Get the free Hotel/motel Room Tax Exemption

Get, Create, Make and Sign hotelmotel room tax exemption

How to edit hotelmotel room tax exemption online

Uncompromising security for your PDF editing and eSignature needs

How to fill out hotelmotel room tax exemption

How to fill out hotelmotel room tax exemption

Who needs hotelmotel room tax exemption?

Understanding Hotel/Motel Room Tax Exemption Forms: Your Comprehensive Guide

Understanding hotel/motel room tax exemption

The hotel/motel room tax exemption form is a critical document for eligible individuals and organizations that seek to avoid paying local hotel or motel taxes during their stays. This exemption can result in significant financial savings, especially for those traveling for purposes aligned with the mission of non-profit organizations or government functions.

The primary purpose of this exemption is to facilitate travel and accommodation expenses for entities that are exempt from certain taxes, allowing them to allocate resources more effectively to their core mission. For example, many educational institutions and charities benefit from such exemptions, enabling them to host seminars, training, or other activities without incurring additional tax burdens.

Who qualifies for the exemption?

Eligibility for hotel/motel room tax exemption generally falls into two categories: organizations and individuals. Types of organizations that might qualify include non-profits, educational institutions, and governmental entities. For instance, a nonprofit hosting a fundraising event can utilize this form to save on hotel accommodations.

Individuals also qualify under certain circumstances, particularly government officials and business travelers representing exempt entities. It is crucial for both parties to provide evidence of their eligibility through proper documentation and justification of their travel purpose.

Overview of the tax exemption process

Navigating tax regulations associated with hotel/motel taxes can be complex. Specific state and local laws govern these exemptions, which means understanding your location’s regulations is essential. These laws can vary widely, including differences in tax rates depending on where you’re staying.

Securing a room tax exemption not only helps in cutting costs but also simplifies compliance and record-keeping. Maintaining accurate records allows travelers and organizations to verify their exemption status and ensures they remain in good standing with tax authorities.

