Get the free Mo-1120s

Get, Create, Make and Sign mo-1120s

How to edit mo-1120s online

Uncompromising security for your PDF editing and eSignature needs

How to fill out mo-1120s

How to fill out mo-1120s

Who needs mo-1120s?

Your Definitive Guide to the MO-1120S Form

Understanding the MO-1120S Form

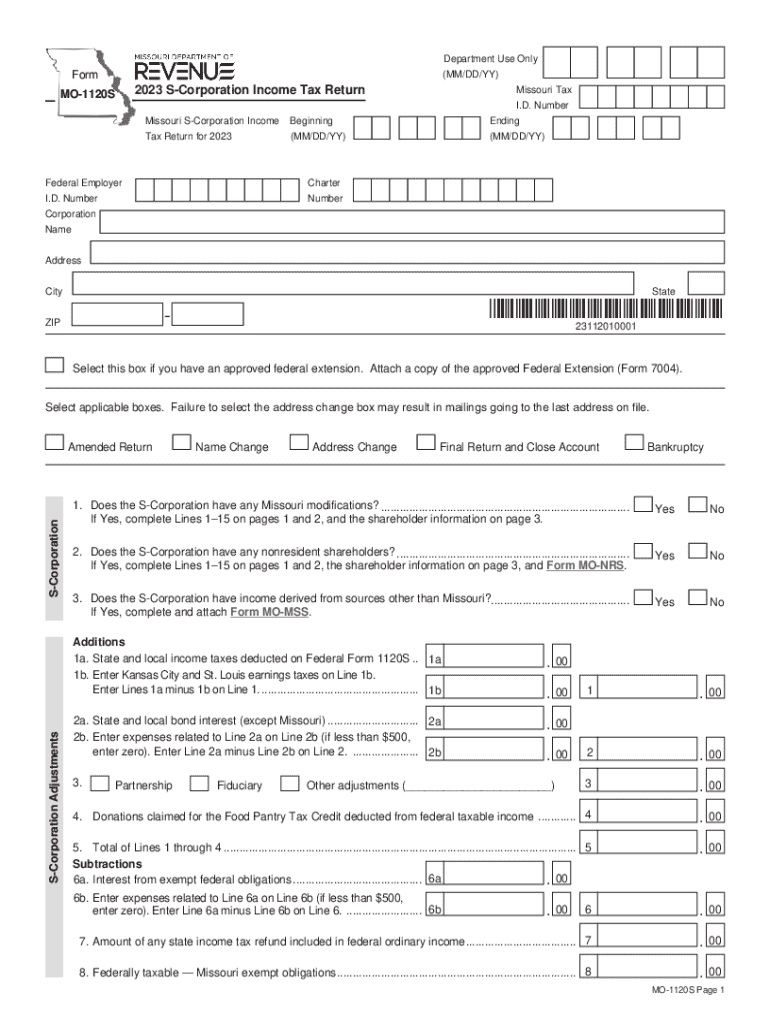

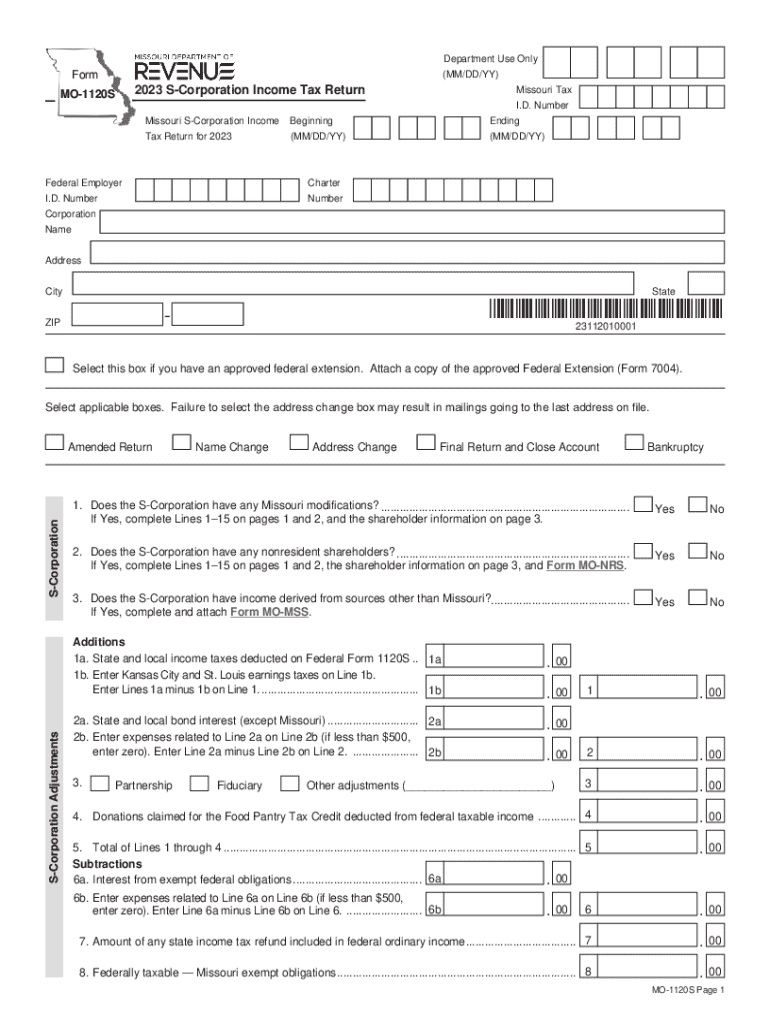

The MO-1120S form is Missouri's tax return specifically designed for S corporations. This form is crucial for reporting the income, deductions, and credits of qualifying S corporations operating in Missouri. Unlike the standard MO-1120 used for C corporations, the MO-1120S focuses on pass-through taxation, where profits are passed to shareholders and taxed at their individual tax rates.

The main distinction lies in the tax implications for each business structure; while C corporations are taxed at the corporate level, S corporations benefit from avoiding double taxation. This essential form keeps businesses compliant and supports the understanding of their financial obligations within the state.

Who must file the MO-1120S form?

Not every corporation can file the MO-1120S form. To do so, a corporation must meet specific eligibility criteria, primarily being designated as an S corporation by the IRS and having its principal place of business in Missouri. This designation means that the corporation chose to be taxed under Subchapter S of the Internal Revenue Code.

Additionally, certain types of entities, such as financial institutions and insurance companies, typically cannot elect S corporation status and therefore do not file this form. It’s essential for businesses operating under limited criteria, including having a maximum of 100 shareholders, to ensure compliance with both federal and state regulations.

Preparing to fill out the MO-1120S form

Before diving into the MO-1120S form, it's critical to gather all the necessary information. Businesses will require documentation detailing income figures, deduction categories, and other financial data that will support the accurate completion of the form. Familiarizing yourself with key terms such as 'pass-through income' or 'shareholder basis' can greatly enhance your understanding of what information to report.

Typically, this may include profit and loss statements, balance sheets, and records of any taxable income and credits. Having this financial documentation organized simplifies the process, making it straightforward to reflect your business's financial activity on the form.

