Get the free Annual Payroll Reconciliation

Get, Create, Make and Sign annual payroll reconciliation

Editing annual payroll reconciliation online

Uncompromising security for your PDF editing and eSignature needs

How to fill out annual payroll reconciliation

How to fill out annual payroll reconciliation

Who needs annual payroll reconciliation?

Annual Payroll Reconciliation Form: How-to Guide

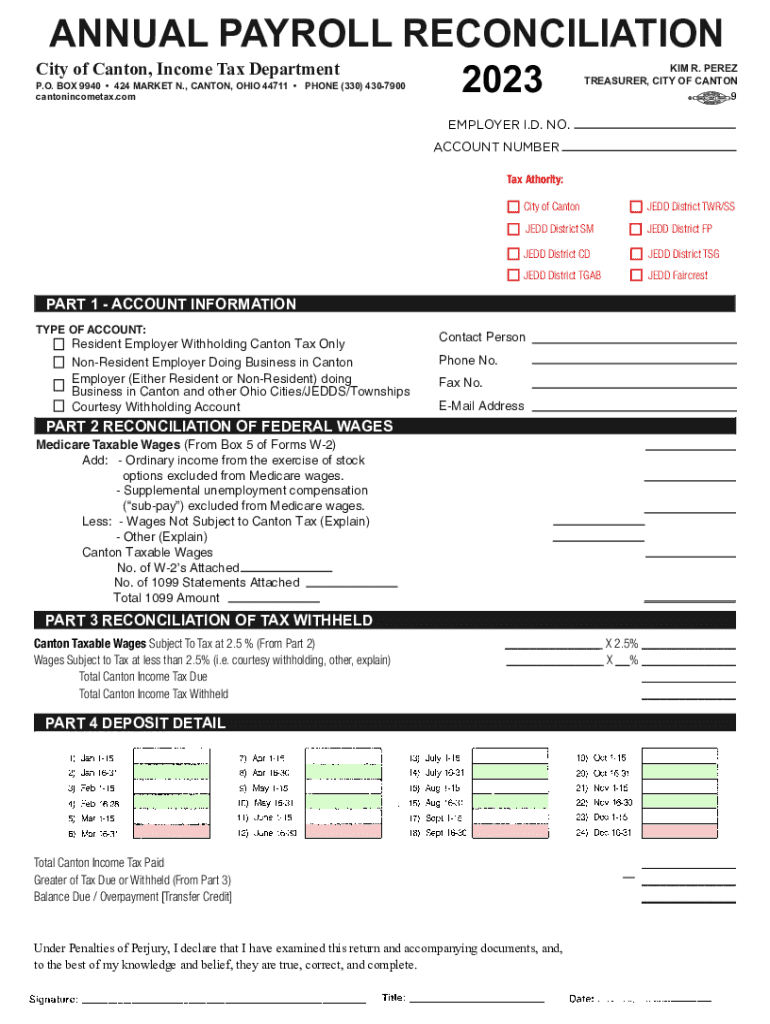

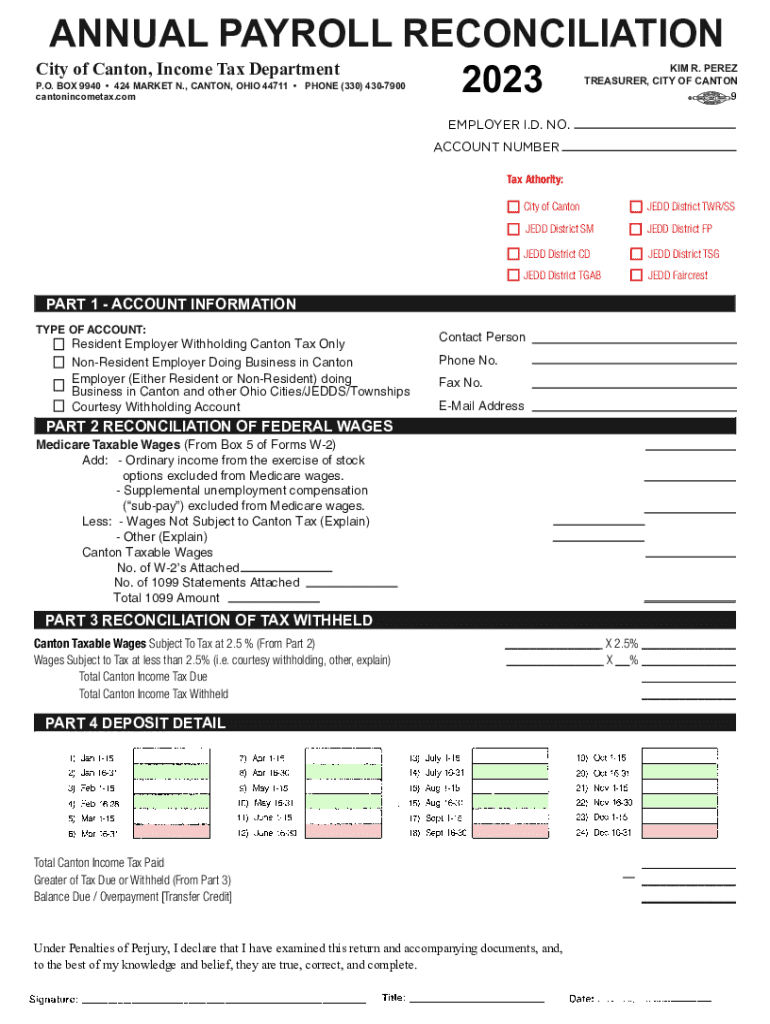

Understanding the annual payroll reconciliation form

The annual payroll reconciliation form is a critical document used by employers to summarize all payroll-related information for each employee over the reporting year. This form consolidates data such as total earnings, taxes withheld, and any adjustments made throughout the year. It serves as an essential tool for ensuring compliance with tax laws and regulation requirements, thereby safeguarding both employees' and employers' interests.

Annual payroll reconciliation holds significant importance in the workplace. It helps maintain accurate and transparent records, providing a complete picture of an employee's earnings and contributions. This process can prevent costly errors during tax filing, ensuring that employees are not over-taxed or under-taxed, which can lead to complications during audits.

Despite its importance, many employers harbor misconceptions about payroll reconciliation. Some believe it is solely a year-end task, while others think that a single mistake cannot affect the overall payroll process. In reality, payroll reconciliation should be part of a continuous review process to catch discrepancies early, thus facilitating a smoother year-end close.

Key components of the form

The annual payroll reconciliation form includes several key components that ensure all necessary information is accurately captured. The first major section typically contains employee details such as name, Social Security Number, and address. Accurate entry of this information is crucial as it directly impacts tax submissions and record-keeping.

Next, the earnings summary details the gross earnings for each employee, including base pay, overtime, and bonuses. It's essential to document any special adjustments made throughout the year to ensure a complete overview of the employee's earnings.

