Get the free Ftb 3536

Get, Create, Make and Sign ftb 3536

How to edit ftb 3536 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out ftb 3536

How to fill out ftb 3536

Who needs ftb 3536?

A Comprehensive Guide to the FTB 3536 Form

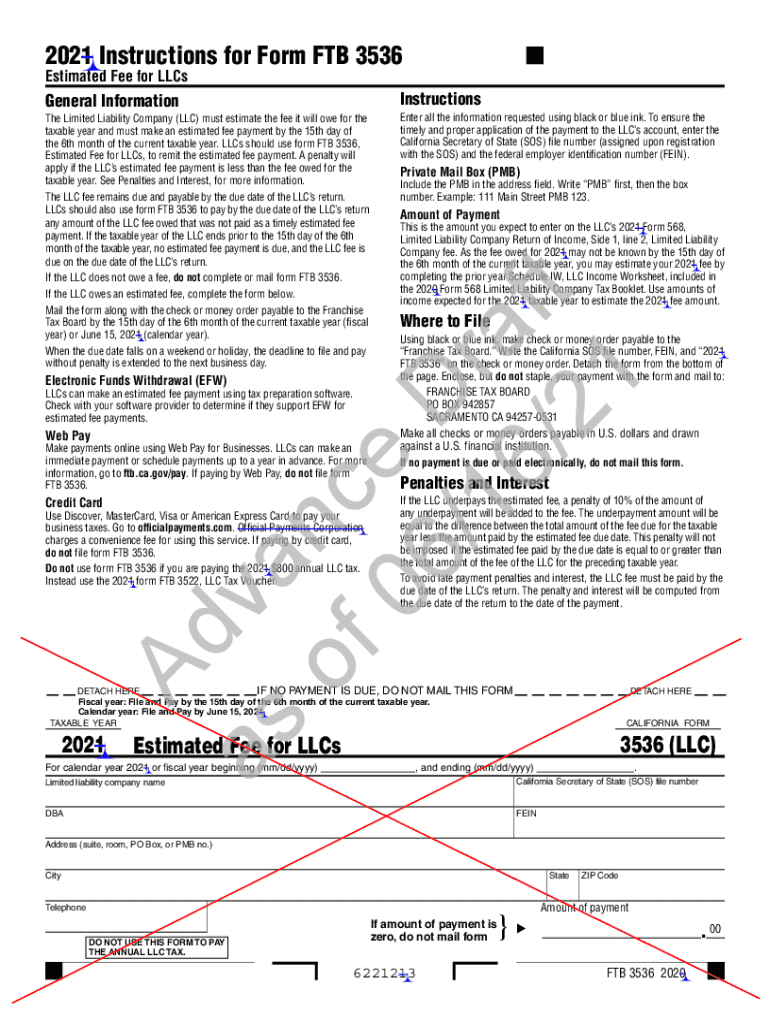

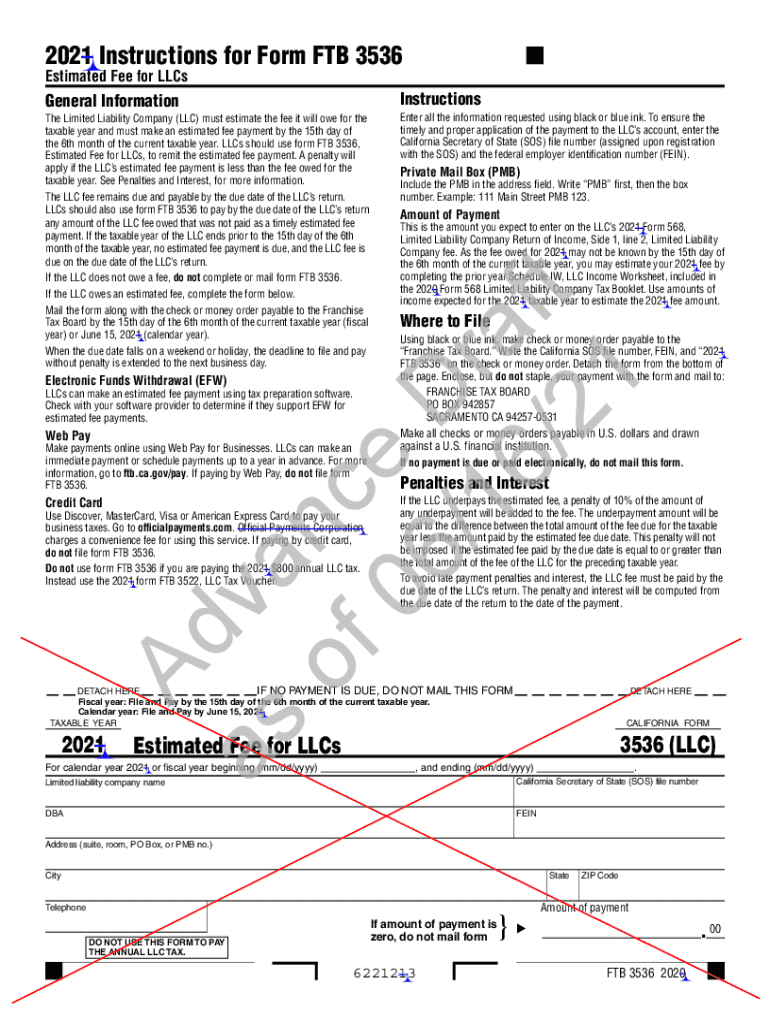

Overview of the FTB 3536 Form

The FTB 3536 Form is a critical document for California taxpayers, serving as the official request for a payment plan to settle tax liabilities with the Franchise Tax Board (FTB). This form is especially important for individuals who find themselves unable to pay their state taxes in full by the due date and seek a manageable way to fulfill their tax obligations. The FTB 3536 allows taxpayers to propose a payment plan that aligns with their financial capabilities, thereby avoiding more severe penalties or action from the FTB.

Anyone facing financial difficulties that prevent them from making a lump sum tax payment should consider using the FTB 3536 Form. This includes both individual taxpayers and business entities residing in California who owe state taxes and want to avoid further consequences.

Key features of the FTB 3536 Form

The FTB 3536 Form is structured to facilitate a straightforward and effective communication process between taxpayers and the California FTB. It includes several key sections that help outline the taxpayer's situation, proposed payment plan, and any additional relevant information. Notably, the form includes a section for detailing income sources and existing expenses, which helps assess the taxpayer's ability to repay their debts.

California residents must also be aware of unique requirements when filling out this form, such as providing accurate information on any outstanding taxes and ensuring that all proposed payment terms comply with the FTB’s guidelines for payment plans.

Step-by-step instructions for completing the FTB 3536 Form

Filling out the FTB 3536 Form may appear daunting, but it can be simplified by following a structured approach. Here’s a detailed breakdown of how to prepare and complete the form.

Preparing to fill out the form

Detailed guide to each section

Additional tips for accuracy

To maximize accuracy, double-check all figures entered into the form to prevent calculation errors. Consider using tools such as pdfFiller’s editing features for error correction, which streamline the process and minimize common mistakes.

How to submit the FTB 3536 Form

Once your FTB 3536 Form is completed, the next step is submitting it to the California FTB. There are two primary methods to accomplish this.

Options for submission

Confirmation of submission

To confirm the status of your submission, you can check online through the FTB’s website or via the confirmation email received if you submitted electronically using pdfFiller. Timely verification can help alleviate concerns regarding potential delays.

Common issues and solutions

As with any form of tax filing, errors can arise when submitting the FTB 3536 Form. Common issues might include incorrect financial figures, missing documentation, or failing to meet submission deadlines.

