Get the free Cscl/cd 502

Get, Create, Make and Sign csclcd 502

Editing csclcd 502 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out csclcd 502

How to fill out csclcd 502

Who needs csclcd 502?

A Comprehensive Guide to the CSCL/-502 Form for Nonprofit Organizations in Michigan

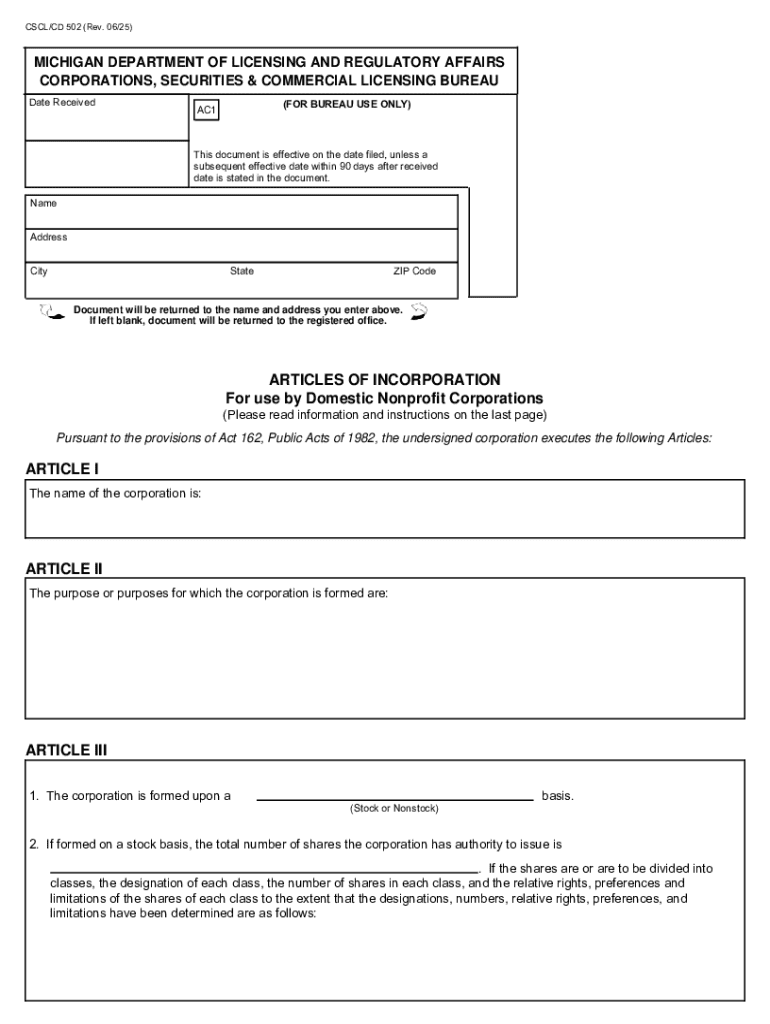

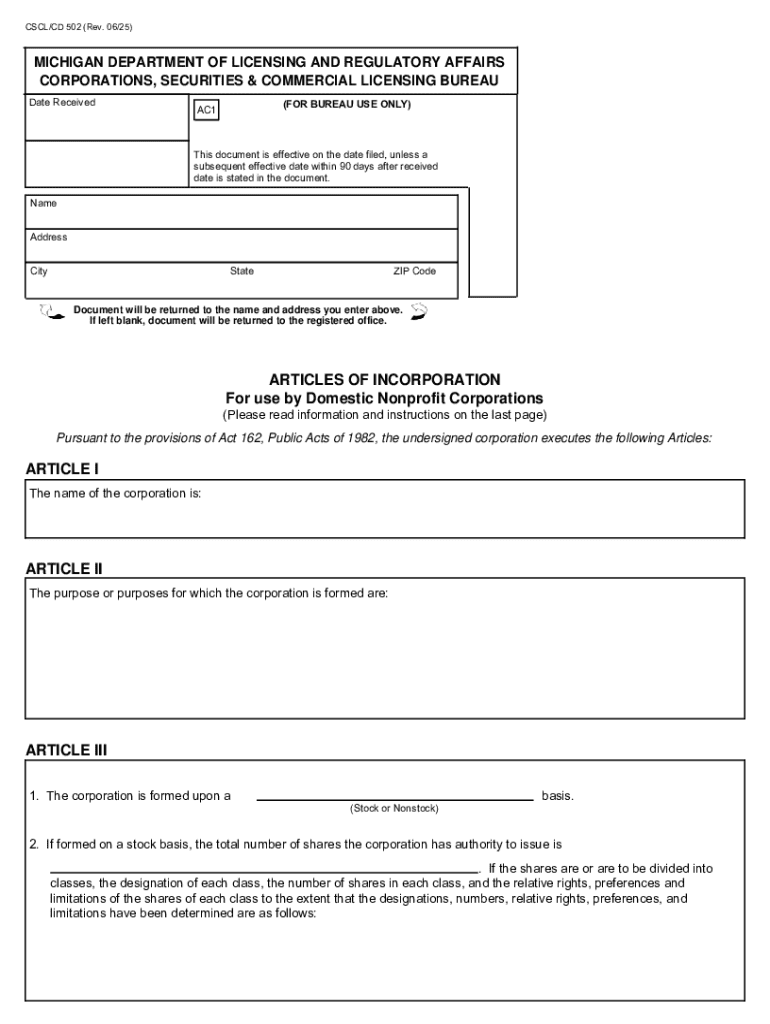

What is the CSCL/-502 form?

The CSCL/CD-502 form is a critical document required for the registration of nonprofit organizations in the state of Michigan. This form establishes the legal framework for your nonprofit, ensuring compliance with state regulations and facilitating your organization's ability to operate officially. By filing the CSCL/CD-502, you not only register your nonprofit but also open avenues for tax-exempt status, fundraising, and grants, which are essential for sustainability.

The necessity of this form stems from Michigan's legal framework governing nonprofit operations, primarily outlined in the Michigan Nonprofit Corporation Act. Understanding these laws is pivotal for anyone seeking to establish a nonprofit in this state, ensuring they navigate the process correctly to avoid legal pitfalls.

Preparing to fill out the CSCL/-502 form

Before diving into the details of the CSCL/CD-502 form, it’s important to grasp the requirements and ensure that you are eligible to file. Nonprofits in Michigan typically need to demonstrate a clear mission, a structured organization with a Board of Directors, and compliance with specific operational guidelines.

Eligibility criteria for filing include having a defined nonprofit purpose that serves the public good. Additionally, you will need to prepare supporting documents, including bylaws, a conflict of interest policy, and a list of initial directors. Ensuring these documents are in order can streamline the application process and prevent delays.

