Get the free Hotel/motel Room Tax Permit Application

Get, Create, Make and Sign hotelmotel room tax permit

Editing hotelmotel room tax permit online

Uncompromising security for your PDF editing and eSignature needs

How to fill out hotelmotel room tax permit

How to fill out hotelmotel room tax permit

Who needs hotelmotel room tax permit?

Your Guide to HotelMotel Room Tax Permit Form: Everything You Need to Know

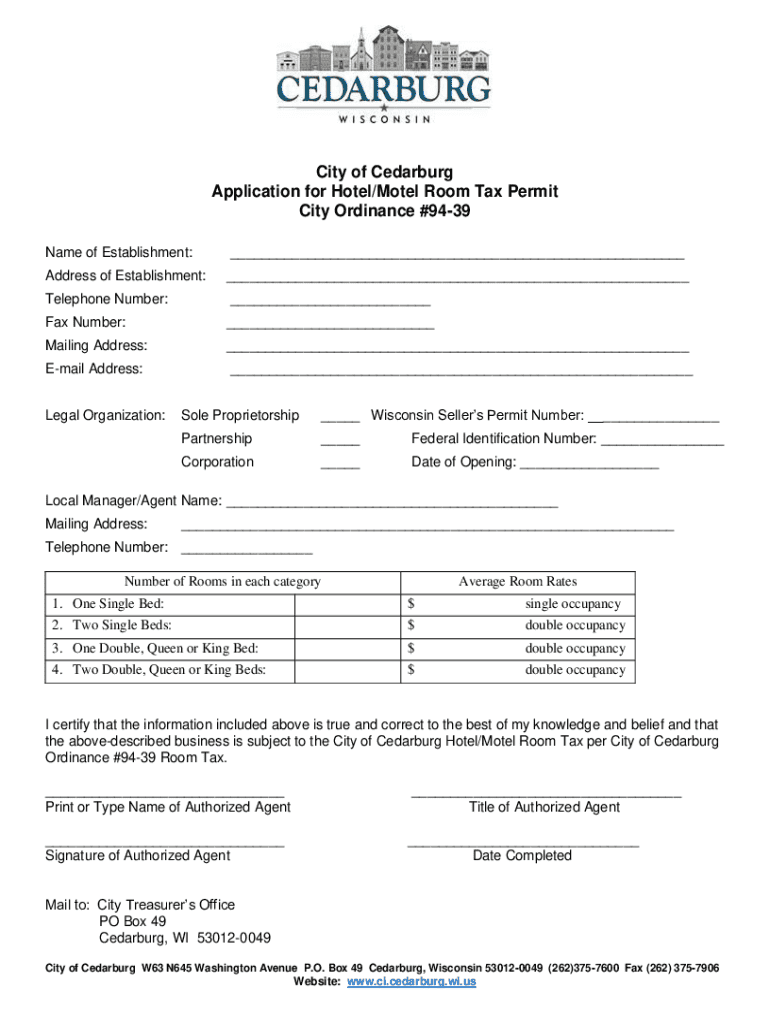

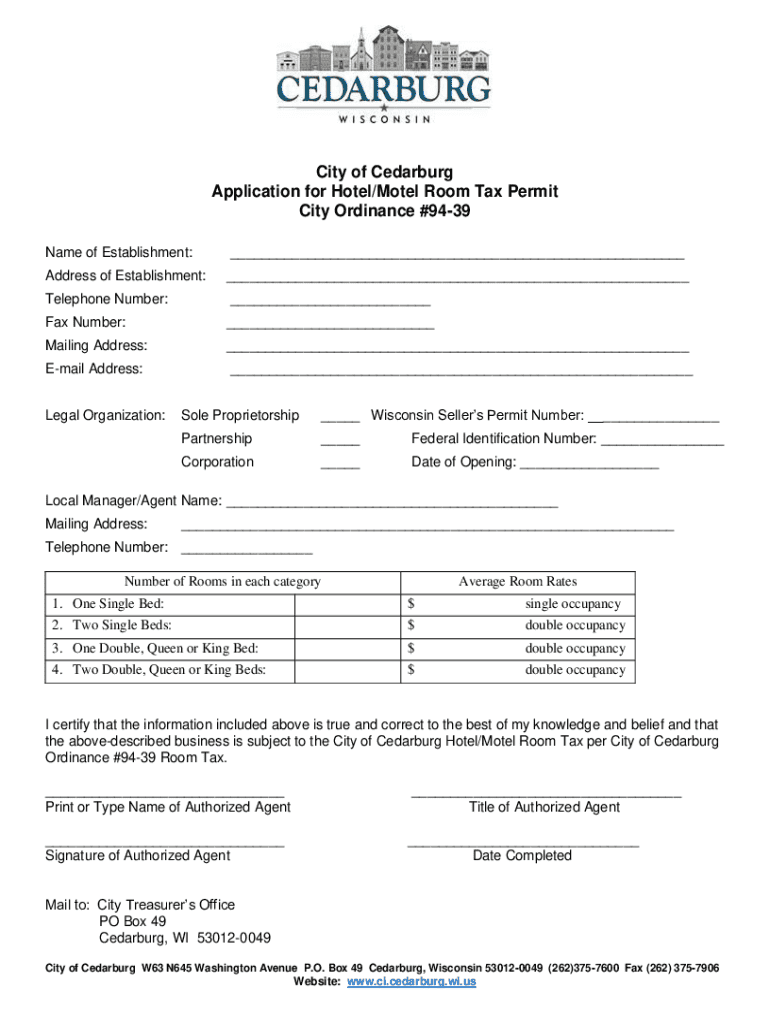

Overview of hotelmotel room tax permits

A hotelmotel room tax permit is a necessary legal document that allows hotel and motel operators to collect local taxes from guests who occupy their facilities. This tax, often referred to as a transient occupancy tax or lodging tax, is typically imposed by state and local governments to generate revenue for specific projects, such as tourism promotion or infrastructure development. For hotel and motel operators, obtaining this permit is essential not only for legal compliance but also for maximizing the financial benefits derived from their operations.

A well-understood room tax framework creates a transparent and fair environment for both hotel operators and guests. Operators who understand the nuances of their local taxation laws are better positioned to comply efficiently and avoid costly fines. Important terms within this domain include the 'room tax permit,' which certifies that operators are authorized to charge guests this tax, and 'jurisdictional variations,' which refer to differences in tax laws that can vary widely from one locality to another.

Understanding the hotelmotel room tax permit requirements

Before applying for a hotelmotel room tax permit, it's important to understand the eligibility criteria, which can differ by jurisdiction. Typically, any establishment that allows guests to stay overnight for a fee, including hotels, motels, inns, and vacation rentals, must obtain this permit. By gathering relevant documentation ahead of time, the process becomes considerably smoother.

Step-by-step guide to filing for a hotelmotel room tax permit

Filing for a hotelmotel room tax permit can seem overwhelming, but breaking it down into a step-by-step guide simplifies the process. Start by preparing your application, ensuring to fill out each section with accuracy, as incorrect information can lead to delays or denials.

