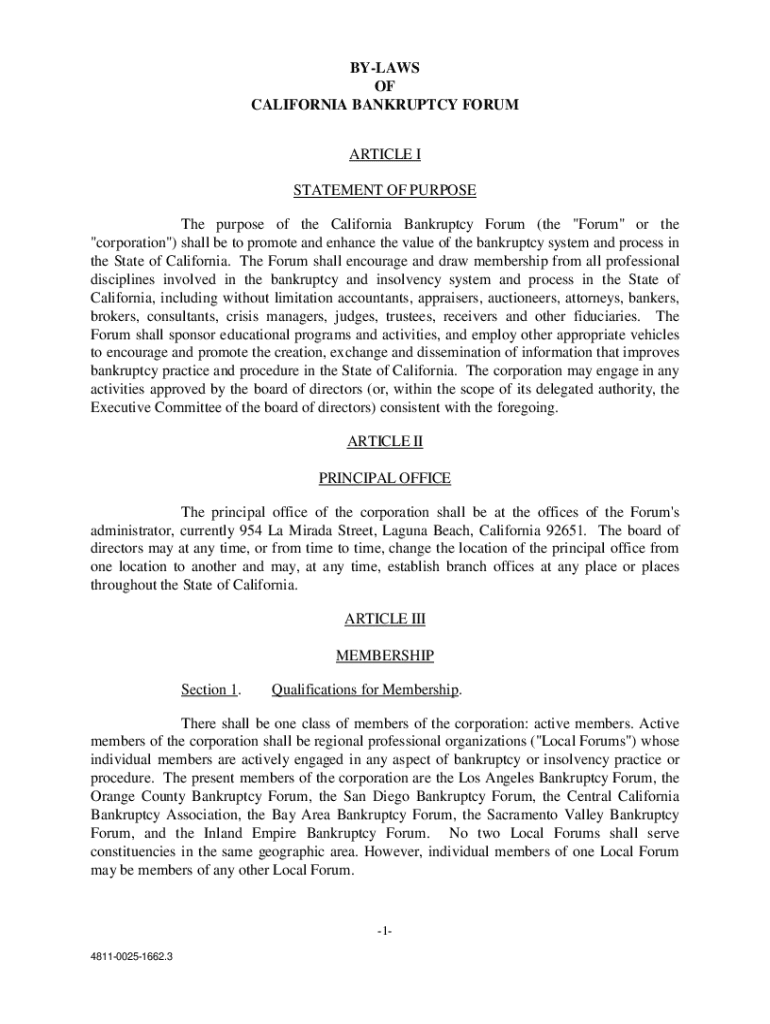

Get the free by-laws of California Bankruptcy Forum

Get, Create, Make and Sign by-laws of california bankruptcy

How to edit by-laws of california bankruptcy online

Uncompromising security for your PDF editing and eSignature needs

How to fill out by-laws of california bankruptcy

How to fill out by-laws of california bankruptcy

Who needs by-laws of california bankruptcy?

By-laws of California Bankruptcy Form: A Comprehensive Guide

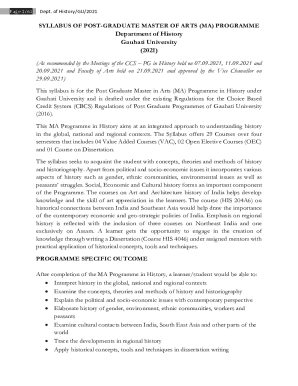

Understanding California bankruptcy laws

California bankruptcy laws provide individuals and businesses a legal process to address unmanageable debts. By adhering to these laws, debtors can seek relief through various bankruptcy options that cater to their financial situations. In California, bankruptcy cases are handled under both federal and state guidelines, making it essential for filers to understand the nuanced regulations specifically applicable to the state.

There are different types of bankruptcy available in California, primarily Chapter 7 and Chapter 13. Each type serves different financial needs and potential debtor outcomes, providing individuals the framework to either liquidate their assets or establish a repayment plan. Understanding these types helps individuals make informed decisions when filing bankruptcy.