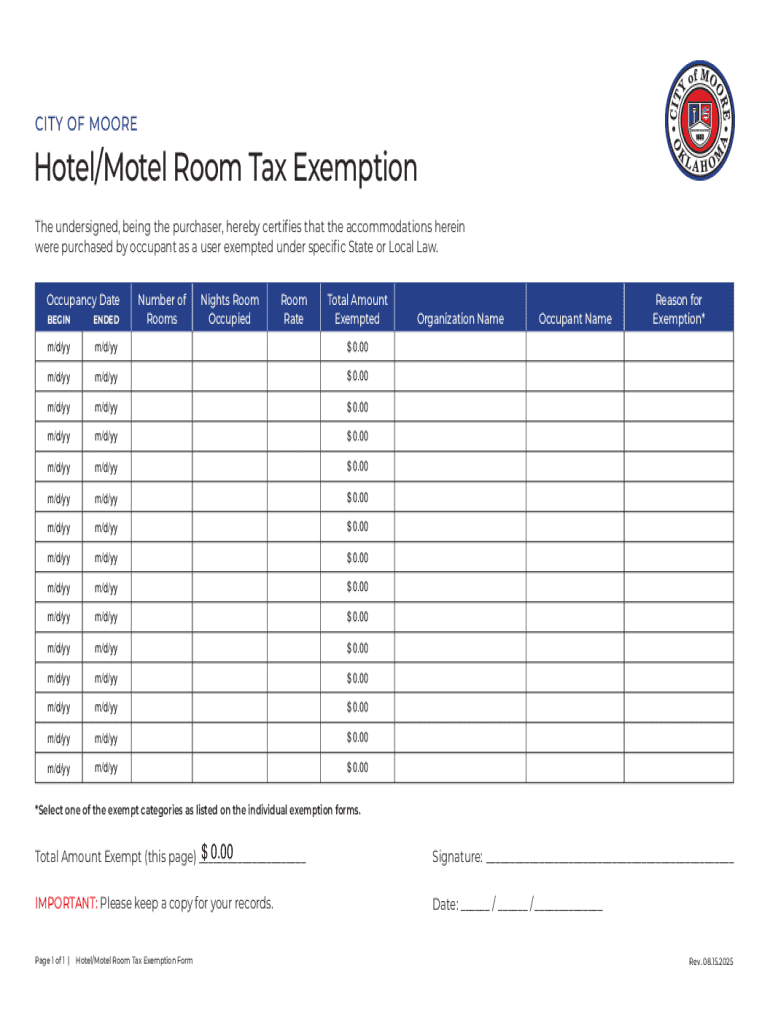

Detailed guide to the hotel/motel room tax exemption form

The hotel/motel room tax exemption form serves as the foundational support for exemption claims. Without it, eligible travelers or organizations may inadvertently incur unnecessary tax liabilities. This form functions as a formal request for tax relief, functioning within the confines of local legislation.

To access the form, you can typically find it on your local tax authority's website. For example, many states provide downloadable forms directly from their tax division pages. Ensure that you have access to a printer, as you will need a physical copy to fill out and submit.

Step-by-step instructions for completing the form

Before you start filling out the hotel/motel room tax exemption form, gather all necessary information. This includes details about your organization (if applicable), the purpose of your travel, and your accommodation dates. Having these details on hand simplifies the filling process and reduces the risk of errors.

Breaking down the form section-by-section will help ensure completeness: start with your personal information, such as your name and contact details. If applying for an organization, include the legal name and tax identification number. Be specific when stating the purpose of your travel, as this justification is crucial for gaining approval.

Submitting the hotel/motel room tax exemption form

After completing the hotel/motel room tax exemption form, it’s time to submit it for processing. Many locations allow for online submissions through their respective tax authority's website, while others may require physical mail. If mailing, be sure to keep a copy of the application for your records.

In case of any confusion, reaching out to your local tax authority can offer clarification. They often have dedicated staff to assist with tax exemption questions. Additionally, many tax offices provide FAQs addressing common concerns that filers encounter.

Managing your exemption records

Keeping diligent documentation of your hotel/motel room tax exemption applications is essential for compliance and future reference. Maintain copies of all submitted forms along with any correspondence with tax authorities. This organization can save time in case of audits or queries regarding your exemption status.

If you want to track the status of your submitted exemption request, most tax agencies provide an online portal or hotline. Following up on the status of your application can help prevent misunderstandings and ensure that your exemption is acknowledged and approved.

Interactive tools and resources

Utilizing tools like pdfFiller can significantly simplify the process of managing your hotel/motel room tax exemption form. With pdfFiller, you can edit, sign, and collaborate on documents from any device. This cloud-based platform allows for easy access and organization of crucial forms.

The steps are straightforward: upload the PDF form to your pdfFiller account, make necessary edits, and use the eSignature feature to sign electronically. Additional collaborative features enable team members to work together seamlessly, boosting efficiency for those managing multiple forms.

Common issues and solutions with form submissions

Filers of the hotel/motel room tax exemption form often encounter challenges that may hinder their approval process. Common issues include incomplete submissions, incorrect signatures, or failure to provide adequate justification for tax status. Recognizing these pitfalls can prepare you to avoid them.

If a submission is denied, understanding the process for appealing or contesting this decision can be crucial. Promptly addressing any required fixes or additional documentation can greatly improve the chances of approval on resubmission.

Staying informed on tax changes

Tax regulations are subject to frequent changes, and it is vital for travelers and organizations to stay informed about these updates. Regularly reviewing your eligibility and being aware of changes in tax laws that could affect your status is foundational for long-term compliance.

Engaging with local or state tax bodies can provide additional insights and resources. Many agencies offer educational workshops that can further demystify tax exemption requirements and processes.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit hotelmotel room tax exemption from Google Drive?

How can I get hotelmotel room tax exemption?

Can I create an electronic signature for the hotelmotel room tax exemption in Chrome?

What is hotelmotel room tax exemption?

Who is required to file hotelmotel room tax exemption?

How to fill out hotelmotel room tax exemption?

What is the purpose of hotelmotel room tax exemption?

What information must be reported on hotelmotel room tax exemption?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.