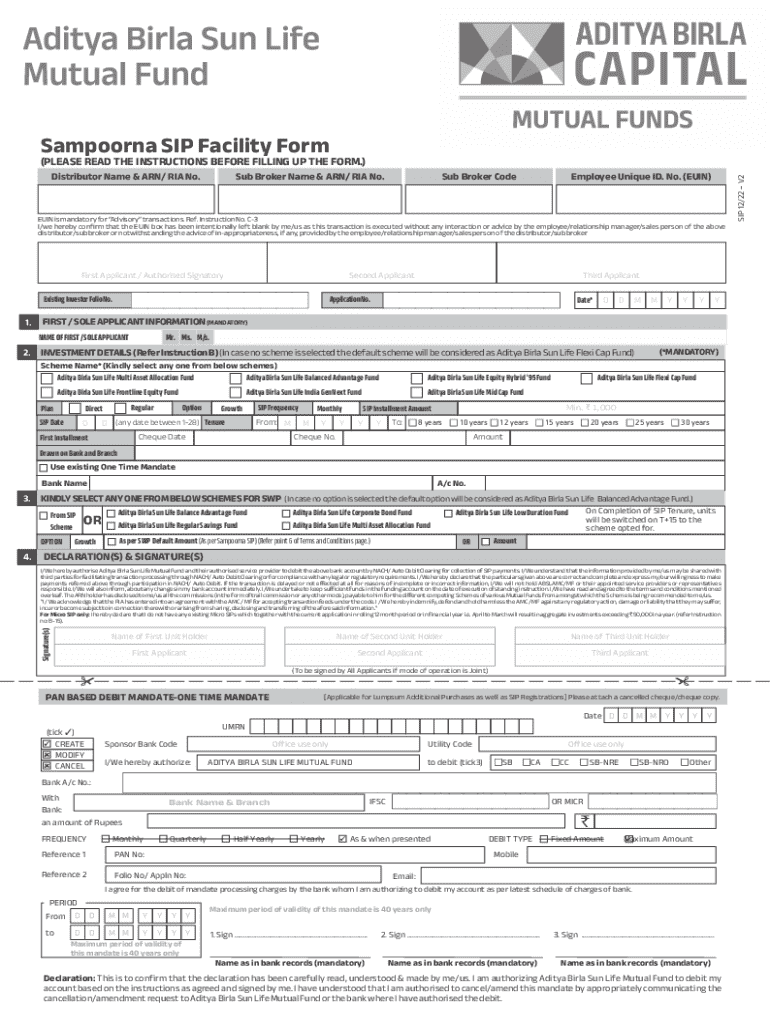

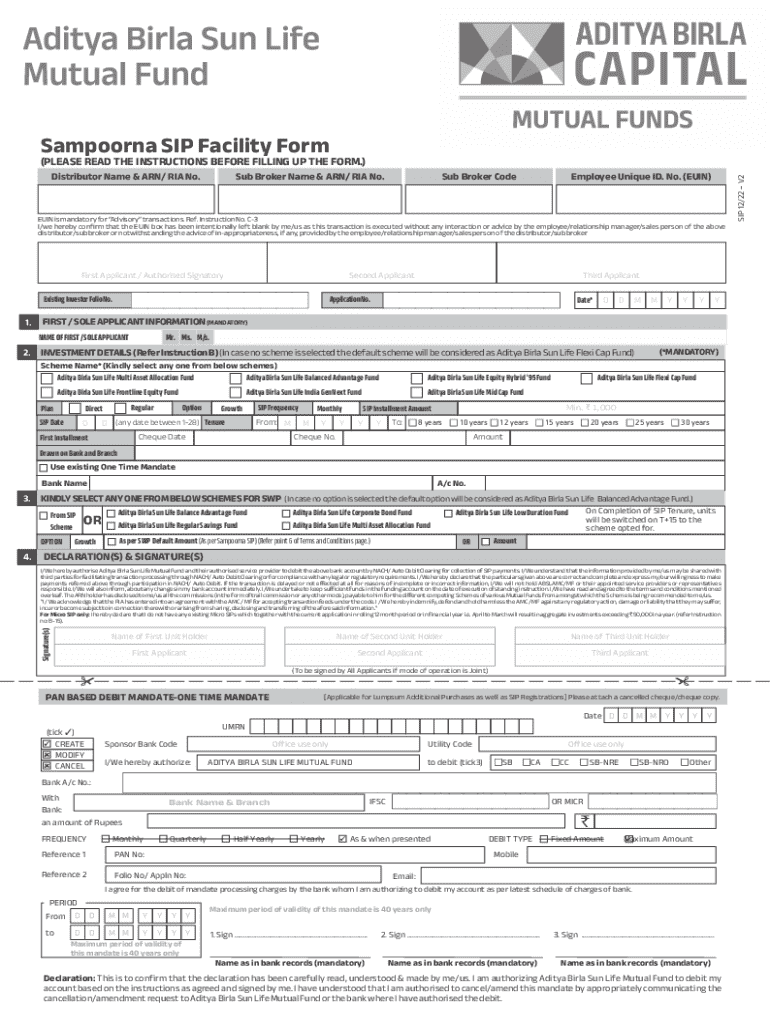

Get the free Sampoorna Sip Facility Form

Get, Create, Make and Sign sampoorna sip facility form

How to edit sampoorna sip facility form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out sampoorna sip facility form

How to fill out sampoorna sip facility form

Who needs sampoorna sip facility form?

