Canada 5000-D1 2024-2026 free printable template

Get, Create, Make and Sign 2024 federal worksheet form

Editing Canada 5000-D1 online

Uncompromising security for your PDF editing and eSignature needs

Canada 5000-D1 Form Versions

How to fill out Canada 5000-D1

How to fill out federal worksheet

Who needs federal worksheet?

Federal Worksheet Form: A Comprehensive How-to Guide

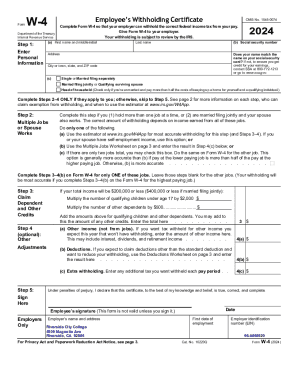

Overview of the federal worksheet form

The federal worksheet form is a crucial document used in many government and personal contexts for assessing and reporting various types of information, including financial data. The primary purpose of this form is to streamline data collection and assessment processes, enabling more efficient decision-making for both individuals and government entities.

Understanding the importance of the federal worksheet form requires recognizing its applications in diverse areas, such as tax filing, grants application, and even organizational budgeting. By employing these worksheets, individuals and organizations ensure that they remain compliant with federal regulations and accurately report their financial situations.

Key features of the federal worksheet form

One of the defining features of the federal worksheet form is its structured layout, allowing users to systematically enter information without confusion. The unique elements within the form are designed to delineate various data sections clearly, offering a seamless experience in data entry.

The benefits of using the federal worksheet form encompass significant time savings, enhanced accuracy in data entry, and comprehensive documentation, making it a preferred choice for both individuals and organizations. By systematically breaking down complex information, users can navigate the process more smoothly.

Preparing to use the federal worksheet form

Before diving into the specifics of filling out the federal worksheet form, it is crucial to understand the information you will need to provide. Typically, the required information includes your personal identification details, such as Social Security number and contact information, as well as your financial data that may encompass income, expenses, and other monetary factors.

Moreover, gathering supporting documents—like previous tax returns, bank statements, and identification proof—can enhance the overall accuracy of your submission. To ensure a smoother process, be aware of common mistakes, such as overlooking necessary signatures or miscalculating financial figures, that can lead to complications during evaluation.

Step-by-step guide to filling out the federal worksheet form

The first step in completing the federal worksheet form is accessing it on pdfFiller. Navigate to the federal worksheet section of the website, where you can easily find the specific forms needed for your requirements. Once you have located the form, begin by inputting your personal information in the designated fields.

When filling out the personal information section, be diligent in entering all required data, including full name, address, and Social Security number. A critical tip is to double-check that all entries are accurate to avoid any issues down the line. The next step involves completing the financial sections of the form, which may consist of detailed entries about your income sources and expenses.

Following financial data entry, attach supporting documentation. This could include various files ranging from PDF documents to image files. Ensure that you know what attachments are necessary so that you upload the right documents using pdfFiller’s intuitive upload feature.

Once your form is filled out and supporting documents are attached, the next crucial step is to review and edit your entries. Utilizing the edit tools on pdfFiller can help you make necessary adjustments and confirm that the information provided is accurate and complete. Proofreading here is essential to confirm that every detail is correctly represented.

eSigning and authorizing your federal worksheet form

After carefully filling out the federal worksheet form, signing it electronically is the next critical step. A legally binding signature is essential for the form’s acceptance and validation. Fortunately, pdfFiller makes this process straightforward with multiple eSigning options at your disposal.

To eSign the form using pdfFiller, follow the intuitive prompts that guide you step-by-step through the signing process. Additionally, the platform allows for tracking signature requests and responses so that you know exactly when your form has been signed and is ready for submission.

Collaborating on the federal worksheet form

If you are working within a team, collaborating on the federal worksheet form becomes even more achievable with pdfFiller's features. You can invite team members to jointly complete the form, which is particularly useful for shared financial or organizational data. This collaborative capability ensures that all relevant input is considered while fostering a team-oriented environment.

Moreover, pdfFiller includes features to facilitate collaboration, such as commenting and shared access, thus simplifying communication and edits among team members. Keeping track of document versions and history also allows users to roll back or review changes as needed, making the process more transparent.

Managing your federal worksheet form post-filing

After submitting your federal worksheet form, managing your completed forms effectively is crucial. PdfFiller provides several saving options, enabling users to download their completed forms in various formats such as PDF and Word. This flexibility allows you to store the document in a manner that suits your organization's or personal filing system.

In terms of finding and storing your forms, pdfFiller ensures that all completed documents are easily accessible from your account. This organized structure is beneficial for future reference or in case you need to access previously submitted forms for comparison or review.

Troubleshooting common issues with federal worksheet forms

Like any electronic documentation process, issues can arise with federal worksheet forms. If you encounter technical difficulties while using pdfFiller, it's important to first check your internet connection and browser compatibility. If problems persist, consult the help section provided on the pdfFiller website.

Furthermore, if you notice a mistake after submitting your form, address it promptly. Most forms allow for amendments to be made, but you'll often have to follow specific guidelines. For complex issues, pdfFiller offers user support channels that can assist you in resolving your concerns efficiently.

Staying informed: Updates and changes to federal worksheet forms

Remaining up-to-date with changes to federal worksheet forms is essential, as regulations and requirements can evolve. Utilizing resources for monitoring legal changes can help ensure compliance, preventing unnecessary complications during submission. Tools available on pdfFiller assist users in staying current and adapting to any new requirements.

Moreover, you can often find announcements or updates regarding worksheet forms directly on government websites or through financial news outlets, thus further supporting your commitment to compliance.

Best practices for efficient use of the federal worksheet form

To maximize efficiency when using the federal worksheet form, it is advisable to adopt several best practices. One key element is to streamline your document management process by organizing your forms and associated documents in a structured manner. This saves time and reduces stress when completing forms.

Leveraging pdfFiller’s full range of features—from templates to eSigning—is crucial for optimal efficiency in form creation and submission. Regularly updating and maintaining your templates can also help to keep your records accurate and current, thereby reducing the chances of errors as regulations change.

User testimonials: Experiences with the federal worksheet form on pdfFiller

User feedback reveals a wealth of positive experiences with the federal worksheet form on pdfFiller. Many individuals appreciate the ease of access and the simple interface which allows for hassle-free navigation. Teams have also provided testimonials about the collaborative features that enable multiple users to contribute effectively.

Common themes among users include the efficiency gained through using pdfFiller’s features like eSigning and shared editing options. Overall, the effectiveness of the federal worksheet form via pdfFiller has been highlighted as a practical solution for addressing both personal and organizational documentation needs.

People Also Ask about

Are unrecaptured Section 1250 gains taxable?

How do you report unrecaptured 1250 gains?

Where do I report unrecaptured 1250 gain?

How do I report Unrecaptured Section 1250 gain from K 1?

What is unrecaptured Section 1250 gain worksheet?

Where do I report Unrecaptured Section 1250 gain on 1040?

Our user reviews speak for themselves

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the Canada 5000-D1 electronically in Chrome?

How do I fill out Canada 5000-D1 using my mobile device?

Can I edit Canada 5000-D1 on an Android device?

What is federal worksheet?

Who is required to file federal worksheet?

How to fill out federal worksheet?

What is the purpose of federal worksheet?

What information must be reported on federal worksheet?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.