Get the free Form 8868

Get, Create, Make and Sign form 8868

How to edit form 8868 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 8868

How to fill out form 8868

Who needs form 8868?

Comprehensive How-to Guide for Form 8868: Application for Extension of Time To File

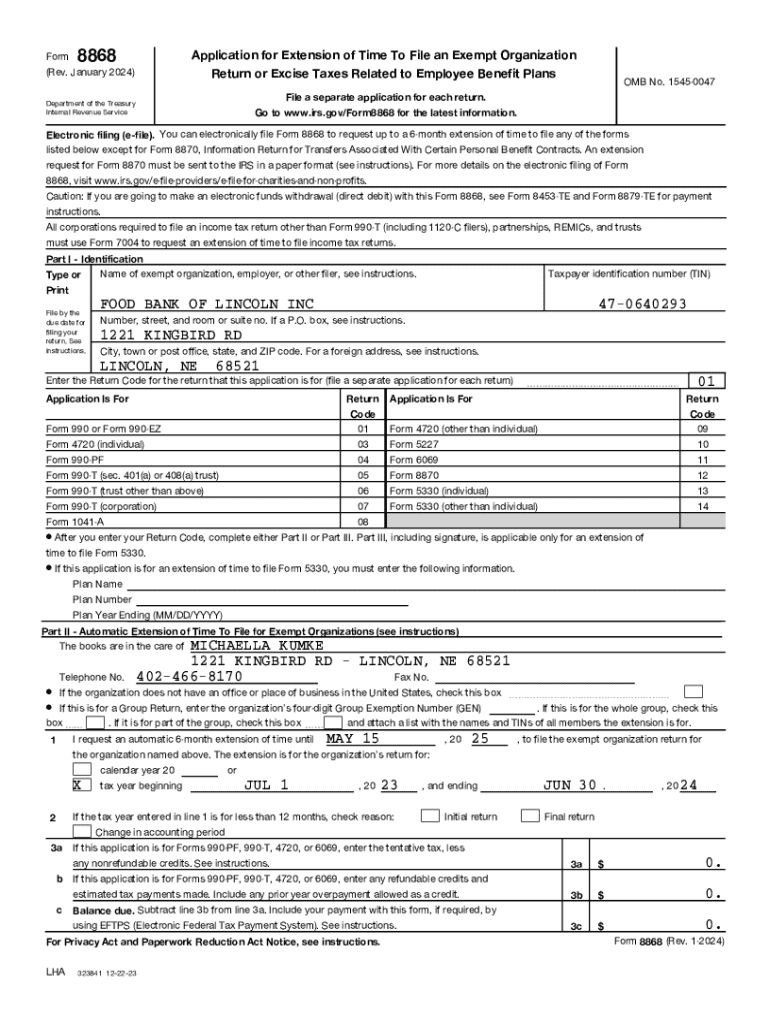

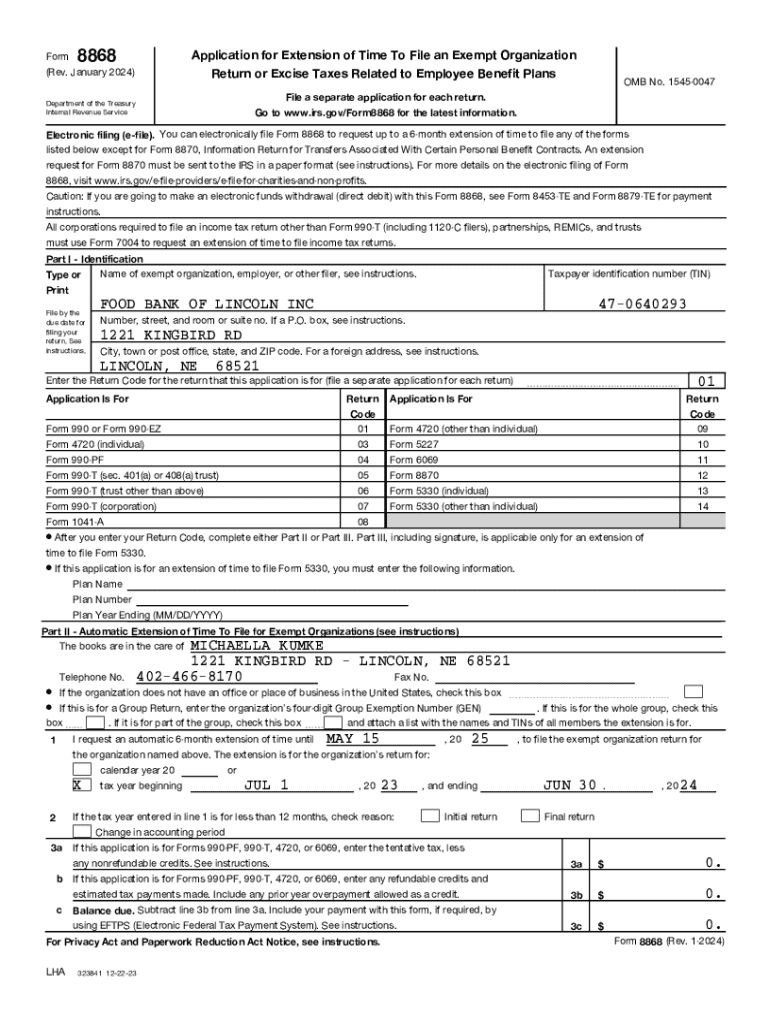

Overview of Form 8868

Form 8868 is an important IRS form utilized by exempt organizations to request an automatic extension of time to file their annual returns. This form is specifically designed for organizations recognized under Internal Revenue Code section 501(c) and allows them additional time to prepare and submit necessary documentation without facing penalties. By ensuring timely filing with the help of Form 8868, organizations can avoid late fees and maintain good standing with the IRS.

Key features of Form 8868

The process of completing and managing Form 8868 has been enhanced significantly through user-friendly tools available on pdfFiller. This platform not only makes the form accessible but also provides interactive functionalities that greatly streamline the documentation process. For instance, users can easily fill out the form electronically, utilize templates, and save their progress. Furthermore, the integration of collaboration features empowers teams to work together cohesively, ensuring all necessary information is accounted for and filed accurately.

Understanding the purpose of Form 8868

Filing Form 8868 is not merely a procedural step; it serves essential functions for organizations that require extra time to prepare their annual financial reports. Various circumstances may lead to this need, including unforeseen delays in auditing or compiling necessary information. It's crucial to understand that failing to file Form 8868 on time can result in significant consequences, including penalties and interest on unpaid taxes. Organizations that anticipate potential delays should proactively file for an extension to mitigate these risks.

When to file Form 8868

Filing deadlines for Form 8868 are critical to ensure compliance with IRS regulations. Organizations need to submit this form by the regular due date of their return. For many organizations, the typical deadline falls on May 15. However, if the due date falls on a weekend or holiday, the deadline is extended to the next business day. Understanding these timelines can save organizations from unnecessary penalties.

Where and how to file Form 8868

Organizations have multiple submission options for Form 8868, including electronic filing through the IRS e-file system or traditional paper filing via mail. Electronic filing is often the recommended method as it can speed up the processing time and provides a confirmation once the form is received by the IRS. pdfFiller enhances this process by providing a simple, step-by-step guide for users who want to file electronically, ensuring they can submit Form 8868 with ease.

Detailed instructions for completing Form 8868

Completing Form 8868 involves several critical steps that require careful attention to detail. The first part of the form asks for essential identification information, including the name and address of the organization and the Employer Identification Number (EIN). Following this, Part II focuses on requesting an automatic extension for the specified returns. Lastly, Part III pertains to organizations that are also filing for an extension to Form 5330, a specialized form for specific tax issues regarding employee benefit plans.

