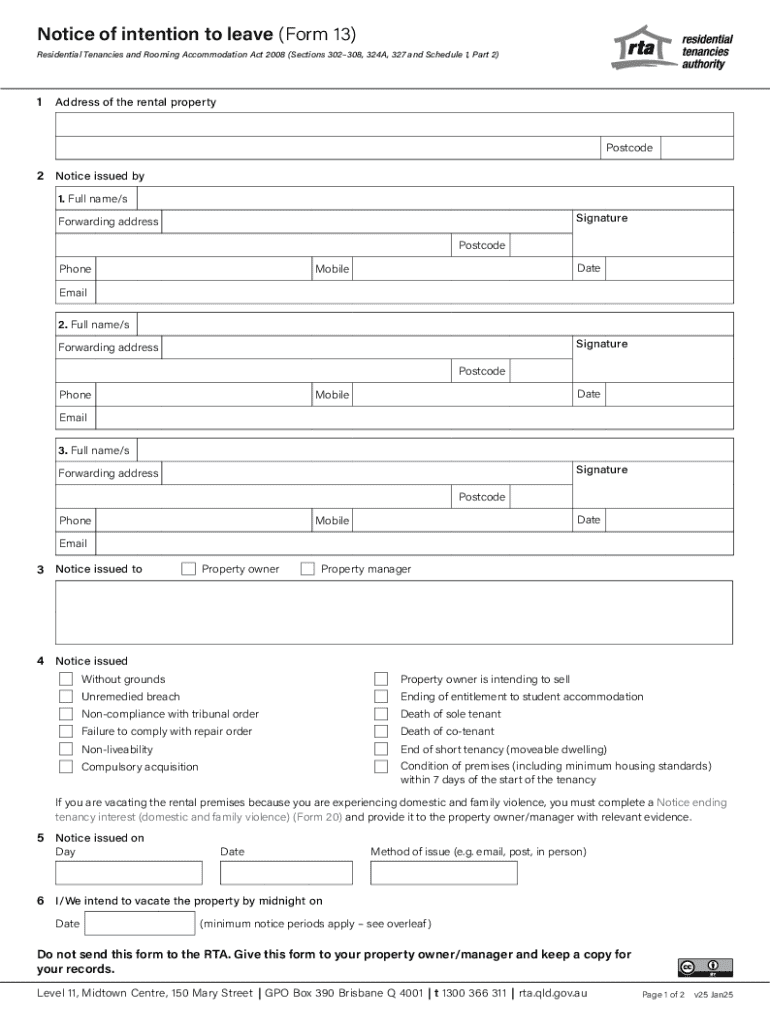

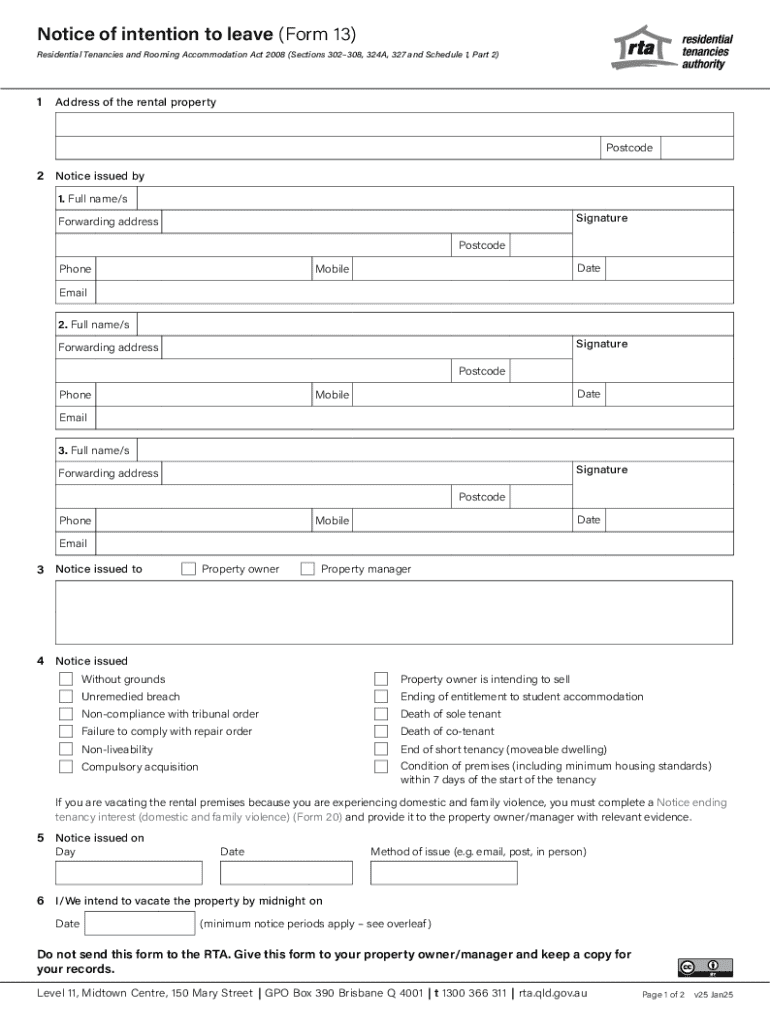

Get the free Notice of Intention to Leave (form 13)

Get, Create, Make and Sign notice of intention to

How to edit notice of intention to online

Uncompromising security for your PDF editing and eSignature needs

How to fill out notice of intention to

How to fill out notice of intention to

Who needs notice of intention to?

Notice of intention to form: A comprehensive guide

Overview of a notice of intention to form

A notice of intention to form is a formal document that signals the intent of individuals or groups to establish a new corporation or legal entity. This notice typically includes essential details such as the proposed name of the corporation and the names of its founders. The primary purpose of filing this notice is to provide transparency and legal acknowledgment of the founders’ intention to create a corporation, which is a critical first step in the incorporation process.

The importance of filing a notice of intention to form cannot be overstated. Not only does it serve as a preliminary step before actual incorporation, but it also helps to establish priority over the proposed corporate name. This filing can prevent other entities from using the same or a similar name, thereby protecting the founding group's identity and brand in the marketplace.

Understanding the legal framework

Filing a notice of intention to form is governed by various laws and regulations, which vary depending on the jurisdiction. These legal frameworks dictate how and when a notice should be filed, the documentation required, and the relevant fees involved. It’s crucial to consult the specific laws pertaining to your jurisdiction, as compliance with these regulations ensures the process is smooth and recognizes the intent of the founders legally.

Non-compliance with legal requirements can lead to significant complications, including rejected filings or potential delays in establishing your corporation. It's advisable to engage with legal professionals or services that can assist in guiding you through the complexity of these regulations. Being informed can prevent costly mistakes and ensure your plans to form a corporation proceed without undue hindrance.

