Get the free 990

Get, Create, Make and Sign 990

How to edit 990 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 990

How to fill out 990

Who needs 990?

Your Comprehensive Guide to Form 990

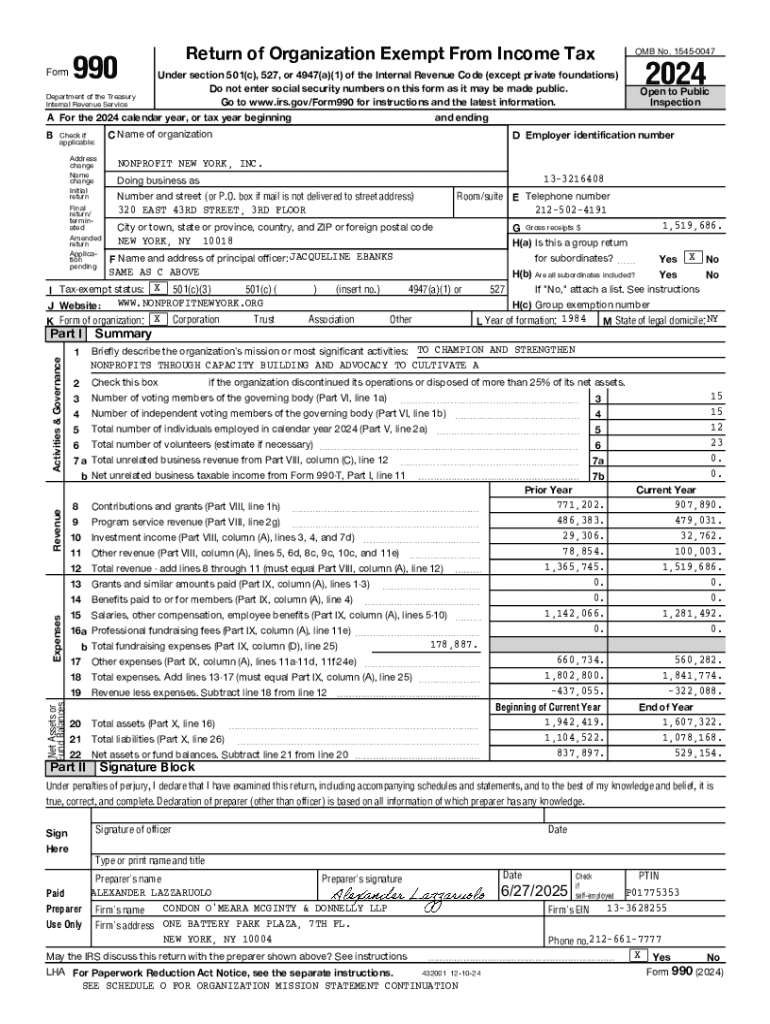

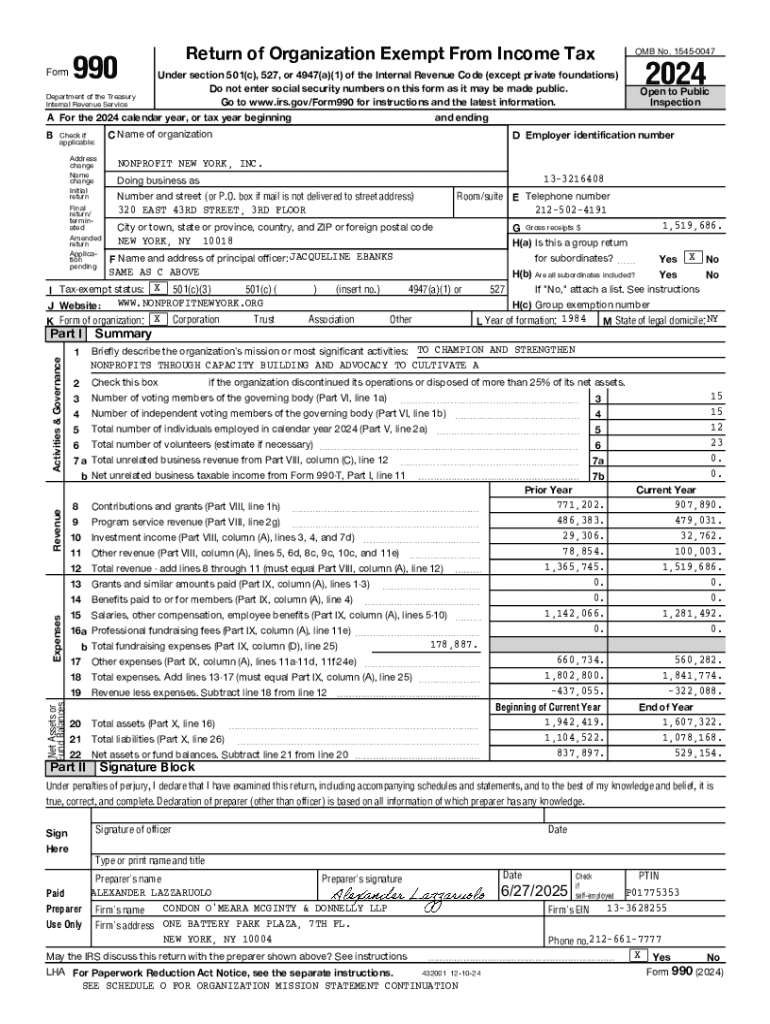

Understanding the 990 form

Form 990 is a critical tax document required by the IRS for tax-exempt organizations in the United States. Its primary purpose is to provide transparency regarding the financial activities of nonprofits, ensuring that they adhere to federal tax regulations. Unlike traditional tax forms that private businesses file, the 990 form allows the public and government entities to scrutinize the financial health and operational effectiveness of charities.

For tax-exempt organizations, filing Form 990 not only meets legal obligations but also promotes accountability in the nonprofit sector. Various stakeholders, such as donors, grantmakers, and researchers, utilize this information to evaluate the financial integrity and social impact of organizations. Therefore, understanding the nuances of the 990 form is crucial for both compliance and effective organizational management.

Types of organizations required to file Form 990

Nonprofit organizations are categorized into two main types for tax purposes: public charities and private foundations. The distinction between these entities determines their reporting requirements with respect to Form 990. Public charities, which rely on public support and funding, generally face simpler reporting requirements, while private foundations often deal with stricter regulations and must file Form 990-PF, a specialized version of the form.