Tools and resources for preparation

Several tools and resources can make preparing the MO-1120S form less daunting. Platforms like pdfFiller provide effective solutions for editing and managing your tax documents. Users can easily fill out forms and leverage collaborative tools, such as sharing documents with accountants or financial advisors.

Additionally, accessing state tax guidelines via the Missouri Department of Revenue's website will provide clarity on any specific requirements or updates that affect your filing process. Taking advantage of these resources ensures you're equipped with all necessary information to file accurately.

Step-by-step instructions for completing the MO-1120S form

Completing the MO-1120S form can feel overwhelming, but a section-by-section breakdown simplifies the process significantly. Start with the corporation's basic information, including name, address, and federal employer identification number (EIN). It’s crucial to ensure that this information is accurate as it helps in the identification of your business for tax purposes.

The next sections require financial details including total income, deductions, and credits. Be diligent in inputting these figures; an error here can lead to incorrect tax liability calculations. Carefully follow the instructions on the form and take care to report the correct amounts based on your accounting records. Lastly, ensure that every signer adds their signature and date at the conclusion of the form.

Common mistakes to avoid

Tax forms can be intricate, and the MO-1120S is no exception. Common mistakes often include incorrect calculations of income and deductions, failing to report all income streams, or neglecting to sign the form. A significant error could trigger an audit or delay in processing your return, so it’s imperative to double-check all entries before submission.

To improve your chances of a successful filing, consider having a colleague or tax professional review the completed form. Utilizing tools like pdfFiller allows for easy editing and tracking any adjustments, thus promoting accuracy throughout.

Editing and signing the MO-1120S form

Once the MO-1120S form is filled out, it’s time for editing and signing. Utilizing pdfFiller makes this process seamless. Users can upload the form to the platform, rectify any inaccuracies, and prepare it for signature efficiently. The ease of dragging and dropping elements within the document directly helps in adjusting layouts or correcting any content.

