Get the free Hotel-motel Room Tax Permit Application

Get, Create, Make and Sign hotel-motel room tax permit

Editing hotel-motel room tax permit online

Uncompromising security for your PDF editing and eSignature needs

How to fill out hotel-motel room tax permit

How to fill out hotel-motel room tax permit

Who needs hotel-motel room tax permit?

Hotel-Motel Room Tax Permit Form: A Comprehensive Guide

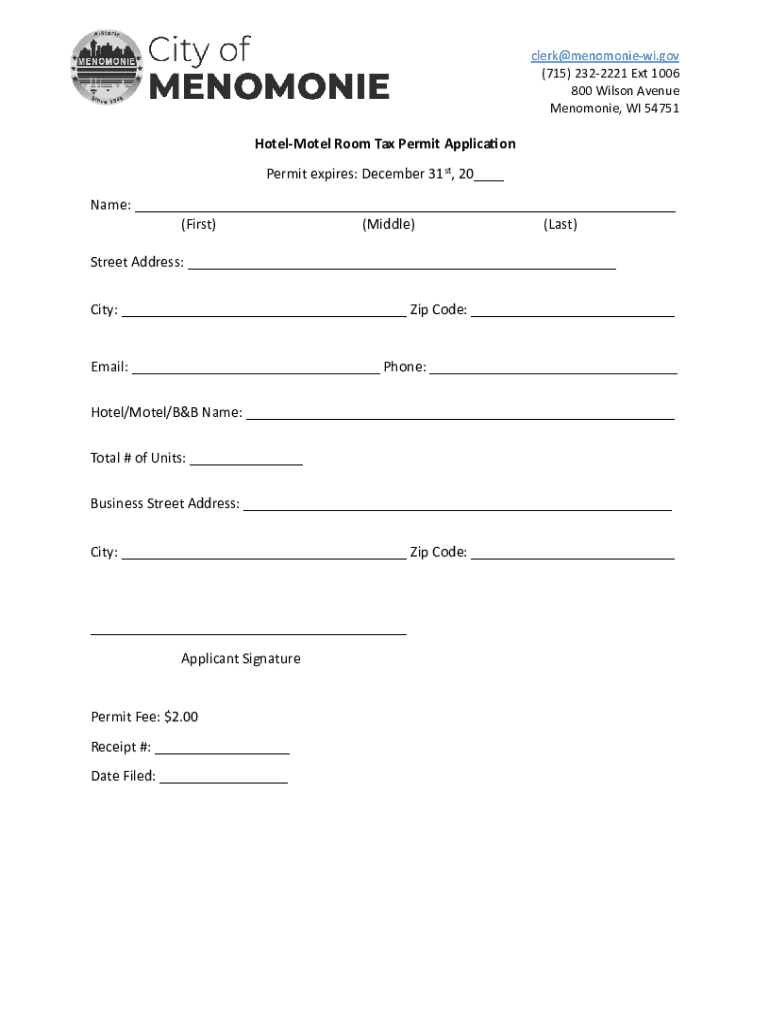

Overview of the hotel-motel room tax permit form

Understanding the hotel-motel room tax permit form is crucial for anyone involved in the hospitality industry. This form serves as official documentation that allows lodging providers to collect and remit local room taxes. The room tax grant is mandated by municipalities to fund various public services, and compliance is enforced to ensure fair contributions to community needs.

Without this permit, hotel and motel operators risk significant penalties, including fines and revocation of business licenses. Essentially, the hotel-motel room tax permit form acts as a bridge between business operations and local regulations, aiding both governmental bodies and businesses in maintaining a seamless flow of tax revenue.

Anyone providing temporary lodging, whether a large hotel chain or an independent motel, must secure this permit. It applies broadly, serving both conventional establishments and newer types of temporary accommodations, such as short-term rental properties.

Steps to obtain your hotel-motel room tax permit

Acquiring a hotel-motel room tax permit involves a series of steps. Here’s how to navigate the process effectively.

Step 1: Determine eligibility

First, you must verify your eligibility. Most local governments dictate specific criteria that you must meet to qualify for the room tax permit. Generally, this means you need to operate a property that provides temporary accommodations. However, there may be common exclusions, such as private rentals that fall outside of designated zoning areas.

Step 2: Gather required information

Next, gather the necessary documentation for your application. A standard list may include the following items:

Step 3: Fill out the permit form

After gathering your documents, fill out the hotel-motel room tax permit form. It includes specific fields requiring detailed information about your business operations. Take your time to ensure accuracy, as incomplete information can result in delays.

Step 4: Submit your application

Submit your completed form along with any associated fees, which vary depending on your locality. Be sure to check your local tax authority's website for submission options, which could include online submissions or in-person visits.

Interactive tools and features on pdfFiller

Utilizing tools like pdfFiller can make the application process smoother. With editable templates available, you can easily customize your hotel-motel room tax permit form, ensuring all your inputs are tailored specifically to your needs.

Moreover, pdfFiller provides e-signature solutions, allowing you to quickly authorize the document electronically. This not only speeds up the process but also maintains a secure chain of custody for your application. Additionally, its collaborative features are fantastic for teams, enabling multiple stakeholders to provide input and review the application before submission.

Managing your hotel-motel room tax permit

Once you've received your permit, management is key to staying compliant. Start by tracking your application status periodically, which usually involves a follow-up with the local tax authority. Since approval times can vary, establishing a clear communication line early in the process saves future headaches.

Renewing your permit

Renewal processes typically vary, but you should expect to undergo a similar procedure as the initial application. Be aware of expiration dates and begin your renewal process well in advance to avoid lapses in compliance. Regular reviews of your financial records and operational adjustments are advisable to ensure they meet evolving regulations.

Common questions and troubleshooting

It's common to have questions during the application process. For instance, you might wonder how to handle a situation where your application is rejected. If this happens, take time to understand the reasons given for rejection and address those specific issues before reapplying.

Frequently asked questions (FAQs)

A few frequently asked questions include: - What is the average time for permit approval? - Are there any exemptions available? - What happens if I fail to collect the tax?

By preparing answers to these common inquiries, you can streamline your understanding of the whole process and ensure that you're well informed.

Contact information for assistance

Should you need assistance, reaching out to your local tax authority is the best first step. They can provide clarity on specific requirements and processes unique to your area. Additionally, many state tax departments have robust online resources, including help centers that can guide you through the complexities.

Related documents and forms

To successfully navigate the permit process, familiarize yourself with other essential documents. This includes business registration forms and any exemption certificates if applicable to your operation.

Upcoming events and updates

Stay informed about any upcoming training sessions or seminars related to the hotel-motel room tax permit process. Local governments occasionally update regulations, and participating in information sessions is a proactive way to adapt to any changes that could affect your operations.

Web links and resources

For official guidelines and resources, government websites are a reliable source. They provide the most accurate and up-to-date information regarding permits and compliance. Utilizing these resources effectively can save time and enhance your understanding of local regulations.

Web accessibility and user support

Leveraging the support features available at pdfFiller can significantly enhance your user experience. If you encounter difficulties, their customer support and accessible resource guides offer the help you need to ensure your forms are filled out correctly and meet compliance standards.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute hotel-motel room tax permit online?

Can I sign the hotel-motel room tax permit electronically in Chrome?

How do I fill out the hotel-motel room tax permit form on my smartphone?

What is hotel-motel room tax permit?

Who is required to file hotel-motel room tax permit?

How to fill out hotel-motel room tax permit?

What is the purpose of hotel-motel room tax permit?

What information must be reported on hotel-motel room tax permit?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.