Get the free Registering for Self Assessment - peterchalkco co

Get, Create, Make and Sign registering for self assessment

How to edit registering for self assessment online

Uncompromising security for your PDF editing and eSignature needs

How to fill out registering for self assessment

How to fill out registering for self assessment

Who needs registering for self assessment?

Registering for Self Assessment Form: A Comprehensive How-To Guide

Understanding self assessment

Self assessment is a system used by HM Revenue and Customs (HMRC) to collect income tax. Under this system, individuals and businesses calculate their own tax liabilities and submit their tax returns based on their earnings and allowable expenses. This ensures transparency and accountability in taxing processes.

Self assessment is particularly important for self-employed individuals, company directors, and those with other income sources that aren't taxed at source. By participating in self assessment, taxpayers ensure that they meet legal obligations, avoid financial penalties, and take advantage of potential tax reliefs.

Eligibility criteria for self assessment registration

Registering for self assessment is essential for many individuals. Typically, any individual earning more than £1,000 in a tax year from self-employment must register, but there are nuances. Understanding who must register is critical for compliance and financial planning.

Self-employed individuals must register upon starting their business, and company directors are also required to register if they receive taxable income. However, some exceptions apply, such as when income is sent directly tax-deducted at source. Being aware of one's tax position is crucial.

Preparing to register for self assessment

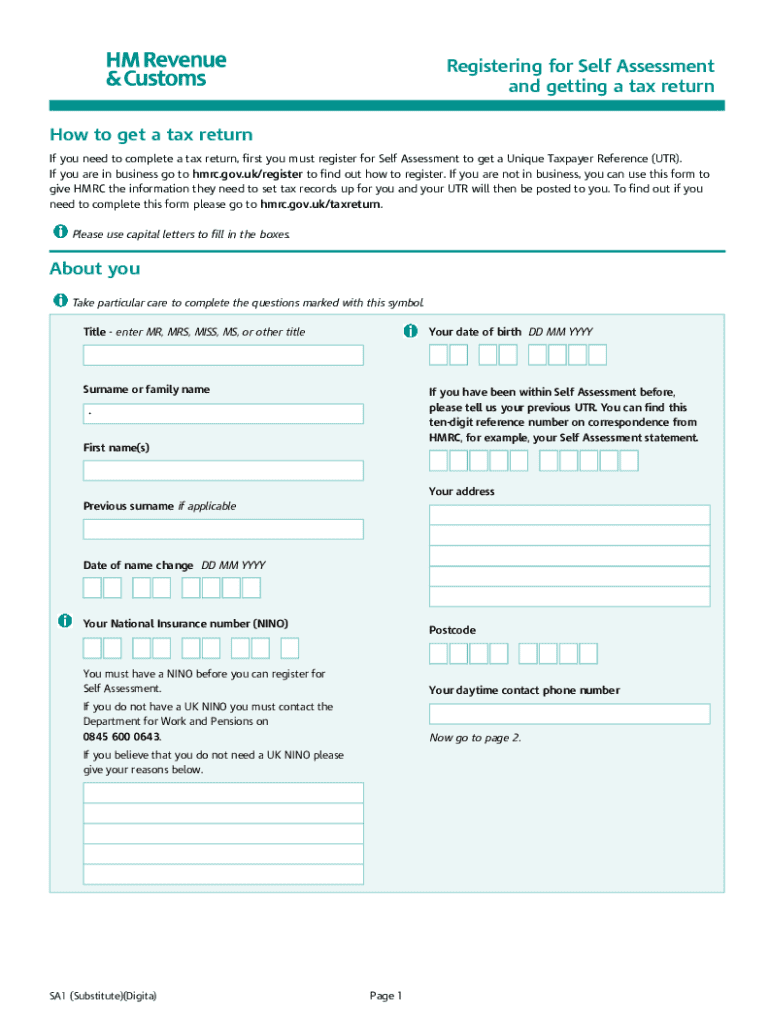

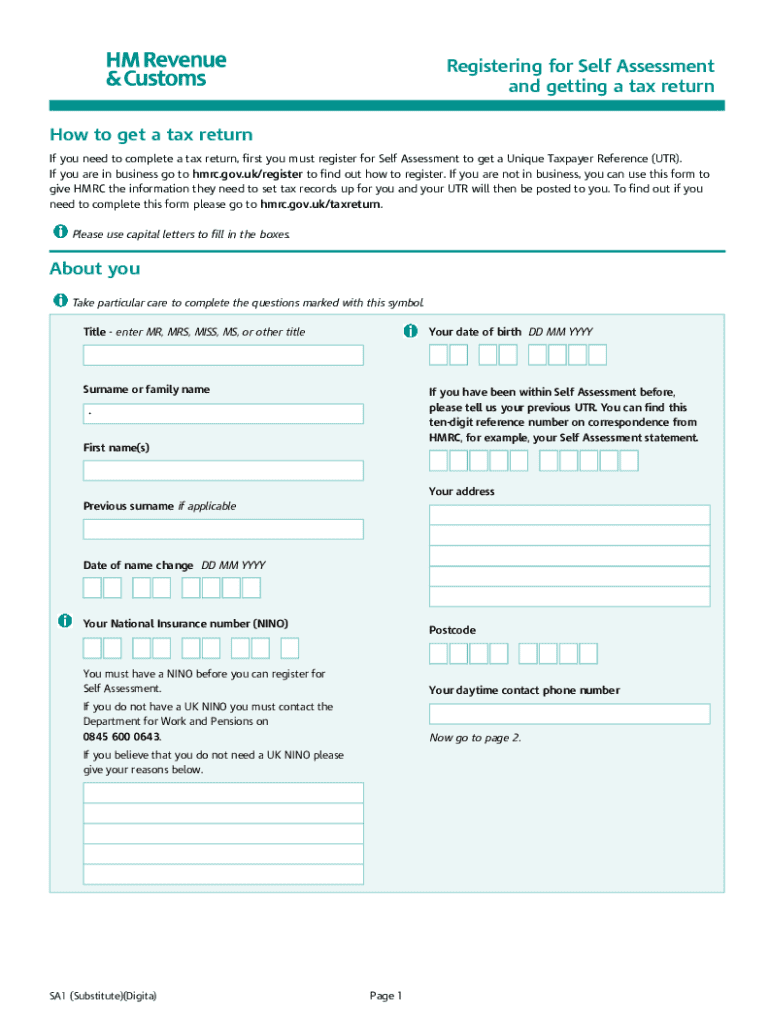

Before registering for self assessment, it’s essential to gather all necessary information and documents. This helps in completing the registration accurately and swiftly, reducing the risk of errors that could lead to penalties.

Key documents include personal identification details, income information from all sources, and your National Insurance number. Additionally, understanding your Unique Taxpayer Reference (UTR) is vital as it links your tax records to HMRC.

Step-by-step guide to registering for self assessment

Registering for self assessment can be completed either online or via paper. Understanding the preferred method is key to ensuring a smooth registration. Here’s how to proceed with both methods.

Online registration

Most individuals find online registration convenient. To start, visit the HMRC Online Services portal, where you'll create your HMRC account. Follow the prompts to complete the online registration form, ensuring all information is correct.

Paper registration

If you prefer traditional methods or face issues with online access, you can download the registration form from the HMRC website. Fill out the form carefully and mail it to HMRC. Be mindful that processing times for paper submissions are longer.

Regardless of the registration method, be aware of key timelines and deadlines to avoid penalties for late registration.

Common mistakes to avoid when registering

Understanding the common pitfalls is vital during the registration process. Many taxpayers unknowingly make errors that can complicate their tax affairs.