Certain income thresholds dictate whether an organization is required to file Form 990. Nonprofits with gross receipts exceeding $200,000 or total assets above $500,000 must file the full version of the 990 form. Smaller organizations may qualify for the simpler Form 990-EZ or even determine that they are eligible for the 990-N, also known as the e-Postcard, a brief online filing confirming their tax-exempt status.

Navigating the components of the 990 form

Understanding each section of Form 990 is vital for accurate completion. The form comprises several key parts, each providing critical insights into the organization’s operations. Part I summarizes the organization’s revenue and expenses, offering a snapshot of financial health—essential information for donors and stakeholders. Part II contains the signature block, certifying the authenticity of the submitted information.

Part III highlights program service accomplishments, detailing how resources have been utilized to meet the organization's mission. This section plays a pivotal role in illustrating effectiveness, making it a key area for nonprofits to focus on. Parts IV and V address governance practices, including management disclosure and tax compliance measures, ensuring that nonprofits uphold transparency in both financial and operational aspects.

Step-by-step instructions for filling out the 990 form

Filling out Form 990 requires meticulous attention to detail. Before starting, it’s essential to gather all necessary financial documents such as bank statements, audits, and previous tax returns. These documents provide essential data, ensuring accuracy when reporting revenue and expenses. It’s also crucial to compile information about your organization’s management team and board of directors, as transparency about governance is a mandatory aspect of the filing.

