Get the free Complete the Independent Family Size Worksheet

Get, Create, Make and Sign complete form independent family

How to edit complete form independent family online

Uncompromising security for your PDF editing and eSignature needs

How to fill out complete form independent family

How to fill out complete form independent family

Who needs complete form independent family?

Complete Form Independent Family Form: Your Comprehensive Guide

Understanding the independent family form

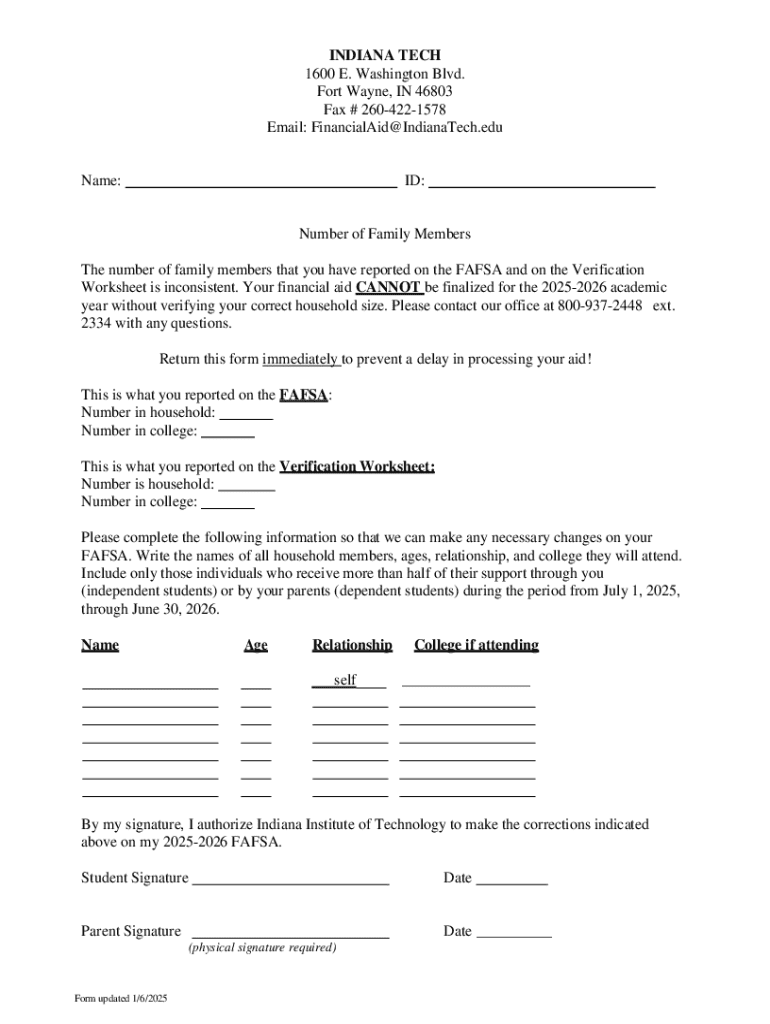

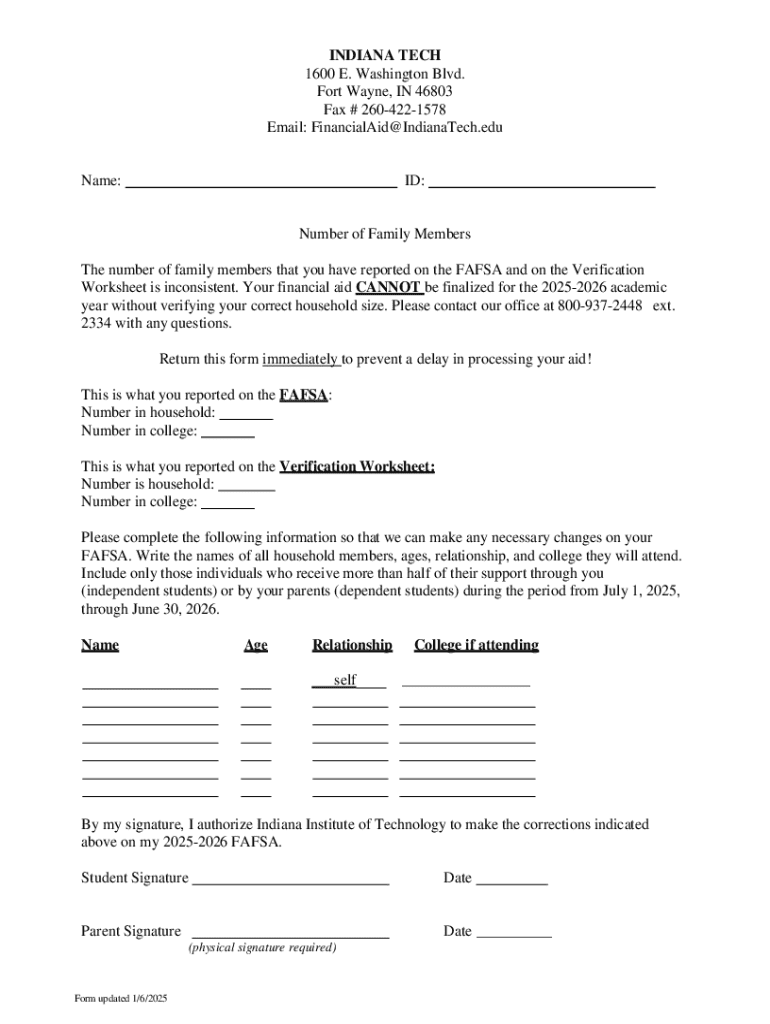

The independent family form is a crucial document used to gather essential information regarding the family's structure and financial situation. Its primary purpose is to facilitate applications for various legal and financial services, including housing assistance, tax filings, and education-related benefits. By providing a clear snapshot of the family's dynamics, this form ensures that necessary support is directed to the appropriate recipients.

