Get the free Ptax-350-schedule I

Get, Create, Make and Sign ptax-350-schedule i

How to edit ptax-350-schedule i online

Uncompromising security for your PDF editing and eSignature needs

How to fill out ptax-350-schedule i

How to fill out ptax-350-schedule i

Who needs ptax-350-schedule i?

Understanding the PTAX-350 Schedule Form: A Comprehensive Guide

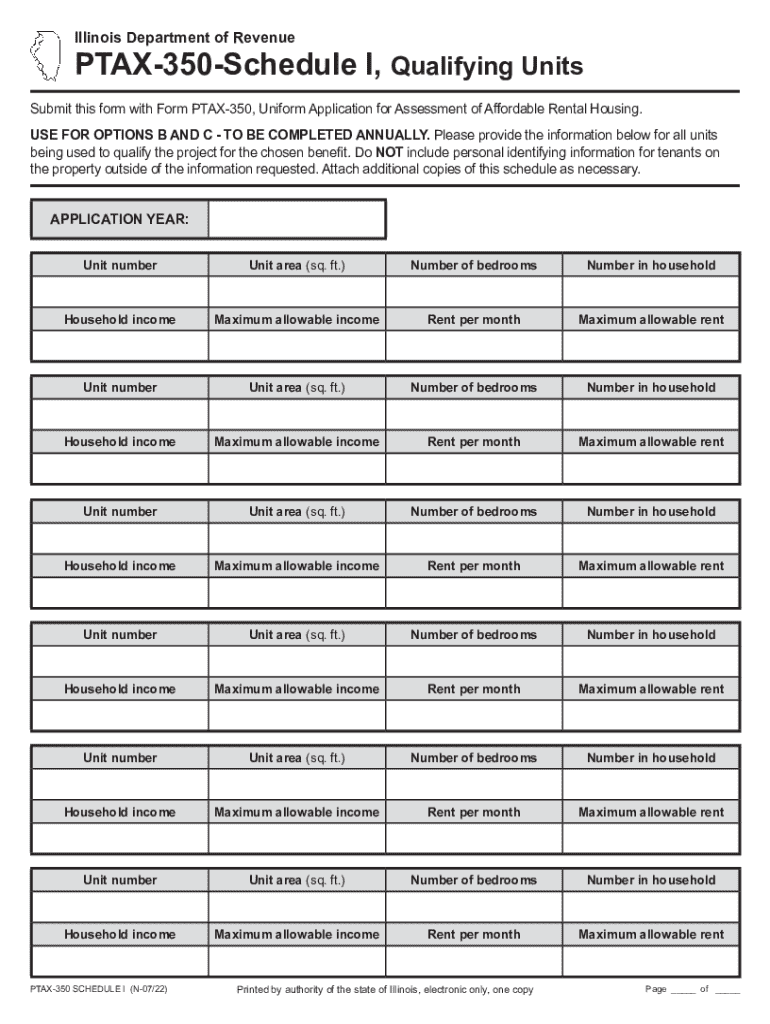

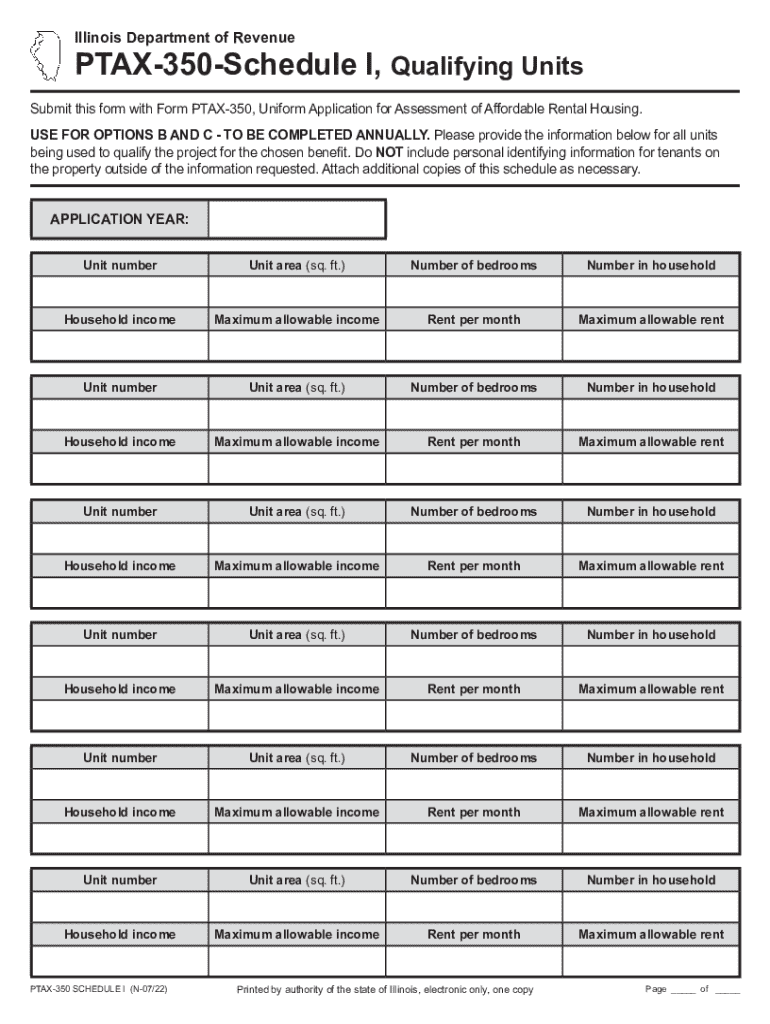

Overview of PTAX-350 Schedule Form

The PTAX-350 Schedule I Form is a critical document in the tax-exemption landscape, primarily used in the state of Illinois. This form is designed specifically for property tax exemption purposes, particularly for those entities or individuals seeking to reduce their taxable property values due to qualifying donations, ownership status, or exemptions like charitable or religious use.

