Get the free Bank confirmation letter. - Sole prop

Get, Create, Make and Sign bank confirmation letter

How to edit bank confirmation letter online

Uncompromising security for your PDF editing and eSignature needs

How to fill out bank confirmation letter

How to fill out bank confirmation letter

Who needs bank confirmation letter?

Comprehensive Guide to the Bank Confirmation Letter Form

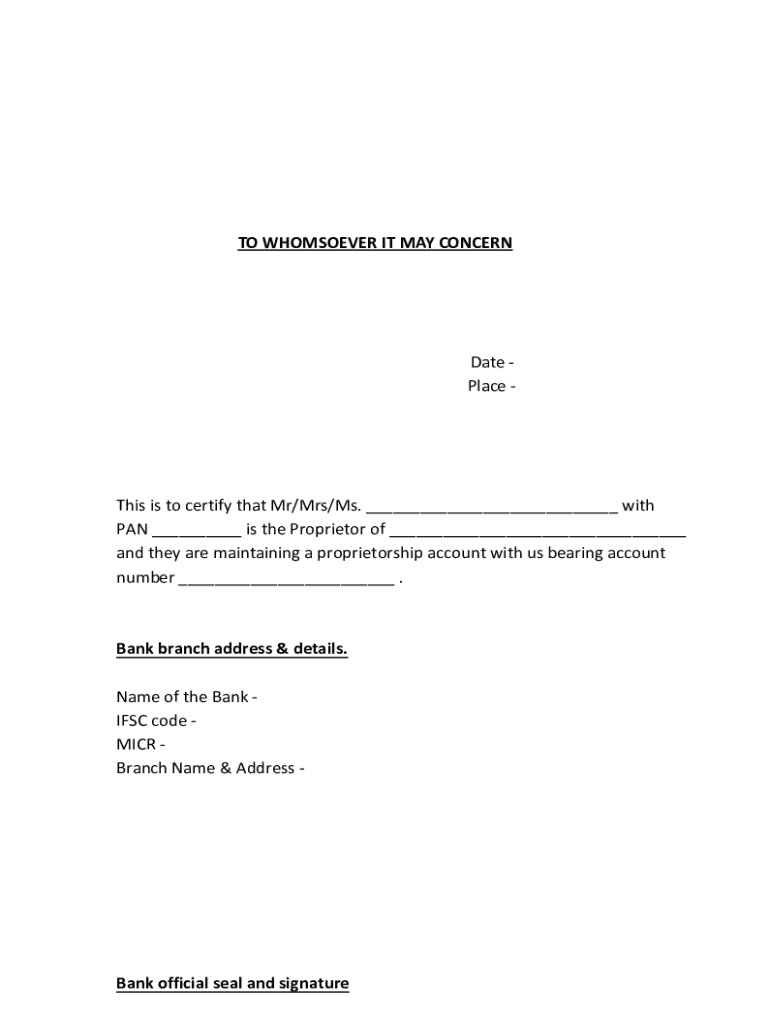

Overview of the bank confirmation letter form

A bank confirmation letter form serves as a crucial document when verifying the existence of financial accounts and the accuracy of account balances between parties. This form is often essential during significant financial transactions such as loan applications, audits, and financial reviews. The primary purpose of a bank confirmation letter is to provide a reliable means of confirming financial information directly from a bank, thereby adding credibility and assurance to the financial dealings.

In various scenarios, a bank confirmation letter is required. For instance, it can be a vital document for accountants during audits, ensuring transparency between the auditor and the client's financial statements. Similarly, financial institutions may request such confirmations to validate an applicant’s financial status before approving loans.

Template description

The bank confirmation letter template encompasses essential elements designed to facilitate the clear communication of financial details. The template typically includes specific sections that streamline the process of creating an effective bank confirmation letter.

When to use a bank confirmation letter

Understanding when to utilize a bank confirmation letter can significantly impact the efficiency of financial transactions. This letter is critical in several common scenarios such as loan applications, where lenders need verification of the applicant's assets before disbursing funds. Additionally, during audits, accountants require confirmation letters to validate client records against bank statements, ensuring accuracy and transparency.

Certain industries, particularly corporate finance and accounting, regularly use bank confirmation letters. In corporate finance, companies often need to verify their liquidity and creditworthiness, while accounting processes require this documentation to assure stakeholders of the integrity of financial reports.

