Get the free Health Insurance Claim Form

Get, Create, Make and Sign health insurance claim form

How to edit health insurance claim form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out health insurance claim form

How to fill out health insurance claim form

Who needs health insurance claim form?

Health Insurance Claim Form - How-to Guide

Understanding the health insurance claim form

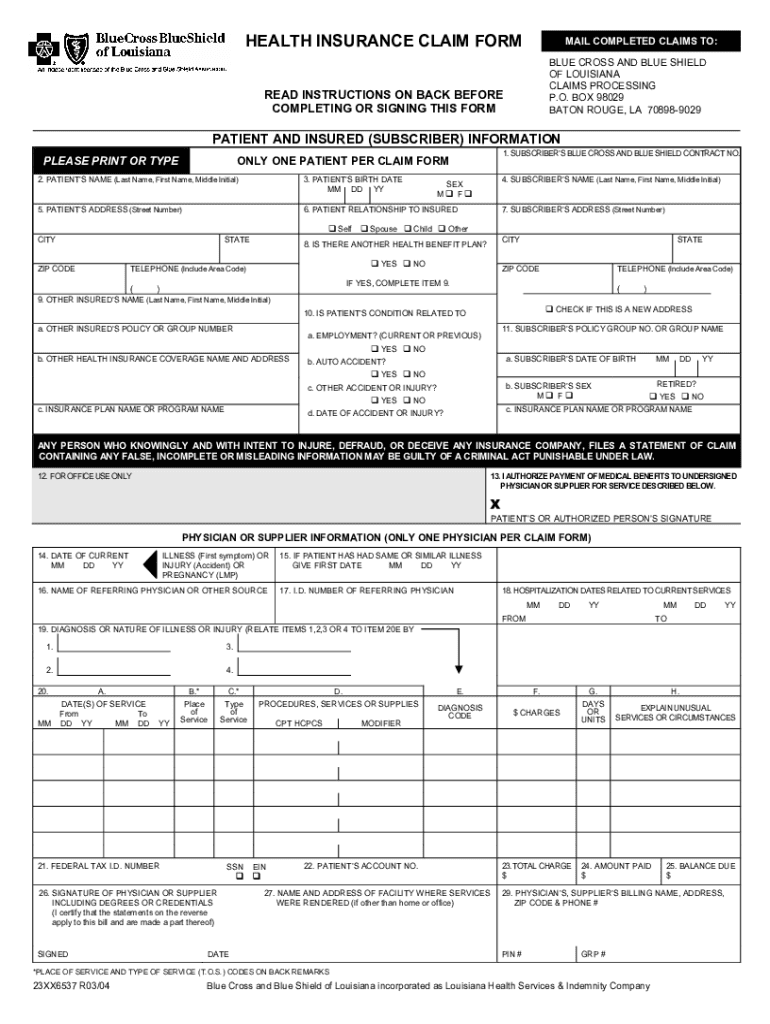

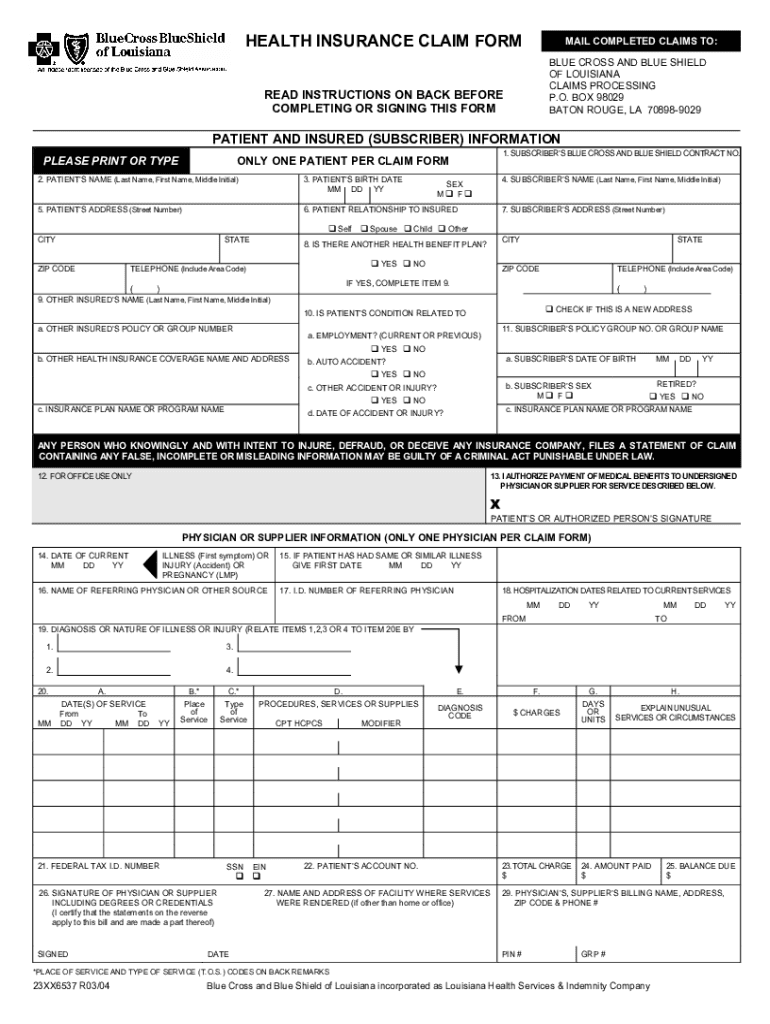

The health insurance claim form is a standardized document used by healthcare providers to bill insurance companies for medical services rendered to patients. Understanding this form is crucial for both patients and providers, as it plays a significant role in obtaining timely reimbursements for medical expenses. Not only does it serve as a medium for communication between providers and insurers, but it also ensures that patients receive the coverage they are entitled to.

