Get the free Arts Income Tax Return

Get, Create, Make and Sign arts income tax return

How to edit arts income tax return online

Uncompromising security for your PDF editing and eSignature needs

How to fill out arts income tax return

How to fill out arts income tax return

Who needs arts income tax return?

A comprehensive guide to the arts income tax return form

Understanding the arts income tax return form

The arts income tax return form serves as a crucial document for artists and arts organizations, enabling them to report and assess their income, expenses, and tax obligations. This specialized form helps capture the unique financial landscape of individuals and entities engaged in artistic endeavors. Accurate completion and submission of this form not only fulfill legal requirements but also help in unlocking potential benefits, including grants, loans, and other financial aids tailored to the arts community.

For artists, the importance of accurate tax reporting cannot be overstated. Misreporting income or overlooking applicable deductions can lead to unnecessary tax burdens or legal complications. Given the unique nature of arts income—which may comprise sales, royalties, and fees for performances or exhibits—understanding how to effectively navigate the arts income tax return form is essential for maintaining financial health in an often unpredictable industry.

Who needs to file the arts income tax return form?

Eligibility to file the arts income tax return form extends to a broad spectrum of professionals within the arts sector. Both individual artists and organizations significantly engaged in arts production or performance must be familiar with this form. Student artists or emerging creators who generate income from their projects, even if not full-time, may also need to file under certain income thresholds.

Required documents for filing

Preparing to file the arts income tax return form requires gathering essential supporting documents that validate income reports and deductions. Adequate documentation not only strengthens the validity of submitted information but also simplifies the filing process.

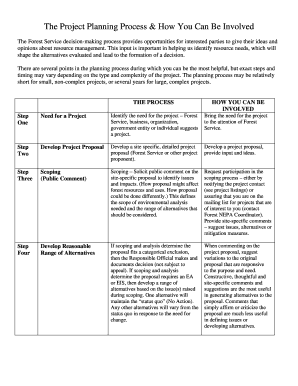

Step-by-step guide to filling out the arts income tax return form

Filing the arts income tax return form can seem daunting, but breaking it down into manageable sections demystifies the process. Each section of the form serves a specific purpose and requires detailed input.

Accuracy is key throughout this form. Artists should take the time to review entries, cross-reference income statements with bank records, and consult resources to clarify potential deductions. Common mistakes to avoid include misentering figures and not providing necessary documentation.

Interactive tools for simplifying the process

The advent of digital tools has revolutionized document management, making it easier for artists and arts organizations to handle their tax obligations efficiently. pdfFiller offers interactive solutions specifically designed to facilitate the creation, editing, and signing of forms, including the arts income tax return form.

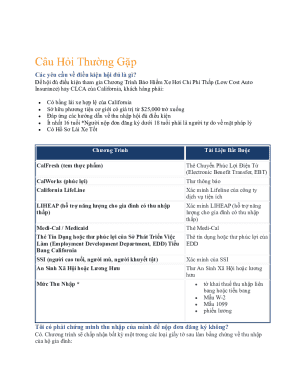

FAQs on the arts income tax return form

As artists delve into the arts income tax return form, it often raises numerous questions. Here are some frequently asked questions that might assist in clarifying concerns regarding tax filing for arts income.

Clarifying these questions can significantly ease the stress of tax season, ensuring artists focus more on their creativity than on confusion surrounding financial obligations.

Keeping track of changes in tax laws

Tax regulations can shift, impacting how arts income is reported and taxed. It's vital for artists to remain informed about recent developments in tax law, particularly those relevant to their unique circumstances.

Continuing education is vital not only for compliance but also for optimizing tax benefits and ensuring all deductions are fully leveraged.

Contact information for tax support

Navigating the complexities of the tax system can sometimes require assistance. For individuals dealing with complicated cases or needing specific advice, contacting professionals is advisable. Many organizations offer workshops, supporting both individual artists and arts organizations in understanding their tax responsibilities.

Related topics and resources

Understanding the arts income tax return form also opens the door to a broader financial literacy within the arts. Artists should be aware of other relevant tax forms, support programs, or funding opportunities available for creatives.

These resources contribute not only to compliance but also to an artist's longevity and success in a thriving, yet often unpredictable industry.

Engaging with the arts community

Networking within the arts community can yield valuable insights and support. Artists are encouraged to participate in workshops, seminars, or online forums where experiences regarding tax obligations are shared and discussed. Engaging with local arts organizations can foster collaboration and resource-sharing.

This collaborative spirit within the arts ecosystem strengthens communities while providing essential resources, ultimately benefiting everyone's creative journey.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the arts income tax return electronically in Chrome?

How do I fill out arts income tax return using my mobile device?

How do I complete arts income tax return on an iOS device?

What is arts income tax return?

Who is required to file arts income tax return?

How to fill out arts income tax return?

What is the purpose of arts income tax return?

What information must be reported on arts income tax return?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.