Get the free Chapter 6.10 - BUDGET AND APPROPRIATIONS GENERALLY

Get, Create, Make and Sign chapter 610 - budget

How to edit chapter 610 - budget online

Uncompromising security for your PDF editing and eSignature needs

How to fill out chapter 610 - budget

How to fill out chapter 610 - budget

Who needs chapter 610 - budget?

Chapter 610 - Budget Form: A Comprehensive Guide

Overview of Chapter 610 - Budget Form

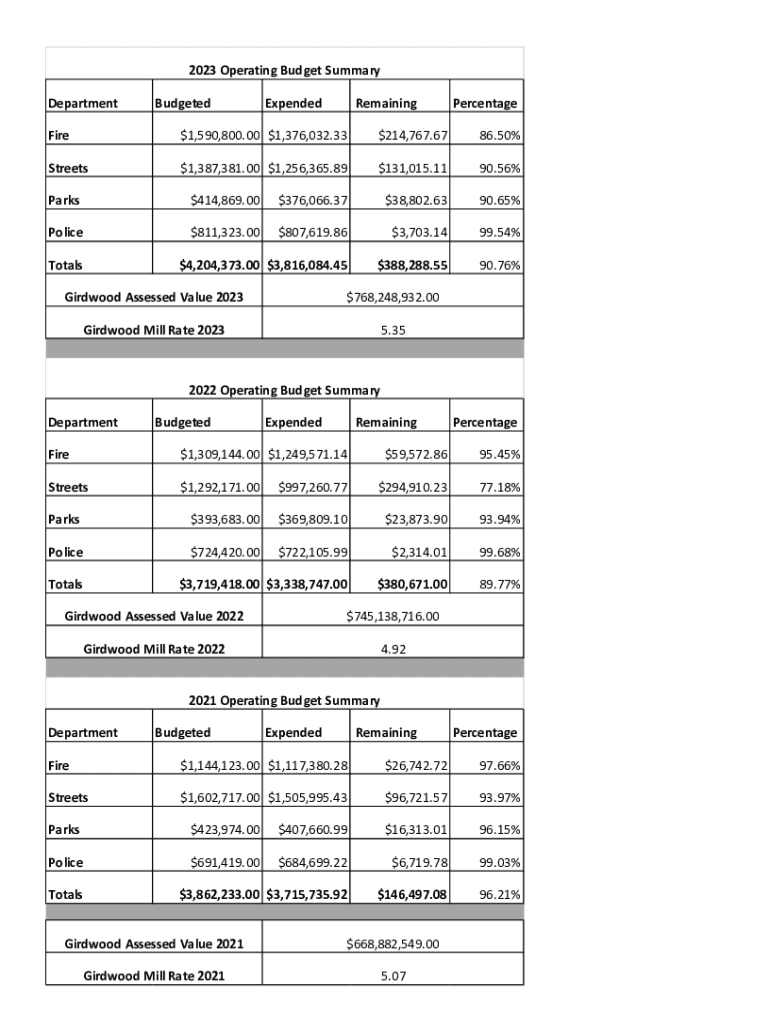

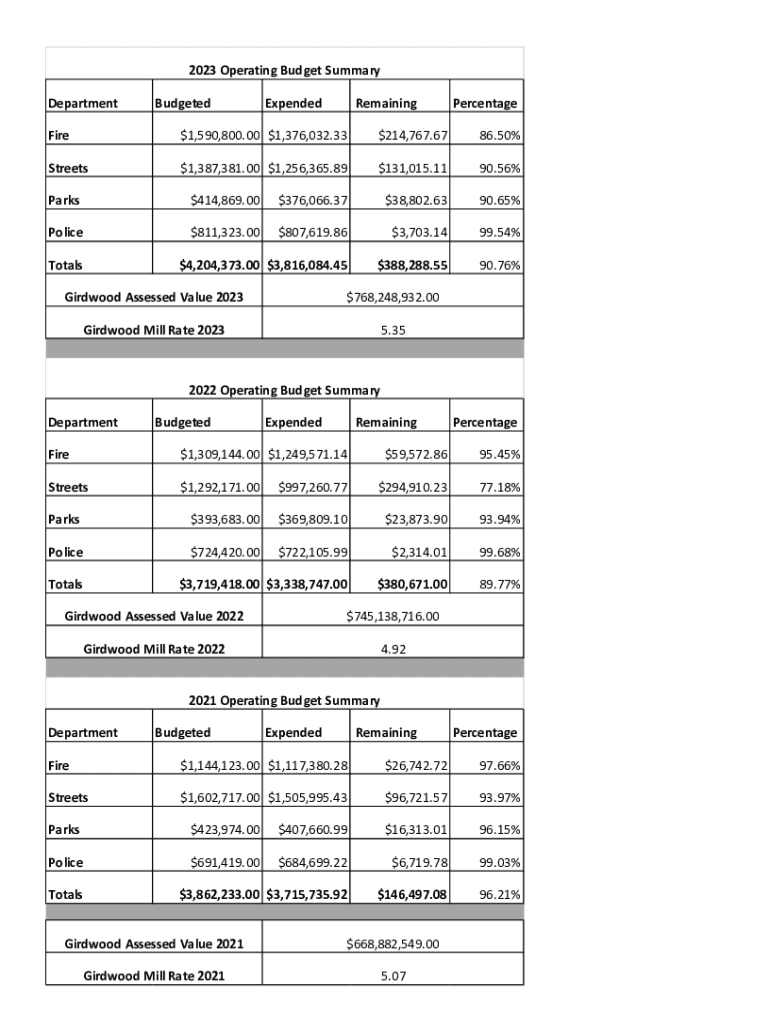

Chapter 610 refers specifically to the budget form required by various organizations, particularly within government and educational institutions. This document serves as the foundation for financial planning, ensuring that all potential revenue and expenditures are accurately estimated and aligned with strategic goals. A well-prepared budget form plays a critical role in fiscal management, allowing entities to allocate resources effectively and monitor financial performance throughout the fiscal period.

The primary objectives of completing the budget form include forecasting financial needs, ensuring resource availability, and enforcing accountability in spending. Additionally, this form is essential for identifying possible funding shortfalls and strategizing accordingly, whether through increased revenue initiatives or cost-cutting measures.

Understanding the structure of Chapter 610

Chapter 610 is organized into several key sections, each of which must be meticulously completed to ensure a comprehensive budget overview. Understanding this structure is crucial for efficient budget preparation.

Each section serves a unique purpose. Together, they provide a holistic view of the fiscal landscape, assisting stakeholders in making informed decisions.

Step-by-step guide to completing the budget form

Completing the budget form can appear daunting; however, a systematic approach can simplify the process considerably. Here’s a step-by-step guide to ensure success.

Interactive tools for budget creation

pdfFiller offers a variety of interactive tools that facilitate the completion of the Chapter 610 budget form, enhancing user experience and increasing efficiency. Key tools include PDF editing features which allow users to annotate, highlight, or adjust fields within the document.

