Get the free 990

Get, Create, Make and Sign 990

How to edit 990 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 990

How to fill out 990

Who needs 990?

A Comprehensive Guide to IRS Form 990: Navigating Nonprofit Reporting

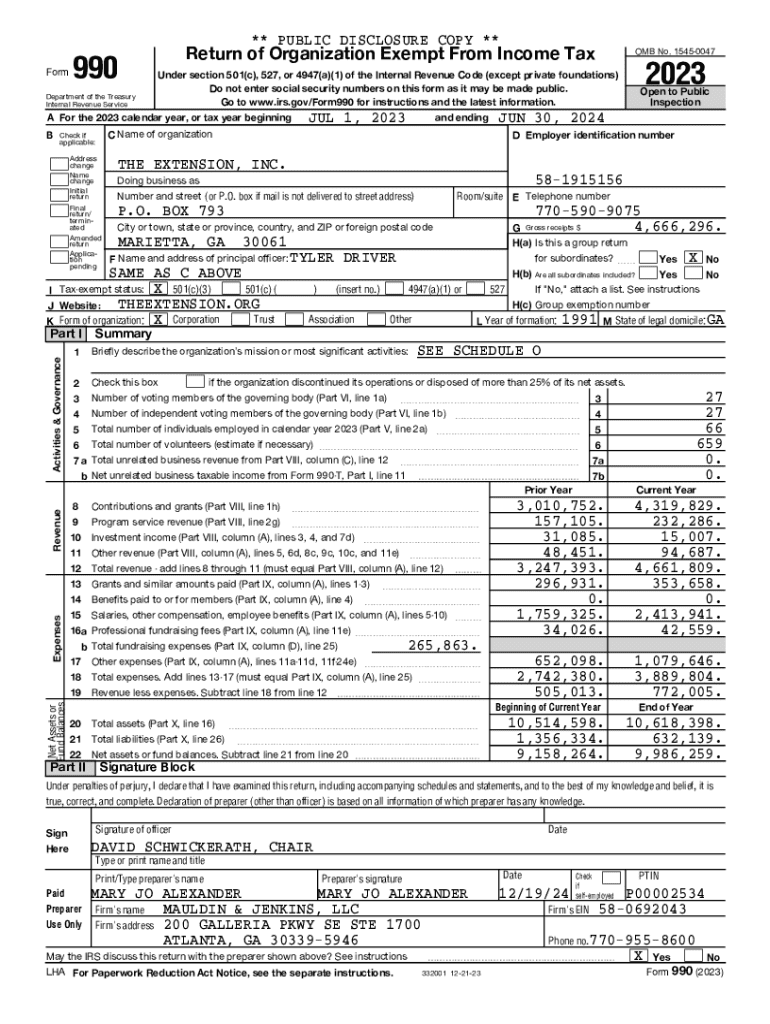

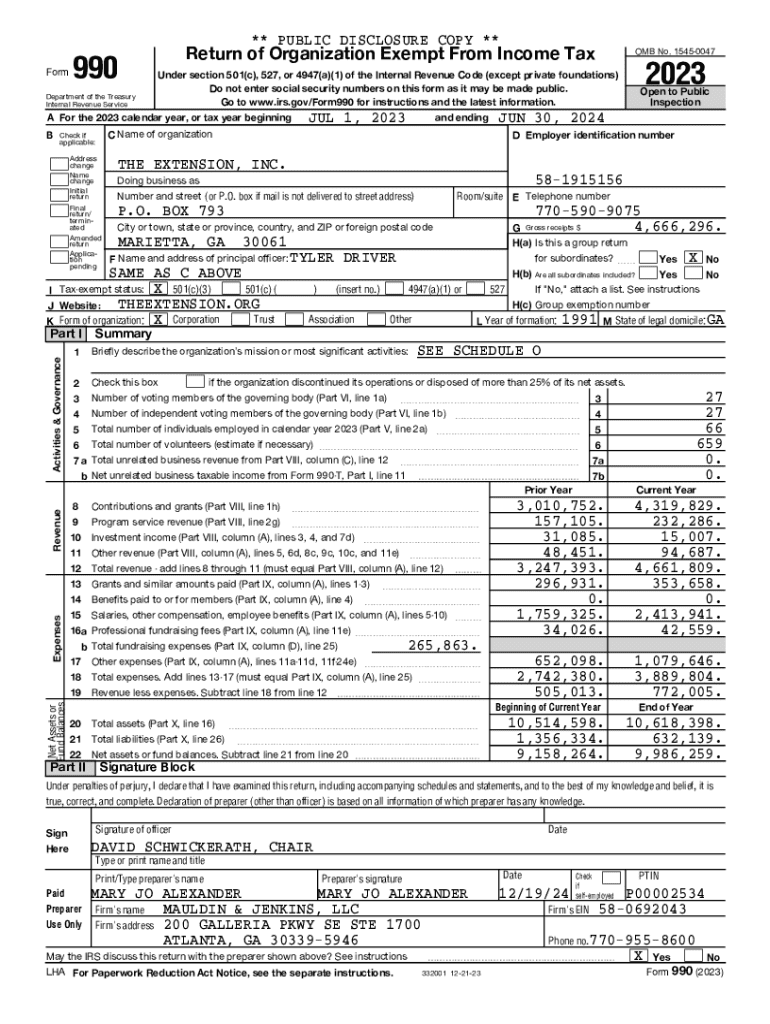

Understanding the 990 form

IRS Form 990 serves as an essential document for tax-exempt organizations. Its primary purpose is to provide the Internal Revenue Service (IRS) with information about the organization's financial performance, governance, and operations. By completing this form, organizations can maintain their tax-exempt status while ensuring transparency in their financial dealings.

