Get the free Cscl/cd 753

Get, Create, Make and Sign csclcd 753

How to edit csclcd 753 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out csclcd 753

How to fill out csclcd 753

Who needs csclcd 753?

A Comprehensive Guide to the CSCL/ 753 Form: Converting Partnerships to LLCs in Michigan

Overview of the CSCL/ 753 form

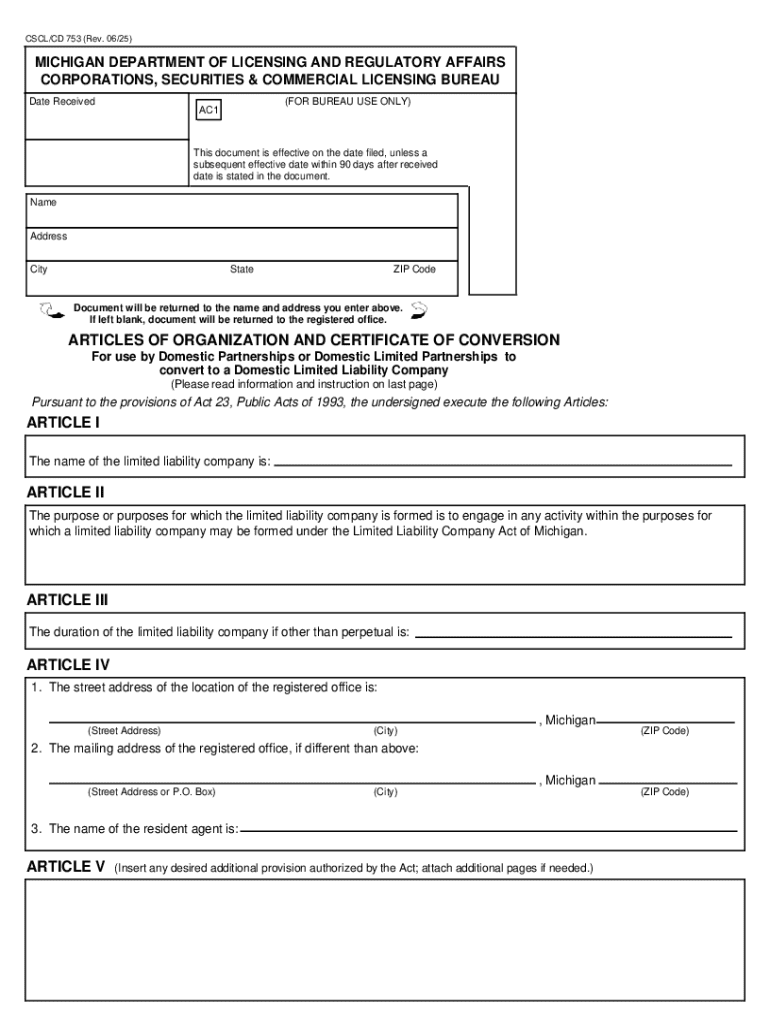

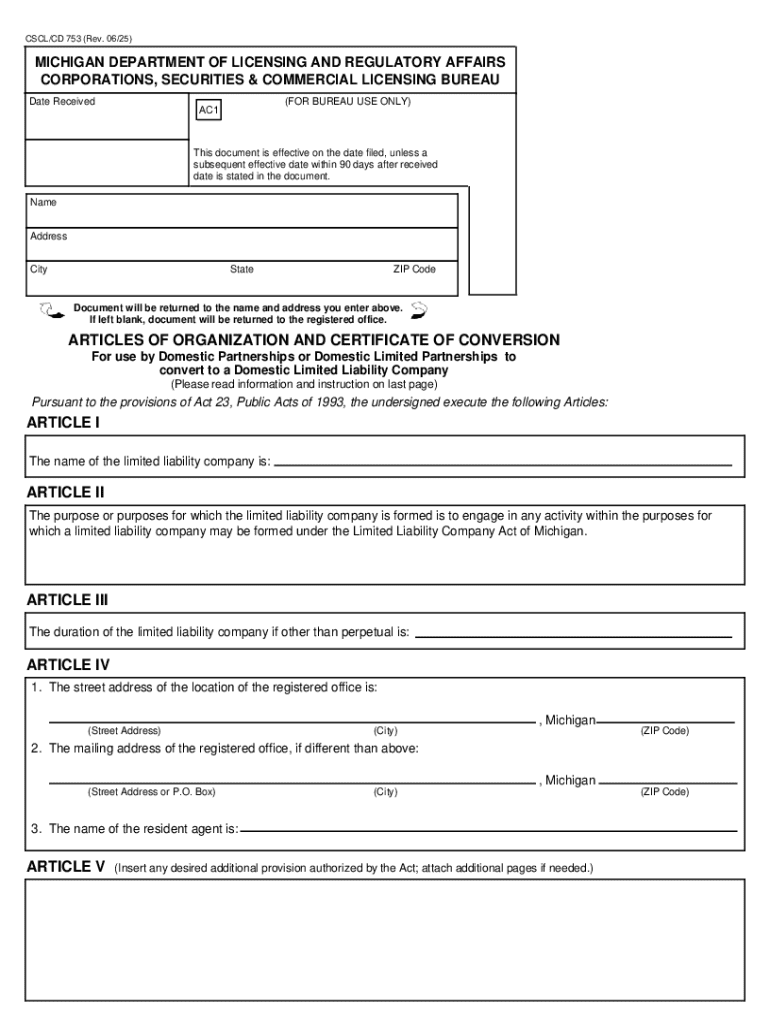

The CSCL/CD 753 form is a critical document used in Michigan for the conversion of domestic partnerships or limited partnerships into domestic limited liability companies (LLCs). This form serves as the official request to change the business structure, offering a pathway for partnerships to enjoy the benefits associated with LLCs. Its significance lies in its ability to provide clarity and legal standing to the entity, ensuring adherence to state laws.

