Get the free 1023-ez

Get, Create, Make and Sign 1023-ez

How to edit 1023-ez online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 1023-ez

How to fill out 1023-ez

Who needs 1023-ez?

Your Complete Guide to the 1023-ez Form: Streamlining Nonprofit Status Applications

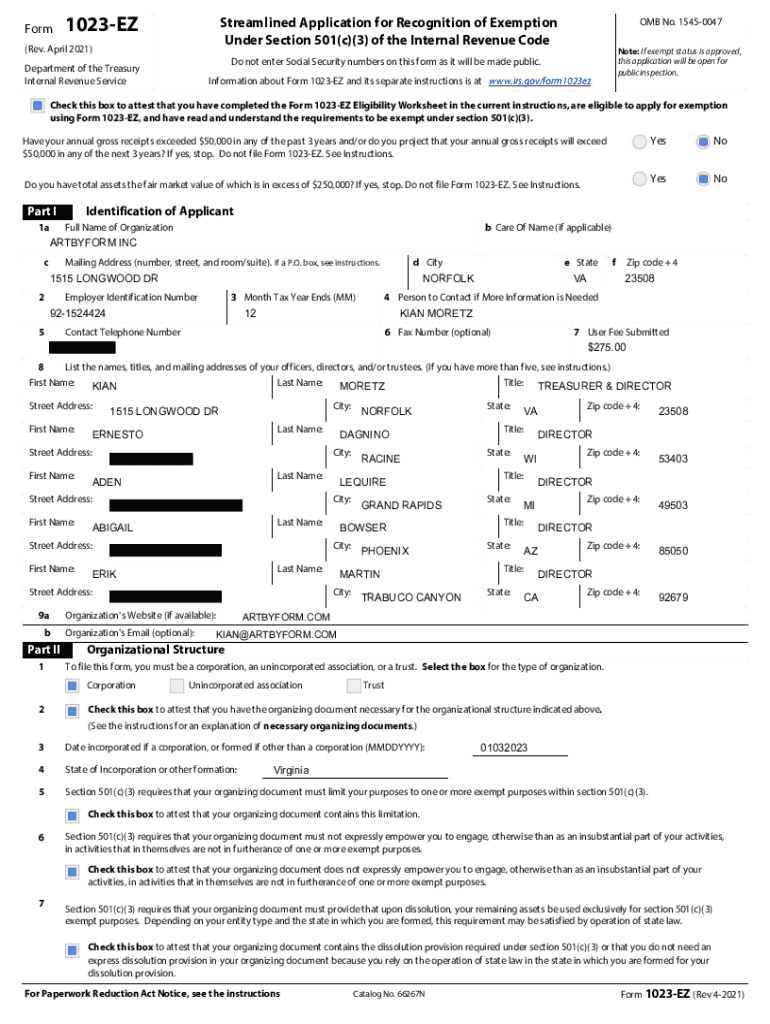

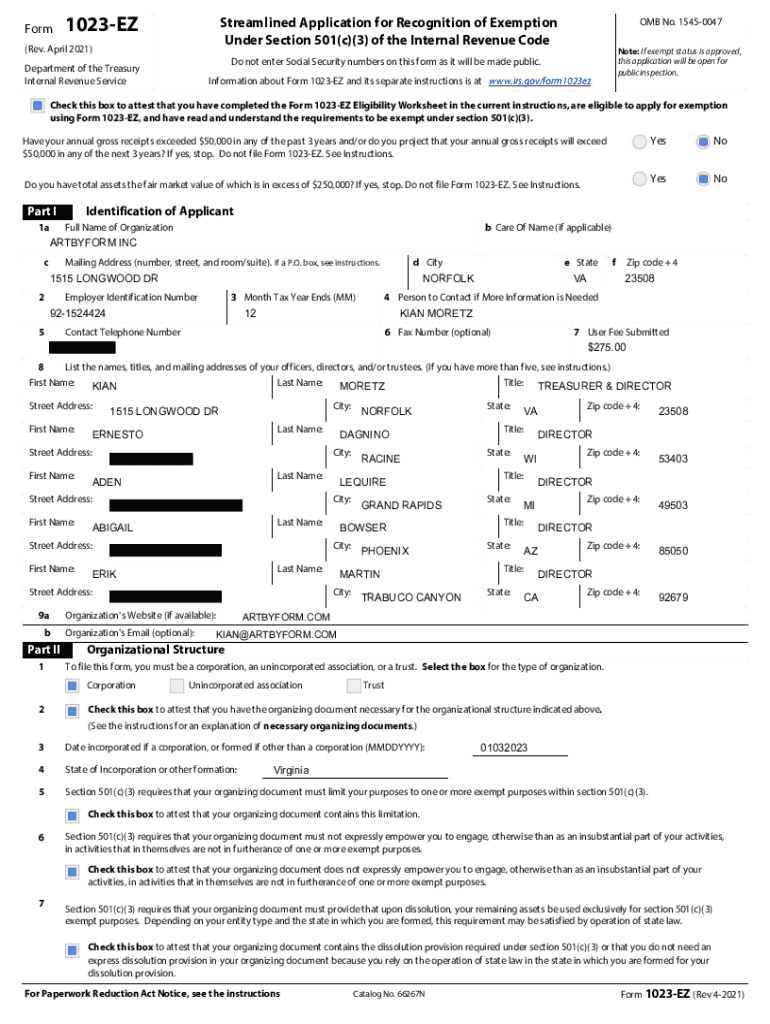

Understanding the 1023-ez form

The 1023-ez form is a streamlined application process for small organizations seeking tax-exempt status under section 501(c)(3) of the Internal Revenue Code. This form is ideal for smaller nonprofits, which can simplify and expedite the often daunting task of applying for tax-exempt status. The 1023-ez form has been designed to ease the burden for eligible organizations, allowing them to maintain focus on their philanthropic missions rather than paperwork.