This form holds significant importance not only for the nonprofit organizations themselves but also for a range of stakeholders, including donors, researchers, and public interest groups seeking insights into how nonprofits utilize their funds. Organizations that rely on public funding or charitable donations must recognize the necessity of timely and accurate filings.

Types of organizations required to file Form 990

Form 990 must be filed by various types of tax-exempt organizations, predominantly public charities and private foundations. Understanding the distinctions between these entities is crucial for compliance.

Public charities primarily focus on charitable activities and receive a significant portion of their funding from the general public. On the other hand, private foundations typically derive their funding from a single source, such as an individual or family. Income thresholds also dictate filing requirements; for instance, organizations with gross receipts exceeding $200,000 or total assets greater than $500,000 must complete the full Form 990.

Navigating the components of the 990 form

Understanding the structure of Form 990 is vital for ensuring accurate completion. Key sections of the form offer important insights into the organization’s finances and activities.

Part I provides a snapshot of the organization’s revenue and expenses, crucial for demonstrating fiscal health. Part II features a signature block, certifying the accuracy of the information provided. Part III outlines program service accomplishments, highlighting the impact of the organization’s work. In contrast, Part IV focuses on governance and management, ensuring transparency in leadership.

Step-by-step instructions for filling out the 990 form

Filling out Form 990 can be a detailed process. Start by gathering essential information, such as financial documents including bank statements, prior tax returns, and relevant data about staff and management. Being well-prepared will streamline the process and ensure accuracy.

As you fill out each section, pay close attention to accurately reporting all revenue streams and expenses. Include best practices while detailing your organization’s mission in Section III, ensuring you highlight significant accomplishments and program metrics. Be mindful of compliance with both state and federal regulations, and seek revisions from team members when necessary.

Using tools like pdfFiller can simplify this process significantly. pdfFiller allows users to easily edit the 990 form, securely sign it online, and share it with team members for collaboration. The platform also enables tracking changes, ensuring an organized approach to document management.

Common mistakes to avoid when filing the 990 form

Filing Form 990 is complex, and several common mistakes can lead to significant issues, such as omissions, misclassification of revenue or expenses, or late submissions. Organizations must ensure all required information is included, as missing details can raise red flags with the IRS.

By double-checking all entries and ensuring proper classification of funds, organizations can avoid these pitfalls. An often overlooked aspect is meeting submission deadlines; late filings can result in penalties and damage your organization's reputation. Leveraging pdfFiller can enhance accuracy as this platform offers various features designed to minimize errors, such as validation checks and convenient templates.

Important deadlines and filing requirements

Understanding filing timelines is vital for maintaining compliance with IRS regulations. Organizations typically must file Form 990 by the 15th day of the 5th month following the end of their fiscal year. For instance, if your fiscal year ends on December 31, your Form 990 is due on May 15.

Organizations requiring more time may request an extension using Form 8868, which grants an automatic six-month extension. However, it’s crucial to remember that any tax due must still be paid by the original deadline to avoid penalties.

Post-filing actions and managing your 990 form

After filing Form 990, organizations should understand that their filing becomes publicly accessible. This transparency aids in building trust with donors and stakeholders, as they can view the organization’s financial information and mission effectiveness.

Should the IRS inquire further about your filing, be prepared to provide additional documentation as needed. Maintaining accurate records and a well-organized filing system is paramount for quick access and reference in the event of audits or inquiries. It's best practice to retain form records and related documents for at least three years.

The impact of Form 990 on your organization

Form 990 serves as a reflection of your nonprofit's financial health and operational effectiveness. By providing a detailed account of your organization's income, expenses, and accomplishments, Form 990 enhances transparency, which is critical for fostering public trust.

Donors often look at Form 990 filings to make informed decisions about their contributions. Additionally, data insights gleaned from Form 990 can be invaluable for grant applications and partnership opportunities, helping to demonstrate your organization’s impact in the community.

Interactive tools and resources

pdfFiller provides interactive features to make the process of managing Form 990 easier. Users can access customizable templates designed for Form 990, allowing for streamlined data entry and reporting. Collaborative editing enables multiple team members to contribute and finalize the document seamlessly.

In addition to the ease of use, pdfFiller offers FAQs and support options to address any common questions about Form 990. The platform is designed to enhance user experience, ensuring that organizations can focus on their missions rather than getting bogged down in paperwork.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify 990 without leaving Google Drive?

How can I get 990?

How do I edit 990 on an Android device?

What is 990?

Who is required to file 990?

How to fill out 990?

What is the purpose of 990?

What information must be reported on 990?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.