Sampoorna SIP Facility Form: A Comprehensive How-to Guide

Overview of Sampoorna SIP Facility

A Systematic Investment Plan (SIP) allows investors to contribute a fixed amount regularly into mutual funds, which fosters disciplined investment habits and promotes wealth creation over time. The Sampoorna SIP Facility is specifically designed to cater to individuals and teams looking for an efficient, hassle-free way to invest in mutual funds and build a robust financial future. Understanding the significance of SIPs in financial planning cannot be overstated; they are ideal for risk-averse investors while maximizing returns over the long term.

By utilizing the Sampoorna SIP facility, individuals can enjoy a multitude of benefits, including affordability and flexibility in managing investments, as well as the convenience of online access through platforms like pdfFiller. Effortlessly handling SIP investments through well-structured forms ensures users can focus on their financial goals rather than paperwork.

Key features of the Sampoorna SIP Facility

One of the primary attractions of the Sampoorna SIP facility is the flexibility it offers. Investors can choose their investment amounts ranging from a few hundred to several thousand rupees based on their financial circumstances and goals. Furthermore, users can decide on the duration and frequency of their investments, allowing them to tailor the SIP according to their personal financial strategy. This adaptability not only helps in accommodating varying income levels but also encourages consistent investing habits.

Additionally, the potential returns from the Sampoorna SIP investments are substantial, usually outperforming traditional savings accounts or fixed deposits over time, although there are inherent risks involved. Market fluctuations can impact returns, making it essential for investors to stay informed and ready to adjust their strategies as needed.

Eligibility criteria for applying

The Sampoorna SIP facility is accessible to a diverse range of investors, including individuals, families, and corporate teams. Typically, applicants must meet a minimum age requirement of 18 years. For more inclusive access, necessary documentation includes identity proof like an Aadhar card, PAN card, and proof of address, ensuring a valid verification process.

For Non-Resident Indians (NRIs) and High Net-Worth Individuals (HNIs), there may be specific criteria and additional documentation needed depending on the nature of investments. Understanding these requirements is crucial for a smooth application process and successful fund registration.

Step-by-step guide to filling out the Sampoorna SIP Facility Form

Filling out the Sampoorna SIP Facility form is straightforward and can be done with ease using platforms like pdfFiller. First, access the specific form via pdfFiller's website. Once accessed, proceed section by section to fill in the required information.

Ensure accuracy while filling out the form as this can expedite the application process. A few tips for completion include double-checking each section, ensuring that you provide up-to-date information, and using correct spellings to avoid processing delays.

Editing and customizing your form with pdfFiller

One of the remarkable features of pdfFiller is the ability to edit PDF fields easily. After filling out the form, you can make quick adjustments as needed without hassle. This feature is particularly useful for correcting minor errors or updating information.

Additionally, pdfFiller provides electronic signing tools, allowing you to add your signature to the form seamlessly. This process is not only secure but also ensures that documentation is legally binding and professionally presented. Another advantage is the real-time collaboration feature, enabling teams to work together on the same document, reducing turnaround time and improving efficiency.

Managing your Sampoorna SIP application

Once you have submitted the Sampoorna SIP application, it's crucial to keep track of its status. Fortunately, pdfFiller allows you to check your application status online effortlessly. You can log into your account at any time to receive updates on your document.

Understanding the process following form submission is necessary to facilitate prompt follow-ups and ensure that all required documentation has been adequately processed. Familiarizing yourself with key timelines, such as approvals and confirmations, will put you in control of your investment journey.

Troubleshooting common issues

While filling out the Sampoorna SIP Facility form, various common issues may arise. For instance, applicants might face difficulties related to submission errors or vague error messages. It's important to consult the support section on pdfFiller or reach out to their dedicated customer support team for resolution.

Additionally, frequently asked questions related to the SIP facility and application process can offer further clarity and guidance.

Interactive tools and calculators on pdfFiller

To enhance your investment experience, pdfFiller provides a variety of interactive tools and calculators specifically designed to support SIP planning. Investment calculators can help project potential returns based on your inputs, making it easier to set realistic financial goals.

Moreover, users can access interactive features for comparing various SIP plans. This comparison allows investors to evaluate options based on aspects like expected returns, risk involved, and fund management fees. Utilizing tools for budget planning can also assist in making informed decisions on investments.

Sampoorna SIP Facility FAQs

Real-life success stories of users

Numerous testimonials from individuals and teams utilizing the Sampoorna SIP facility highlight the effectiveness and ease of use. Users have reported significant financial gains attributed to disciplined investing patterns achieved through SIPs.

Case studies featuring successful investments through the Sampoorna SIP facility reveal sound financial strategies prepared by customers that illustrate the facility's perks and potentials for achieving long-term wealth. These success stories serve as motivation for prospective users considering the investment venture.

Continuous learning and updates

Staying informed about the latest developments in SIPs and investment advice is crucial. Regularly visiting pdfFiller's blog and articles dedicated to finance provides valuable insights into market trends and investment tips designed to empower both novice and experienced investors.

Consistent education and learning can positively impact your investment decisions, allowing you to adapt to changing market conditions and optimize financial outcomes. Utilize these resources to refine your strategies continually.

Conclusion: The future of your investments with Sampoorna SIP

Overall, subscribing to the Sampoorna SIP facility is an excellent investment decision that offers numerous benefits including flexibility and potential growth. It is the gateway to a more structured approach to financial planning when paired with the capabilities of pdfFiller for seamless document management.

Encouragement is key; step forward in your investment journey today, leveraging the power of the Sampoorna SIP facility and pdfFiller to make your financial aspirations a reality!

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my sampoorna sip facility form directly from Gmail?

How can I edit sampoorna sip facility form from Google Drive?

How do I edit sampoorna sip facility form in Chrome?

What is sampoorna sip facility form?

Who is required to file sampoorna sip facility form?

How to fill out sampoorna sip facility form?

What is the purpose of sampoorna sip facility form?

What information must be reported on sampoorna sip facility form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.