Additionally, the form includes sections for deductions and contributions, highlighting items such as health insurance, retirement contributions, and tax withholdings. Special adjustments might also reflect any corrections needed from previous payrolls or other necessary financial adjustments.

Common questions surrounding the components of this form often pertain to how to handle variations in employee statuses, late payroll entries, or how to document various deductions accurately. Clear guidelines must be established to handle these situations efficiently.

Preparing for completion

Proper preparation is key to a successful annual payroll reconciliation. Employers should gather all necessary documentation well in advance of the form's submission deadline. Essential documents include payroll records, employee tax information, and data on any deductions or benefits offered. Having the details organized and compiled will significantly streamline the process.

To ensure accurate data collection, it is advisable to double-check employee information against tax forms like the W-2 and any other relevant payroll reports. Accurate details are vital not only for tax compliance but also for maintaining trust within the workforce.

Understanding deadlines for submission is crucial. Many jurisdictions require forms to be submitted by specific dates in January following the end of the tax year, which necessitates timely preparation to meet compliance requirements.

Step-by-step guide to completing the form

Completing the annual payroll reconciliation form can seem daunting, but following a structured approach can simplify the process. Start by filling out the employee information accurately, ensuring there are no typos or inaccuracies since this could result in issues down the line.

Next, document the total earnings and any adjustments that occurred during the year. It's vital to break down earnings in detail and highlight any anomalies, such as significant bonuses or corrections to prior pay periods.

After calculating the taxes and deductions, ensure all items align with the documentation provided. A thorough review helps in catching potential errors before submission, thus avoiding complications later. Finally, submit the form in a timely manner to meet regulatory deadlines.

