Get the free Anti-money Laundering Information Collection & Certification Form - Buyers

Get, Create, Make and Sign anti-money laundering information collection

Editing anti-money laundering information collection online

Uncompromising security for your PDF editing and eSignature needs

How to fill out anti-money laundering information collection

How to fill out anti-money laundering information collection

Who needs anti-money laundering information collection?

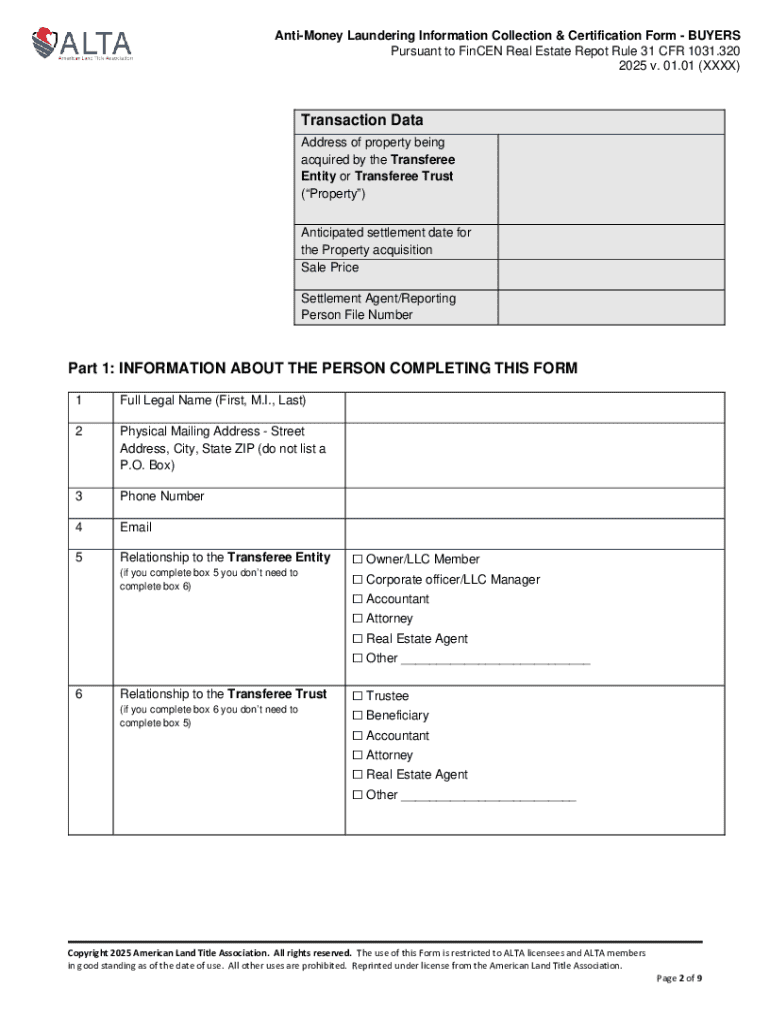

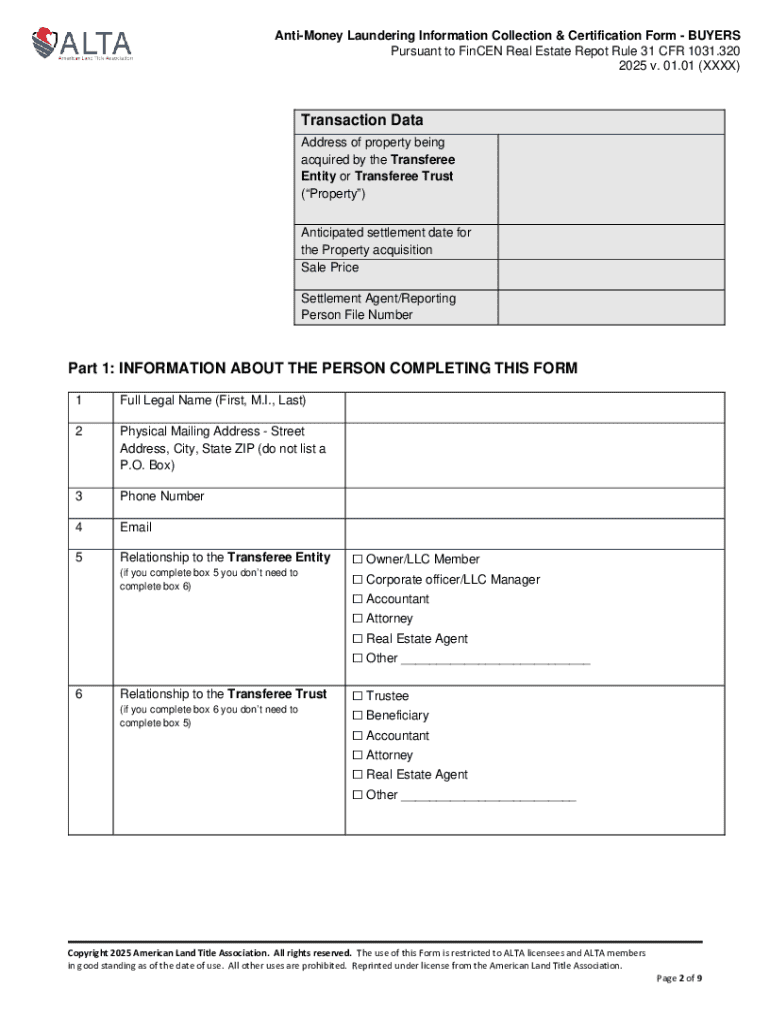

Essential Guide to the Anti-Money Laundering Information Collection Form

Understanding anti-money laundering (AML) information collection

Anti-money laundering (AML) encompasses a set of laws, regulations, and procedures aimed at preventing individuals and organizations from disguising illegally obtained funds as legitimate. The significance of compliance with AML regulations cannot be overstated, as failure to adhere can lead to severe penalties, legal repercussions, and reputational damage. Governments and regulatory bodies globally have established mandates that compel businesses, particularly in finance and real estate, to collect information to identify and mitigate potential money laundering risks.

Key stakeholders in the AML process include financial institutions, regulatory authorities, law enforcement agencies, and any organization that deals with monetary transactions. Each entity has a role to play in ensuring compliance and safeguarding against potential risks associated with money laundering.

Essential components of the AML information collection form

The AML information collection form is designed to gather comprehensive data to support compliance efforts. Each field on the form is critical, and detailed attention is required to ensure compliance with regulatory requirements. The essential components include:

Accuracy and completeness are paramount in this section. Any omissions or errors can hinder investigations and reflect poorly on organizational compliance efforts.

Purpose of collecting AML data

The collection of AML data serves several integral purposes. Primarily, it supports adequate risk assessment and management, allowing organizations to identify potentially suspicious activities that could indicate money laundering. Legal obligations also drive the necessity for data collection, as failing to meet regulatory standards can result in significant fines and sanctions.

Additionally, thorough data collection enhances due diligence processes, enabling businesses to make informed decisions regarding their clients and partners. This proactive approach is instrumental in establishing a robust compliance culture within organizations.

Navigating the AML information collection form

Accessing the AML information collection form through pdfFiller is straightforward and user-friendly. Simply visit the platform and search for the relevant form. From there, follow these key steps to fill it out accurately:

Common areas of confusion often involve properly identifying clients or outlining transaction details. If facing uncertainties, retain associated documentation or consult with compliance professionals for assistance.

Once completed, pdfFiller allows for seamless digital editing, signing, and submission, enhancing the overall efficiency of document management.

Frequently asked questions (FAQs)

The AML data collection process often raises several questions; understanding how to navigate these queries can streamline compliance efforts. Here are some commonly posed questions:

Ensuring data security and privacy

The integrity and security of collected AML information are paramount. pdfFiller employs robust security measures to protect sensitive data, from encryption to regular security audits, ensuring that users can trust the platform with their documentation.

For organizations handling AML information, best practices for secure document management include a few key guidelines:

By implementing these practices, organizations can bolster their AML compliance and protect against data breaches.

Interactive tools for efficient form management

To optimize form management processes, pdfFiller offers various interactive tools that facilitate collaboration and streamline form efficiency. Real-time editing features enable teams to work together on the AML information collection form, reducing the risk of errors and ensuring that all necessary data is captured.

Additional features include:

These tools can be instrumental in ensuring that your AML compliance processes remain efficient and transparent.

Resources for further learning and compliance

For organizations looking to deepen their understanding of anti-money laundering practices and regulations, several resources are available. Key links to official regulations and guidelines can help educate your team on compliance responsibilities. pdfFiller also provides access to informative webinars, comprehensive guides, and articles tailored to AML documentation needs, ensuring users stay updated and informed.

Additionally, it is advisable to establish a contact point for AML-related queries and support within your organization. This helps ensure that all employees understand their responsibilities in terms of compliant documentation and reporting.

Sector-specific considerations for AML compliance

Different sectors may carry unique data requirements for AML compliance. For instance, businesses in real estate might need to collect additional due diligence documentation compared to those in the technology sector. Factors such as business size, the complexity of transactions, and local regulations also influence data requirements.

Organizations must adapt their data collection strategies based on these sector-specific demands, and case studies showcasing successful AML reporting can provide valuable insights into best practices for various industries.

Managing AML risks with pdfFiller tools

Employing technology to manage AML risks effectively is crucial in today’s evolving regulatory environment. pdfFiller equips organizations with tools that facilitate proactive risk management, enabling timely responses to regulatory updates and compliance challenges.

Staying educated on regulatory changes through resources available on pdfFiller ensures that your compliance efforts are not only current but also proactive, safeguarding your business against potential non-compliance repercussions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my anti-money laundering information collection directly from Gmail?

How can I send anti-money laundering information collection for eSignature?

How do I edit anti-money laundering information collection on an iOS device?

What is anti-money laundering information collection?

Who is required to file anti-money laundering information collection?

How to fill out anti-money laundering information collection?

What is the purpose of anti-money laundering information collection?

What information must be reported on anti-money laundering information collection?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.