Get the free Withdrawal Slip

Get, Create, Make and Sign withdrawal slip

Editing withdrawal slip online

Uncompromising security for your PDF editing and eSignature needs

How to fill out withdrawal slip

How to fill out withdrawal slip

Who needs withdrawal slip?

Withdrawal Slip Form: A Comprehensive Guide

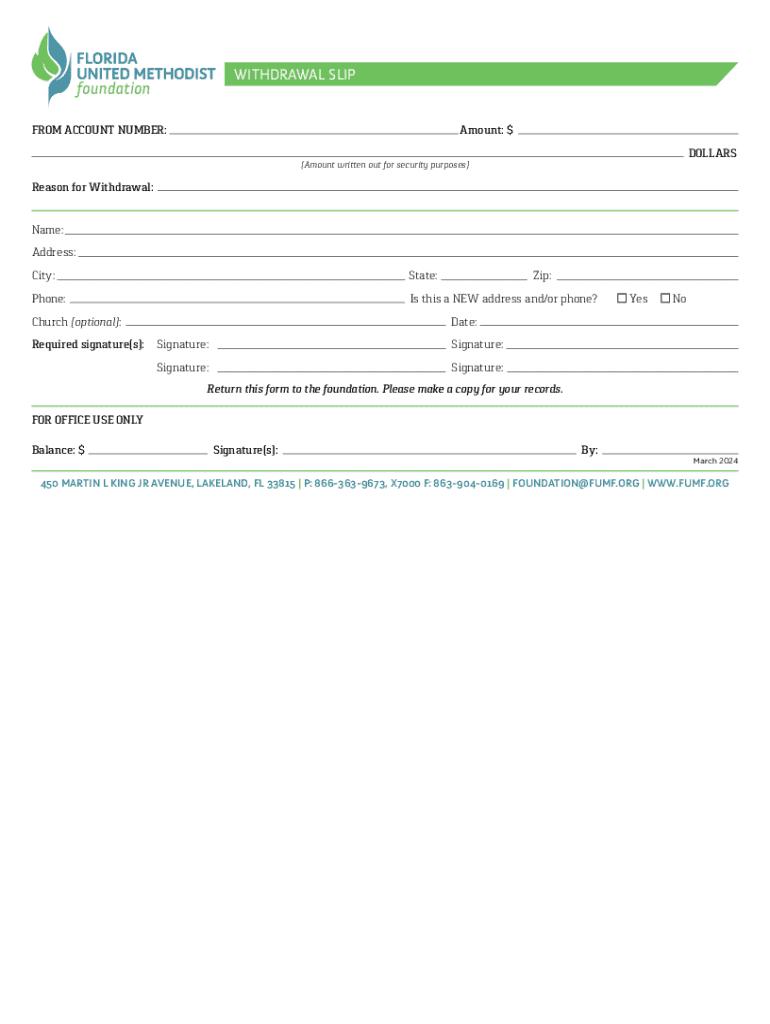

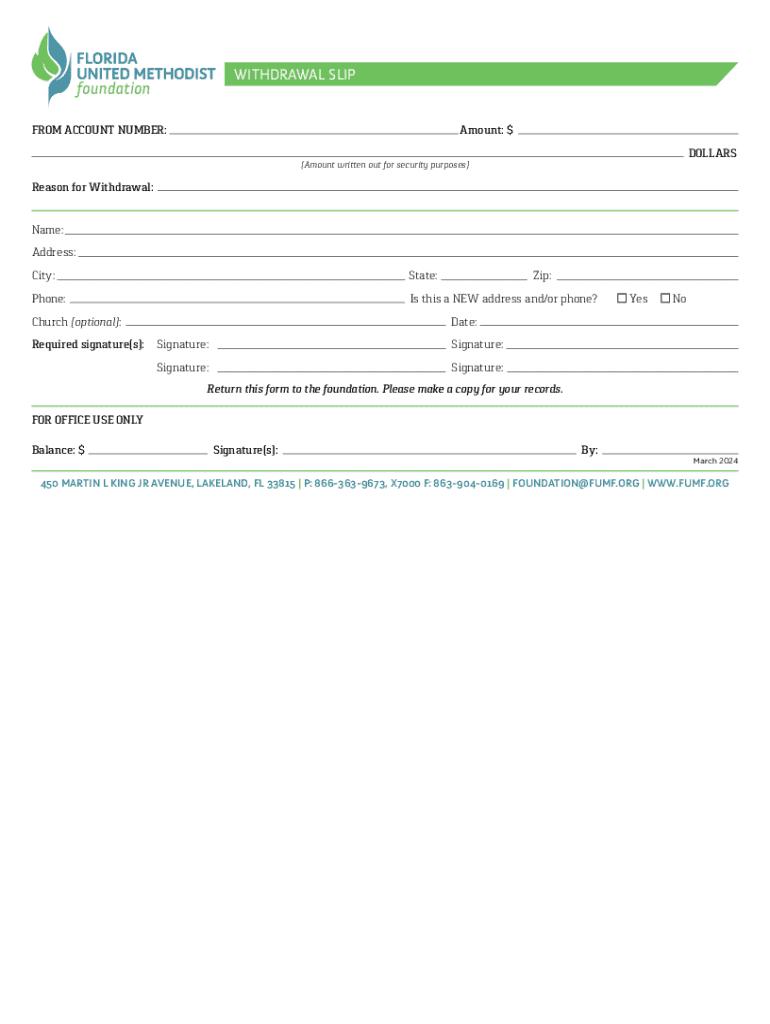

Understanding the withdrawal slip form

A withdrawal slip form is a document used by individuals or businesses to request the withdrawal of funds from a bank account. This form is essential in formalizing the transaction and ensuring that all parties involved have a clear record of the amount being withdrawn and from which account. The importance of a withdrawal slip in financial transactions cannot be overstated, as it provides a documented trail that can be referenced in case of discrepancies.