Common mistakes include submitting inaccurate information, such as wrong income figures or personal details. Missing registration deadlines can lead to late penalties, which can accumulate quickly. Additionally, failing to update your registration details when circumstances change can lead to significant complications in tax assessments.

What happens after registration?

After successfully registering for self assessment, you will receive your Unique Taxpayer Reference (UTR) number. This number is crucial as it identifies your tax records with HMRC. Obtaining your UTR ensures that you comply with tax obligations and can file your returns correctly.

Setting up online account access allows you to manage your tax affairs more efficiently. With an online account, you can view your tax position, file returns, and communicate with HMRC effortlessly. Understanding your tax responsibilities will help you remain compliant and avoid potential issues in the future.

Submitting your self assessment tax return

Once registered, your next crucial task is filing your self assessment tax return. Key dates for submission are important to note to ensure compliance and avoid potential penalties.

Filing can be done online or on paper, with the online method generally preferred for its convenience. Required documents include proof of income, allowable expenses, and any relevant supporting documents. Being organized will ensure this process goes smoothly.

Frequently asked questions about self assessment registration

Navigating self assessment registration can raise several questions. Here are some common queries that individuals encounter during the process.

Many wonder whether registration details can be updated post-registration or what actions to take if they miss their registration deadline. Fortunately, changes can be made by contacting HMRC, and late registration can still be addressed if you get in touch promptly.

Important changes and updates

Tax laws and self assessment guidelines can change, impacting registration processes and requirements. Staying informed about recent updates from HMRC is essential for all taxpayers.

Recent changes may affect registration criteria or deadlines, so regularly checking HMRC communication and updates is wise. This ensures that you are compliant and can make the most of any new guidelines or reliefs available.

Using pdfFiller for self assessment registration

Navigating the self assessment registration process can be significantly streamlined by utilizing pdfFiller. This platform provides user-friendly tools for document creation, allowing you to manage your self assessment paperwork seamlessly.

From editing PDFs to eSigning and collaborating with team members, pdfFiller simplifies the registration process. By storing your documents in the cloud, you can access your important tax documents from anywhere, making tax season less stressful.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify registering for self assessment without leaving Google Drive?

Where do I find registering for self assessment?

How do I edit registering for self assessment online?

What is registering for self assessment?

Who is required to file registering for self assessment?

How to fill out registering for self assessment?

What is the purpose of registering for self assessment?

What information must be reported on registering for self assessment?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.