Organizations eligible to file the 1023-ez form must meet specific criteria that differentiate them from those needing to complete the standard 1023 form. Typically, these criteria include total gross receipts of $50,000 or less in the past three years and assets totaling $250,000 or less. By using the 1023-ez form, organizations benefit from a faster processing time and lower fees, often receiving a determination letter in a matter of weeks rather than months.

Key features of the 1023-ez form

One of the most significant advantages of the 1023-ez form is its simplified application process. Unlike the standard form, which demands extensive documentation and detailed narratives, the 1023-ez condenses this information into a straightforward format. The fewer documentation requirements mean organizations can avoid the headaches that often accompany traditional applications.

Additionally, the review time for the 1023-ez is significantly shortened, leading to quicker responses from the IRS. This expedited timeline allows organizations to start their charitable activities sooner. It also features interactive elements that guide users through the process efficiently, making it accessible even for those unfamiliar with IRS forms.

Step-by-step guide to completing the 1023-ez form

Step 1: Determining eligibility

Before you begin filling out the 1023-ez form, confirm your organization's eligibility. The primary criteria for qualification include being a Pennsylvanian organization, having gross receipts of $50,000 or less in the last three years, and possessing total assets not exceeding $250,000. Clear this initial hurdle by using a self-assessment checklist to streamline your efforts.

Step 2: Gathering necessary information

A key to successfully completing the 1023-ez form is gathering all necessary information ahead of time. You'll need your organization's mission statement, details about your operations, and an overview of your financial data. This foresight will make filling out the form far easier and increase the accuracy of your submission.

Step 3: Accessing the form

Access the 1023-ez form online through the IRS website. It's recommended to fill out the form electronically for efficiency and ease of use. Furthermore, software such as pdfFiller can help you edit and fill the form seamlessly, allowing for a more organized and accessible approach to your paperwork.

pdfFiller also offers several interactive features, making it easier to manage your documents without hassle. Users can save their progress, fill out forms collaboratively, and store them securely in the cloud.

Step 4: Filling out the 1023-ez form

As you begin filling out the 1023-ez form, pay close attention to each section. Start with the organization's name and type, outlining your purpose and activities. Enter financial information last to maintain focus on the mission. Accurate information is critical to avoid delays or denials.

Step 5: Reviewing your form

Once you've completed the 1023-ez form, it’s vital to conduct a thorough review. Double-check every detail to minimize the risk of errors. Utilizing pdfFiller's review tools adds another layer of assurance, as the software flags common mistakes and supports collaboration.

Step 6: Submitting your application

After ensuring that your form is accurate, the next step is submission. To make this process efficient, follow the step-by-step instructions for submitting the 1023-ez application. You can utilize the eSigning options available through pdfFiller for a seamless, quick signature process.

Once you submit, you will receive a receipt, and your application will enter the review queue. It’s essential to track your application status and be prepared for potential requests for additional documentation from the IRS.

Managing your 1023-ez application through pdfFiller

After submitting your 1023-ez application, managing its progress becomes crucial. pdfFiller allows you to track your application status comprehensively. This capability is particularly important when handling potential requests from the IRS for additional information or clarifications as they may arise.

In addition to tracking, pdfFiller empowers users with efficient document management solutions that allow you to store and organize not just the 1023-ez form but all your nonprofit’s essential documents seamlessly.

Frequently asked questions about the 1023-ez form

With any application process, questions often arise. Common concerns for nonprofits filing the 1023-ez form often relate to processing times, eligibility, and specific requirements. Users can find clarity through various state and national nonprofit support organizations that offer resources for ongoing support.

Understanding the most frequent FAQ can demystify common uncertainties. Think about joining forums or community groups focused on nonprofit management where shared experiences can serve as valuable guidance.

Testimonials and user experiences

Users of pdfFiller have shared numerous success stories about their experiences with the 1023-ez form. Many report significant time savings and an enhanced ability to focus on their mission rather than paperwork. This efficiency translates to higher effectiveness in launching successful community initiatives.

The ease of use in filling and managing the 1023-ez form creates outstanding testimonials from those who leverage it for their nonprofit needs. By optimizing this process, organizations find themselves positively impacting their respective communities sooner than anticipated.

Alternative forms and resources

While the 1023-ez form suits many small nonprofits, other forms like the full 1023 exist for larger organizations or those with more complex needs. It's essential to identify the right form for your organization's scale and scope.

Moreover, pdfFiller integrates smoothly with various document types and offers a suite of additional tools tailored for nonprofit organizations. This means that users can centralize all their document creation and management needs through a single, user-friendly platform, ensuring efficiency and consistency across their projects.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I fill out the 1023-ez form on my smartphone?

How do I edit 1023-ez on an iOS device?

Can I edit 1023-ez on an Android device?

What is 1023-ez?

Who is required to file 1023-ez?

How to fill out 1023-ez?

What is the purpose of 1023-ez?

What information must be reported on 1023-ez?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.