Part : Identification section

Part : Automatic extension of time to file for exempt organizations

In this section, organizations indicate their eligibility for an automatic extension. Note that while most organizations can automatically obtain a six-month extension, certain criteria must be met. It's imperative to check all the correct boxes and provide any additional requested information.

Part : Extension of time to file Form 5330

This section is specifically for requesting an extension related to Form 5330. Organizations should clearly indicate the reason for this request and follow IRS instructions for providing supplementary details. Understanding the implications of filing this extension is crucial for compliance and avoiding potential penalties.

Privacy and compliance considerations

Navigating the compliance landscape when filing Form 8868 requires a firm understanding of privacy regulations, such as the Privacy Act and Paperwork Reduction Act. Organizations are expected to protect both their information and that of their stakeholders. pdfFiller offers features that promote compliance, ensuring that all forms submitted meet IRS standards and data protection laws.

Recent changes and future developments

Stay updated with the IRS for any changes related to Form 8868. Recent developments may include changes in submission guidelines or new compliance requirements, impacting how organizations file their extensions. Users should consistently check for updates and be prepared for anticipated changes, particularly those projected for the 2025 filing year.

Common reminders when filing Form 8868

Preparation is key when it comes to filing Form 8868. Organizations should establish best practices to ensure a smooth filing process. This includes maintaining up-to-date records, creating a checklist of required information, and verifying that all fields are correctly filled before submission.

Managing tax payments related to Form 8868

Understanding the financial implications of filing Form 8868 is essential. Organizations should be aware of any associated fees for late filings or extensions. Efficiently managing tax payments through pdfFiller's document management features can facilitate keeping track of these obligations and streamline day-to-day financial operations.

Interactive support tools and resources on pdfFiller

pdfFiller provides an extensive suite of support tools to assist users in completing and filing Form 8868. Features like live chat support, along with access to additional templates and forms, enhance the user experience. Organizations can leverage these resources to ensure comprehensive understanding and compliance when managing their documentation.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my form 8868 directly from Gmail?

How can I edit form 8868 from Google Drive?

How do I complete form 8868 online?

What is form 8868?

Who is required to file form 8868?

How to fill out form 8868?

What is the purpose of form 8868?

What information must be reported on form 8868?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.