Common challenges and solutions

While preparing the annual payroll reconciliation form, challenges may arise. Common issues often involve missing information or incorrect calculations. These can lead to significant discrepancies affecting tax obligations or payroll accuracy.

To address missing information, regularly audit payroll records throughout the year. Implement a system to ensure data is updated consistently to prevent last-minute scrambles. Incorrect calculation issues can be mitigated by utilizing payroll software that automates tax calculations and provides error-checking features. Tools like pdfFiller can also enhance the accuracy of data entry by providing digitally editable forms.

If mistakes are discovered before submission, promptly correct them. Understand the necessary procedures to resubmit corrected forms to tax authorities. Leveraging pdfFiller tools can aid in this process by allowing easy editing and immediate updates.

Managing your reconciliation process

To ensure the annual payroll reconciliation process runs smoothly, it is essential to implement best practices. Regular reviews of payroll information throughout the year will aid in maintaining up-to-date records and minimize the end-of-year pressures.

Setting up a compliance calendar can also be beneficial. By mapping out critical dates and deadlines for submissions, employees responsible for payroll management can stay organized and ahead of potential workloads. Utilizing cloud tools allows for collaborative efforts across the team, ensuring all members are informed and involved in the preparation process.

Interacting with the annual payroll reconciliation form

When completing the annual payroll reconciliation form, employers may find themselves needing professional assistance. If uncertainties arise around compliance, tax laws, or how to accurately fill out specific sections, seeking help from a payroll specialist or tax advisor can be a prudent decision. This expertise can not only save time but also reduce the risk of costly mistakes.

Additionally, it's important for both employees and employers to understand their rights. Employees should be aware of their entitlements concerning reporting errors and tax obligations, while employers must understand their duties in providing accurate payroll information.

For additional resources, organizations like the IRS provide clear guidance and documents necessary for preparing payroll forms, while platforms like pdfFiller offer numerous tools for managing these documents efficiently.

Related services and documentation

Beyond the annual payroll reconciliation form, several other payroll-related documents are vital for efficient HR and finance management. These may include forms such as W-2s, 1099s, and various state and local tax forms. Understanding the integration of these forms with the annual payroll process helps employers maintain thorough and compliant records.

Using a platform like pdfFiller allows for the efficient management and editing of these documents. Integration with other business tools, such as accounting software, can further streamline payroll processes, ensuring all data is easily accessible and organized.

User testimonials and success stories

Real experiences shared by users of pdfFiller illustrate the impact of group collaboration and efficient document management on payroll processes. Users report that leveraging pdfFiller's innovative cloud-based platform significantly reduces time spent on preparing the annual payroll reconciliation form.

From enhanced accuracy during data entry to streamlined workflows, pdfFiller has aided numerous businesses, allowing them to focus on growth and compliance rather than becoming bogged down by administrative duties. Case studies reveal that integrating such tools encourages collaborative efforts among HR and finance teams, leading to improved payroll management.

Contact information for support

For users needing support while navigating the annual payroll reconciliation form, pdfFiller offers robust customer service. The support team is well-equipped to answer inquiries, offer guidance on document management, and assist with any technical issues that may arise.

Additionally, community support forums provide an avenue for users to share experiences and tips, creating a collaborative environment for problem-solving. The FAQ section on pdfFiller’s website also serves as a quick reference to address common issues and questions.

Bonus: Tips for a smooth payroll process year-round

To ensure a streamlined payroll process throughout the year, creating an audit checklist can be invaluable. This checklist should detail all necessary invoicing, payroll processing, and reporting tasks. By having a structured approach, organizations can reduce errors and improve accountability during the payroll cycle.

Moreover, leveraging technology can simplify payroll management. Tools like pdfFiller not only facilitate the creation and editing of necessary documents but also offer storage and sharing features to enhance collaboration. Staying informed about changes in tax regulations and legal requirements ensures that the payroll process remains compliant and efficient.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send annual payroll reconciliation to be eSigned by others?

Can I create an eSignature for the annual payroll reconciliation in Gmail?

Can I edit annual payroll reconciliation on an Android device?

What is annual payroll reconciliation?

Who is required to file annual payroll reconciliation?

How to fill out annual payroll reconciliation?

What is the purpose of annual payroll reconciliation?

What information must be reported on annual payroll reconciliation?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.