Get the free Notice 2020-78

Get, Create, Make and Sign notice 2020-78

Editing notice 2020-78 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out notice 2020-78

How to fill out notice 2020-78

Who needs notice 2020-78?

Comprehensive Guide to the Notice 2020-78 Form

Understanding Notice 2020-78: An overview

Notice 2020-78, issued by the IRS, pertains specifically to the treatment of eligible tax-exempt employers during the COVID-19 pandemic. This notice is crucial for both individuals and organizations as it clarifies the eligibility for certain tax credits under the CARES Act. Notably, it addresses the rules around qualified wages employers can claim under the Employee Retention Credit.

The importance of Notice 2020-78 extends beyond immediate tax relief; it also offers clarity in complex scenarios that many organizations have faced due to the pandemic. Organizations can better assess their eligibility for tax credits that can substantially alleviate financial strain arising from operational changes. Additionally, it highlights key changes in tax policy and offers insights into how these modifications can help sustain workforce employment.

Accessing the Notice 2020-78 Form

Finding the Notice 2020-78 form is straightforward with the right resources. Several platforms, including the IRS's official website, provide access to this essential document. However, pdfFiller offers a user-friendly interface that allows for a seamless experience when obtaining and filling out the form.

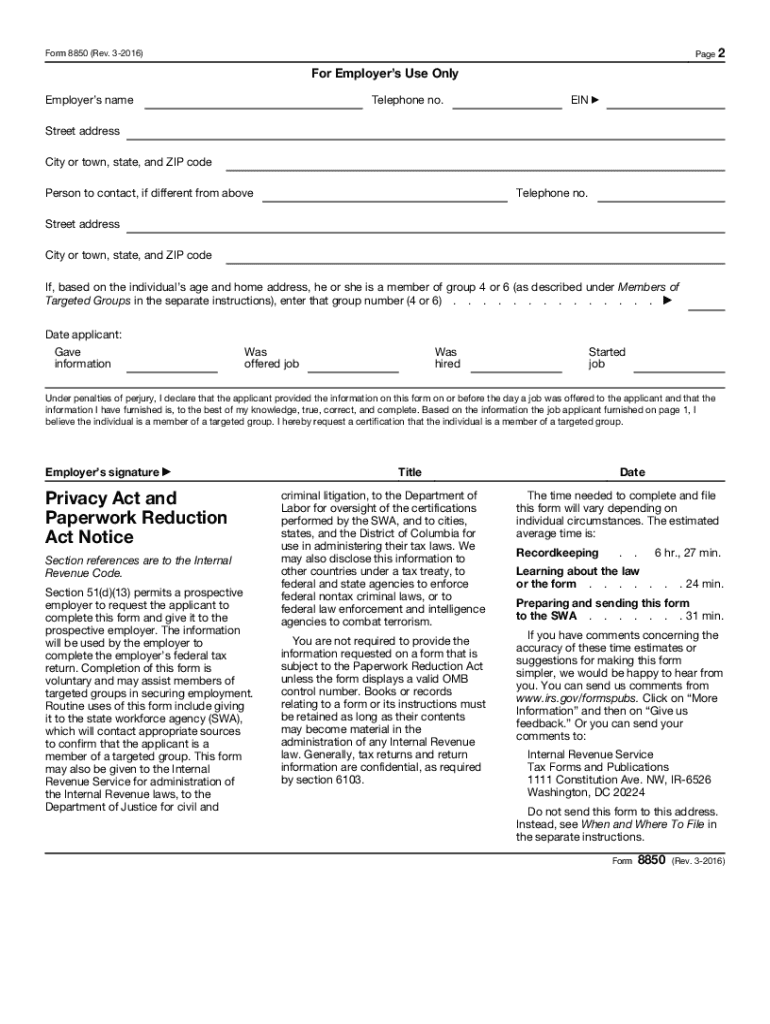

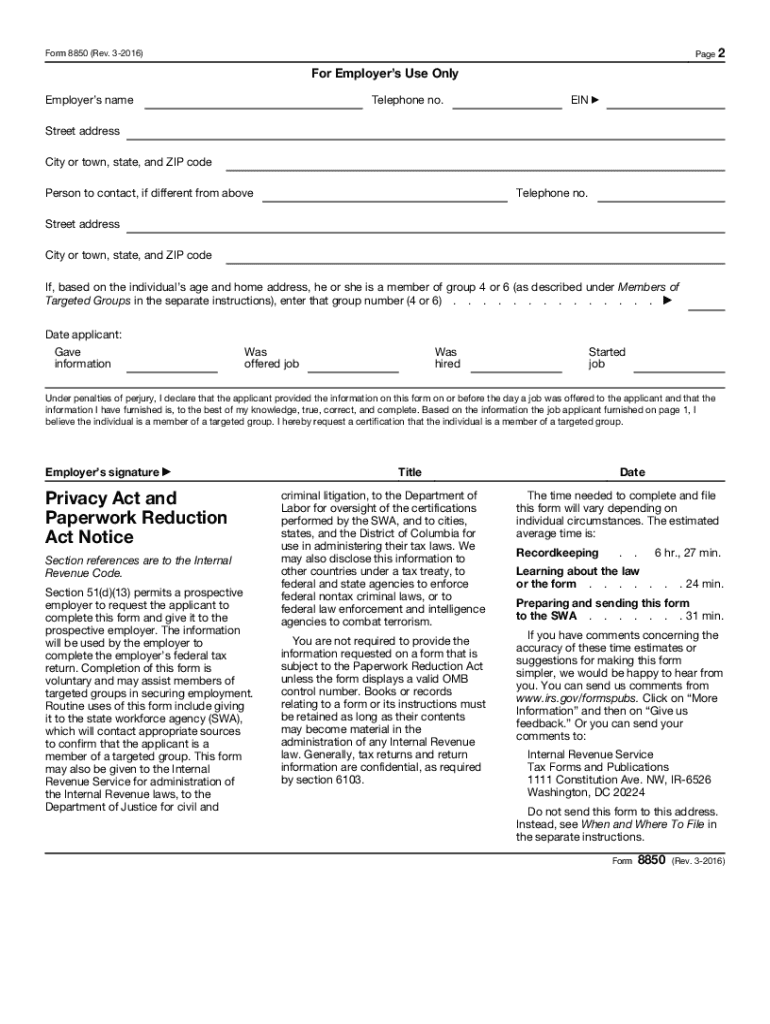

To download the Notice 2020-78 form using pdfFiller, follow these simple steps:

Filling out the Notice 2020-78 Form

Accurately completing the Notice 2020-78 form is critical for ensuring compliance and optimizing any potential tax benefits. Several key pieces of information are required, including personal identification details and specific income and tax information. Understanding each section of the form is vital to avoid mistakes.

Here’s a step-by-step breakdown of how to accurately fill out the different sections of the Notice 2020-78 form:

To ensure the highest level of accuracy while filling out the form, take the time to cross-check your entries. Any discrepancies could lead to processing delays or complications regarding your tax obligations.

Editing the Notice 2020-78 Form with pdfFiller

pdfFiller enhances the way users can edit the Notice 2020-78 form. Utilizing its comprehensive editing tools allows for quick adjustments and modifications, making the process smooth and efficient. Adding text, comments, or highlighting sections of interest becomes a straightforward task.

Collaborative features are also a highlight of pdfFiller. Users have the ability to share the document with team members or stakeholders for input and comments, streamlining workflows. This capability is particularly beneficial for organizations that require multiple approvals or input from different departments.

Signing the Notice 2020-78 Form

Adding a signature to the Notice 2020-78 form is essential for finalizing the document. pdfFiller makes it easy by providing options for electronic signatures, catering to both convenience and security. Users can select from various signature styles or create a custom signature that fits their preference.

Understanding the legal validity of eSignatures is crucial; rest assured that electronic signatures hold the same legal weight as traditional handwritten signatures, adhering to the Electronic Signatures in Global and National Commerce (ESIGN) Act. This ensures that your signed Notice 2020-78 form is just as enforceable as any hard copy.

Managing the Notice 2020-78 Document

