Get the free Notice of Sheriff’s Levy and Sale

Get, Create, Make and Sign notice of sheriffs levy

How to edit notice of sheriffs levy online

Uncompromising security for your PDF editing and eSignature needs

How to fill out notice of sheriffs levy

How to fill out notice of sheriffs levy

Who needs notice of sheriffs levy?

Your Complete Guide to the Notice of Sheriffs Levy Form

Understanding the notice of sheriffs levy form

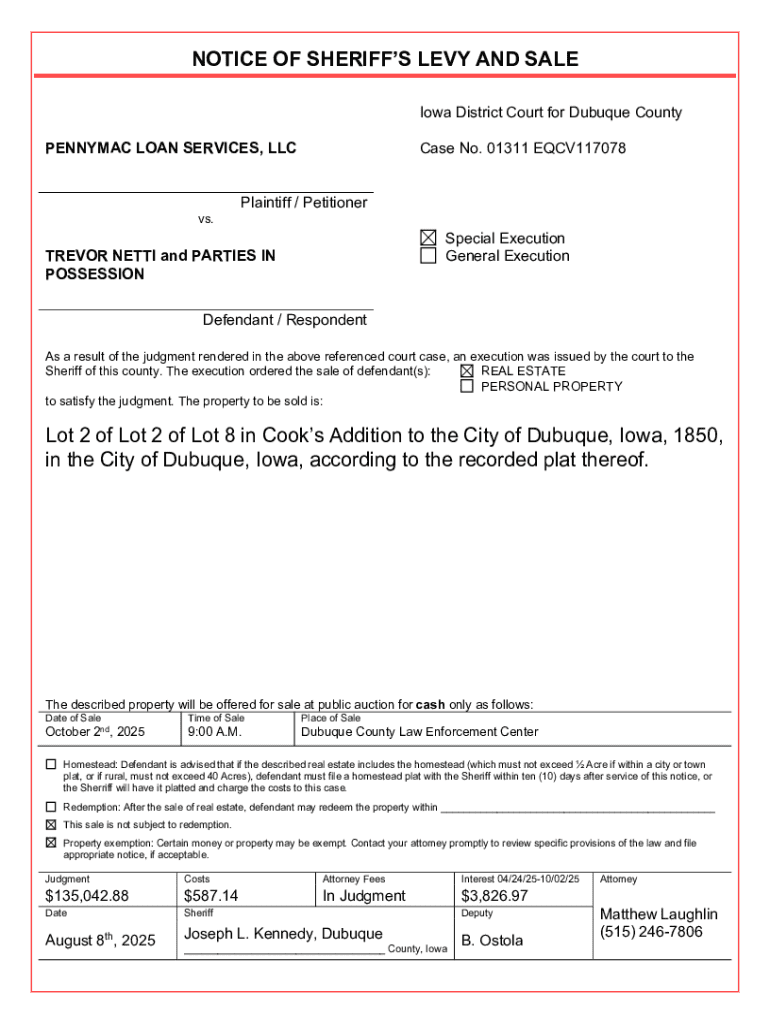

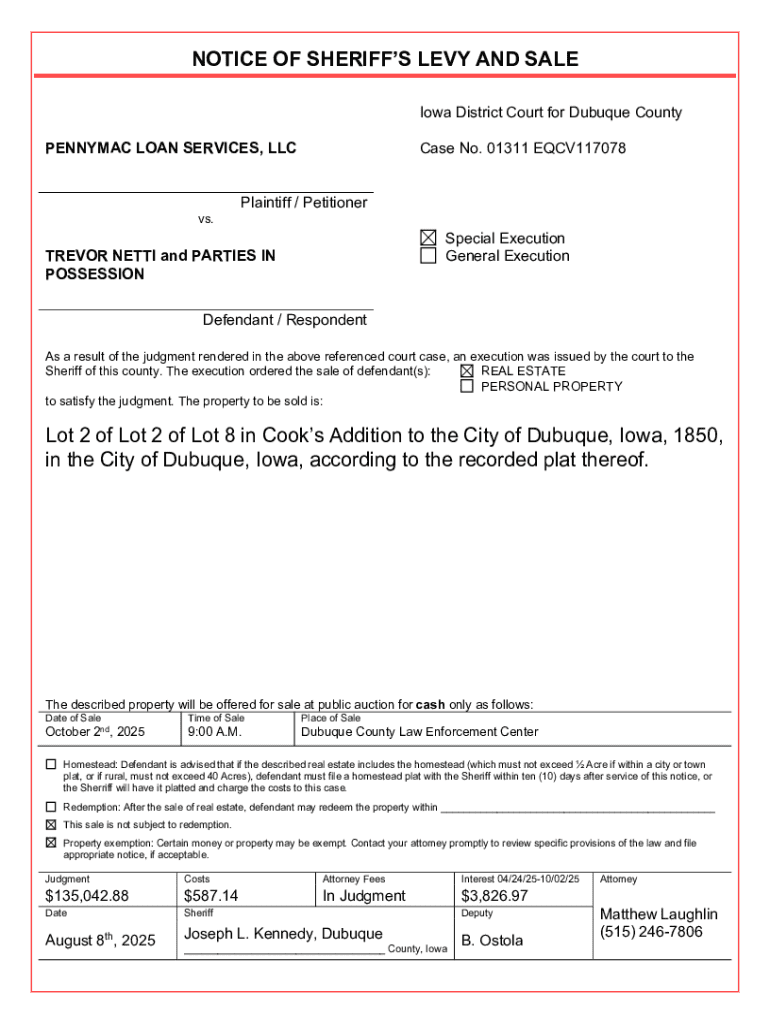

The Notice of Sheriffs Levy Form is a critical legal document used by law enforcement agencies to inform property owners that a levy has been placed on their assets as part of a court-ordered collection process. This form signifies an official step towards the enforcing of a judgment where monetary debts are owed. It plays a key role in ensuring that the due process is followed, and the property owner is made aware of the actions being taken against their property.

The importance of this form cannot be understated. It not only serves as a formal notification but also provides a legal record of the levy, detailing the specifics of the debt, which is crucial for both parties involved—the creditor seeking repayment and the debtor whose property is at risk. Legal frameworks regarding levies and property seizures vary by jurisdiction, thus understanding the relevant laws is essential.

Key components of the notice of sheriffs levy form

The Notice of Sheriffs Levy Form consists of several key sections that serve to convey essential information about the levy in an organized manner. Each section of the form plays a specific role, ensuring transparency and clarity regarding the enforcement actions being taken. Understanding these components is vital for those required to fill out or respond to the form.

Typically, the form includes the following sections:

Preparing to fill out the notice of sheriffs levy form

Before you begin filling out the Notice of Sheriffs Levy Form, it is crucial to gather all relevant information and documents to ensure the accuracy and legitimacy of the submission. Each piece of information contributes to the clarity of the notice and can affect the outcome of any legal proceedings.

Start by collecting the following information:

Best practices for accurately completing the form include double-checking all entered information against legal documents and ensuring all required fields are filled out accurately to prevent delays or complications with the levying process.

Step-by-step instructions for completing the form

Completing the Notice of Sheriffs Levy Form is a process that requires careful attention to detail. Follow this step-by-step guide for ensuring your form is filled out correctly and comprehensively.

Editing and modifying the notice of sheriffs levy form

If you need to make changes to the Notice of Sheriffs Levy Form, pdfFiller offers various tools to edit and modify your document efficiently. Using this online platform, you can easily track revisions and updates, which is crucial during legal processes.

