Get the free 990-w

Get, Create, Make and Sign 990-w

How to edit 990-w online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 990-w

How to fill out 990-w

Who needs 990-w?

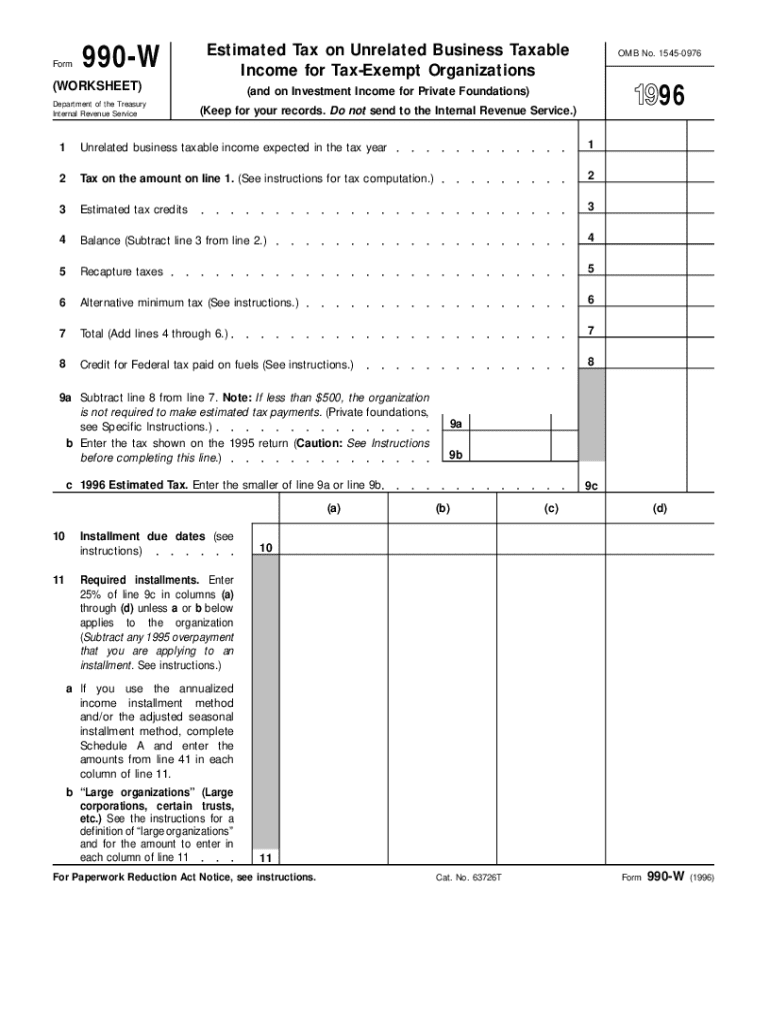

990-W Form: A Comprehensive How-to Guide

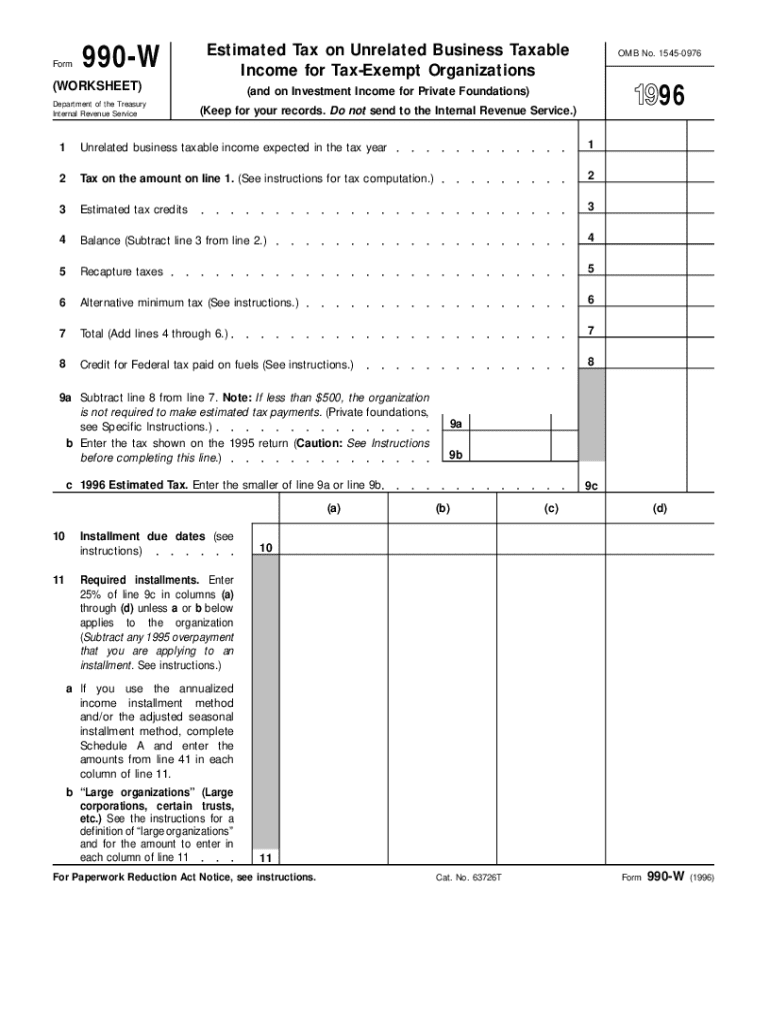

Understanding Form 990-W

Form 990-W, also referred to as the 'Estimated Tax for Individuals, Estates, and Trusts,' is a crucial document used by taxpayers to calculate and pay their estimated tax obligations. This form is particularly important for those who anticipate owing a certain amount of tax during the year and wish to avoid unexpected tax liabilities at year-end. Filing Form 990-W allows taxpayers to make timely estimated tax payments, which can prevent any penalties for underpayment.

The significance of Form 990-W in tax compliance cannot be overstated. It assists individuals, estates, and trusts in accurately computing their estimated tax based on projected income, deductions, and credits. By strategically managing payments throughout the year, taxpayers can ensure they remain compliant with tax regulations and minimize their financial risk.

Who needs to file Form 990-W?

Individuals and entities required to file Form 990-W typically include those whose tax liability is expected to be $1,000 or more for the year. Specifically, self-employed individuals, partners in a partnership, and shareholders in an S corporation fall under this category. Additionally, estates and trusts that anticipate taxable income meeting or exceeding certain thresholds are also mandated to file.

However, some exceptions apply. For example, if you expect your withholding and refundable credits to cover your tax liability, or if you meet specific conditions outlined by the IRS, you may not be required to file Form 990-W. Understanding these nuances is essential for maintaining compliance without incurring unnecessary obligations.

Filing requirements for Form 990-W

To determine eligibility for filing Form 990-W, taxpayers must evaluate their income relative to the IRS provided thresholds. For the 2023 tax year, individuals expecting a tax liability of $1,000 or more must file this form. Trusts and estates follow similar guidelines, with specific thresholds that may vary. It’s crucial to analyze your financial situation each year to establish your obligations.

The timeline for filing Form 990-W consists of key deadlines that taxpayers must follow. Generally, estimated taxes must be paid in four separate installments throughout the year, falling on April 15, June 15, September 15, and January 15 of the following year. Taxpayers must be mindful of these dates to avoid penalties and interest on late payments.

Key components of Form 990-W

Understanding each section of Form 990-W is critical for accurate completion. The form is divided into several parts, including income reporting, deductions, and tax calculations. Each section must be filled out thoughtfully to present an accurate estimate of the expected tax liability. Taxpayers should review the form thoroughly to ensure they provide correct entries that reflect their financial activities.

A glossary of common terms associated with Form 990-W can assist in navigating the complexities of tax obligations. Terms such as 'gross income,' 'deductions,' 'tax credits,' and 'estimated tax' play pivotal roles in understanding how to calculate and manage payments effectively. Familiarity with these terms will enable better comprehension and more robust filing practices.

