Get the free Business License Tax Review Form

Get, Create, Make and Sign business license tax review

Editing business license tax review online

Uncompromising security for your PDF editing and eSignature needs

How to fill out business license tax review

How to fill out business license tax review

Who needs business license tax review?

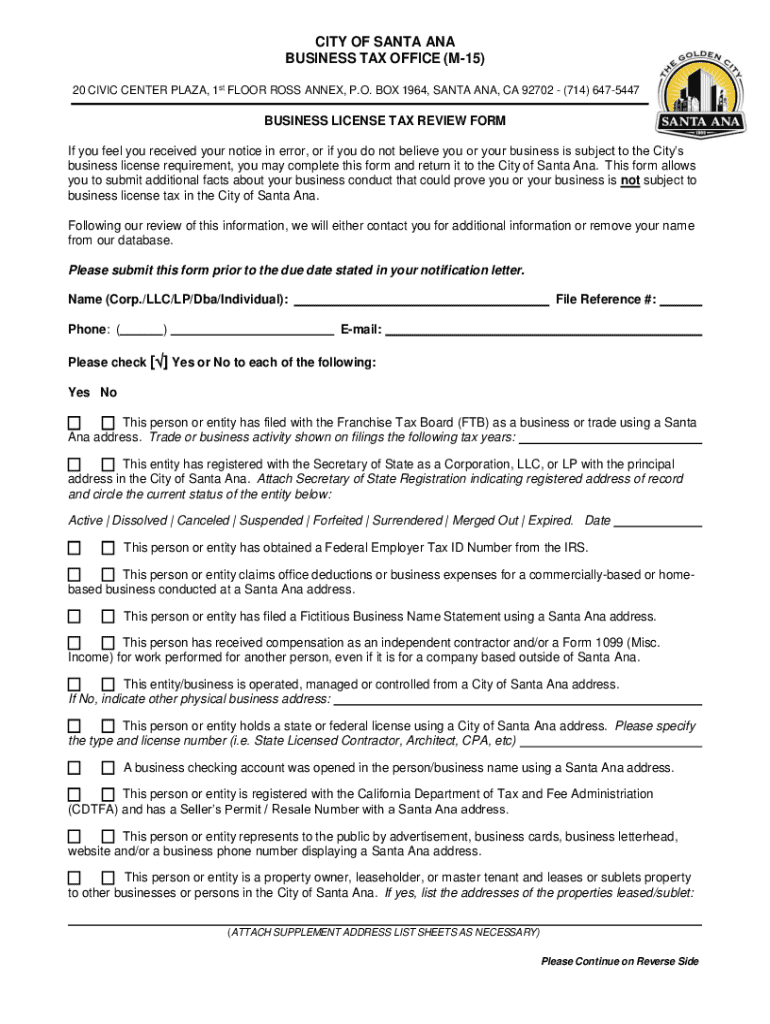

Comprehensive Guide to the Business License Tax Review Form

Understanding the business license tax review process

A business license tax review is a critical process that allows businesses to ensure that their tax obligations align with their operational realities. This review not only validates the accuracy of the business license tax owed but also offers an opportunity to rectify any discrepancies proactively. For many business owners, navigating tax requirements can be daunting; this review process helps demystify that landscape.

Requesting a business license tax review can be necessary for various reasons. Perhaps your business has experienced significant growth, or you have recently changed your business structure or location. Alternatively, mistakes might have been made in previous tax calculations, or you may have received a notice suggesting an audit or adjustment.

Common scenarios that necessitate a tax review include launching a new product line that alters revenue streams, relocating to a new jurisdiction with different tax laws, or adjusting service offerings that impact tax liabilities.

Preparing for the review

Preparation is critical to a successful business license tax review process. Before you initiate the review, gather essential documents that reflect your business operations and tax obligations. The first document to secure is your initial business license application, as it provides the foundational reference for your current status.

