Get the free Chapter 34 Occupation Tax Ordinance ( ...

Get, Create, Make and Sign chapter 34 occupation tax

How to edit chapter 34 occupation tax online

Uncompromising security for your PDF editing and eSignature needs

How to fill out chapter 34 occupation tax

How to fill out chapter 34 occupation tax

Who needs chapter 34 occupation tax?

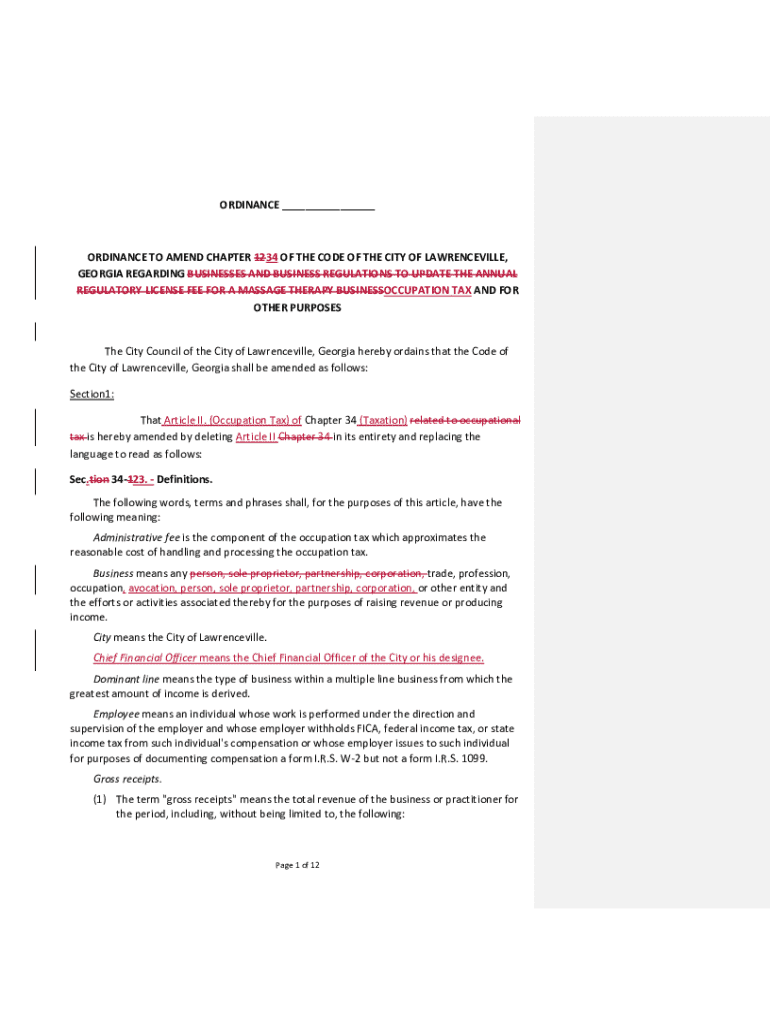

Understanding the Chapter 34 Occupation Tax Form

Understanding the Chapter 34 Occupation Tax Form

The Chapter 34 Occupation Tax Form is a crucial document utilized to assess the tax obligations of individuals and businesses engaged in various occupations. This form serves dual purposes: it establishes a legal framework for collecting taxes associated with occupational income and ensures compliance with local tax regulations. The form is particularly important for local government entities that rely on occupation taxes as key revenue sources.

Filing the Chapter 34 Occupation Tax Form is essential for proper financial record-keeping for both individuals and businesses. Failure to submit this form may lead to penalties, delayed tax processing, or even legal repercussions. Various jurisdictions require this form, notably cities and counties that implement occupational taxes to enhance their community's public services.

Who needs to fill out the Chapter 34 Occupation Tax Form?

The Chapter 34 Occupation Tax Form must be filled out by both individuals and businesses involved in activities deemed taxable by local regulations. Specifically, professionals, freelancers, and partnership businesses engaged in services or products that fall under the occupation tax category are required to file this form. Individuals earning income from their profession—regardless of whether they are self-employed or employees—should also complete this form.

Businesses, ranging from sole proprietorships to large corporations, also need to pay close attention. Certain trades or occupations, such as construction, hospitality, and entertainment, may have unique stipulations regarding the occupation tax. For example, a contractor doing business in a municipality with an occupation tax needs to report their earnings accurately, while an office employee in the same area may have different requirements based on local laws.

Key components of the Chapter 34 Occupation Tax Form

The Chapter 34 Occupation Tax Form is structured to collect essential information that facilitates the determination of tax liability. The form includes several critical sections that taxpayers must complete with precision to ensure compliance. Primarily, the sections consist of general personal information, business details if applicable, income declarations, and the calculation of taxes owed.