Step-by-step guide to completing the 990-W form

Gathering necessary information is the first step in completing Form 990-W. Essential documents include your previous year’s tax return, details about any income received, and documentation for deductions you intend to claim. Having these materials organized can simplify the filing process and ensure accuracy.

Next, you will begin filling out the form. Here’s how to approach each section:

It’s important to be aware of common mistakes to avoid when completing Form 990-W. Frequent errors include miscalculating income, overlooking applicable deductions, and failing to check for accuracy before submission. Taking the time to double-check all entries can help prevent complications that lead to penalties or further scrutiny.

Editing and managing your 990-W form

Utilizing tools for editing PDFs can streamline the management of your Form 990-W. pdfFiller offers a comprehensive suite of PDF editing functionality that makes it easy to import, edit, and format your 990-W form. With digital capabilities, users can conveniently adjust entries, ensuring optimal accuracy.

Furthermore, pdfFiller provides advanced eSignature features that enable secure signing of your completed form. Collaborating with team members on tax-related documentation is made easy through sharing options which allows for seamless updates and access.

Filing and submission options for Form 990-W

Electronic filing has become the preferred method for submitting Form 990-W due to its convenience and speed. E-filing allows you to submit documents almost instantly while receiving confirmation of receipt right away. pdfFiller supports e-filing by providing step-by-step guidance on how to submit your 990-W electronically, ensuring a hassle-free process.

If you prefer paper filing, follow these instructions carefully. After completing your form, print it clearly, ensuring all information is legible. Once printed, place it in a standard envelope addressed to the appropriate IRS office based on your location and mail it directly. Be sure to retain a copy for your records.

After filing: what to expect

Understanding the review process post-filing will help taxpayers stay informed on the status of their Form 990-W. The IRS typically processes these forms within a few weeks; however, processing times can vary based on their workload and your submission method. Keeping an eye on your account and any correspondence from the IRS is recommended to catch potential issues early.

Keeping records is vital after filing your Form 990-W. You should maintain copies of your forms, any supporting documentation, and payment confirmations for at least three years. This practice protects you in the event of an audit and provides a comprehensive overview of your tax history.

Troubleshooting and FAQs

Common issues encountered when filing Form 990-W may include rejection of the electronic submission, incorrect calculations, or incomplete information. Should you face such problems, resolve them by revisiting your entries, ensuring compliance with IRS guidelines, and utilizing available support tools.

Frequently asked questions about Form 990-W often center on eligibility, filing methods, and payment schedules. Familiarizing yourself with these queries can streamline the process and provide clarity on any uncertainties. If you have specific questions, resources from pdfFiller are available to guide you further.

Additional considerations

Adjusting estimated tax payments may become necessary depending on your financial situation throughout the year. For example, if you experience significant changes in income or allowable deductions, consider recalculating your estimated tax. The IRS allows for modifications to avoid underpayment penalties and ensure compliance.

Failure to file Form 990-W can lead to serious consequences, including penalties and interest on unpaid amounts. Consistent non-compliance may result in additional legal actions or increased scrutiny from the IRS. Understanding the ramifications of not filing is essential for maintaining good standing and minimizing risks.

Contacting support for assistance

For users in need of assistance with Form 990-W, pdfFiller offers robust customer support. They provide resources such as tutorials, live chat options, and detailed guides that can aid in addressing specific queries or complications you might face during the process.

You can contact pdfFiller support via their website or customer service telephone number. Their team is equipped to provide help regarding the completion, filing, or management of your Form 990-W. Comprehensive support from pdfFiller ensures that you can navigate your tax responsibilities with confidence.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send 990-w to be eSigned by others?

How do I complete 990-w online?

How do I fill out 990-w on an Android device?

What is 990-w?

Who is required to file 990-w?

How to fill out 990-w?

What is the purpose of 990-w?

What information must be reported on 990-w?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.