You will also need previous tax returns and related documents, as these will demonstrate your compliance history and help identify areas that may require reevaluation. Additionally, financial statements, including profit and loss statements and balance sheets, are crucial, as they quantify your business activities over the review period.

Maintaining accurate records plays a fundamental role in this process. Proper organization of documents not only facilitates smoother reviews but also supports your business's financial health.

Step-by-step guide to the business license tax review form

To begin the review, you’ll need to access the business license tax review form. pdfFiller offers straightforward navigation to locate this form—simply search the platform, and you'll find it readily available in a fillable format. Completing it accurately is essential for a smooth review process.

The form consists of several sections that require detailed information. Start with providing accurate business information like your name, address, and license number. Then, move to the tax calculation details, where you'll specify the tax year and how you calculated your taxes owed.

When filling out the review form, it’s important to avoid common pitfalls, such as skipping sections or providing inaccurate figures. Ensure you meet submission deadlines to avoid unnecessary delays.

Submitting your business license tax review request

Once you've completed the business license tax review form, the next step is submission. pdfFiller allows for both online and manual submission options. If you choose online, you can upload your documents directly through the platform, ensuring a faster processing time.

Make sure to send all supporting documents along with your form submission to avoid delays. Following submission, it’s critical to track the status of your review; pdfFiller provides convenient tools for monitoring your submission so you can stay informed throughout the process.

Frequently asked questions (FAQs)

Understanding the timeline of a business license tax review can alleviate uncertainty. Typically, the review may take anywhere from a few weeks to several months, depending on the complexity of your case and the tax office's workload.

After submission, the next steps usually involve the review team assessing your request and contacting you if further information is needed. If there are any disagreements with the outcome, you may have the option to modify your request or appeal the decision based on specific guidelines.

Post-review actions

Upon completion of the review, the outcome can vary. If your review is approved, adjustments to fees may be made, allowing you to pay the correct amount. Conversely, if your request is rejected, understanding the appeals process is critical; follow up promptly to ensure your rights are protected.

It’s also essential to keep a regular review schedule for future tax compliance. By planning periodic checks into your business operations, you can better anticipate changes that may impact your tax obligations.

Leveraging pdfFiller for a seamless document management experience

pdfFiller not only offers the business license tax review form but also provides a suite of features that streamline document management. Editing PDFs has never been easier, allowing you to maintain all necessary documentation in real-time.

The platform’s eSignature capabilities expedite the review process, allowing for quick approvals. Additionally, you can collaborate with team members effortlessly, ensuring everyone stays on the same page when managing documents.

Support and resources

Accessing customer support is vital when navigating the complexities of a business license tax review. pdfFiller offers dedicated support channels to assist with specific inquiries.

Utilize the interactive tools available on the platform, which can guide you through common issues or provide insights into the review process. Additionally, troubleshooting resources provided by pdfFiller can help resolve any challenges you may encounter.

Related forms and resources

pdfFiller hosts a variety of related business forms that help streamline other aspects of your operational needs. For instance, the business license application form and fee schedules are easily accessible, helping you maintain overall tax compliance.

If you’re interested in broader compliance matters, exploring the tax compliance programs offered through pdfFiller will provide additional insights and resources essential for your business.

State-specific considerations

It's crucial to understand that business license tax review processes can vary significantly by state. Each state may have its own set of rules and regulations that dictate how tax reviews are handled.

Researching state resources and connecting with local tax authorities will provide clarification and guidance tailored to your business’s unique location.

User experiences and testimonials

Many businesses have benefited from efficient document management related to their tax reviews. Success stories abound, showcasing how organized documentation and leveraging pdfFiller’s platform have led to quick and positive tax outcomes.

Case studies reveal the significant impact that efficient reviews have on business operations—saving time, reducing stress, and maintaining compliance with local tax laws.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find business license tax review?

How do I edit business license tax review in Chrome?

How do I fill out business license tax review using my mobile device?

What is business license tax review?

Who is required to file business license tax review?

How to fill out business license tax review?

What is the purpose of business license tax review?

What information must be reported on business license tax review?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.