Before you begin: Requirements and preparations

Before preparing your notice of intention to form, gather the necessary documentation and information. The key items to consider include the chosen corporate name, which must comply with state regulations, and the names and addresses of all the founders or incorporators responsible for the corporation.

Additionally, understanding the filing fees and costs associated with submission is essential. These fees can vary widely by jurisdiction and type of corporation. Identifying the appropriate jurisdiction for your business is another critical step. Different states or provinces may offer distinct regulations, incentives, and costs associated with forming a corporation.

Step-by-step guide to preparing the notice

The preparation of the notice of intention to form entails a few key steps. First, drafting the notice itself is crucial, and it should include key components such as the desired corporate name, the purpose of the corporation, and the details of its founders. Using clear and effective language is paramount; avoid jargon that might confuse the reader and ensure that all information is concise and accurate.

Following the draft, gathering necessary signatures is the next step. Typically, the founders or incorporators must sign the document. It’s important to verify the signature requirements as these can differ by state or province—some jurisdictions may require notarization.

Filling out the form

When filling out the notice of intention to form, it involves completing several sections of the form. Section 1 typically requires basic information, including the proposed corporate name, the registered office address, and the type of corporation. In Section 2, the details of the founders and management should be accurately recorded, along with their responsibilities. Section 3 outlines the purpose of formation, which must clearly define the business activities the corporation will pursue.

