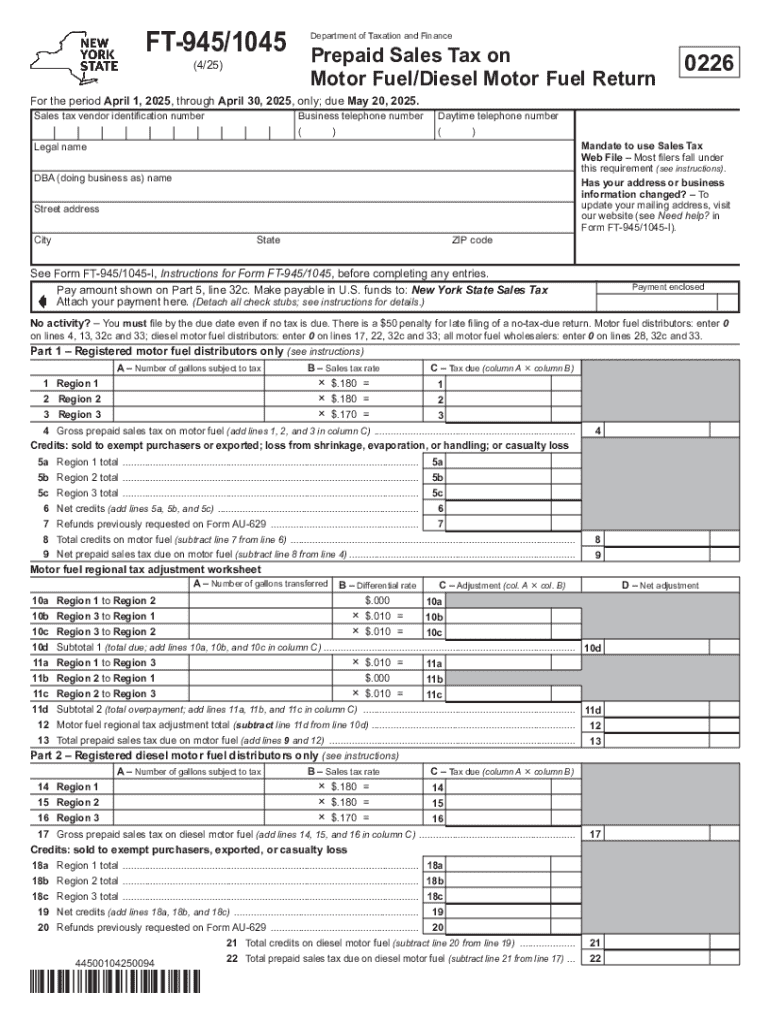

Get the free Ft-945/1045

Get, Create, Make and Sign ft-9451045

Editing ft-9451045 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out ft-9451045

How to fill out ft-9451045

Who needs ft-9451045?