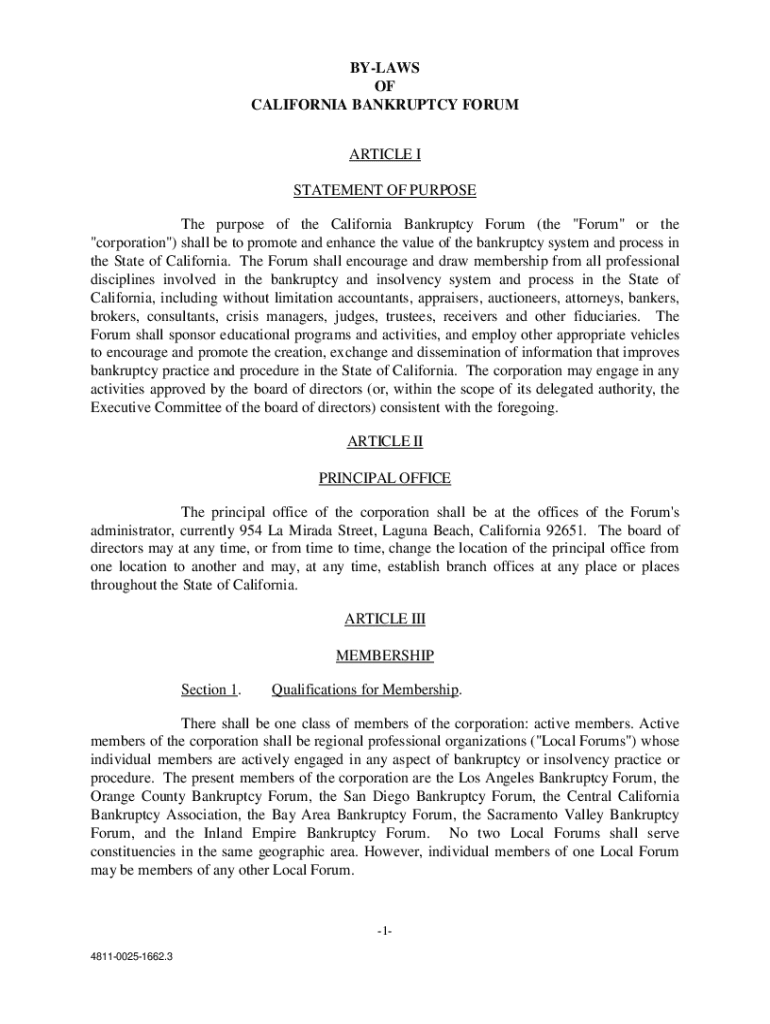

The role of by-laws in bankruptcy

By-laws in the context of bankruptcy refer to the specific rules and provisions governing how bankruptcy cases are filed and processed in California. They outline the legal framework under which debtors operate and provide necessary guidelines for attorneys, trustees, and the courts involved in these proceedings.

The importance of by-laws cannot be overstated; they ensure that the bankruptcy process is executed fairly and consistently. By-laws help in defining processes such as filing requirements, responsibilities of debtors and creditors, and stipulations for the discharge of debts. Understanding these rules is crucial for individuals navigating bankruptcy, as they can significantly affect the procedures and outcomes.

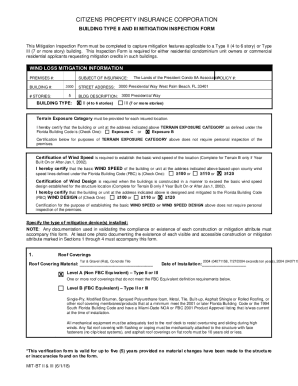

Key California bankruptcy forms

Filing for bankruptcy in California requires the completion of essential forms, which structure the process and ensure that all pertinent information is documented. These forms are critical for both Chapter 7 and Chapter 13 filings and include specific by-laws forms unique to each type.

The main by-laws form needed when filing seeks to provide an overview of the debtor's financial situation, allowing the courts to evaluate the case efficiently. Two of the key forms include:

In addition to these forms, other relevant documents to consider include the Means Test Form, which assesses eligibility for Chapter 7, and the Schedule of Income and Expenditures, detailing monthly income and essential expenses.