Additionally, pdfFiller provides eSigning capabilities so clients can securely sign budget documents digitally, expediting the approval process. Users can leverage interactive templates designed explicitly for Chapter 610 to streamline the data entry process.

Tips for effective document management

Managing the Chapter 610 budget form effectively is just as important as completing it accurately. Implementing best practices for document management can streamline this process significantly.

Common mistakes to avoid when filling the budget form

While preparing the budget form, common pitfalls can detract from the quality of the submitted document. Being aware of these mistakes can help avoid significant setbacks.

Compliance with relevant regulations and standards

Submissions of the Chapter 610 budget form are often governed by strict regulations. Understanding these legal requirements is crucial for compliance.

Organizations must adhere to specific reporting guidelines, reflecting transparency and accountability in their budgetary processes. Failure to comply can result in penalties or funding issues. It's important to consult relevant local regulations to ensure all requisite elements are included in the form.

FAQs related to Chapter 610 - Budget Form

Individuals completing the Chapter 610 budget form often have questions regarding its requirements and processes. Familiarity with common inquiries can ease the preparation process.

Real-life applications and case studies

Understanding the real-world applications of Chapter 610 can offer valuable insights. Successful budget submissions can often serve as roadmaps for others.

Finalizing and submitting the Chapter 610 budget form

Once the budget form has been completed, ensuring it is ready for submission is the final essential step in the process. A thorough review can help identify any last-minute issues.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send chapter 610 - budget for eSignature?

How do I edit chapter 610 - budget in Chrome?

How can I fill out chapter 610 - budget on an iOS device?

What is chapter 610 - budget?

Who is required to file chapter 610 - budget?

How to fill out chapter 610 - budget?

What is the purpose of chapter 610 - budget?

What information must be reported on chapter 610 - budget?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.