Understanding the implications of filing FTB 3536

Filing the FTB 3536 Form has significant implications for your tax obligations. If the form is submitted and approved, you can establish a clear payment plan that benefits both you and the FTB. This proactive approach not only alleviates some immediate financial pressure but also prevents additional penalties that could arise from failing to file or pay taxes on time.

Timely filing can also lead to potential benefits such as reduced interest on tax debt or foregone penalties, depending on your specific situation and adherence to the payment plan.

Additional tools and resources

Interactive tools for calculation

Utilize tools like pdfFiller’s built-in calculators to make estimations regarding your finances easily. These calculators can assist you in determining a realistic payment plan that aligns with your current financial status.

Document management solutions

pdfFiller offers robust features for managing your documents in the cloud. This means you can access your forms from anywhere, collaborate with others effectively, and keep your documents organized—all vital for managing your tax obligations.

Collaboration features for teams

If you’re part of a team, pdfFiller allows multiple users to work together on completing the FTB 3536 Form efficiently, sharing feedback and ensuring that all necessary details are correct before submission.

Managing your personal information

When submitting the FTB 3536 Form, it's crucial to protect your personal information. Ensure that any online submission is made through secure platforms such as pdfFiller, which specializes in protecting user data and maintaining privacy.

Understanding how your data is stored and secured is essential. pdfFiller is committed to safeguarding your information, employing stringent security measures to ensure that your documents remain confidential.

Contacting support for assistance

Should you need help while filling out the FTB 3536 Form or face issues during submission, reaching out to pdfFiller’s customer support can provide immediate assistance. You can easily contact support through the website.

Utilizing live chat options or help features can be extremely beneficial for obtaining quick answers to your questions, ensuring that you can navigate the submission process confidently.

Environmental impact of paper filings

Opting for a digital method of filing the FTB 3536 Form has significant environmental benefits. By going paperless, you not only streamline your process but also contribute positively to reducing paper waste, which impacts the environment.

pdfFiller advocates for sustainability through digital solutions; by promoting responsible use of resources, you can adopt eco-friendly practices while fulfilling your tax obligations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my ftb 3536 directly from Gmail?

How do I execute ftb 3536 online?

How do I complete ftb 3536 on an iOS device?

What is ftb 3536?

Who is required to file ftb 3536?

How to fill out ftb 3536?

What is the purpose of ftb 3536?

What information must be reported on ftb 3536?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.