Each of these sections has specific requirements: personal information identifies the taxpayer, while business details encompass the nature of enterprise and any relevant registration numbers. Income declarations are pivotal, as they define tax liability based on earnings from occupational activities. Finally, the tax calculation section often includes a breakdown of applicable tax rates which vary depending on the occupation type or local jurisdiction, requiring users to accurately refer to local tax guidelines.

Step-by-step guide to completing the Chapter 34 Occupation Tax Form

Completing the Chapter 34 Occupation Tax Form may seem daunting, but breaking it down into manageable steps simplifies the process significantly. First and foremost, gather all the necessary documentation relevant to your income and business. This could include income statements, proof of business registration, and other supporting documents required by your local jurisdiction.

Once your documents are in order, begin filling out personal information accurately. Ensuring correct details here establishes a strong foundation for the rest of the form. Then, disclose your occupation and income details completely and honestly. This transparency is crucial for tax calculation; utilize precise figures rather than estimates. After entering this information, calculate your tax obligation based on provided tax rates, keeping a detailed record of the methods used for calculations. Before finalizing, review the form meticulously for any inaccuracies or omissions. Finally, submit the form electronically or by mail as per your locality’s requirements.

Common mistakes to avoid when filling out the form

Mistakes on the Chapter 34 Occupation Tax Form can lead to unnecessary complications and delays. Some common errors include misreporting income figures, neglecting to include all applicable deductions, and failing to submit the form by local deadlines. Users should refrain from guessing figures; instead, rely on accurate records to substantiate all reported information.

To mitigate these risks, double-check each entry against supporting documents. Review the instructions provided with the form carefully, as each jurisdiction may have specific rules and nuances affecting how the form should be completed. If uncertain about particular fields, consult local resources or seek professional advice to clarify any discrepancies before submission.

eSigning & sending your Chapter 34 Occupation Tax Form

After completing the Chapter 34 Occupation Tax Form, you will need to sign it before submission. The eSignature process simplifies this task, making it possible to approve documents digitally without needing to print, sign, and scan. This method not only saves time but also enhances the security of your personal information during transmission.

Utilizing solutions such as pdfFiller for eSigning provides a smooth and efficient way to finalize your Chapter 34 Occupation Tax Form. Following instructions to create an electronic signature ensures your form is signed correctly and complies with local regulations. Once completed, confirm your submission via email or direct acknowledgement from the relevant tax authority.

Managing your Chapter 34 Occupation Tax Form with pdfFiller

pdfFiller offers an array of features designed to make managing your Chapter 34 Occupation Tax Form straightforward and efficient. After submitting your form, you can easily edit it if corrections are needed. The platform supports robust document management solutions, ensuring all your records are accessible in one centralized location.

For teams handling multiple tax documents, pdfFiller provides collaboration tools that facilitate seamless sharing and editing without the risk of data loss. The platform’s cloud-based nature allows for on-the-go management, ensuring that users can access and update their forms wherever they are, making it easier to stay compliant and organized.

Frequently asked questions (FAQs)

Many common queries arise concerning the Chapter 34 Occupation Tax Form. A frequent question pertains to deadlines for submission, which can vary by locality—it's crucial for taxpayers to check local government deadlines to avoid late penalties. Another common concern involves submission methods; while many jurisdictions now accept electronic submissions, others may still require forms to be mailed in.

Lastly, individuals frequently ask about the penalties associated with late filing. Understanding the consequences of noncompliance can motivate timely submissions. Each jurisdiction has its policies regarding penalties, so consulting local tax offices for accurate information is advisable.

Additional tools and features on pdfFiller

Beyond managing the Chapter 34 Occupation Tax Form, pdfFiller provides a wealth of additional tools for users. One popular feature is the existence of interactive templates for other tax forms, making it easier to streamline a range of tax obligations through one platform. Users can explore various document types tailored to different legal and financial needs.

Furthermore, pdfFiller's document management solutions equip individuals and teams with functionalities to create, edit, and store vital documents securely in a cloud environment. The platform’s versatility means that whether you’re working from home, at the office, or on the go, comprehensive access to essential documents is always at your fingertips. This flexibility allows users to maximize efficiency while ensuring compliance with all necessary regulations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my chapter 34 occupation tax directly from Gmail?

How do I edit chapter 34 occupation tax straight from my smartphone?

How do I complete chapter 34 occupation tax on an iOS device?

What is chapter 34 occupation tax?

Who is required to file chapter 34 occupation tax?

How to fill out chapter 34 occupation tax?

What is the purpose of chapter 34 occupation tax?

What information must be reported on chapter 34 occupation tax?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.