Understanding the importance of this form cannot be overstated. It serves not only to outline the exemptions that the property owner is entitled to but also helps in maintaining transparency and accountability within property tax systems.

Typically, the following individuals and entities are required to file the PTAX-350 Schedule I Form: schools, charitable organizations, religious institutions, and certain nonprofits. If you believe you qualify for any property exemptions, filing this form becomes imperative.

Key components of the PTAX-350 Schedule Form

Each PTAX-350 Schedule I Form is structured with several distinct sections, each playing a vital role in the exemption process. Let’s break down each of these sections for a clearer understanding.

Common terms you'll encounter throughout the form include 'tax-exempt property,' 'deduction,' and 'valuation.' Understanding these terms will facilitate more straightforward form completion.

Who is eligible?

Eligibility for exemptions under the PTAX-350 Schedule I Form varies, depending on the property type and use. Typically, organizations such as charitable nonprofits, educational institutions, and religious organizations qualify. Individuals can also file if they hold title to property meeting specific exemption criteria.

Exemptions can cover several areas, like recreational uses, religious practice, or housing for low-income individuals. Common supporting documentation often includes proof of ownership, financial statements, and descriptions of how the property is utilized.

Step-by-step instructions for completing the PTAX-350 Schedule Form

Before you begin filling out the PTAX-350 Schedule I Form, make sure to gather all necessary information including financial documents, property deed, and details of existing exemptions. Familiarizing yourself with local regulations is essential to ensure that you are compliant with specific filing requirements.

When completing each section of the form, accuracy is crucial. Here are tips for entering data correctly:

Typical mistakes include incorrect parcel identification numbers or incomplete sections. Carefully review all information before submission.

Filing the PTAX-350 Schedule Form

Once the PTAX-350 Schedule I Form is filled out, you have multiple options for submission. The form can be filed electronically using services like pdfFiller, making it a convenient choice for individuals who prefer a streamlined process. Traditional methods involve mailing the form directly to the appropriate tax office, which can take longer to process.

Make sure to adhere to local deadlines for filing, as missing these can result in forfeiting exemptions. Once your form is submitted, you should expect an acknowledgment of receipt and, subsequently, you will either receive a confirmation of exemption or be contacted for further information.

Editing and modifying your form

If you've filled out your PTAX-350 Schedule I Form and notice an error, don't panic. Using pdfFiller’s tools, you can easily edit your form before the submission deadline. The platform enables you to make real-time changes, which is invaluable for ensuring accuracy.

Saving and sharing your completed form is straightforward with pdfFiller. Simply save it to your cloud storage and share it via email or other platforms. Collaboration is also easy; you can invite others to review or contribute information on the same document, streamlining the process.

Frequently asked questions (FAQs)

First-time filers often have many questions about the PTAX-350 Schedule I Form. Common concerns involve eligibility criteria, filing deadlines, and the complexities surrounding documentation requirements. Clarification on what constitutes a valid exemption is crucial.

It’s crucial to ensure you thoroughly understand your eligibility and the extent of your property’s qualifications. If in doubt, consulting a tax professional can provide peace of mind and guidance.

Troubleshooting common issues

The journey to successfully filing your PTAX-350 Schedule I Form isn't always smooth sailing. Common errors may include incomplete sections or miscalculations in property value. If your form is rejected, it's essential to understand the reasons for rejection and rectify them promptly.

To address rejections, check the acknowledgment letter for specific mismatches or missing information. If an assessment inquiry arises, responding quickly with the necessary documentation is key to avoiding further complications.

Benefits of using pdfFiller for your PTAX-350 Schedule Form

Leveraging a cloud-based solution like pdfFiller has several advantages when dealing with the PTAX-350 Schedule I Form. This platform allows for seamless document management, making it easy to fill, sign, and share forms from anywhere.

Its features streamline the filling process, such as auto-population of data, customizable templates, and electronic signatures, ensuring compliance and accuracy throughout.

Case studies: Success stories of PTAX-350 Schedule filers

Real-life examples abound where organizations and individuals successfully received property tax exemptions by adeptly navigating the PTAX-350 Schedule I Form process. Schools and charities have benefitted significantly by claiming their status efficiently using platforms like pdfFiller.

The experience of these filers demonstrates the importance of completing their forms accurately and on time, thus maximizing their benefits and reducing financial burdens.

Updates to the PTAX-350 Schedule Form and regulations

Keeping abreast of recent changes to the PTAX-350 Schedule I Form guidelines is essential for filers, as legislative adjustments can have significant implications on eligibility and requirements. Changes might affect crucial aspects like deadlines for submission or the types of exemptions available.

Fortunately, staying informed is easier than ever. Many platforms, including pdfFiller, offer notifications on updates related to tax forms to ensure that users do not miss critical changes.

Explore more forms and resources on pdfFiller

pdfFiller provides access to not only the PTAX-350 Schedule I Form but also a variety of related forms and templates that can aid in tax filings. The interactive tools available for document management, such as form editors and collaboration features, enhance user experience.

Finding supporting features and user guides helps users navigate through different forms, ultimately optimizing the document management process.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in ptax-350-schedule i without leaving Chrome?

Can I create an eSignature for the ptax-350-schedule i in Gmail?

How do I edit ptax-350-schedule i on an Android device?

What is ptax-350-schedule i?

Who is required to file ptax-350-schedule i?

How to fill out ptax-350-schedule i?

What is the purpose of ptax-350-schedule i?

What information must be reported on ptax-350-schedule i?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.