Common mistakes in filling out the form can lead to rejections or delays. For instance, misspellings in the corporate name or incorrect addresses could result in necessary amendments. To avoid these issues, utilizing interactive form-filling tools offered by pdfFiller can be invaluable. These tools provide templates and format checks to ensure you are filling in the information correctly.

Filing process

The filing process begins with selecting the method of submission, which can generally be done online or through mailing. Many jurisdictions are now enabling online submissions, which can streamline the process significantly. After submission, understanding processing times is key; varying by state, expect anywhere from a few days to several weeks for approval.

For peace of mind, it’s recommended to follow up on your submission. You can contact the appropriate agency to check on the status of your notice. Ensure that you keep a copy of all documentation for your records, as proving your filing might be necessary in the future.

Serving the notice

Once the notice is filed, there are legal requirements for notification, which may vary by jurisdiction. This may include serving notice to interested parties or the public, ensuring everyone who may be affected by the new corporation is aware of its formation.

Techniques for effective service can include publishing the notice in local newspapers, posting it on official websites, or direct notifications to specific parties. It's vital to keep meticulous records of how and when the service was conducted as this documentation may be required for compliance verification.

Post-filing steps

After filing the notice of intention to form, several critical steps must follow. First and foremost, begin preparing for actual incorporation. This involves drafting bylaws, gathering additional necessary documents for incorporation, and setting up your first board meeting.

Ongoing compliance is also paramount. Corporations must adhere to various operational regulations and file necessary annual reports to maintain good standing. Accurate record-keeping is essential to ensure compliance with state laws and facilitate smooth operations.

Potential challenges and how to overcome them

While the process of filing a notice of intention to form appears straightforward, various challenges can arise. Common issues include rejected applications due to improper formatting, missing information, or name conflicts. Amendments may be necessary in such cases, leading to delays in establishing the corporation.

To navigate these potential hurdles effectively, it’s essential to be diligent during the preparation and submission phases. Create a checklist to ensure that all requirements are met before submission, consult experienced professionals if needed, and stay informed about your jurisdiction’s specific regulations to avoid timeline delays.

Leveraging pdfFiller to enhance your experience

pdfFiller streamlines the entire document management process associated with filing a notice of intention to form. Discover various tools that enhance collaboration within teams, allowing multiple founders to edit and sign the notice seamlessly. The platform also supports eSigning capabilities, making the approval process quicker and more efficient.

Moreover, with cloud storage, important documents can be accessed anytime and anywhere, allowing the team to stay organized and compliant with ongoing requirements. This unified approach simplifies documentation management, making the entire process of filing a notice of intention to form more manageable.

FAQs about the notice of intention to form

Who should file a notice of intention to form? Generally, this document must be filed by individuals or groups intent on creating a corporation. It establishes legal recognition of their purpose and intentions. However, specific regulations might dictate who is allowed to file, so consulting with legal resources may clarify individual obligations.

What happens if I don’t file a notice? Failing to file can lead to legal repercussions, such as name conflicts or the inability to establish a corporation properly. Moreover, it may hinder your ability to conduct business legally, impacting your brand's integrity and market entry.

How long does the process take? The timeline varies greatly between jurisdictions and can range from a few business days to several weeks. It’s crucial to account for this variability during your planning phase.

Additional tools and resources available on pdfFiller

pdfFiller not only aids in managing your notice of intention to form but also provides a wide range of related forms and templates that can streamline your entire business setup process. Access to expert assistance is available for individuals seeking clarification on legal matters, ensuring you navigate your formation requirements seamlessly.

Moreover, educational webinars and tutorials hosted by pdfFiller can offer deep insights into various related topics, empowering you to make informed decisions as you establish your new corporation. Embrace these resources to fully leverage your incorporation journey.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find notice of intention to?

How do I edit notice of intention to straight from my smartphone?

How do I edit notice of intention to on an Android device?

What is notice of intention to?

Who is required to file notice of intention to?

How to fill out notice of intention to?

What is the purpose of notice of intention to?

What information must be reported on notice of intention to?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.