There are several types of withdrawal slips depending on the method of withdrawal. For instance, ATM withdrawal slips are generated by the machine during a transaction, whereas traditional bank withdrawal slips are filled out by customers at the teller. Additionally, online banking platforms may offer digital versions of withdrawal slips, further enhancing convenience and efficiency.

Features of the withdrawal slip form

The withdrawal slip form consists of several key components that ensure its effectiveness and clarity. First and foremost, the account information section identifies the account holder and the account number from which the funds will be withdrawn. This is crucial in preventing unauthorized access to accounts and securing the transaction process. Secondly, fields for the date and the specific amount being withdrawn must be filled out to provide a detailed record.

Another vital component is the signature line, where the account holder must sign to authorize the withdrawal. This signature serves as a form of verification. Different types of withdrawal slips may have variations in their layouts or additional components, but these essential features remain consistent.

How to fill out a withdrawal slip form

Filling out a withdrawal slip form correctly is crucial to avoid any delays or issues with your transaction. Follow these step-by-step instructions to ensure accuracy:

Common mistakes include writing the wrong amount, providing incorrect account numbers, or forgetting to sign the form. To ensure accuracy, double-check the information before submitting your withdrawal slip.

Editing and customizing your withdrawal slip form

Modifying your withdrawal slip form can enhance convenience, especially for repeated transactions. With tools like pdfFiller, you can easily customize the form to include pre-filled information, like your usual withdrawal amounts or account details. This saves time, especially if you frequently withdraw funds.

You can also insert additional notes or comments on the form to clarify the purpose of the withdrawal or to inform your accountant about the transaction. Customizing forms can be beneficial for both personal use and within a team setting, allowing teams to maintain a clear record of financial transactions.

Signing the withdrawal slip form

The signing process for a withdrawal slip form is essential as it authorizes the transaction. If you’re using pdfFiller, you have the option to electronically sign your form. This digital signature is not only legally binding but also offers practicality, as it can be completed from virtually anywhere.

Digital signatures have numerous advantages, such as reducing paperwork and enhancing security through encryption. If the account is a joint one, multiple signatures may be required, and pdfFiller facilitates this by allowing you to include several signers on one document.

Managing and storing your withdrawal slip form

Proper management and storage of your withdrawal slip forms are vital for easy access and long-term tracking. You can opt for digital storage solutions that allow you to store your forms securely and retrieve them from any location. Platforms like pdfFiller provide cloud-based solutions that ensure your documents are organized and accessible anytime.

For physical forms, ensure they are kept in a secure location to prevent unauthorized access. Sharing your forms with accountants or family members can also be managed easily through pdfFiller's sharing features, which allow you to send documents directly from the platform.

Frequently asked questions about withdrawal slip forms

Addressing common queries regarding the withdrawal slip form can help users navigate this essential document effectively.

Real-life scenarios and use cases

Understanding how the withdrawal slip form can be utilized in various contexts can broaden its appeal among users.

Internal engagements: Best practices for teams

For teams, implementing best practices in the usage of withdrawal slip forms can improve collaboration and efficiency. Utilizing collaboration features in tools like pdfFiller allows for seamless document handling among team members.

Additionally, tracking changes and versions of withdrawal slip forms is crucial for maintaining an accurate history of transactions. Organizations can establish a protocol for regular reviews of completed slips to ensure compliance and accuracy across financial records.

Quick access tools for users

For frequent users of withdrawal slip forms, having quick access tools can streamline the process drastically. Users can bookmark commonly used forms or save favorite actions within the pdfFiller platform to enhance their efficiency.

Creating templates for regularly submitted forms can also save considerable time and effort, ensuring that users can focus more on their transactions rather than repetitive form filling.

Useful links

Several resources can guide users towards effective application of the withdrawal slip form, including legal considerations for withdrawal transactions, relevant planning resources, and user guides for platforms such as pdfFiller.

Important links

Accessing the pdfFiller platform is straightforward, and users can also reach customer support for assistance with any queries. For those looking to dive deeper into the platform's full suite of tools, user guides are available to provide advanced features.

Other links

Consulting blog articles on effective document management can offer further insights into optimizing your use of withdrawal slip forms, while tutorials for utilizing pdfFiller can enhance your knowledge of the platform.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify withdrawal slip without leaving Google Drive?

How can I get withdrawal slip?

How do I fill out withdrawal slip using my mobile device?

What is withdrawal slip?

Who is required to file withdrawal slip?

How to fill out withdrawal slip?

What is the purpose of withdrawal slip?

What information must be reported on withdrawal slip?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.