The importance of a properly filled health insurance claim form cannot be overstated. A correctly completed claim form allows healthcare providers to receive appropriate payment for their services and keeps patients from facing unexpected out-of-pocket expenses. Any errors or omissions can delay the claims process or result in denials, leading to frustration.

Key components of the health insurance claim form

A health insurance claim form consists of several key components that must be accurately filled out to ensure successful processing. Essential sections include patient information, which identifies the individual receiving care, and provider information that details the healthcare practitioner or facility performing the service.

Diagnosis and procedure codes are critical for insurance reimbursement, as they categorize the medical services provided. An itemized billing section outlines specific charges related to each service, while a signature and certification section signifies that the information provided is accurate and that the services were indeed rendered.

Common types of health insurance claim forms

There are several types of health insurance claim forms, with the CMS-1500 and UB-04 being the most commonly used. The CMS-1500 form is primarily used by individual medical providers and should be filled out meticulously to prevent claim denials due to errors.

Conversely, the UB-04 form is intended for institutional providers, such as hospitals or skilled nursing facilities. Understanding the differences between these forms is crucial for healthcare providers to ensure they are utilizing the correct one. Additionally, there may be specialized forms required by specific insurance providers, so it's vital to know which form to use in various scenarios.

Step-by-step process for filling out the health insurance claim form

Filling out a health insurance claim form requires diligence to ensure accuracy and completeness. The first step is to gather necessary information, including invoices, medical records, and provider details. Accurately collecting this data is crucial for smooth processing.

Once you have all the required information, begin completing each section of the form. Fill out patient information accurately, ensuring that all personal details match those in your insurance policy. Next, input the provider information correctly to avoid any confusion regarding who provided the service.

Detail the services rendered by including diagnosis and procedure codes. Accurate coding prevents delays and denials. Then, clarify itemized billing in the designated section, breaking down the costs for each service provided. Finally, ensure that you sign and date the form, affirming that all information is true and correct. This step not only validates your claim but also aligns with legal requirements.

Common pitfalls and how to avoid them

Even minor errors on a health insurance claim form can lead to significant delays or outright denials of claims. Common pitfalls include entering incorrect codes, which can completely alter the meaning of the services provided. Ensuring that all codes correspond accurately with the treatment and are up-to-date is essential.

Additionally, missing information can cause processing holdups. Each section must be diligently checked to confirm completeness. Signature issues also frequently arise; make sure that the necessary parties sign the form to validate its submission. Developing a checklist to review the claim form before submission can avoid many of these common errors.

Editing and managing the health insurance claim form using pdfFiller

pdfFiller simplifies the process of managing health insurance claim forms by offering a cloud-based platform that enables users to edit PDFs, collaborate in real-time, and sign documents electronically. This solution streamlines the entire process, from filling out forms to submitting claims.

Utilizing pdfFiller, users can easily upload their claim forms, regardless of the file format. The intuitive editing tools allow for effortless adjustments, whether highlighting key sections, erasing mistakes, or adding text where necessary. Moreover, pdfFiller enables collaboration by allowing multiple team members to access and edit a document simultaneously, reducing the chances of errors.

Frequently asked questions about health insurance claim forms

When a health insurance claim is denied, it can be disheartening. However, it’s important not to panic. The first step is to familiarize yourself with the reason for the denial, which should be included in the communication from your insurance provider. Common issues may stem from incorrect coding, lack of necessary information, or failure to meet coverage guidelines.

Post-denial, the resubmission process simply involves correcting the identified mistakes or gathering additional information as required by the insurance company. Understanding the typical claims process and appealing systems allows patients to navigate through service denials more effectively.

Best practices for efficient claim management

Effective claim management begins with keeping meticulous records of all submitted claims and related communications. Documenting submissions not only aids in tracking but also serves as a valuable reference in case of disputes or follow-ups. Utilizing digital tools like pdfFiller can streamline record-keeping efforts, consolidating everything in one accessible platform.

Understanding patient rights regarding claims is equally important. Patients are entitled to know the specifics of their coverage and what is required for successful claims. In cases of persistent issues or confusion, seeking professional assistance can prove beneficial to navigate complex situations effectively.

Conclusion

The effectiveness of managing health insurance claims significantly improves with platforms like pdfFiller that empower users to edit, eSign, collaborate, and manage documents efficiently. Navigating the intricacies of a health insurance claim form becomes less daunting with comprehensive understanding and the right tools at your disposal. As healthcare management continues to evolve, embracing these digital solutions is essential for optimizing claims process and ensuring timely reimbursements.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete health insurance claim form online?

How do I make edits in health insurance claim form without leaving Chrome?

Can I edit health insurance claim form on an iOS device?

What is health insurance claim form?

Who is required to file health insurance claim form?

How to fill out health insurance claim form?

What is the purpose of health insurance claim form?

What information must be reported on health insurance claim form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.