Key terms and definitions

Familiarizing yourself with key terms associated with bank confirmation letters enhances understanding and effectiveness in their use. For example, the term 'confirming party' refers to the bank or entity verifying the information stated in the letter. The 'verification process' is the method by which the confirming party checks the details provided, usually involving cross-referencing the information with their internal records.

The 'terms of engagement' outline the scope and conditions under which the confirming party operates, detailing expectations for both the requester and the bank. Understanding these terms is vital for maintaining a professional and efficient relationship during the confirmation process.

How to write a bank confirmation letter

Writing a bank confirmation letter may appear daunting, but following a structured process simplifies it significantly. Here's a step-by-step guide to assist you in crafting an effective letter:

Following these steps not only ensures clarity but also demonstrates professionalism, which is essential in financial communications.

Best practices for managing bank confirmation letters

Proper management of bank confirmation letters is key to maintaining organized documentation and ensuring timely responses. One recommended approach is to adopt a filing system that categorizes letters by date, recipient, or purpose. Utilizing cloud-based platforms, such as pdfFiller, allows you to store and retrieve documents easily while ensuring security.

Tracking responses is equally important. Implementing tools, such as tracking spreadsheets or pdfFiller’s monitoring features, can help you keep tabs on which confirmations are outstanding. Additionally, you must maintain compliance with data protection regulations while handling sensitive financial information, ensuring it is securely managed throughout the process.

Advantages of using pdfFiller for creating bank confirmation letters

pdfFiller offers a multitude of advantages for users engaged in creating bank confirmation letters, particularly through its user-friendly interface. The platform features interactive tools that allow for easy editing, customization, and integration of electronic signatures, streamlining the entire process.

Accessibility is another significant benefit; being cloud-based means users can access their documents from anywhere, making it convenient for individuals and teams who work remotely or require flexibility. Furthermore, pdfFiller provides collaboration features that enable users to work jointly on documents in real-time, greatly enhancing efficiency. Lastly, the platform prioritizes security and proper document management, ensuring that all sensitive data remains protected.

Troubleshooting common issues

Despite the numerous advantages of using pdfFiller, users may encounter some common challenges when dealing with bank confirmation letters. Technical difficulties with editing documents can arise, often due to browser compatibility issues or software updates. It's advisable to ensure your browser is up to date or to switch to a different browser to resolve persistent issues.

Another challenge might include miscommunication in letter content, which can lead to delays in responses. To mitigate this risk, always double-check the clarity of your requests and provide all necessary details within the letter. Implementing checks and balances, such as a second pair of eyes reviewing letters before sending, can significantly reduce these types of problems.

Real-life examples and case studies

Examining real-life examples of effective bank confirmation letters provides valuable insights into best practices and potential pitfalls. For instance, a small business seeking a loan highlighted the importance of precision in its confirmation letter, leading to a swift approval process. By clearly outlining the requested information and adhering to a professional format, the business demonstrated its commitment to transparency and reliability.

Similarly, during a forensic audit, the prompt submission of bank confirmation letters led to the successful identification of discrepancies in reported financials. This case illustrates the critical role that these letters play in ensuring accuracy and accountability within financial reporting.

Related document templates to explore

In addition to the bank confirmation letter form, pdfFiller offers a variety of related templates that can enhance your financial documentation. Templates for financial statements, loan applications, and audit reports are readily available, providing users with tools necessary for comprehensive financial management.

You can easily access these templates on pdfFiller’s platform, allowing for seamless integration into your existing documentation workflows. This availability ensures that users are equipped with all essential documents to meet varied financial needs.

Frequently asked questions (FAQs)

When using a bank confirmation letter form, several common queries arise that can impact understanding and execution. For example, questions about the format of the letter, what details to include, or how to follow up effectively are always pertinent. By establishing a clear understanding of these aspects, users can navigate the requirements more confidently.

Additionally, inquiry about the appropriate timeline for sending a confirmation request or how to effectively handle delayed responses can arise. By addressing these questions and providing clear guidance, users can enhance their overall experience and ensure their financial undertakings are carried out efficiently.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit bank confirmation letter from Google Drive?

How can I send bank confirmation letter for eSignature?

How do I complete bank confirmation letter online?

What is bank confirmation letter?

Who is required to file bank confirmation letter?

How to fill out bank confirmation letter?

What is the purpose of bank confirmation letter?

What information must be reported on bank confirmation letter?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.