When tracking edits, remember to maintain a clear record of all changes made. This is important, as courts may require documented proof of alterations to ensure compliance with legal standards. Be aware of the legal considerations surrounding any modifications—you want to ensure that changes do not inadvertently invalidate your form or affect its enforceability.

eSigning and submitting the form

After completing and reviewing the Notice of Sheriffs Levy Form, the next step is to electronically sign the form using pdfFiller's eSignature feature. This not only streamlines the submission process but also ensures that the document is executed in accordance with legal expectations.

When submitting the form, follow these guidelines for best practices:

Managing your notice of sheriffs levy form

Once submitted, managing your Notice of Sheriffs Levy Form effectively is vital for tracking the progress of the levy and ensuring compliance with any required follow-up actions. pdfFiller provides convenient options for saving and storing your document securely.

Consider the following management tips:

Frequently asked questions (FAQs)

The process surrounding the Notice of Sheriffs Levy Form can generate numerous queries. Many people face common issues that can create confusion during the filing process. Here's a response to some frequently asked questions.

Stay updated on legal changes related to sheriffs levy

It is imperative for individuals and teams involved in the management of Notice of Sheriffs Levy Forms to stay informed about any changes in the legal landscape. This could encompass updated regulations or new forms being required by local courts or sheriff’s departments.

Following relevant legal news sources and updates can help you stay ahead of changes, ensuring that you always have access to the most accurate and current information.

Additional tools and resources

In addition to filling out the Notice of Sheriffs Levy Form, there are other related documents and forms you may need. pdfFiller provides a variety of templates that are readily accessible.

Contact information for further assistance

For additional help and guidance related to the Notice of Sheriffs Levy Form, pdfFiller offers robust customer support. Should you encounter challenges or have questions, feel free to reach out to their dedicated customer service team.

Establishing a relationship with a professional legal consultant may also prove beneficial, especially if you are navigating complex situations involving property levies.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get notice of sheriffs levy?

Can I edit notice of sheriffs levy on an Android device?

How do I fill out notice of sheriffs levy on an Android device?

What is notice of sheriffs levy?

Who is required to file notice of sheriffs levy?

How to fill out notice of sheriffs levy?

What is the purpose of notice of sheriffs levy?

What information must be reported on notice of sheriffs levy?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.