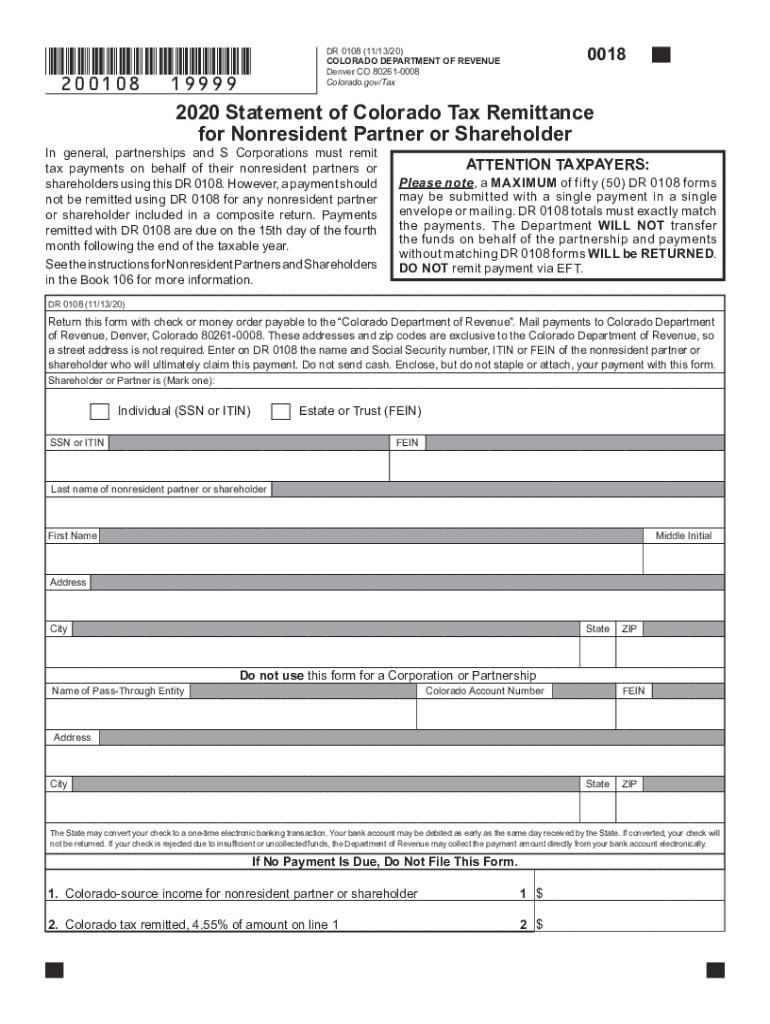

Understanding the DR 0108 Form

The DR 0108 form is a crucial document in the realm of tax administration, particularly related to personal tax returns. Primarily utilized in certain jurisdictions, its significance lies in its role in the accurate reporting of individual taxpayer information to tax authorities. The form is employed to ensure compliance with tax regulations and allows for the proper assessment of taxpayer liabilities.

Some key terms associated with the DR 0108 form include 'taxpayer identification,' 'income reporting,' and 'net tax due.' Understanding these terms is essential for completing the form accurately. For taxpayers, this form represents a commitment to transparency and accountability in their financial dealings.

Common uses of the DR 0108 Form

The DR 0108 form is commonly utilized in various scenarios related to tax filing. Individuals who have multiple sources of income, freelance workers, and business owners often rely on this form to accurately report their earnings and tax liabilities. Additionally, it's relevant for certain tax credits or deductions that are contingent upon the information reported within.

The target audience for the DR 0108 form encompasses a diverse group, including self-employed individuals, small business owners, and those who have received miscellaneous income throughout the year. Everyone in this category must ensure that their tax filings are thorough and accurate to avoid future penalties or complications.

Step-by-step instructions for completing the DR 0108 Form

Before diving into filling out the DR 0108 form, it's essential to prepare accordingly. Start by gathering all necessary documents, such as W-2s, 1099 forms, and records of any other income. This preparation will simplify the completion process and help ensure accuracy.

Before filling out the form, check your eligibility based on your tax status and the specific requirements laid out by the tax authority in your jurisdiction. In certain cases, additional documentation may be required to substantiate your claims.