FT-9451045 Form: A Comprehensive Guide

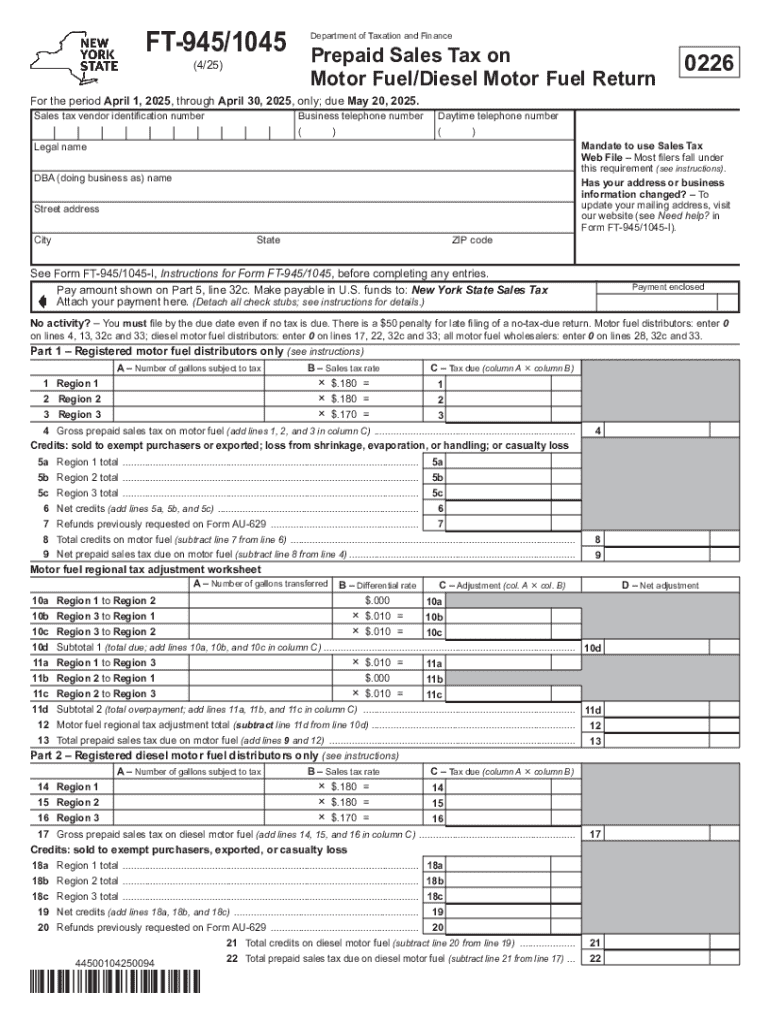

Understanding the FT-9451045 Form

The FT-9451045 Form is a significant document used in the context of prepaid sales tax on motor fuel and diesel. Its importance lies in ensuring that businesses within the fuel industry correctly report their tax obligations and comply with state regulations.

This form serves a dual purpose: it acts as a tool for tax reporting while simultaneously allowing businesses to manage their prepaid sales tax more efficiently. By accurately completing the FT-9451045 Form, companies can help streamline their tax processes and avoid potential issues with regulatory bodies.

Pre-requisites for Filing the FT-9451045 Form

Before filing the FT-9451045 Form, businesses must understand the eligibility criteria. Certain entities within the fuel industry, such as wholesalers and retail distributors of motor fuel, are required to file this form. Meeting these criteria ensures that companies stay compliant with tax obligations.

Additionally, companies must determine whether they should file the form annually or quarterly, based on their sales volume. Businesses with lower volumes may qualify for annual submissions, while larger enterprises must file quarterly to accurately report sales tax.

Step-by-step instructions for completing the FT-9451045 Form

Filling out the FT-9451045 Form requires careful attention to detail. The first section, Identification, requires accurate personal and business identification details. These include the name, address, and federal identification number, which are essential for the form’s validity.

The second section focuses on Sales Tax Calculations. Businesses must accurately report the total sales, calculate the tax owed, and determine any credits or adjustments. Understanding the formulas used in these calculations is crucial to ensure accuracy.

Finally, the last section requires signatures for verification. This step is critical because it confirms that the information provided is accurate and sincere, distinguishing the submission as a legal document.

Interactive tools for filling out the FT-9451045 Form on pdfFiller

pdfFiller offers robust editing features that streamline the process of completing the FT-9451045 Form. Users can easily upload the blank form, edit required fields, and even add electronic signatures, ensuring a seamless filing experience.

Utilizing templates available on pdfFiller is another way to maintain consistency and accuracy across multiple submissions. By customizing templates tailored for the FT-9451045 Form, businesses can save time and ensure that all necessary information is included without starting from scratch.

Addressing common issues with the FT-9451045 Form

Businesses often encounter common errors while completing the FT-9451045 Form, including miscalculations and omitted information. Avoiding these mistakes is crucial for ensuring a smooth filing process and maintaining compliance with tax regulations.

If mistakes are detected after submission, the form can typically be amended. Companies should follow the specific steps provided by their tax authority, ensuring that any corrections maintain updated records and comply with regulatory requirements.

Compliance and deadlines for the FT-9451045 Form

Filing deadlines for the FT-9451045 Form vary depending on whether businesses are filing quarterly or annually. Adhering to these deadlines is essential to avoid penalties and audits from tax authorities. For many states, quarterly filings are due at the end of each quarter with annual forms generally due at the end of the fiscal year.

Non-compliance can lead to severe consequences, such as financial penalties or increased scrutiny during audits. Hence, businesses must implement proactive strategies to ensure timely submissions and accurate reporting.

Additional resources for FT-9451045 Form users

Businesses filing the FT-9451045 Form can benefit from additional resources. State revenue department websites offer valuable links to forms, guidelines, and contact information that can assist users through the process.

Furthermore, understanding related forms, such as the FT-500 and FT-930, which often function alongside the FT-9451045 Form, can enhance overall compliance and reporting efficiencies.

Feedback and community support for FT-9451045 Form users

User experiences can provide invaluable insights into the process of completing the FT-9451045 Form. Businesses and individuals are encouraged to share their experiences which can foster a supportive environment for others facing similar challenges.

Joining dedicated forums and groups focused on tax compliance in the fuel industry can provide opportunities for collaboration and knowledge exchange, ultimately leading to a more informed community.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in ft-9451045?

Can I create an eSignature for the ft-9451045 in Gmail?

How do I complete ft-9451045 on an iOS device?

What is ft-9451045?

Who is required to file ft-9451045?

How to fill out ft-9451045?

What is the purpose of ft-9451045?

What information must be reported on ft-9451045?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.