By utilizing the CSCL/CD 753 form, business owners can streamline their operations under a structure that affords enhanced liability protection and improved flexibility in management. This transformation is essential for partnerships looking to evolve, adapt to market demands, and safeguard personal assets.

Understanding the need for the CSCL/ 753 form

Several scenarios necessitate the completion and filing of the CSCL/CD 753 form. The most common situation occurs when a domestic partnership desires to convert its structure into an LLC. This transition is often motivated by the appeal of limited liability protections, which shield personal assets from business liabilities and risks. Other benefits include simplified management, easier tax treatment, and enhanced credibility in business dealings.

Eligibility to file this form is typically limited to entities with clear operational history and partnerships that meet specific criteria set by Michigan law. Any domestic partnership or limited partnership considering this transition can take advantage of this form, as long as they meet the legal requirements necessary to maintain compliance.

Frequently asked questions (FAQs) about the CSCL/ 753 form

When it comes to filing the CSCL/CD 753 form, numerous common queries arise. Understanding these frequently asked questions can streamline the filing process and ensure compliance. One of the primary questions is about the documentation required for submission. Applicants must present their partnership agreement, proof of registration, and a Tax ID number. Knowing the necessary documents in advance can save time and potential delays.

Being prepared with the correct documents and understanding the timelines involved can significantly smooth the transition from a partnership to an LLC.

Step-by-step guide to filling out the CSCL/ 753 form

Before filling out the CSCL/CD 753 form, it's crucial to undertake several preparatory steps that lay the groundwork for a successful application. Ensure you gather all necessary information and documents, including your Partnership Agreement, Tax ID, and any prior registration information. Familiarizing yourself with the specifics required in each section of the form will help eliminate errors during the completion process.

Once the form is complete, review each section meticulously. Look for common mistakes such as missing signatures or incorrect entity names. To avoid any delays in processing, ensure the form is submitted correctly with all necessary documentation.

When ready to submit, there are several options available, including online submission, mailing, or in-person delivery to the appropriate state office. Payment can be made through various methods, including check or electronic transfer.

Tips for success in completing and submitting the CSCL/ 753 form

Ensuring a successful filing of the CSCL/CD 753 form hinges on attention to detail and an understanding of the form's requirements. Avoiding common mistakes such as incomplete information or incorrect filing methods is essential. Familiarize yourself with the instructions provided with the form, as they provide valuable insights into the requirements.

Utilizing resources such as pdfFiller can further streamline the process. Their platform offers tools for easy editing, signing, and managing forms to help ensure compliance.

Post-filing actions after submitting the CSCL/ 753 form

After submitting the CSCL/CD 753 form, it's important to know what to expect regarding processing times and outcomes. Typically, the timeline for processing is between 4-6 weeks, but this can vary based on current workloads at the state office. Upon approval, you will receive confirmation of your conversion, allowing you to operate legally as an LLC.

If there are any issues or requests for additional information, prompt action will ensure your application remains on track. It's crucial to be proactive in addressing any concerns raised by the state.

Don't forget to update your business records accordingly, including your operating agreement and any relevant documentation. Properly maintaining these records post-conversion will prevent confusion and ensure everyone is aligned with the new business structure.

Tools and resources for managing the CSCL/ 753 form

Among the many platforms available, pdfFiller stands out for document management and streamlining the process of handling the CSCL/CD 753 form. This cloud-based platform allows users to fill, edit, and electronically sign forms with ease. It provides the capability to collaborate on documents, which is especially useful when multiple partners are involved in the conversion.

Benefits of using pdfFiller include the ability to access documents from anywhere, saving time in editing and management, and the provision of secure storage for sensitive information. Its user-friendly interface ensures that even those with limited technical experience can navigate the platform successfully.

Alternative forms for specific situations

For entities considering other types of transformations, various forms beyond the CSCL/CD 753 exist. Understanding these alternatives can be beneficial; for example, the LLC-1 form is used for traditional LLC formations, whereas LLC-5 serves specific purposes for changes in registered agent or management. Knowing the right form to use is critical for ensuring compliance and efficiency in business operations.

Each of these forms serves distinct purposes and aligns with different legal requirements. Understanding your options will better equip you to choose the best path forward based on your business needs, minimizing the chances of errors or delays.

Legal considerations when using the CSCL/ 753 form

Compliance with Michigan laws is paramount when filing the CSCL/CD 753 form. Familiarity with relevant legal statutes and regulations surrounding business conversions is essential for avoiding costly mistakes. Non-compliance can result in penalties or delays, which might hinder business operations.

It's advised that businesses consulting legal professionals specializing in business law review their filing to ensure accuracy and adherence to local laws. Being proactive about compliance will save heartache down the line and facilitate a smoother transition to an LLC structure.

Conclusion: Importance of using the CSCL/ 753 form correctly

The CSCL/CD 753 form plays a significant role in business structuring in Michigan, enabling partnerships to transition smoothly into LLCs with enhanced protections and operational efficiency. Understanding the nuances of this form and the filing process ensures higher chances of success and compliance with state regulations.

Those looking to convert their business structures should prioritize accurate completion and thorough review of the CSCL/CD 753. Utilizing reliable tools like pdfFiller can simplify this journey, allowing for an organized and efficient approach to managing important business documentation.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the csclcd 753 electronically in Chrome?

Can I create an electronic signature for signing my csclcd 753 in Gmail?

How do I fill out csclcd 753 using my mobile device?

What is csclcd 753?

Who is required to file csclcd 753?

How to fill out csclcd 753?

What is the purpose of csclcd 753?

What information must be reported on csclcd 753?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.