Typically, the independent family form is requested in contexts where financial assessments are required, such as during welfare evaluations or educational subsidies. Comprehending the nuances of this form is vital, especially for families looking to secure their rights and access necessary resources.

It's essential to differentiate between the independent family form and other family forms, such as the household form or income verification forms. While those may focus on broader metrics or specific incomes, the independent family form zeroes in on individual family members’ information and financial circumstances, leading to more personalized support.

Key components of the independent family form

Completion of the independent family form requires specific information that accurately represents your family unit. Essential details include personal information about each family member, such as names, birth dates, relationship to the head of the family, and social security numbers. Additionally, financial disclosures are mandatory, providing insights into household income sources, expenses, and any special circumstances that may impact the family’s financial standing.

Supplemental documents will further enhance your submission, supporting the claims made in your independent family form. Key documents include proof of income—like pay stubs or tax returns— and identification such as state IDs or utility bills that confirm residency.

Step-by-step guide to completing the independent family form

Filling out the independent family form can seem daunting, but following a systematic approach will streamline the process. Start by gathering all required information beforehand; this simple step can save considerable time and frustration. Keep documents organized in folders or a digital format directly accessible for easy reference.

When filling out the form, pay special attention to each section, as certain fields may require additional clarification. Common mistakes include incorrect personal information or missing financial disclosures, which can lead to rejection or delays in processing. Utilize pdfFiller’s editing capabilities to ensure your final submission is flawless.

Signing and submitting the independent family form

Once the independent family form is complete, it’s time to sign and submit it. Electronic signatures have become increasingly popular due to their efficiency, and pdfFiller provides an easy way to sign documents electronically. This method not only saves time but also allows for easy tracking of signatures and submissions.

Understanding how to track your submission status can provide peace of mind during this process. Whether you opt for paper mail or electronic submission, ensure you receive confirmation to verify your form was submitted successfully.

Managing your independent family form after submission

After you have submitted the independent family form, efficiently managing your documents becomes paramount. Secure storage is essential, particularly for sensitive information. Utilizing cloud storage solutions offered by pdfFiller grants peace of mind as you can access documents from any device while maintaining high security and confidentiality.

As your family's situation evolves, ensuring this form reflects current data is important. Regularly updating your records will make future submissions much easier.

Troubleshooting common issues

Occasionally, issues may arise during the submission of the independent family form. Knowing what to do if your form is rejected is key to a smooth process. Often, rejections stem from missing information or errors that can quickly be corrected upon review.

Establishing connections with local support services can also provide additional context or assistance, ensuring your next submission is smooth and successful.

Leveraging pdfFiller features for enhanced document management

pdfFiller not only streamlines the filling process but also enhances document management through its collaboration features. This allows families or teams to share the independent family form efficiently, facilitating feedback and input from each member.

Automating document workflows enhances efficiency, allowing users to concentrate on more pressing issues rather than repetitive form-filling tasks.

Unique considerations for specific situations

Families come in various forms, and specific considerations may apply, especially for multi-generational households or unique situations. Such households may require increased financial disclosure to present a full financial picture, influencing benefits. It is vital to recognize that forms might differ state-by-state, influencing what details are necessary and how they must be presented.

Staying informed of state guidelines can significantly affect your access to benefits and supports tailored to your family’s needs.

Feedback and iteration for future forms

After submitting the independent family form, collecting feedback from family members can provide valuable insights for next time. Engaging everyone in this process can help refine how information is presented, identifying which elements worked well and which could be improved. This iterative approach allows for enhanced clarity and understanding among family members regarding financial and logistical responsibilities.

Establishing a routine for document updates can significantly streamline future submissions while ensuring accuracy in presenting your family’s data.

Frequently asked questions about the independent family form

As users engage with the independent family form, certain questions frequently arise. Common queries often center on what specific information is essential or how to handle unique circumstances in reporting family dynamics. Familiarizing yourself with these FAQs can give you confidence moving forward as you complete your forms.

Utilizing these resources not only answers pressing questions but also enhances your overall experience with filling out the independent family form.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the complete form independent family in Chrome?

Can I create an eSignature for the complete form independent family in Gmail?

Can I edit complete form independent family on an iOS device?

What is complete form independent family?

Who is required to file complete form independent family?

How to fill out complete form independent family?

What is the purpose of complete form independent family?

What information must be reported on complete form independent family?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.