Moreover, digital signatures are acceptable for the MO-1120S form in Missouri. Understanding these legal implications is essential as the state has clear guidelines for validating electronic signatures. After preparing the form, ensure that both the authorized individual and any shareholders complete their required eSignature fields to validate the document.

Submitting the MO-1120S form

After verification and signing, the next step is submitting the MO-1120S form. There are several avenues for submission. Corporations can choose to file online through the Missouri Department of Revenue’s portal or mail the form directly to the state’s tax office. Choosing the right method depends on the corporation’s preferences and capacity for electronic filing.

Whichever submission method is chosen, ensure that all components of the form are included, and keep copies for your records. It’s helpful to track submission dates to avoid missing critical deadlines and incurring late fees, enhancing compliance for future filings.

Important dates and deadlines

Timeliness is key when dealing with tax forms like the MO-1120S. The standard deadline for submission is the 15th day of the third month after the end of the corporation’s tax year, but this date may shift slightly depending on weekends or holidays. Staying on top of submission timelines helps avoid unnecessary penalties which can pile up due to late filings.

Corporations should mark important tax dates on their calendars to ensure compliance. The Missouri Department of Revenue website would provide updates on any changes in deadlines, especially during the current tax year.

Post-submission actions

Once you submit the MO-1120S form, it's important to monitor its status. You can verify the receipt of your submission through the state’s online portal, giving peace of mind after filing. If you don’t receive confirmation within a reasonable timeframe, it’s advisable to follow up to ensure there were no issues with processing.

Understanding potential post-filing actions is just as critical. Prepare for possible audits or inquiries from the state, which can be a standard part of the process. Organizing documentation utilized during the filing can significantly ease response times in facilitating any state inquiries.

Frequently asked questions about the MO-1120S form

Over the years, numerous questions have emerged regarding the MO-1120S form, ranging from matters about eligibility to common filing errors. It’s essential to clarify these uncertainties well in advance to ensure smooth filing experiences. For instance, many taxpayers inquire about whether their S corporation status impacts the deductions they can claim, highlighting the necessity for detailed guidance.

Accessing reliable resources or consulting with tax professionals can provide further clarity on these issues. The Missouri Department of Revenue is also a valuable source, offering insights into the nuances of state-specific regulations and filing requirements.

Resources for additional guidance

For further assistance with the MO-1120S form, various resources can provide the knowledge needed to navigate the filing process effectively. Comprehensive guides are available on the Missouri Department of Revenue website, containing step-by-step instructions and vital updates that impact S corporations.

Users can also benefit from consultation with tax professionals who understand the nuances of Missouri tax laws. Platforms like pdfFiller not only help in document management but frequently share tips and articles to aid users in understanding tax requirements.

Leveraging pdfFiller for efficient tax management

With the increasing complexity of tax documentation, tools like pdfFiller have grown essential for efficient tax management. Its cloud-based solution offers a seamless approach for individuals and teams, allowing for real-time document collaboration and easy access from anywhere. This flexibility enhances communication between team members while preparing essential forms, like the MO-1120S.

The platform also supports a variety of formats, providing more versatility when working with different types of tax documents. By utilizing pdfFiller, users can automate part of the process, significantly reducing the chances of errors and enhancing organizational efficiency across the workspace.

Testimonials and case studies

Many users have found success when leveraging pdfFiller for their tax forms. Real-life stories illustrate the difference cloud-based document management can make, especially during tax season. From startups to established S corporations, users attest to reduced filing times and increased accuracy.

Case studies show how companies streamlined their processes by employing tools like automated reminders for filing deadlines and improved document sharing, thereby simplifying compliance with tax regulations.

Engaging with comprehensive support

pdfFiller also shines with its comprehensive customer support. Users can access live chat options for any questions they may have while completing the MO-1120S form. Expert support allows businesses to resolve issues in real-time, ensuring a smooth process from filling out the form to submission.

Additionally, community forums hosted on the platform serve as vibrant hubs for users to share experiences, best practices, and solving mutual issues around tax documentation. Engaging with other users enhances learning and builds a supportive network among business professionals.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find mo-1120s?

How do I edit mo-1120s in Chrome?

How do I edit mo-1120s on an iOS device?

What is mo-1120s?

Who is required to file mo-1120s?

How to fill out mo-1120s?

What is the purpose of mo-1120s?

What information must be reported on mo-1120s?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.