Detailed instructions for completing the by-laws form

Completing the California bankruptcy by-laws form involves meticulous attention to detail to ensure that all necessary information is accurately captured. Start by locating the by-laws form online, often available on the official California bankruptcy court website or through resources like pdfFiller, which streamlines the process.

You’ll need to provide relevant personal information, including your name, address, and social security number, along with detailed financial disclosures. Data about both assets and liabilities is mandatory for effective processing. To avoid common errors, it's essential to double-check all entries.

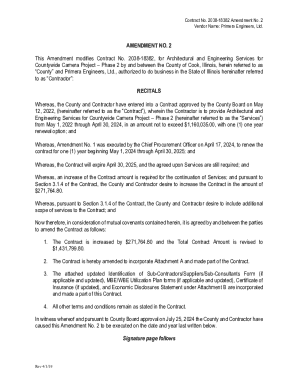

Editing and managing your bankruptcy documents

Managing your bankruptcy documents effectively is a critical component of the process. By utilizing tools like pdfFiller, you can upload and edit your by-laws forms seamlessly. This platform not only allows for efficient editing but also provides features for collaboration if you're working with a legal team or advisors.

One key feature of pdfFiller is its ability to support e-signatures, which hold legal validity in California. Utilizing these digital signing tools can expedite the process and help maintain a secure, organized approach to document handling.

Keeping your bankruptcy forms organized

Organization is vital when handling bankruptcy forms, as it can significantly influence case outcomes. Whether you choose digital or physical formats, developing a system that categorizes and tracks your documents will ease the stress of the filing process.

Effective document organization techniques include using clear labels and constructing a filing system that separates forms by type, date, and relevance. For those opting for digital storage, leveraging document management tools can keep your information easily accessible.

Frequently asked questions about California bankruptcy by-laws

Potential filers often have a range of questions regarding by-laws in the bankruptcy process. Understanding these common inquiries can help clarify critical aspects of filing.

For example, what happens if by-laws need to be updated after filing? While it’s possible to amend your filings, it’s important to follow the proper procedures to avoid complications. Additionally, the challenge of by-laws in bankruptcy court can arise, where a debtor’s claim could be contested, underlining the importance of completeness and accuracy.

Resources for further guidance

For individuals seeking additional support on bankruptcy matters, numerous resources are available. Local legal aid organizations can provide guidance tailored to unique situations, ensuring personalized assistance throughout the process.

Consider consulting professional organizations that specialize in bankruptcy law. They can offer valuable insights and potentially connect you with reputable legal counsel to aid in your journey.

Next steps after completing your by-laws form

After successfully completing your by-laws form, it's vital to stay proactive in managing the next steps of your bankruptcy process. Scheduling important dates and adhering to deadlines ensures that you don’t miss crucial court appearances or response timelines.

Preparing for the bankruptcy hearing will also require gathering necessary documentation and being ready to discuss your financial situation candidly. Understanding your rights as a debtor in California, including protections against creditor harassment, is integral to the process and provides a sense of empowerment during proceedings.

Conclusion and best practices for bankruptcy filing

In conclusion, understanding the by-laws of California bankruptcy forms is crucial for anyone embarking on the journey of filing for bankruptcy. From knowing the types of bankruptcy available to completing the necessary forms accurately, every step plays a significant role in the process.

By adopting best practices such as proper organization, utilizing technology like pdfFiller for document management, and staying informed about rights as a debtor, individuals can navigate this complex system with confidence. A streamlined approach not only aids in compliance but also paves the way for a fresh financial start.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in by-laws of california bankruptcy?

Can I create an electronic signature for the by-laws of california bankruptcy in Chrome?

Can I create an eSignature for the by-laws of california bankruptcy in Gmail?

What is by-laws of california bankruptcy?

Who is required to file by-laws of california bankruptcy?

How to fill out by-laws of california bankruptcy?

What is the purpose of by-laws of california bankruptcy?

What information must be reported on by-laws of california bankruptcy?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.