Managing your hotelmotel room tax permits

Once your hotelmotel room tax permit is approved, managing it becomes crucial for continued compliance. Keep track of permit expiration dates and any renewal requirements to avoid lapsing your permit, which can lead to fines or operational restrictions.

Tools and resources for effective document management

In today's digital age, leveraging document management tools is vital for maintaining compliance and streamlining operations. pdfFiller is an excellent platform for creating and editing your hotelmotel room tax permit form and related documents.

Frequently asked questions (faqs) about hotelmotel room tax permits

Despite the relatively straightforward process of applying for a hotelmotel room tax permit, many operators still have questions. Understanding common challenges can alleviate stress and streamline operations.

Best practices for tax compliance

To ensure ongoing compliance, hotels and motels must establish best practices in managing their tax obligations. Regular reviews and organized documentation can dramatically reduce the risk of errors.

Case studies and examples

Learning from those who have successfully navigated the hotelmotel room tax permit process can provide valuable insights. Examining success stories alongside common pitfalls elucidates best practices.

Conclusion and next steps

In summary, acquiring and managing a hotelmotel room tax permit is essential for any hospitality operation. With the aid of tools like pdfFiller, you are empowered to manage your documents with ease. Stay informed about ongoing changes and utilize the right resources to ensure compliance.

Taking deliberate steps toward understanding your tax obligations will not only minimize legal risks but will also position your establishment for success in an increasingly competitive marketplace.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get hotelmotel room tax permit?

Can I create an electronic signature for signing my hotelmotel room tax permit in Gmail?

How do I edit hotelmotel room tax permit straight from my smartphone?

What is hotelmotel room tax permit?

Who is required to file hotelmotel room tax permit?

How to fill out hotelmotel room tax permit?

What is the purpose of hotelmotel room tax permit?

What information must be reported on hotelmotel room tax permit?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.