Before filling out the CSCL/CD-502 form, consider gathering all necessary documentation and information to avoid common mistakes. Ensure all names, addresses, and board member details are accurate. Utilizing tools such as pdfFiller can significantly enhance your efficiency in managing and editing these documents.

Step-by-step instructions for filling out the CSCL/-502 form

Completing the CSCL/CD-502 form necessitates attention to detail, particularly in a number of key sections. Below, we break down each section to guide you through the process.

Section 1: Name of your nonprofit organization

Choosing a unique name is not only a matter of preference but also a requirement under Michigan law. Your chosen name should not only reflect your organization’s mission but also comply with naming regulations set forth by the state.

To check if your desired title is available, utilize Michigan's online resources, which provide a name availability search tool, ensuring you avoid redundant names that could lead to potential legal challenges.

Section 2: Purpose of the organization

In this section, clearly articulate your nonprofit's mission statement. This statement should summarize your core objectives and how you intend to serve the community or a specific demographic. Examples of common nonprofit purposes include charity, education, scientific advancement, and health services.

Section 3: Registered office and agent

The registered agent acts as the official contact for your organization and must be a resident of Michigan or a corporation authorized to conduct business in the state. Choose someone reliable for timely communication regarding legal documents and notices.

Section 4: Board of Directors

Michigan requires a minimum of three directors for your board, and these individuals should represent diverse perspectives aligned with your nonprofit's mission. Selecting dedicated board members who are willing to fulfill their roles effectively is crucial for the governance of your nonprofit.