Once the Notice 2020-78 form is completed and signed, proper management of the document is critical. pdfFiller provides users with an intuitive platform to organize, store, and retrieve their completed forms effortlessly. This level of organization is particularly valuable during tax season when multiple documents need to be accessed rapidly.

Additionally, the sharing feature is invaluable for individuals or teams that need to forward the form to relevant parties, such as tax advisors or financial departments. Keeping all associated documents in one location can streamline the entire process, reducing the time spent searching for specific files.

FAQs about Notice 2020-78 Form

Understanding common questions surrounding the Notice 2020-78 form can help users navigate the complexities of tax documents. Here are some frequently asked questions:

Related forms and documentation

In the realm of tax documentation, there are often additional forms that accompany the Notice 2020-78. For instance, forms associated with tax credits under the CARES Act play a crucial role in understanding your full scope of benefits. Users are encouraged to familiarize themselves with related documents to ensure they are maximizing their tax relief.

pdfFiller is equipped to support these ancillary forms, providing templates similar to Notice 2020-78 for easy filing and organization. This capability is valuable when you need to pivot quickly between documents based on evolving tax law.

Tips for submitting the Notice 2020-78 Form

When it comes to submitting the Notice 2020-78 form, it's crucial to be aware of the available methods. Submission can usually be carried out either online or via traditional mail, depending on what is stipulated by the IRS.

Here are some tips that can aid in a smooth submission process:

Keeping up to date: Current events related to Notice 2020-78

Staying informed about any changes affecting the Notice 2020-78 is critical for making educated decisions. Recent events or changes in tax law could impact eligibility criteria, submission deadlines, and benefits associated with the form.

This is where pdfFiller comes into play; its continuously updated platform will help you adapt to new regulations seamlessly, ensuring you remain on top of your compliance and documentation needs.

Success stories: How users benefit from the Notice 2020-78 Form

Individual users and organizations alike have shared their success stories surrounding the Notice 2020-78 form. Many have successfully navigated the complexities of tax credits and employee retention using the guidelines specified within the notice.

Case studies illustrate various scenarios of use, such as small businesses who leveraged the information to retain staff during challenging economic periods while still claiming their eligible tax credits.

Feedback and suggestions for pdfFiller users

User feedback is invaluable for enhancing pdfFiller’s features. Engaging with the community for sharing experiences related to the Notice 2020-78 form allows for better product refinement and new feature implementation. Providing specific examples of how the platform could improve or any features that would streamline your document management process can be incredibly beneficial.

Encouraging communication between users and pdfFiller not only helps users but also aids in creating a more efficient document management experience for all.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in notice 2020-78?

How can I edit notice 2020-78 on a smartphone?

How do I fill out notice 2020-78 using my mobile device?

What is notice 2020-78?

Who is required to file notice 2020-78?

How to fill out notice 2020-78?

What is the purpose of notice 2020-78?

What information must be reported on notice 2020-78?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.