Detailed walkthrough of each section

The DR 0108 form can be broken down into several key sections that require careful attention.

Keep in mind that some unique cases may necessitate additional documentation or special considerations. For instance, if you're handling trust income or dealing with cross-border taxation, consulting with a tax professional can provide clarity.

Editing and modifying the DR 0108 Form

After filling out the DR 0108 form, you may find it necessary to make changes or corrections. Using pdfFiller provides an easy path for editing your PDF fields. It offers user-friendly editing tools to update any part of the form without having to fill it out from scratch.

To edit the form, simply upload your completed PDF to pdfFiller, and use the text editing tool to click on the fields you wish to change. It's a seamless process that allows you to correct errors or update information before finalizing your submission.

Tips for effective collaboration on form edits

If you're working as part of a team, sharing the DR 0108 form with colleagues can enhance collaboration. pdfFiller allows users to easily share documents to gather input and feedback on the form.

eSigning the DR 0108 Form

eSigning the DR 0108 form adds a layer of authenticity to your submission. It is essential as it ensures that your digital signature holds the same legal validity as a handwritten one, which is important for tax documents.

Using pdfFiller, signing the DR 0108 form is a straightforward process that can be completed in moments. Simply click on the signature option in the menu, follow the prompts to create or upload your signature, and place it on the document.

For mobile users, pdfFiller's mobile platform offers similar capabilities, allowing you to sign documents directly from your phone or tablet. This flexibility ensures you can complete your tax documentation on-the-go.

Managing and storing your completed DR 0108 Form

Once you've completed and signed the DR 0108 form, effective document management becomes essential. Begin by organizing your completed forms in a methodical manner for easy retrieval later on.

Consider secure storage solutions, such as cloud storage, which offer both accessibility and security for sensitive documents. Services like pdfFiller provide built-in options to format, store, and protect your documents.

Sharing your completed form with tax authorities

To submit the DR 0108 form to tax authorities, utilize electronic filing methods available through pdfFiller. E-filing can expedite processing times and often includes immediate confirmation of receipt.

Always save a copy of your submission and any confirmation emails for your records. This ensures that you have proof of compliance with tax regulations and can easily follow up if needed.

Troubleshooting common issues with the DR 0108 Form

Despite careful attention, issues can arise when completing the DR 0108 form. Common problems typically include missing signatures, incorrect information, or discrepancies between reported income and official records.

If errors occur post-submission, contact your tax authority promptly. They can advise on remedying mistakes, which may involve submitting an amended return, depending on the nature of the error.

Resources for further assistance

To facilitate a smoother process, utilize online resources, including tax authority websites, for specific guidance regarding the DR 0108 form. Additionally, consider consulting a tax professional for personalized assistance and to stay compliant with regulations.

Updates and changes to the DR 0108 Form

Tax forms, including the DR 0108, can undergo changes frequently, making it essential to stay informed about updates. Recent years have seen updates to reporting requirements and filing deadlines, reflecting changes in tax law and policy.

To stay updated, regularly check the official tax authority website and subscribe to newsletters or alerts regarding tax form changes. Engaging with these resources ensures you’re always prepared for any adaptations needed in your filing process.

How to stay informed about future updates

Beyond checking government resources, participating in online forums and communities dedicated to tax matters can provide insight and shared experiences regarding the DR 0108 form. Engaging in discussions can help you learn from others' interactions with the tax authority.

Using pdfFiller as your go-to document creation solution

pdfFiller stands out as an essential tool for those needing to manage the DR 0108 form effectively. Its comprehensive features, from editing to eSigning and secure storage, make it the perfect companion for tax preparation.

With pdfFiller’s cloud-based solution, you gain the benefit of accessibility from any device, making remote work more manageable. This is especially crucial in tax season, where deadlines loom, and swift, accurate submissions are mandatory.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit colorado dr 0108 form from Google Drive?

How do I make changes in colorado dr 0108 form?

Can I create an electronic signature for signing my colorado dr 0108 form in Gmail?

What is dr 0108?

Who is required to file dr 0108?

How to fill out dr 0108?

What is the purpose of dr 0108?

What information must be reported on dr 0108?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.