Section 5: Incorporators information

Incorporators are individuals who officially file the CSCL/CD-502 form, and they are essential to the formation process. Ensure that the information for each incorporator is accurate, as incorrect details could add delays to your application.

Section 6: Duration of the corporation

Here, you can choose whether your organization will have a perpetual existence or a defined duration. Most nonprofits opt for perpetual existence, allowing them to operate uninterrupted unless formally dissolved.

Section 7: Distribution of assets upon dissolution

Understanding the laws surrounding asset distribution is vital for compliance and ethical stewardship. This section provides essential guidelines on how your organization's assets will be handled if you choose to dissolve, ensuring adherence to Michigan's nonprofit regulations.

Editing and reviewing your CSCL/-502 form

Once you have filled out the CSCL/CD-502 form, it’s paramount to review it meticulously before submission. Key areas to cross-check include the accuracy of all information provided, proper formatting, and clarity in presentation.

Ensure that all required documents are included and formatted appropriately. Using a tool like pdfFiller can significantly enhance this process, allowing you to check for errors and adjust details in real time, ensuring a polished final submission.

Submitting the CSCL/-502 form

Submitting the CSCL/CD-502 form can be done through various methods to suit your preference. The Michigan Department of Licensing and Regulatory Affairs (LARA) offers an online filing platform that is user-friendly and efficient.

Alternative options include mailing your application along with a check to the appropriate address, ensuring that you include sufficient postage to avoid any delays in processing.

As for filing fees, it’s important to be prepared for the associated costs, as these can vary. Certain nonprofit organizations may be eligible for fee waivers, providing further incentives for those seeking to establish their organization ethically and efficiently.

After submission: What to expect

Upon successfully submitting your CSCL/CD-502 form, you can expect a typical processing time of several weeks. However, you can speed up your application by ensuring all details are correct and all required documents are submitted.

Once your nonprofit is officially registered, it’s crucial to follow up with the necessary actions, including opening a bank account and setting up systems for compliance with state requirements. Adhering to best practices is essential for the continued success of your nonprofit organization.

Additional considerations for nonprofit organizations

Long-term sustainability for nonprofit organizations hinges on effective strategies for fundraising, grant writing, and community engagement. Developing a robust financial plan and diversifying income sources are critical, especially in Michigan's evolving nonprofit landscape.

Maintaining compliance with state laws and regulations is equally important. Regular filings and reports are part of your obligations, thus investing in document management tools like pdfFiller can help in maintaining accurate records and facilitating ongoing compliance.

Resources for further assistance

For those seeking further support, the Michigan Department of Licensing and Regulatory Affairs (LARA) offers valuable information and assistance regarding nonprofit registration. Additionally, there are nonprofit support organizations and legal aid resources available that can provide guidance through various stages of nonprofit establishment and management.

Utilizing a tool like pdfFiller can enhance your experience with managing and editing nonprofit documents, ensuring all records are up-to-date and easily accessible.

Explore more

In addition to the CSCL/CD-502 form, it’s beneficial to familiarize yourself with related documents and applications that may come into play in the lifecycle of your nonprofit. Frequently asked questions can help clarify common processes and concerns regarding nonprofit creation in Michigan.

For deeper insights into nonprofit management, engaging with blog posts and articles on best practices can provide innovative strategies to enhance your organization’s impact.

Stay informed

Staying up-to-date with upcoming webinars and workshops on nonprofit management is crucial for continued development. Subscribing to updates on changes in nonprofit legislation in Michigan will help ensure your organization remains compliant with new regulations.

Support and contact

Should you have any inquiries, reaching out to pdfFiller support can offer the assistance you need. Additionally, community forums can provide platforms for sharing experiences and solutions among nonprofit creators.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in csclcd 502?

Can I create an electronic signature for the csclcd 502 in Chrome?

How do I fill out the csclcd 502 form on my smartphone?

What is csclcd 502?

Who is required to file csclcd 502?

How to fill out csclcd 502?

What is the purpose of csclcd 502?

What information must be reported on csclcd 502?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.