As you begin to fill out each section of Form 990, accuracy is paramount—don’t rush through the process. Reporting revenue and expenses accurately is critical; misclassifications can lead to penalties or even worse, jeopardize your tax-exempt status. In Section III, focus on showcasing your mission effectiveness through clear descriptions of program outcomes and impacts. This narrative is not just a requirement; it's an opportunity to present your organization's story.

For those looking for an efficient way to complete Form 990, pdfFiller offers versatile tools that can enhance your form-filling experience. The software allows easy editing of PDF forms, ensures documents are securely signed and shared, and offers features for tracking changes and collaborating with team members on your filing.

Common mistakes to avoid when filing the 990 form

Filing Form 990 can be complex, and many nonprofits stumble over common pitfalls. Omitting required information can lead to significant consequences, including fines and additional scrutiny from the IRS. Misclassifying revenue or expenses is another frequent error that can distort your organization’s financial picture and mislead stakeholders. Furthermore, late submissions can result in penalties, and it’s essential to adhere to the filing timeline to maintain compliance.

To avoid these errors, consider using tools like pdfFiller, which provides features geared towards accuracy and consistency. Templates and automated checks can minimize mistakes, while the platform helps maintain organized records, allowing for an easier filing process.

Important deadlines and filing requirements

Understanding the filing timelines for Form 990 is critical for compliance. Most organizations must submit their 990 forms by the fifteenth day of the fifth month after the end of their fiscal year. This means organizations operating on a calendar year must file by May 15. Extensions are available for organizations needing more time, but it's essential to file for an extension before the due date to avoid penalties.

Additionally, state-specific filing requirements can vary significantly. Some states may require additional forms or different filing schedules, making it vital for organizations to familiarize themselves with local regulations. Resources such as state nonprofit associations can provide valuable insights into these requirements and help ensure compliance.

Post-filing actions and managing your 990 form

Once you've filed Form 990, understanding what comes next is essential. Form 990 submissions are accessible to the public, enabling potential donors and stakeholders to review your organization’s financial dealings. Hence, being prepared for any inquiries from the IRS or the public is crucial. Transparency is key; maintaining communication is an important practice to foster trust and accountability.

Also, retaining records and documentation is imperative. Keeping organized files not only aids in future filings but also simplifies the process of responding to inquiries. Best practices include categorizing documents by year, maintaining a digital archive, and ensuring hard copies are stored securely.

The impact of Form 990 on your organization

Form 990 significantly affects how your nonprofit is perceived in the community and among potential funders. A well-prepared 990 form presents transparency and fosters public trust. The narrative and data contained within the form can influence donor decisions and open avenues for partnerships. This form is not merely a regulatory necessity; it serves as a tool for storytelling and demonstrating your organization’s impact.

Moreover, analysis of Form 990 filings can yield valuable data. By examining trends, patterns, and financial strategies reflected in your submissions, organizations can make data-driven decisions that enhance operational effectiveness. Grasping these insights can provide significant leverage when pursuing grants, collaborations, and other funding opportunities.

Interactive tools and resources

pdfFiller offers a suite of interactive features to enhance the process of completing Form 990. Users can access templates specifically designed for this form, streamlining the preparation process. Furthermore, the platform allows for collaborative editing, enabling multiple team members to contribute and enhance documents efficiently. This capability is particularly beneficial for organizations with diverse stakeholders involved in the filing process.

In addition to the editing and signing features, pdfFiller provides resources to answer common questions about Form 990. Its robust support system is designed to assist organizations in navigating the complexities of their filings. By leveraging these tools, nonprofits can ensure a smoother experience from drafting to submission, making the filing of the 990 form a less daunting task.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send 990 for eSignature?

Can I sign the 990 electronically in Chrome?

Can I create an electronic signature for signing my 990 in Gmail?

What is 990?

Who is required to file 990?

How to fill out 990?

What is the purpose of 990?

What information must be reported on 990?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.